* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download 7IM Specialist Investment Funds-7IM Emerging Markets Equity

Survey

Document related concepts

Investor-state dispute settlement wikipedia , lookup

Trading room wikipedia , lookup

Present value wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Private equity wikipedia , lookup

International investment agreement wikipedia , lookup

Financial economics wikipedia , lookup

Stock valuation wikipedia , lookup

Stock trader wikipedia , lookup

Private equity secondary market wikipedia , lookup

Financialization wikipedia , lookup

Business valuation wikipedia , lookup

Early history of private equity wikipedia , lookup

Investment banking wikipedia , lookup

Land banking wikipedia , lookup

Fund governance wikipedia , lookup

Transcript

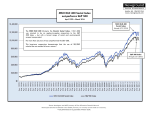

7IM EMERGING MARKETS EQUITY VALUE FUND AS AT 30 JUNE 2017 INVESTMENT OBJECTIVE FUND SUMMARY The objective of the 7IM Emerging Markets Equity Value Fund is to achieve long-term capital growth through investing predominantly in a portfolio of equities of companies that are incorporated in, have their head office in and/or are domiciled in Emerging Markets and/or have a significant part of their operations in Emerging Markets. The Fund may also invest in other companies that are listed in Emerging Markets. Fund Managers Launch Date Fund Size Reference Benchmark Initial Charge Yield XD Dates Distribution Dates Authorised Corporate Director INVESTMENT PROCESS The Fund uses a systematic investment process, identifying profitable and growing companies which are assessed as trading at a discount to their intrinsic value using company fundamentals. Securities trading at a discount to intrinsic value are generally defined as companies with a high cash-flow to price, high book-to-price or similar valuation ratio. Profitability is defined as high return-on-equity (ROE), return-on-asset (ROA), return-on-invested-capital (ROIC) or similar profitability metrics. High growth companies are characterised by significant positive increments in sales, dividends, earnings or growth in similar income/cash-flow variables. Investment risk factors (including value, size, price momentum, sector, market beta and country) are identified, isolated, and then selected in combination so that the required risk factor exposure is achieved, and exposure to risk factors which are not desired is minimised. ASSET ALLOCATION The Fund's sector and country weighting against the index are shown below. 7IM – Investment Team 13 July 2015 £52.3m MSCI Emerging Markets Index 0% 2.00% 31 May, 30 November 31 July, 31 January‡ Seven Investment Management LLP DETAILS OF FUND CHARGES & INCOME DISTRIBUTION Share Classes C Income Lump Sum SEDOL OCF (includes AMC)† Investment BWBSHQ1 0.40% (incl. 0.25% AMC) from £1,000 The specific details of the funds including investment policy, charges and the particular risks associated with the funds are explained in the Key Investor Information Documentation (KIIDs) – a link to these is available via the 7IM website (www.7im.co.uk). ‡ Please allow up to 10 working days after the Distribution Date for dividends to be processed and applied to individual client accounts. † Ongoing Charges Figure includes 7IM Annual Management Charge. Source: KIIDs 13/02/2017. PORTFOLIO TOP TEN HOLDINGS Tencent Samsung Bank of China Taiwan Semiconductor Manufacturing Maruti Suzuki Pegatron Posco Ambev Agricultural Bank of China Bank of Communications Total Financials Information Technology Consumer Discretionary Health Care Industrials Energy Consumer Staples Utilities Materials Telecommunication Services Real Estate 4.6% 4.5% 3.7% 3.5% 3.2% 3.1% 3.0% 3.0% 3.0% 2.8% 34.4% Source: 7IM. -2 -1 0 1 FUND PERFORMANCE & YIELD Rolling Performance to Last 6 30/06/2017 Since Months 1 Year 2 Years 3 Years 4 Years Launch Chile China C Income 9.18% 26.21% Ref. Benchmark* 12.29% 28.98% Colombia Egypt - - - 15.08% - 16.02% * Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or relating to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent. Hungary India Indonesia Malaysia Mexico Peru Philippines Qatar The value of investments may fluctuate in price or value and you may get back less than the amount originally invested. Past performance is not a guide to the future. Republic of Korea FUND AVAILABILITY Poland The 7IM Funds are available via the majority of the major wraps, platforms and life and pension wrappers. If you would like further information please call us on 020 7760 8777. Russia South Africa Taiwan Thailand Turkey United Arab Emirates -1 0 1 2 This factsheet is intended for Professional Intermediaries only. For further details on 7IM and our funds call 020 7760 8777 or visit www.7im.co.uk. Seven Investment Management LLP is authorised and regulated by the Financial Conduct Authority. Member of the London Stock Exchange. Registered Office: 55 Bishopsgate, London EC2N 3AS. Registered in England and Wales number OC378740.