* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Not All Benchmarks Are Created Equal

Survey

Document related concepts

Trading room wikipedia , lookup

Syndicated loan wikipedia , lookup

Financialization wikipedia , lookup

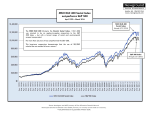

Land banking wikipedia , lookup

Interbank lending market wikipedia , lookup

Market (economics) wikipedia , lookup

Systemic risk wikipedia , lookup

Private equity secondary market wikipedia , lookup

Business valuation wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Financial economics wikipedia , lookup

Investment fund wikipedia , lookup

Transcript

Not All Benchmarks Are Created Equal Tuesday 25th March 2014 1 Benchmark Proliferation How can we make sense of the apparent proliferation of benchmarks available? Which have merit to be used as benchmarks and which do not? Teach-in Not All Benchmarks Are Created Equal 25 March 2014 2 LDI Hub Liquid Markets Liquid Credit Illiquid Credit Illiquid Markets Collateral Mgt. Equities (EM, DM) Sterling Credit (IG) Structured Finance Reinsurance Pooled vs. Seg DGFs Global Credit (IG) Infrastructure Debt Private Equity Leverage & Liquidity Style Premia HY/Loans Senior Direct Lending Infrastructure Overlay Strategies Risk Parity ABS Mezzanine Finance Real Estate CTA Emerging Market Debt Distressed Debt Global Macro Absolute Return Bonds Senior CRE Debt Equity Long-Short Total Return Sub-IG Credit Relative Value Teach-in Not All Benchmarks Are Created Equal 25 March 2014 3 Is Alpha Just Beta Waiting to be Discovered? Time Alpha Alpha Alpha Equity Risk Premium Prior to capweighted indices, all returns were effectively viewed as alpha With the introduction of CAPM, the equity market effect was separated from returns Other Market Risk Premia Equity Risk Premium This was then extrapolated to include other asset classes such as bonds and commodities Alpha Style Premia Other Market Risk Premia Equity Risk Premium Now we can separate out a number of risk premia with much less being left as pure alpha Source: AQR Teach-in Not All Benchmarks Are Created Equal 25 March 2014 4 What should a benchmark be trying to achieve ? Liquid Markets Access/capture the desired market “beta” in the most effective way • • • Transparent • No unintended biases • Sectors • Geography • Issuer • No unnecessary transaction costs in tracking the index • Captures evolution in market development Different approaches to weighting components • Market capitalization – retains a lot of the above properties (but not always all) • Equal weighting/capped • Risk weighting • Optimized, eg minimum variance Teach-in Not All Benchmarks Are Created Equal 25 March 2014 5 What characteristics do we look for in forming benchmarks for our clients ? Liquid Markets • Performance metric for fund management • • Assess the performance of fund managers relative to relevant benchmark net of fees Basis for synthetic allocations • Total Return Swap and Futures exposures • Take liquidity considerations into account (other things being equal) as this affects pricing • Liquidity concentrated in market capitalization indices • Places a high “bar” on non-market capitalization approaches Teach-in Not All Benchmarks Are Created Equal 25 March 2014 6 Style Premia Case Study Teach-in Not All Benchmarks Are Created Equal 25 March 2014 7 Neil Woodford: Style Premia in Practice 350 300 250 200 150 100 50 0 Invesco Perpetual High Income Fund FTSE All Share - Neil Woodford presents us with an intriguing practical look into style premia investing in the UK. - His track record is impressive – he has beaten the FTSE All Share over the past 12 years by 3.4% p.a. - But is this the correct benchmark to use to assess his performance? Teach-in Not All Benchmarks Are Created Equal 25 March 2014 8 Applying Style Premia to Neil Woodford 350 300 250 200 150 100 50 0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Regressed Portfolio Weights Invesco High Income Fund FTSE All Share Source: Deutsche Bank, Invesco, Bloomberg; Calculations: Redington Market Value Momentum Defensive 75% 13% 19% 52% Woodford’s performance can broadly be explained by: a lower than 100% weight to the market (represented by the FTSE All Share) along with allocations to value, momentum and defensive factors. Teach-in Not All Benchmarks Are Created Equal 25 March 2014 9 Major Style Premia Families Cutting Across Liquid Markets Value Momentum •Buying assets that are “cheap” relative to their fundamental value and selling “expensive” assets •For example: go long lowest price-to-book stocks, go short highest price-to-book stocks •Involves buying assets that recently outperformed peers and selling those that recently underperformed •For example: go long stocks with highest 3 month return, go short stocks with lowest 3 month return Carry •Implies buying high-yielding assets and selling lowyielding assets •For example: go long highest yielding currencies, go short lowest yielding currencies Defensive •Consists of buying low-risk, high-quality assets and selling high-risk, low-quality assets •For example: go long high return-on-equity stocks, go short low return-on-equity stocks Need to be able to go long, go short and to leverage across multiple asset classes Teach-in Not All Benchmarks Are Created Equal 25 March 2014 10 Style Premia Decomposition of A Fundamental Index 250 200 150 100 50 0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Regressed Portfolio Weights RAFI Fundamental Index Source: Deutsche Bank, Research Affiliates, Bloomberg; Calculations: Redington Market Value Momentum Defensive 100% 21% 8% 0% Mostly market exposure gained along with some value and momentum style premia Is this the most effective way of gaining these exposures ? Teach-in Not All Benchmarks Are Created Equal 25 March 2014 11 What characteristics do we look for in forming benchmarks for our clients ? Multi-Asset • Diversified Growth Fund • • Risk Parity • • Static / Dynamic / Total Return / Absolute Return Fully Systematic / Systematic with active overlay “Traditional” comparison often used is either “equity returns with lower volatility” or simple 60/40 equity bond asset mix which has a number of shortcomings • Allocations are more dynamic • Much greater range of assets/strategies employed • Credit • Options • Illiquid assets • Commodities • Global interest rates / FX • Relative value (market neutral) • Risk control Is it possible to create a multi-asset benchmark suitable for assessing these products ? Teach-in Not All Benchmarks Are Created Equal 25 March 2014 12 Conclusions • Access/capture the desired market “beta” in the most effective way • Transparent • No unintended biases • No unnecessary transaction costs in tracking the index • Captures evolution in market development • Market capitalization indices satisfy a lot of these requirements (although not necessarily all of them, all of the time) • Makes market cap logical starting point • Although there are situations when an alternative is more appropriate • Be cognisant of tilts being introduced by new indices – are they just giving largely market exposure with small style tilts ? Teach-in Not All Benchmarks Are Created Equal 25 March 2014 13 Contact Dan Mikulskis FIA Director Direct Line: 020 3326 7129 [email protected] Disclaimer For professional investors only. Not suitable for private customers. The information herein was obtained from various sources. We do not guarantee every aspect of its accuracy. The information is for your private information and is for discussion purposes only. A variety of market factors and assumptions may affect this analysis, and this analysis does not reflect all possible loss scenarios. There is no certainty that the parameters and assumptions used in this analysis can be duplicated with actual trades. Any historical exchange rates, interest rates or other reference rates or prices which appear above are not necessarily indicative of future exchange rates, interest rates, or other reference Teach-in rates or prices. Neither the information, recommendations or opinions expressed herein constitutes an offer to buy or sell any securities, futures, options, or investment products on your behalf. Unless otherwise stated, any pricing information in this document is indicative only, is subject to change and is not an offer to transact. Where relevant, the price quoted is exclusive of tax and delivery costs. Any reference to the terms of executed transactions should be treated as preliminary and subject to further due diligence. This presentation may not be copied, modified or provided by you , the Recipient, to any other party without Redington Limited’s prior written permission. It may also not be disclosed by the Recipient to any other party without Redington Limited’s prior written permission except as may be required by law. Registered Office: Austin Friars House, 2-6 Austin Friars, London EC2N 2HD. Redington Limited is an investment consultant company regulated by the Financial Conduct Authority. The company does not advise on all implications of the transactions described herein. This information is for discussion purposes and prior to undertaking any trade, you should also discuss with your professional, tax, accounting and / or other relevant advisers how such particular trade(s) affect you. All analysis (whether in respect of tax, accounting, law or of any other nature), should be treated as illustrative only and not relied upon as accurate. Redington Limited (reg no 6660006) is registered in England and Wales. Not All Benchmarks Are Created Equal ©Redington Limited 2014. All rights reserved. 25 March 2014 14 Not All Benchmarks are Created Equal: Building Better Benchmarks – The MSCI Way Altaf Kassam – Managing Director ©2014. All rights reserved. msci.com msci.com msci.com Presentation Overview I. Introduction to MSCI II. Not All Benchmarks Are Created Equal III. Building Better Benchmarks IV. Evolution of Benchmarks V. Appendix ©2014. All rights reserved. msci.com msci.com 16 16 I. Introduction to MSCI ©2014. All rights reserved. msci.com msci.com 17 17 MSCI is More Than Indexes MSCI provide investors with world-class, investment decision support tools • Indexes • Risk and Portfolio Analytics • Corporate Governance 1969 2012 Index ©2014. All rights reserved. Research & Innovation 2004 2013 2010 2004 Analytics msci.com II. Not All Benchmarks Are Created Equal ©2014. All rights reserved. msci.com msci.com 19 19 Why should anyone care about benchmarks? The concept of a market portfolio plays an important role in many financial models, including the Capital Asset Pricing Model (CAPM). In theory, the market portfolio should be the portfolio of choice for a truly passive investor 1 Widely used in the investment process in several applications: Tools for investment research and strategic asset allocation Performance benchmarks for actively managed portfolios Index-linked vehicles to capture the market beta (equity risk premium) The broad acceptance of market cap weighted indices does not rely on (potentially flawed) academic theories, such as the CAPM; it stems from practical considerations linked to the institutional investment process: Automatic rebalancing, replicate simple buy and hold strategy Low turnover, implying low transaction / implementation costs High trading liquidity and high (maximum) investment capacity 1 “Global Invested Capital Market”, Hewitt ennisknupp, February 2014 ©2014. All rights reserved. msci.com What Matters Most and How MSCI Builds Better Benchmarks MSCI puts emphasis on: Leading to MSCI indices being: Accuracy, timeliness and transparency Consistent global framework: no gap, no overlap Timely reflection of market changes 1. Accurate measures of markets Transparent methodology and market classification framework 2. Fair benchmarks for managers Investability and replicability Systematic use of buffer zones to reduce turnover 3. Cost effective solutions for index replication Accurate implementation of corporate events Stringent short and long term liquidity measures ©2014. All rights reserved. msci.com MSCI has been defining the Equity space for 40+ years ©2014. All rights reserved. Removal of home and size biases MSCI ACWI All Country World Index MSCI ACWI IMI (45 countries) MSCI EAFE was created in 1969 MSCI EM 99% coverage No GAPS & OVERLAPS EM SC International SC was created in 1988 Domestic SC Emerging Markets LC & MC EM SC International LC & MC International SC Domestic SC Domestic LC & MC Home and size biases Removal of home bias msci.com MSCI Index Families MSCI Country & Regional Indices All Country (DM+EM) MSCI Size Indices Large Cap MSCI Style Indices Value MSCI Sector Indices Sector MSCI Thematic Indices Commodity Producers MSCI ESG Indices Best-in-Class MSCI Strategy Indices Risk Premia - Value Weighted Custom Indices Equity Screening - Risk Weighted Developed Markets (DM) Mid Cap Growth Industry Agriculture & Food Chain - Equal Weighted Socially Responsible - GDP Weighted - Minimum Volatility Custom Weighting - Factor Emerging Markets (EM) Standard (Large + Mid) Infrastructure Sub-industry Ex-Controversial Weapons - High Div Yield - Risk Control - Quality - Momentum Faith-Based Frontier Markets (FM) Domestic -US Small Cap SMID (Small + Mid) -China - Catholic Environmental - Quality Mix - Islamic Economic Exposure Capped - 10/40 Custom Delivery and File Format - 25/50 -Australia - Standard Capped Tradable -Asia APEX IMI (Large+ Mid + Small) Hedged & Currency - Hedged -EM 50 -FM 100 Real Estate Custom Currencies and Tax Rates Micro Cap (DM Only) All Cap (DM Only) ©2014. All rights reserved. - FX Hedged - Global Currency Short & Leveraged (Daily) msci.com III. Building Better Benchmarks ©2014. All rights reserved. msci.com msci.com 24 24 How MSCI Does it Key benefits that make MSCI the number one choice for global institutional investors include: Emphasis on objectivity, accuracy and transparency: - Transparent market classification framework - Comparability of size segments across markets - Exclusion of non-equity like securities - Precise methodology to assign companies to markets Emphasis on investability and replicability: - Precise free float factors - Stringent short and long term liquidity measures - Minimum foreign room requirements - Effective migration buffer mechanism - Predictable implementation of corporate events ©2014. All rights reserved. msci.com 25 The MSCI Market Classification Framework The MSCI Market Classification Framework consists of three criteria: economic development, size & liquidity and market accessibility In order to be classified in a given investment universe, a country must meet the requirements of all three criteria Criteria Frontier Emerging Developed No requirement No requirement Country GNI per capita 25% above the World Bank high income threshold* for 3 consecutive years 2 USD 449 mm USD 33 mm 2.5% ATVR 3 USD 898 mm USD 449 mm 15% ATVR 5 USD 1796 mm USD 898 mm 20% ATVR At least some At least partial Modest Modest Significant Significant Good and tested Modest Very high Very high Very high Very high A Economic Development A.1 Sustainability of economic development B Size and Liquidity Requirements B.1 Number of companies meeting the following Standard Index criteria Company size (full market cap) ** Security size (float market cap) ** Security liquidity C Market Accessibility Criteria C.1 C.2 C.3 C.4 Openness to foreign ownership Ease of capital inflows / outflows Efficiency of the operational framework Stability of the institutional framework * High income threshold for 2010: GNI per capita of USD 12,276 (World Bank, Atlas method) ** Minimum in use for the May 2012 Semi-Annual Index Review, updated on a semi-annual basis ©2014. All rights reserved. msci.com MSCI Country Classification ©2014. All rights reserved. msci.com MSCI Has Captured the Evolution of Markets For 40+ Years 2013 ©2014. All rights reserved. msci.com Size Segments: Global Investable Market and All Cap Indices Large Cap Total Listed Equity Universe Investable Equity Universe Investable Market Indices All Cap Indices Mid Cap Large Cap Mid Cap Small Cap Micro Cap Small Cap Micro Cap Universe ©2014. All rights reserved. Micro Cap Indices Micro Cap Indices msci.com Breadth vs. Coverage: Number and Size Global Market Cap and Coverage Market Cap (in USD) 100 97.9 98.8 99.4 99.7 99.9 100.0 96.6 95 Market Coverage (% of full market cap) 94.4 90 90.3 85 81.3 80 Largest company 506,035,318,230 5% 9,638,785,576 10% 4,058,595,491 20% 1,562,054,938 30% 792,022,114 40% 474,873,840 50% 302,909,404 60% 192,671,360 70% 122,852,450 80% 74,378,487 90% 40,621,572 75 70 70.2 65 <5% 5 to 10% 10 to 20% 20 to 30% 30 to 40% 40 to 50% 50 to 60% 60 to 70% 70 to 80% 80 to 90% 90 to 100% Smallest company 1,529 Global Companies (sorted by full market cap, as % of total) Source: MSCI Goal: represent the global equity universe, while keeping the number of securities and size of the smallest security at reasonable levels ©2014. All rights reserved. msci.com IV. Evolution of Benchmarks ©2014. All rights reserved. msci.com msci.com 31 31 Yesterday’s Alpha is Today’s Beta 1970s 1980s 2000s Alpha Alpha Factor Beta Portfolio Return Regional Beta Beta Country Beta Sector Beta ©2014. All rights reserved. msci.com What Attracts Investors to Factor Investing? Performance Characteristics (June 1988 to June 2013) (Gross Total Return in USD) LOW RISK & HIGH RETURN HIGH RISK & HIGH RETURN 11.5% Annualized Return Quality High Dividend Yield 10.5% Momentum Risk Weighted 9.5% Value Weighted 8.5% Equal Weighted Minimum Volatility 7.5% MSCI World HIGH RISK & LOW RETURN LOW RISK & LOW RETURN 6.5% 11.0% 12.0% 13.0% 14.0% 15.0% 16.0% 17.0% 18.0% 19.0% Annualized Risk ©2014. All rights reserved. msci.com What is Factor Investing? Factor investing is the investment process that harvests risk premia through exposure to factors A large body of academic research highlights that long term equity portfolio performance can be explained by systematic factors. Some factors represent exposure to systematic risk and have historically earned a long term risk premium We currently identify six risk premia factors. They are grounded in academic research and have solid explanations as to why they have provided a premium ©2014. All rights reserved. 6 KEY FACTORS Low Size Value Momentum Quality Yield Low Volatility msci.com Is This a Free Lunch? Cyclicality is a Key Dimension 300 Relative Performance of Factor Indexes (June 88 – June 2013) 250 200 150 100 50 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 Risk Weighted/World Value Weighted/World Min Volatility/World Quality/World Momentum/World High Div Yield/World ©2014. All rights reserved. 07 08 09 10 11 12 13 Equal Weighted/World msci.com The MSCI Family of Factor Indexes MSCI Return-Based Factor Indexes MSCI Risk-Based Factor Indexes MSCI Value Weighted Indexes MSCI Minimum Volatility Indexes Weighted according to four fundamental variables (Sales, Earnings, Cash Flow, Book Value) Constructed using minimum variance optimization • Semi-annual rebalancing • Launched in 2008, index history from 31 May 1988 (World) / 31 May 1993 (EM) • Semi-annual rebalancing • Launched in 2010, index history from 31 May 1973 (World)/31 May 1991 (EM) MSCI Quality Indexes MSCI Risk Weighted Indexes Weights derived from market cap times a quality score based on D/E, ROE, earnings variability • Semi-annual rebalancing • Launched in 2012, index history from 28 Nov 1975 (World)/29 May 1992 (EM) Weights based on the inverse of historical variance • Semi-annual rebalancing • Launched in 2011, index history from 31 May 1973 (World) / 31 May 1991 (EM) MSCI Momentum Indexes MSCI Equal Weighted Indexes Weights derived from market cap times a momentum score based on shortand long-term momentum signals • Semi-annual rebalancing along with conditional rebalancing • Launched in 2013, index history from 31 May 1973 (World) / 31 May 1991 (EM) Equal allocation across parent index constituents • Quarterly rebalancing • Launched in 2008, index history from 31 May 1973 (World) / 31 May 1991 (EM) MSCI High Dividend Yield* Indexes MSCI Quality Mix Indexes High dividend yield opportunity set within parent index constituents • Semi-annual rebalancing • Launched in 2006, index history from 28 Nov 1975 (World) / 29 May 1992 (EM) Combining Quality, Value and Minimum Volatility Strategy Indexes with equal weights • Semi-annual rebalancing • Launched in 2013, index history from 31 May 1988 (World)/ 31 May 1993 (EM) MSCI Multi-Factor Indexes * On June 3, 2013, MSCI launched the enhanced HDY Indexes to incorporate additional screens which exclude stocks based on certain “low quality" characteristics and recent 12-month price performance. ©2014. All rights reserved. msci.com 36 V. Appendix ©2014. All rights reserved. msci.com msci.com 37 37 MSCI – The Index That Matters 40+ Years of experience in index calculation and maintenance 150,000 Indices calculated daily 9,000+ in real-time 99.8% Accuracy rate1 $8.4tn In assets is benchmarked to MSCI indices2 600+ 7,500 ETFs are based on MSCI indices3 Clients supported across 83 countries 1 Accuracy calculated based on number of corrections performed over total number of securities or data points covered. As of September 30, 2012, as published by eVestment, Lipper and Bloomberg on January 31, 2013. 3 As of February 2013. 2 ©2014. All rights reserved. msci.com How MSCI Does It Over the last four decades MSCI has been recognized as the preferred index provider for global institutional investors based on: 1. Methodology that promotes a global framework, broad coverage, investability and representativeness, while reflecting our clients’ investment process 2. Construction process that supports data quality, index stability and continuity, with low error rates and low index turnover 3. Innovative new products through thought leadership and research that captures the evolution of investment best practices 4. Superior client service focused on responsiveness and adding value ©2014. All rights reserved. msci.com 39 MSCI Investability MSCI MSCI Rationale Minimum Equity Universe Size Indexed to 99th percentile of DM universe ($100M) Objective and dynamic market-based definition Minimum Equity Universe Size 50% of minimum full market cap size ($50M) Facilitates replication in institutional portfolios Liquidity Minimum Annualized Traded Value Ratio (ATVR) of 20% for DM 15% for EM Allows only inclusion of relevant liquid securities and recognizes liquidity differences between DM & EM Global Minimum Foreign Inclusion Factor 15% in general or (or 1.8 X Standard minimum size) Ensures meaningful access to publicly owned securities Free Float Bands 5% bands, free float rounded up to nearest 5% Captures availability to foreign investors in the most accurate way Seasoning Minimum of 3 months of trading history; 10 business days for larger IPOs Reduces volatility impact around small issuances and includes large IPOs to reflect key market changes ©2014. All rights reserved. msci.com 40 MSCI : Index Maintenance & Additional Features MSCI MSCI Rationale Reconstitution Semi-annual rebalancing + quarterly index reviews (all synchronized) Frequently and regularly reflects market changes on a timely basis Buffer Zones Yes (Upper band +50%; lower band -33% of size segment cut-off) Reduces turnover and reflects managers’ investment processes Size Indices Yes Offers value and growth segmentation at each size segmentation Index Structure Country Indices (with the exception of Europe being considered as a single country from an index construction and maintenance perspective) Reflects the institutional process Sector Classification Global Industry Classification Standard (GICS®) GICS® is widely adopted by institutional investors ©2014. All rights reserved. msci.com 41 Assets Benchmarked to MSCI indices Over $8.4 trillion in assets are benchmarked to MSCI indexes Over $60 billion in assets are benchmarked to MSCI Factor Indexes Assets Benchmarked to Key MSCI Indexes $ billion Total Mar-13 ** Sep-13# Δ ACWI 1,364 1,714 26% EAFE 1,496 1,682 12% EM 1,434 1,364 -5% World 2,161 2,388 10% US 190.8 199.6 5% Europe 281.3 336.9 20% APAC 415.4 371.8 -11% Other 363.9 387.1 TOTAL 7,707 8,442 6% 10% ©2014. All rights reserved. msci.com MSCI Factor Indexes as of 30 September 2013 Over USD 60 billion in assets benchmarked to MSCI Factor Indexes (USD bn) Active Passive Total All MSCI Factor Indexes 25.9 37.9 63.8 High Dividend Yield 19.8 4.2 24 Minimum Volatility 3.5 19.7 23.2 Equal Weighted 0 8.3 8.3 GDP Weighted 2.3 0.6 2.9 Value Weighted 0 3.3 3.3 0.3 1.3 1.6 Momentum 0 0.2 0.2 Quality 0 0.3 0.3 Active Passive Total Global 25.9 37.9 63.8 Americas 5.5 15.1 20.6 EMEA 20.4 19.1 39.5 0 3.7 3.7 Risk Weighted (USD bn) Asia Data segregated by index family and region for active and passive funds as of September 30, 2013 and reported as of December 31, 2013 by eVestment, Lipper, Morningstar, Bloomberg and MSCI data ©2014. All rights reserved. msci.com 43 Why Classification Matters: The Korea example A developed economy does not imply a developed capital market Korea’s capital market is not yet at the developed level. Why does this matter to investors? Difficulties trading the Korean currency outside Korea Local currency ONLY during local business hours Inability to transfer shares between different accounts operational difficulties + higher portfolios management costs Korea has been under review by MSCI for 5 years and will stay in Emerging Markets until accessibility issues are resolved ©2014. All rights reserved. msci.com 44 Introducing Multi-Factor Indexes Multi-Factor Indexes blend standardized factor Indexes into a composite index which serves as a benchmark for passive replication Multi-Factor Indexes may provide investors with a transparent, flexible and costeffective way to passively seek systematic exposure to premium factors ©2014. All rights reserved. Passive Investing Market Return Factor Investing Rules Based & Transparent Active Management Active Return Discretionary Implementation Implementation msci.com Allocating to Multiple Factors 1. State objectives for the allocation: risk reduction, enhance returns at market level risk, increase yield, … Due Diligence Considerations 1. Investment Beliefs 2. Strategic vs. Tactical Allocations 3. Selection of Individual Factors 2. Select the desired factor exposures based upon: 4. Global vs. Domestic 5. Optimal Allocation investment beliefs (value premium, …) 6. Funding of the Factor Allocation risk/return characteristics (minimum volatility, …) 7. Active vs. Passive Implementation investibility constraints (size of allocation, shorting, …) 8. Index and Manager Selection (methodology, turnover, transparency, fees, … ) 3. Seek combination benefits: 9. Governance and Operational Risk Diversification through low correlation of active returns Trading cost reduction through natural crossing ©2014. All rights reserved. msci.com Considerations for Combining Factor Indexes Factor Risk Correlation Business Cycle Value Comparable to market Low with Momentum and Quality Pro-cyclical Momentum Comparable to market Low with Value, Yield, and Quality Pro-cyclical Low Size Higher than market Low with Min Volatility, Yield, and Quality Pro-cyclical Quality Lower than market Low with Value, Size, Yield and Momentum Defensive Low Volatility Lower than market Low with Value and Momentum Defensive Yield Lower than market Low with Size, Quality and Momentum Defensive ©2014. All rights reserved. msci.com Potential Benefits of Multi-Factor Indexes Historically, tracking errors and information ratios for multi-factor Indexes improve substantially compared to standalone factor Indexes Turnover and cost of replication are reduced due to natural crossing World Standard Quality Total Return* (%) 4.2 5.3 8.6 5.5 6.9 6.7 Total Risk* (%) 16.3 14.3 14.6 17.2 16.7 14.9 Sharpe Ratio 0.18 0.26 0.47 0.25 0.33 0.34 Annualized Active Return (%) 1.1 4.4 1.2 2.7 2.5 Tracking Error* (%) 4.5 5.6 3.6 9.0 3.0 Information Ratio 0.25 0.79 0.35 0.30 0.83 52 10 9 19 2 Max Relative Drawdown Period (months) Risk Value Momentum Weigthed Weighted Multi Factor Index Natural Crossing Benefits Turnover** (%) 3.1 23.0 22.0 18.3 89.6 Turnover if implemented as separate mandates --> 32.0 40.8 * Annualized in USD for the 05/31/1999 to 09/30/2013 period ** Annualized one-way index turnover for the 05/31/1999 to 09/30/2013 period ©2014. All rights reserved. msci.com MSCI 24 Hour Global Client Service Americas Europe, Middle East & Africa Asia Pacific Americas 1.888.588.4567 (toll free) Cape Town +27.21.673.0100 China North 10800.852.1032 (toll free) Atlanta +1.404.551.3212 Frankfurt +49.69.133.859.00 China South 10800.152.1032 (toll free) Boston +1.617.532.0920 Geneva +41.22.817.9777 Hong Kong +852.2844.9333 Chicago +1.312.706.4999 London +44.20.7618.2222 Seoul +798.8521.3392 (toll free) Monterrey +52.81.1253.4020 Milan +39.02.5849.0415 Singapore 800.852.3749 (toll free) Montreal +1.514.847.7506 Paris 0800.91.59.17 (toll free) Sydney +61.2.9033.9333 New York +1.212.804.3901 Tokyo +81.3.5226.8222 San Francisco +1.415.836.8800 São Paulo +55.11.3706.1360 Stamford +1.203.325.5630 Toronto +1.416.628.1007 [email protected] | www.msci.com ©2014. All rights reserved. msci.com msci.com 49 49 Notice and Disclaimer This document and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of MSCl Inc. or its subsidiaries (collectively, “MSCI”), or MSCI’s licensors, direct or indirect suppliers or any third party involved in making or compiling any Information (collectively, with MSCI, the “Information Providers”) and is provided for informational purposes only. The Information may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI. The Information may not be used to create derivative works or to verify or correct other data or information. For example (but without limitation), the Information many not be used to create indices, databases, risk models, analytics, software, or in connection with the issuing, offering, sponsoring, managing or marketing of any securities, portfolios, financial products or other investment vehicles utilizing or based on, linked to, tracking or otherwise derived from the Information or any other MSCI data, information, products or services. The user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF THE INFORMATION PROVDERS MAKES ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, EACH INFORMATION PROVIDER EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION. Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited, including without limitation (as applicable), any liability for death or personal injury to the extent that such injury results from the negligence or wilful default of itself, its servants, agents or sub-contractors. Information containing any historical information, data or analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Past performance does not guarantee future results. None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), any security, financial product or other investment vehicle or any trading strategy. You cannot invest in an index. MSCI’s indirect wholly-owned subsidiary Institutional Shareholder Services, Inc. (“ISS”) is a Registered Investment Adviser under the Investment Advisers Act of 1940. Except with respect to any applicable products or services from ISS (including applicable products or services from MSCI ESG Research Information, which are provided by ISS), neither MSCI nor any of its products or services recommends, endorses, approves or otherwise expresses any opinion regarding any issuer, securities, financial products or instruments or trading strategies and neither MSCI nor any of its products or services is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. The MSCI ESG Indices use ratings and other data, analysis and information from MSCI ESG Research. MSCI ESG Research is produced by ISS or its subsidiaries. Issuers mentioned or included in any MSCI ESG Research materials may be a client of MSCI, ISS, or another MSCI subsidiary, or the parent of, or affiliated with, a client of MSCI, ISS, or another MSCI subsidiary, including ISS Corporate Services, Inc., which provides tools and services to issuers. MSCI ESG Research materials, including materials utilized in any MSCI ESG Indices or other products, have not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. Any use of or access to products, services or information of MSCI requires a license from MSCI. MSCI, Barra, RiskMetrics, ISS, CFRA, FEA, and other MSCI brands and product names are the trademarks, service marks, or registered trademarks or service marks of MSCI or its subsidiaries in the United States and other jurisdictions. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS)” is a service mark of MSCI and Standard & Poor’s. © 2012 MSCI Inc. All rights reserved. ©2014. All rights reserved. msci.com msci.com 50 50