* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Escaping the Last Malthusian Trap

Climate engineering wikipedia , lookup

Climate change mitigation wikipedia , lookup

Solar radiation management wikipedia , lookup

German Climate Action Plan 2050 wikipedia , lookup

Climate governance wikipedia , lookup

Economics of global warming wikipedia , lookup

Climate change and poverty wikipedia , lookup

Climate-friendly gardening wikipedia , lookup

2009 United Nations Climate Change Conference wikipedia , lookup

Decarbonisation measures in proposed UK electricity market reform wikipedia , lookup

Years of Living Dangerously wikipedia , lookup

Economics of climate change mitigation wikipedia , lookup

Carbon pricing in Australia wikipedia , lookup

Climate change feedback wikipedia , lookup

Reforestation wikipedia , lookup

Climate change in Canada wikipedia , lookup

Mitigation of global warming in Australia wikipedia , lookup

Politics of global warming wikipedia , lookup

IPCC Fourth Assessment Report wikipedia , lookup

Citizens' Climate Lobby wikipedia , lookup

Carbon emission trading wikipedia , lookup

Low-carbon economy wikipedia , lookup

Biosequestration wikipedia , lookup

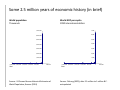

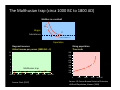

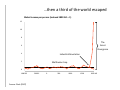

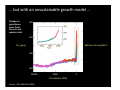

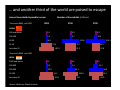

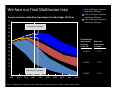

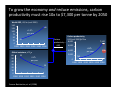

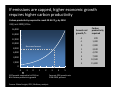

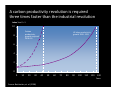

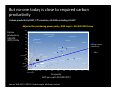

PBL Netherlands Environmental Assessment Agency Escaping the Last Malthusian Trap A talk by Eric Beinhocker McKinsey Global Institute The Hague 26 May 2011 Copyright © 2011 McKinsey & Company, Inc. All rights reserved The last Malthusian trap Today’s discussion Why neoclassical economics is the wrong tool for climate change A complexity economics view of growth Escaping the trap: creating a revolution in carbon productivity The last Malthusian trap Why neo‐classical economics is the wrong tool for climate change A complexity economics view of growth Escaping the trap: creating a revolution in carbon productivity Some 2.5 million years of economic history (in brief) World GDP per capita 1990 international dollars World population Thousands 7,000 7,000,000 6,000 6,000,000 5,000,000 5,000 4,000,000 4,000 3,000,000 3,000 2,000,000 2,000 1,000,000 1,000 0 -2,500,000 -2,000,000 -1,500,000 -1,000,000 -500,000 0 0 500,000 Year Source: US Census Bureau Historical Estimates of World Population; Kremer (1993) -2,500,000 -2,000,000 -1,500,000 -1,000,000 -500,000 0 500,000 Year Source: DeLong (2005); data 2.5 million to 1 million B.C. extrapolated The Malthusian trap (circa 1000 BC to 1800 AD) Malthus in a nutshell A Wages Subsistence C B Population Stagnant incomes Global income per person (1800 AD = 1) Rising population Thousands 12 900 10 800 700 600 500 400 300 200 100 8 6 4 Malthusian trap 2 0 1000 BC 500 BC 0 500 1000 1500 1800 AD 0 Source: Clark (2007) 500 1000 1500 1800 AD Source: US Census Bureau Historical Estimates of World Population; Kremer (1993) …then a third of the world escaped Until 1800 Malthus ruled… Global income per person (indexed 1800 AD = 1) 12 10 8 The Great Divergence 6 4 Industrial Revolution 2 Malthusian trap 0 1000 BC Source: Clark (2007) 500 BC 0 500 1000 1500 2000 AD … but with an unsustainable growth model … Changes in greenhouse gases from ice core and modern data 400 350 Radiative forcing (Wm2) CO2 (ppm) 300 250 10,000 5000 Time (before 2005) Source: IPCC AR4 WG1 (2007) 0 … and another third of the world are poised to escape Annual household disposable income Thousands RMB, real 2000 Number of households (millions) 2005 2015 2025 CHINA 200 and above 1.0 3.4 8.2 100‐199 1.6 5.7 19.0 40‐99 112.6 8.8 71.4 25‐39 Less than 25 107.5 214.1 75.7 54.1 74.2 57.8 Thousands RMB, real 2000 INDIA 1000 and above 1.2 500‐999 2.4 200‐499 10.9 90‐199 Less than 90 Source: McKinsey Global Institute 3.3 9.5 5.5 33.1 55.1 91.3 101.1 94.9 106.0 74.1 93.1 49.9 We face our final Malthusian trap Peak at 550 ppm, long-term stabilization 550 ppm Annual emissions implied by Copenhagen Accord pledges (Gt CO2e) Peak at 510 ppm, long-term stabilization 450 ppm 70 Peak at 480 ppm, long-term stabilization 400 ppm 65 Low range of pledges 60 55 50 45 40 35 30 Probability of temperature increase under 2˚C Expected temperature increase 15-30% 3.0˚C 40-60% 2.0˚C 70-85% 1.8˚C 25 20 15 10 5 0 2005 High range of pledges 2010 2015 2020 2025 2030 2035 2040 2045 2050 Source: “Taking Stock – Emissions Levels Implied by the Copenhagen Accord,” Project Catalyst, February 2010. What we need to do and questions for economics The world’s to‐do list Questions for economics Re‐do the Industrial Revolution, creating a sustainable economic system How did the first Industrial Revolution occur? How might we create a new one? Transition to a low‐ carbon economy with minimal impact on welfare and growth, especially for the developing world What are the interactions between welfare, growth and de‐carbonisation? How do we assess the trade‐ offs? Drive the above with policy – conduct global social engineering on an unprecedented scale What are the leverage points? How do we avoid unintended consequences? Preserve individual freedom? Unfortunately traditional economics ill‐equipped to answer these questions The last Malthusian trap A complexity economics view of growth Why neoclassical economics is the wrong tool for climate change Escaping the trap: creating a revolution in carbon productivity Neoclassical economics cannot explain key characteristics of the economy The economy is viewed as an equilibrium system The economy is viewed as an equilibrium system but such a system cannot grow explosively, create novelty, nor spontaneously self‐organize And such a system cannot just ‘crash’ – as ours has The accidental history of equilibrium in economics Neoclassical failure #1: Theory of growth Y (t) = Output F (K (t) , A (t) Capital Cannot explain the Industrial Revolution Source: Bolow (1956), Romer (1996), Nelson (1996), Daly (1999) * Knowledge L (t) ) Labour No connection with the physical world Neoclassical failure #2: Human behaviour Theory doesn’t match real world behaviour Exponential discounting Hyperbolic discounting Example Society spends $1 billion today to save 10 lives per year in perpetuity Social cost of capital equals 5% Exponential answer Cost = $4.76 million per life saved Source: Axtel and McRae (2006a), (2006b) Hyperbolic answer Cost = $1 million to $4 million per life saved Neoclassical failure #3: Cost‐benefit analysis “Discount rate!” ‘Discount rate!’ Prof. William Nordhaus Lord (Nicholas) Stern • Climate uncertainty has fat tails with power law scaling • Cost‐benefit analysis typically assumes away the tails • Would pay a lot to avoid catastrophe, e.g. Weitzman’s ‘Dismal Theorem’ Source: Stein (2006), Nordhaus (2007), Weitzman (2007), Barker (2008) Neoclassical failure #4: Time symmetry Cost‐benefit analysis and discounting assume path independence and time symmetry Samuelson : M R S (τ, τ’) independent of C τ’’ But climate effects are highly path dependent and largely irreversible on human time scales Source: Arrow and Fischer (1974), Frederich, Lowenstein, Donohue (2002), Dietz (2007) The last Malthusian trap A complexity economics view of growth Why neo‐classical economics is the wrong tool for climate change Escaping the trap: creating a revolution in carbon productivity A different explanation – the economy is a ‘complex adaptive system’ Complex Adaptive System Many interacting agents and organizations of agents Designs and strategies evolve over time Macro patterns emerge from micro behavior A paradigm shift TRADITIONAL ECONOMICS COMPLEXITY ECONOMICS Dynamics Economies are closed, static, linear systems in equilibrium Economies are open, dynamic, non‐linear systems far from equilibrium Agents Homogeneous agents • Only use rational deduction • Make no mistakes, have no biases • No need to learn Heterogeneous agents • Mix deductive/inductive decisions • Subject to errors and biases • Learn and adapt over time Networks Assume agents only interact indirectly through market mechanisms Explicitly accounts for agent‐to‐agent interactions and relationships Emergence Treats micro and macroeconomics as separate disciplines Macro patterns emerge from micro behaviors and interactions Evolution No endogenous mechanism for creating novelty or growth in order and complexity Evolutionary process creates novelty and growing order and complexity over time Long history of evolution in economics (and vice versa) Problems • Driven by a biological metaphor for the economy • Not built on a general computational view of evolution Evolution is a search algorithm for ‘fit order’ VARIATION SELECTION AMPLIFICATION Create a variety of experiments Select designs that are ‘fit’ Amplify fit designs, de‐amplify unfit designs REPEAT Evolutionary search through ‘deductive‐tinkering’ Technologies evolve Economic evolution occurs in three ‘design spaces’ Physical technologies Business plans Social technologies Business plan evolution works on three levels Business A Business B ??? Markets Business C Business D ??? Option A Organizations Option B Option C Option D Option A Individuals Option B ??? Option C Option D What would economic evolution look like? Non-linear wealth creation Increasing variety and complexity Spontaneous selforganization But we cannot avoid the Second Law of Thermodynamics – economic order does not come for free The last Malthusian trap A complexity economics view of growth Escaping the trap: creating a revolution in carbon productivity Why neoclassical economics is the wrong tool for climate change Industrial revolutions are productivity revolutions Physical technologies Business plans Social technologies Rapid evolution (e.g. “Cambrian explosion”) Rapid rise in productivity How do we evolve higher ‘carbon productivity’? Kaya identity F = Anthropogenic (CO2 emissions) p * GDP per capita Population 1 Carbon productivity ~= Source: Beinhocker, et. al. (2008) + e * f g * e * Energy intensity of GDP Non‐energy emissions and other GHGs f Carbon intensity of energy ≈ $GDP CO2e To grow the economy and reduce emissions, carbon productivity must rise 10x to $7,300 per tonne by 2050 World GDP, US$ tn (real 2000) 150 125 100 75 50 25 0 146 +3.1% per year 41 2000 2010 2020 2030 2040 2050 Global emissions, tCO2e 60 55 ‐2.4% 50 per year 40 30 20 10 0 2,000 7,300 10x 740 0 2000 2010 2020 2030 2040 2050 20 2000 2010 2020 2030 2040 2050 Source: Beinhocker, et. al. (2008) Carbon productivity, US$ (real 2000)/tCO2e Carbon productivity = 8,000 GDP 6,000 Emissions +5.6% / 4,000 per year If emissions are capped, higher economic growth requires higher carbon productivity Carbon productivity required to reach 20 Gt CO2e by 2050 US$ (real 2000)/tCO2e 16,000 Annual real growth, % 14,000 Carbon productivity required ‐2 870 ‐1 1,300 0 2,000 1 3,100 6,000 2 4,700 4,000 3 7,000 4 10,500 5 15,800 12,000 10,000 Base case forecast 8,000 2,000 0 ‐2 ‐1 0 1 2 GDP growth required to hit 20Gt at BAU carbon productivity growth Source: Global Insight; IPCC; McKinsey analysis 3 4 5 Forecast GDP growth rate 2008‐2050, percent If we capped emissions and lived at today’s carbon productivity, there is not much we could ‘afford’ * Emissions from land use change not included ** Based on 10Gt/year sustainable emissions and future population of 10 billion people Source: McKinsey analysis A carbon productivity revolution is required three times faster than the industrial revolution Index Year 0 = 1 10 Carbon productivity growth required 2008–50 8 US labor productivity growth 1830–1955 6 4 2 0 0 10 20 30 40 50 60 70 80 90 100 110 120 130 Years Source: Beinhocker, et. al. (2008) But no‐one today is close to required carbon productivity Carbon productivity 2007, 177 countries, all GHGs excluding LULUCF Adjusted for purchasing power parity, 2050 target = $13,300 GDP/tonne Carbon productivity US$ 000 (PPP)/tCO2e 5.5 Saint Kitts and Nevis 5.0 Switzerland Mauritius 4.5 Bangladesh 4.0 Sweden Sri Lanka Norway Average carbon productivity 3.5 France 3.0 United Kingdom Japan Austria 2.5 Singapore Italy Pakistan Turkey 2.0 Indonesia Germany Mexico 1.5 India Brazil South Korea Iran Canada United States Australia Venezuela Saudi Arabia 1.0 Nigeria 0.5 Liberia G8+5 Qatar South Africa Russia 0 0 5 Turkmenistan China 10 15 20 25 30 35 Prosperity GDP per capita US$ 000 (PPP) Source: WRI CAIT; UNFCCC; Global Insight; McKinsey analysis 40 45 50 Carbon productivity has increased over time, but not nearly quickly enough * 5‐year running average. Emissions data includes CO2 from fossil fuels and cement, with projections for CO2 from land use changes and five non‐CO2 gases (CH4, N2O, HFCs, PFCs, and SF6) Source: IEA, CDIAC, OECD, EPA, CEC, World Bank, US Bureau of Economic Analysis, McKinsey analysis Some hypotheses for climate policy • Climate change is far riskier then conventional models lead us to believe – Fat tails, irreversibility, path dependence, etc. • Carbon prices may be necessary but not sufficient – Effectiveness of price signals in noisy, complex markets – Industrial revolution not triggered by spike in labour costs – broad socioeconomic phenomenon • Need to broadly change the “fitness function” of the economy – Regulation, standards (e.g. consumer and worker safety laws early 20th c.) – Behavior, social norms (e.g. slavery, smoking) • Policy and politics for homo realitius vs. homo economicus Some hypotheses for climate policy (cont.) • Social technology innovation just as important as physical technology – Institutions (e.g. green banks?) – Laws (e.g. carbon fiduciary responsibility?) – Information (e.g. climate risk disclosure? GDP measures?) • Must accelerate evolutionary innovation process – – – – Variation – dramatically increase shots on goal Selection – bias fitness function toward low carbon Amplification – capital and talent flows to low carbon Creating green innovation clusters • International cooperation needs to emerge bottom‐ up rather than top‐down – Evolution of trade regime vs. “Rio Dream” and Copenhagen Summary Industrial Revolution enabled a third of the population to escape the Malthusian trap of poverty, hardship and disease But it created our next, and possibly last, Malthusian trap – climate change Escaping that trap will require a low‐carbon revolution on the scale of the Industrial Revolution, but at three times the speed Economic revolutions are profoundly disequilibrium phenomena – not explained well by neoclassical theory A complex systems view helps us understand the evolutionary processes that drive discontinuous innovation and growth Climate policies should activate and leverage economic evolutionary processes – policymakers need new ideas, there is much work to do! ‘We cannot solve problems by using the same kind of thinking we used when we created them.’ ALBERT EINSTEIN Unless we truly understand the system we are dealing with we will fail We cannot afford to fail But if we can more deeply understand that system, we just might succeed