* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download US Fed finally raises rates and sends bond prices down

Survey

Document related concepts

Private equity secondary market wikipedia , lookup

Negative gearing wikipedia , lookup

Modified Dietz method wikipedia , lookup

Business valuation wikipedia , lookup

Present value wikipedia , lookup

Financial economics wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Interest rate swap wikipedia , lookup

Public finance wikipedia , lookup

Securitization wikipedia , lookup

Pensions crisis wikipedia , lookup

Modern portfolio theory wikipedia , lookup

Fund governance wikipedia , lookup

Transcript

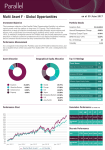

Pension International Fixed Income Fund Dec Net Asset Value: Dec Net Asset Value: Assets: Assets: $1.0629 $5.0396 $260K $42M Inception: Inception: Jan-15 Nov-12 Performance: Fund 1 Month 0.19% 3 Months -0.54% 12 Months 2.89% YTD 2.89% 3-yr Ave Ann Ret n/a Allocation: Portfolio Flat Yield: The International Fixed Income Fund is a pension-only pool of assets that invests in the USD Targeted Income Fund. Performance shown does not include any fees associated with the administration of a pension plan and may differ from other shares offered in the fund as a result of different fee structures. The asset allocation shown is subject to change without notice and at the discretion of the investment manager, subject to any restrictions outlined in the fund’s offering documents. Past performance doesn’t guarantee future success. Q4 2016 Issue 8 US Fed finally raises rates and sends bond prices down Frito Lay Potato Chips used to have a slogan: “Betcha Can’t Eat Just One!” Today, that catch phrase could easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portfolio are not linked directly to the USD rate, the effect of a rise in rates still had a negative impact on security prices. Unlike the Bahamas, variability among international fixed income issues involves both coupon rate and bond price, which could be selling at par, a premium, or a discount, depending how attractive that bond is to the market. When interest rates rise, prices of already issued fixed income issues tend to fall, because any new issue would necessarily have to feature a higher coupon rate to be attractive to investors. The fund recently purchased several attractive Caribbean sovereign bonds, but the full effect of those purchases have not yet been felt. We expect to see greater traction in the upcoming year. As well, we have identified several new securities we plan to add to the portfolio shortly, which should diversify the relatively concentrated mix, as well as boost overall returns. The fund’s return of 2.89% for 2016 certainly won’t break any records, but the goal of further developing a robust, higheryielding portfolio remains. We’re cautiously confident that 2017 will be the year take a large step toward that goal! Royal Fidelity Merchant Bank & Trust 51 Frederick Street PO Box N 4853 www.royalfidelity.com Nassau, Bahamas [email protected] (242) 356-9801