* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Data Transformation: Winning and Retaining the Digital

Sales process engineering wikipedia , lookup

Mobile commerce wikipedia , lookup

Target audience wikipedia , lookup

Food marketing wikipedia , lookup

Social media and television wikipedia , lookup

Brand loyalty wikipedia , lookup

Marketing communications wikipedia , lookup

Marketing strategy wikipedia , lookup

Guerrilla marketing wikipedia , lookup

Marketing research wikipedia , lookup

Online shopping wikipedia , lookup

Multi-level marketing wikipedia , lookup

Integrated marketing communications wikipedia , lookup

Viral marketing wikipedia , lookup

Social commerce wikipedia , lookup

Multicultural marketing wikipedia , lookup

Street marketing wikipedia , lookup

Supermarket wikipedia , lookup

Customer engagement wikipedia , lookup

Product planning wikipedia , lookup

Social media marketing wikipedia , lookup

Marketing mix modeling wikipedia , lookup

Direct marketing wikipedia , lookup

Advertising campaign wikipedia , lookup

Consumer behaviour wikipedia , lookup

Global marketing wikipedia , lookup

Youth marketing wikipedia , lookup

Music industry wikipedia , lookup

Green marketing wikipedia , lookup

Neuromarketing wikipedia , lookup

Marketing channel wikipedia , lookup

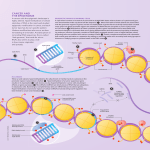

Data Transformation: Winning and Retaining the Digital Consumer 2 Winning and Retaining the Digital Consumer Consumer Packaged Goods (CPG) companies are faced with opportunities and challenges as tech-savvy, on-the-go consumers use a mix of digital channels to move from browse to purchase. eCommerce, eCoupons, social networks and mobile applications provide more opportunities than ever to learn about, engage with and deliver the goods to consumers. Yet, the expanding number of touch points and channels increases the difficulty of finding the right combination to serve them efficiently and consistently, and multiplies the complexity of both managing digital marketing tactics and allocating budgets to generate positive returns. The stakes are high. Consumers are using digital channels to make more informed decisions and making purchases through multiple channels. Their experiences with Amazon, Google and iTunes have increased their expectations that companies will use the gigabytes of personal data surrendered to curate and deliver targeted offers. Frankly, today’s digital consumers are baffled by, if not frustrated with, fragmented cross-channel efforts and irrelevant offers and campaigns. Which brings us to the question at hand: Given what we know about consumers and how they use digital channels, how should CPG companies prioritize their investments to attract, engage, sell to and retain digital consumers? CPG marketers want to invest in digital capabilities that influence consideration, enhance loyalty and drive sales. Many know that an integrated, multichannel consumer-centric organization is critical. But they do not know how to create this cost-efficiently at scale or where to start. Companies have a lot of options and could spend a lot of money with little to show for their efforts. This point of view identifies several leading practices to adopt as well as investments to consider in order to win digital consumers’ loyalty and business. We discuss channel-specific capabilities and strategies that have worked for clients and other companies. Underpinning all these specific ideas, however, is a broader point: Winning the digital consumer is an enterprise-wide responsibility, requiring contributions from functions and areas across a company. Far from being the “role” of sales, brand or marketing teams, we have found that companies that have succeeded, such as P&G, are those that combine talent, assets and insights to operate in a fundamentally different way, using new organizational structures and operating models geared toward making the most of investments in serving digital consumers. Consequently, the practices and capabilities discussed here should be viewed as pieces of the puzzle that could make future investments pay off—both for companies themselves and the consumers they hope to convert to customers. 3 Figure 1: Digital Path to Purchase Drives CPG Sales Shopper in Store (19%) Where are brand purchase decisions made? AWARENESS CONSIDERATION TRIAL PURCHASE LOYALTY ADVOCACY Consumer in Home (81%) Foundation Website Digital Capabilities Branded Sites Affiliate Site Promotional Site Analytics and Website Optimization Usability & Accessibility 4 Awareness & Consideration Trial On the Go Purchase Loyalty Advocacy CRM Social Search iMedia Partnerships Coupons Mobile eCommerce Natural Search SEO Standard Display Ads Content Syndication QR Codes Mobile Browser Direct to Consumer Comparison Shipping (Emerging Countries) eCoupons Mobile Apps Where to Buy Functionality Paid Search SEM Rich Media Ads Search Capability on Website Broadband Video Sponsorships/ Co-branding Online Events Sweepstakes QR Codes GPS RFID POS Web TV Philanthropic Cause Marketing Social Coupons Text Messaging Landing Page Optimization Branded Storefront Loyalty Program Behavioral Targeting and Acquisition Cross-sell Engine Sell Direct on Thirdparty Site Retention & Win Back Technical Platform Campaigns, MRM, Email, Reporting Online Video Communities Answer Forum Word-ofmouth, Buzz, Referrals Wikis, Blogs, Crowd Sourcing, Mash-ups Product Innovation 1. Think—and operate—with multichannel in mind Our research shows that consumers use a variety of channels as they move along the path toward purchase (see Figure 1), yet many companies do not move to meet them where they are swiftly or fluidly. In part, this is a product of organizational structure, when separate channels are managed by largely separate teams. But companies need to tear down those barriers if they are to serve the multichannel consumer well and compete. They also may need new capabilities to understand how consumers are using each channel so that they can react appropriately and move them along the path to purchase. When managed independently, single channels—even if executed superbly—have limited impact and provide just a slice of insight into consumer behavior, and it is a potentially misleading one given that consumers use a variety of channels. A true multichannel strategy integrates, leverages, measures and optimizes the unique properties and advantages of each channel. Consumer behaviors displayed on websites, social networks, mobile apps, emails and in stores should all be considered in prioritizing multichannel investments. CPG companies are finding that the best multichannel marketing is one that promotes an ongoing, synchronized dialogue with consumers. But, like all dialogues, it requires companies to pay constant attention to the flow of information received, and be agile enough to adapt to changes so they can deliver relevant, customized messages at the right time. Putting in place the organizational units, processes and tools to effectively integrate multiple channels is one of the key challenges CPG companies face. Yet, it is a necessary one to overcome to develop a holistic view of consumers, prevent missteps and seize opportunities to connect with them. 2. Employ data analytics to move through the marketing and sales cycle with consumers CPG companies frequently have more data than they know what to do with, yet it is rarely shared to understand and deepen relationships with consumers. Our research with CPG companies found that companies actually use data more to assess financial performance, evaluate supply chain interaction or improve collaboration with channel partners. Accordingly, redeploying analytic firepower to value-generating purposes is a critical step. As we discussed in our report on commercial analytics in consumer goods Moving from Insights to Action,1 CPG companies could potentially save money on the costs of data acquisition and increase revenue if analytics were focused on marketing and sales commercial processes such as deriving shopper insights; brand marketing analytics; or price, promotion and assortment analytics. In a recent survey of CPG executives2 we also found that only 12 percent would rate their company’s ability to execute analytics as “exceptional.” While there are most likely several causes of this deficit, we believe that fragmentation of analytics efforts across the organization is a primary driver. “Engaging consumers through full integration of traditional and digital channels is crucial for efficient international marketing campaigns and… increasingly globalized and digitalized consumer markets have revolutionized advertising strategy, with implications for the marketing planning process.”3 —Keith Weed, CMO at Unilever Consequently, we propose that companies develop a cross-functional, integrated analytics vision, as well as invest in the technology, processes and topflight analytic talent needed to identify target consumer segments and tailor marketing and sales strategies and offers. Delivering personalized, performance-based messages has never been easier given the access that digital channels provide. The companies that use analytics systematically to understand consumers better and act on that understanding will reap the rewards of big data. 1. Moving from Insights to Action can be found on Accenture.com at http://www.accenture.com/us-en/Pages/ insight-moving-from-insights-to-action-cpg.aspx. 2. Research Report: Commercial Analytics in Consumer Goods, September 2012, http://www.accenture.com/us-en/Pages/ insight-commercial-analytics-consumer-goods.aspx. 3. From http://www.takuglobal.net/2011/02/13/unilevercmo/ Retrieved Feb 28, 2013. 5 One study4 found that 44 percent of adults use social channels in part to air grievances about companies or products. 3. Put the “social” back in social platforms Remember how “F-commerce”—Facebook commerce—was going to be the next big thing? It’s not happening, at least not right now. In fact, many companies’ social media efforts are not designed to actually increase sales, or even to facilitate socializing. Fan pages and brand communities often look more like broadcast vehicles than interactive social vehicles. The bottom line is that many companies may need to revisit how they use social platforms, refocusing investments to both generate engagement and increase their social listening capability to extract actionable insights. Engagement takes many forms. Co-creation contests and games on social media engage consumers and give them a vehicle to voice their opinions. From voting on new product flavors to participating in video competitions in support of the brand, to offline scavenger hunts launched online, social media has a distinctive ability to generate engagement. 4. Future of Customer Service: The Rise of the Social Customer, February 2012. A report from The Social Media Leadership Forum (www.socialmedialeadershipforum.org). Retrieved April 1, 2013. 6 Ideally companies could create one-to-one relationships with consumers or one-tomany interactions among consumers over a shared pursuit. Either way, social media can increase the flow of conversation and consumers’ engagement with the brand and with each other, making it a uniquely cost-effective way to generate input and influence new products, offers and marketing approaches. Apart from facilitating interaction, the amount of social data flowing around the digital cosmos demands that companies develop the ability to listen to it, analyze it and identify consumers’ expectations, preferences and opinions—and shifts in all three. One study found that 44 percent of adults use social channels in part to air grievances about companies or products.5 Consumers who go online to talk about or recommend a product or brand can have enormous influence. Intensive, methodical social listening can identify positive and negative trends or conversation threads about companies, brands and products that CPG firms need to respond to or engage in. While many CPG companies know of key influencers on social networks and blogs, few have a real engagement strategy to leverage or mitigate the content that consumers post. Yet, motivated, garrulous consumers can be your best friends or worst enemies, making active social listening and responding critical. Beyond the billion people on Facebook, there are myriad social platforms, particularly in emerging markets, that consumers use to research and post opinions about products, and thus they require attention from CPG companies. 5. Future of Digital Marketing survey, quoted by http://econsultancy.com/us/blog/10168-this-week-stop-six-infographics. Retrieved Feb. 28, 2013. Consider that: • YouTube users upload 72 hours of new video every minute.6 • A recent survey showed the power of social media when it found that people trust peer recommendations seven times more than advertisements.7 • Nielsen now tracks over 180 blogs (up from 36 million in 2006), and social/visual blogs such as Tumblr have doubled unique users in under a year.8 • Twitter executives say that over 400 million tweets are posted each day.9 The bottom line is that companies need an end-to-end, closed-loop process to continuously monitor social media to glean and report insights, as well as policies to respond to social content with targeted communication as needed. Right now, sectors like Financial Services are ahead of CPG companies in this regard. These processes and policies will allow companies to stay in a continuous dialogue with consumers who are interested in their products and motivated enough to discuss them (for better or for worse). The insights gleaned can help target marketing messages and rewards, develop new products, or identify cross-brand bundling opportunities. Our friends at Facebook have taken it on the chin recently, but that doesn’t mean their platform isn’t a good one—and a multipurpose one at that. Our work with CPG companies to improve their eCRM and dialogue marketing capabilities shows that the investment can convert fans and followers to actual buyers. Whether focused on social networks or other channels, an effective social strategy will generate real insight for and connection between a brand and consumers that can benefit each party. 6. http://www.youtube.com/yt/press/statistics.html. Retrieved Feb. 28, 2013. 7. http://www.nielsen.com/us/en/newswire/2009/globaladvertising-consumers-trust-real-friends-and-virtualstrangers-the-most.html. Retrieved Feb. 28, 2013. 8. http://blog.nielsen.com/nielsenwire/online_mobile/buzzin-the-blogosphere-millions-more-bloggers-and-blogreaders/. Retrieved Feb. 28, 2013. 9. http://www.mediabistro.com/alltwitter/twitter-400million-tweets_b23744. Retrieved Feb. 28, 2013. Amazon: The granddaddy of directto-consumer Web-based commerce expands its presence Consumers’ love affair with websites continues, as Amazon’s remarkable growth shows. Once the go-to site for books and CDs, the categories Amazon offers now seem to multiply annually. The numbers tell a remarkable e-commerce success story: • Some analysts project that Amazon will rack up more than $160 billion in annual sales by 2016, representing a 23 percent compound annual growth rate, a momentum almost unmatched by any other retailer.10 • Amazon has diversified quickly from its core book business, as its 2010 acquisition of Diapers.com shows. • The company boasts a 23 percent sales conversion rate for visitors, compared to the 3 percent industry average.11 For those keeping track, the industry average continues to decline while Amazon’s conversion rate continues to grow. 10. http://www.bloomberg.com/news/2013-01-07/amazon-surges-to-record-high-onglobal-e-commerce-growth.html. Retrieved Feb. 28, 2013. 11. http://www.warriorforum.com/main-internet-marketing-discussion-forum/686323-2301-conversion-rate-amazon-good.html. Retrieved Feb. 26, 2013. 7 A coupon trade association calculated in 2012 that digital coupons have a redemption rate of over 20 percent12—nearly 100 percent higher than that of freestanding inserts for which redemption is generally pegged to be just .2 percent. Planet of the Apps You could argue that the debut of the iPhone® in 2007 spawned the real mobile revolution and provided a rare bright spot for CPG firms and retailers as the global economy slowed to a crawl. Consider that: • 15B apps were downloaded in the first six months after the iPhone launched.13 • eBay® generated more than $400M in sales from its iPhone application in the first full year of use.14 • The “Your Reebok” application on the iPhone generated more direct sales for Reebok than its website in 2009, the year of its launch.15 12. http://techzulu.com/the-future-of-couponing-howsocial-local-mobile-has-changed-the-game/. Retrieved Feb. 26, 2013. 13. http://www.asymco.com/2011/07/13/itunes-app-totaldownloads-finally-overtook-song-downloads/. Retrieved Feb. 26, 2013. 14. http://www.ft.com/intl/cms/s/0/b1d0e626-bff3-11deaed2-00144feab49a.html#axzz2MENarYMo. Retrieved Feb. 26, 2013. 15. http://digital-stats.blogspot.com/2009_11_01_archive. html. Retrieved Feb. 28, 2013. 8 to buy now” capability. CPG companies differ tremendously in the e-commerce capabilities in this regard, with fashion and beauty far ahead of grocery and other sectors in providing full-fledged e-store capabilities. 4. Use e-commerce websites as a field-tested path to higher sales Websites are no longer perceived as the “hot” digital channel they once were; mobile and social platforms have taken priority. This makes some sense as it is hard to stand out when there are nearly 300 million websites. Yet, our research confirms the importance of compelling websites in driving sales is significant for two reasons. First, we collaborated with comScore and dunnhumby USA16 to evaluate the link between online behavior and offline buying. What we found is that delivering a compelling website experience is a clear path to increasing sales and engaging and winning the digital consumer. Specifically, we found that: • Over 30 percent of offline sales are influenced by online content; • On average, website visitors spend 37 percent more than non-visitors; and In short, CPG companies are not getting their fair share of e-commerce sales. In 2011, over $12 billion of CPG products were sold online, and our research with comScore and dunnhumby USA shows that multichannel consumers are 30 percent to 200 percent more profitable for companies. While partnering with eRetailers like Amazon and leaders like Wal-Mart can generate sales, they are also more costly and complex than selling direct. The bottom line is that CPG companies can drive sales by enhancing websites, including optimizing content to make it easier for consumers to find products and streamlining navigation and click-to-buy processes. Leading CPG companies invest in e-commerce capabilities that facilitate quick and easy transactions as well as strengthen their presence on other retailers’ sites. In our work we have seen companies that take the time to optimize search engine results improve conversion by 1 percent to 35 percent. The Web is not as flashy as some other digital properties…but it works. • Engaged website visitors are also more involved in the brand’s category, spending 53 percent more than non-visitors and buying almost 60 percent more units. Second, in addition to their ability to drive sales offline, websites continue to be the most direct sales channel to many consumers and one that is underutilized. It’s easy to forget that when the Web first exploded and Amazon launched, websites were about e-commerce. Now the commerce functionality is obscured by other functionalities and content is spread across many sites. Yet, many consumers like to sit down at their computer and buy direct (see Amazon sidebar). Consumers expect brand sites to facilitate where to buy or, even better, provide a “click 16. Read the full report on the research at http:// www.accenture.com/us-en/Pages/insight-cpg-brandsmaximizing-return-digital-investment.aspx. 5. Don’t underestimate the value of digital coupons There is a healthy debate over whether any coupons—in hard-copy circulars, delivered to mobile devices, or downloadable from brand websites or social network pages— translate into sales lift or reward a buyer with a discount on a product he or she would have bought anyway. Some research suggests that 49 percent of shoppers don’t see coupons as an incentive to buy an item they don’t normally buy.17 17. MarketTools Inc. February 2012 survey. Taking a glass-half-full perspective, that means the other 50 percent could be motivated to try something new as a result of the right offer/coupon arriving at the right time through the right channel—all of which digital coupons can do far better than offers in traditional media. Our own research shows the benefits of that precise targeting. Digital coupons have a redemption rate of over 20 percent—nearly 100 percent higher than that of freestanding inserts which are generally pegged at .2 percent. The fact that the debate exists at all underscores that companies are still figuring out all of the dimensions of digital coupons, yet they are clearly placing more bets. More and more companies are moving marketing dollars to digital and away from trade. Digital coupons have a few clear benefits: besides precision targeting, they can be cheaper to produce than inserts or direct mail, and a promotion can be discontinued quickly if it flops or if it is too successful, diminishing fullprice sales. It is far easier to remove a digital coupon from a website than it is to try to stop or recall offers already in the mailbox. For consumers, digital coupons are also becoming easier to use. Apple’s iPhone 5 actually includes a new “Passbook” functionality— an application that stores digital coupons, boarding passes and loyalty cards. Digital coupons provide CPG companies with greater control over brands and allow targeting of coupons at consumers based upon where they are in the path-to-purchase funnel. Yet, far from exploiting these advantages, the low cost and evanescence of digital coupons have led some companies to be less strategic than they could be with digital coupon strategies. While it makes intuitive sense that a solid digital coupon strategy could complement a traditional couponing initiative, the devil is in the details—what should be offered, when, to whom and on which platform? Should the coupon be tied to the website? How do you track whether a person who downloaded a coupon or printed an email coupon has been converted or is just taking advantage of a one-off deal? The most telling metric is how much incremental business a coupon drives in store, but this data needs to be compared to accurate non-promotional data sets in order for companies to learn from it and fine-tune their strategies. Digital coupons add another piece to complete the puzzle that is the consumer purchase decision journey. While adding complexity, the investment in understanding what works is worthwhile as more consumers than ever carry smartphones, log on to social networks, use multiple channels to research and purchase products—and hunt for value. 6. Embrace the small screens and the mobile consumers so attached to them Mobile is the most intensely personal channel for many consumers, and a successful mobile strategy requires a mindset shift that reflects this sensitivity. We anticipate a shift at CPG firms to “context retailing,” where companies interact with consumers based upon where they are and how they live, rather than on the products a company is selling. Marc Pritchard, P&G’s global marketing officer, said as much recently, characterizing the shift from “I want to market to consumers” to “I want to serve people with our brands.”20 They’re everywhere and sometimes in the way: slowly walking while scrolling through texts and emails, clogging store aisles as they scan bar codes, or tinkering with their new mobile payment app to pay for the skinny latte at the coffee shop. In many markets, more than half the population has mobile devices or smartphones, and over 10 percent have more than one mobile device. Smartphones and tablets are the primary drivers of growth in consumer technology (see Figure 2), and by the close of 2012 there were more mobile devices than people on the planet.18 Not surprisingly, revenue from mobile data is projected to overtake that from fixed voice by 2013 in the US.19 Rather than signaling the end of personal interaction, however, the proliferation of small screens provides companies with direct access to consumers, albeit digitally enabled. Mobile devices occupy that hazy territory between animate and inanimate objects, and remain uniquely personal to their owners. Consequently companies need to tread cautiously when using the channel 18. Cisco and TechCrunch, http://techcrunch.com/2012/02/14/ the-number-of-mobile-devices-will-exceed-worlds-populationby-2012-other-shocking-figures/. Retrieved Feb. 26, 2013. 19. http://www.telecompetitor.com/report-wireless-datarevenue-will-overtake-voice-in-2013/ quoting Chetan Sharma research report, US Wireless Market Update – Q2 2012. 20. Quoted in Marketing Week, April 19, 2012. Retrieved Feb. 26, 2013. 9 Figure 2: Global Unit Shipments of Desktop PCs + Notebook PCs v s. Smartphones + Tablets, 2005−2015E 1800 1600 1400 1200 1000 Q4:10: Inflection Point Smartphones + Tablets > Total PCs 800 600 400 200 0 2005 2006 2007 Desktop PCs 2008 2009 2010 Notebook PCs 2011 2012E 2013E Smartphones 2014E 2015E Tablets Source: Kleiner Perkins Caufield & Byers Internet Trends @ Stanford - Bases 2012 December 3, 2012. http://www.slideshare.net/kleinerperkins/kpcb-internet-trends-2012. to connect with consumers. Accenture’s experience in helping companies craft and refine mobile strategies shows that an effective mobile strategy combines heavyduty analytics with deep personalization techniques. For example, consumers crave convenience, which location-based advertising or marketing on mobile devices can deliver. For a consumer compiling a grocery list, the ability to scan a bar code to quickly add an item to the list kept on a smartphone, and receive a related coupon or recipe makes their life easier, more efficient and shopping more cost-effective. If the consumer redeems the mobile coupon at a retailer, another stage of the mobile cycle is launched, which includes additional, targeted offers for products or retailer services, or suggestions to share the product info. Of course, all these mobile interactions generate a stream of data for companies to analyze. But consumers’ surrender of data for the convenience of living a mobileenabled life and more relevant and timely 10 offers is a trade-off many will gladly make. This is particularly true for members of the millennial or digital-native generations who use mobile devices far more than they use laptops or PCs. Mobile is the most intensely personal channel for many consumers, even more than talking with floor salespeople. Consequently, a successful mobile strategy requires new thinking and a mindset shift at CPG companies to reflect this sensitivity. We think pervasive mobility heralds the shift to context retailing, where companies will be expected to interact with consumers based upon where they are and how they live, rather than the products a company is selling. One home and personal care company we are serving is making the most of this shift already. We are helping build an augmented reality mobile app that allows users to search for a product by attribute or user need, and then retrieve related information about product uses, possible pairings or even offers of complimentary trial-size products. By putting the consumer need first, the company is establishing a collaborative, lifestyle-based relationship rather than a transactional one. Mobile consumers and mobile data allow a new level of customer-centric merchandising, but many companies are a bit behind the curve in investing in technology that can make that goal a reality. Gartner recently shared research21 detailing that: • 24 percent of companies still don’t segment consumers based upon demographics, transaction history or loyalty program data, although 27 percent will start major technology upgrades in the next 12-24 months that could facilitate these actions; and • 43 percent don’t or can’t segment customers by channel use. 21. Gartner Int’l., Integrating Analytics With CustomerCentric Merchandising, June 8, 2012. Publ. ID:G00231835. Helping P&G Transform Its Marketing Operations We support P&G’s Marketing Services Organization on a wide-ranging Commercial Business Process initiative to consolidate and simplify marketing service management. An Accenture team with professionals from our consumer goods practice and Accenture Interactive is the single point of contact for digital campaign execution covering over 90 percent of P&G’s global brands. In support of P&G’s XXX Summer Olympiad sponsorship, we also managed the launch of Internet sites, applications and home page features across 39 markets to help P&G execute its popular Thank You Mom campaign. By extending BPO from the back office into the front office, our digital marketing professionals are driving a major business transformation across the majority of P&G’s brands, resulting in efficiencies, cost reductions and the opening of a vast new growth area for Accenture. 11 Digital Channels Reach the Preschool Set Have you played “SuperPretzel Factory” and “Icee Maker”? Probably not, unless you are under four feet tall. The games are not well-known digital properties to most consumers, but they are becoming a fieldtested path for CPG companies to reach and entertain the youngest ones. With some companies voluntarily changing the content of TV advertising to emphasize healthier messages, mobile apps are a popular and unregulated way to market products to children through simple and enticing games for touch-screen phones and tablets. As a new channel in the digital marketing mix, the medium also has the advantage of being far cheaper than Saturday morning TV commercials. Parents may want to watch their iPhone the next time they take junior to the grocery store. The slow movement toward more actionable segmentation using mobile data is puzzling, as mobile provides a field-tested path to connect with and win the digital consumer of today and tomorrow. Our work with companies shows that having both a mobile strategy and an infrastructure that make consumer interactions personal, contextrelevant and efficient is a solid investment for CPG companies. As channels multiply and companies seek to enter more markets more efficiently, it’s imperative to integrate marketing channels and operations more effectively. Taking such steps not only benefit the consumer by delivering more consistent experiences, they deliver financial and competitive benefits to CPG companies as well. 7. Integrate digital marketing platform and services more tightly At the beginning of the digital age, many companies set up a separate unit to manage the “e-commerce” website—separate staff, separate budget, maybe even a separate location. Now, the complexity of executing marketing operations increases significantly as the number of digital touch points and channels multiplies, demanding a new level of integration. The difficulty in quantifying the return on investment in online advertising is a case in point. Many CPG marketers need deeper analytic capabilities to evaluate real-time performance of online properties, campaigns and tactics. And performance needs to be compared accurately across digital properties using consistent analytic solutions and data sources. A standardized, consistent approach would also make analysis of online advertising less costly. With even the most sophisticated companies using a variety of approaches and packages, the CMO may be the right person to bring order to the chaos. Marketers need cost-effective and efficient integrated technology platform and services processes to help manage and consistently evaluate their ever-expanding mix of digital and non-digital assets, and to ensure that they complement one other effectively to deliver consistently relevant consumer experience. 12 Accenture has helped leading companies such as P&G (see sidebar) achieve better integration faster by providing marketing support services in a variety of delivery models. For example, our Digital Production and Content Services are robust services that bring core marketing operations capabilities such as Content Production and Management, Campaign Management and Distribution. 8. Recognize that “winning the digital consumer” is an enterprise responsibility The specter of the digital consumer is pervasive in CPG companies, informing investments and decision making in all major functions and at all levels. Indeed, many CPG companies are evolving their business models to position digital capabilities as foundational elements in their organizational design and across the value chain (Figure 3). The important point is that companies should get started sooner rather than later. Many companies still operate as if serving the digital consumer is primarily the purview of marketing and sales teams, with perhaps a hefty assist from the technology team. Gaining alignment between marketing and technology is crucial, and not always Figure 3: Journey to Digital Organization End-Stage Models Digital Business Model Cohesive Digital Platforms Digital Business Processes Ad Hoc Solutions Digital Maturity 13 With loyalty and sales on the line, companies need to be strategic in how they invest in building their understanding of and relationships with consumers. More focused use of data analytics, better social listening and a comprehensive mobile strategy can all aid in deeper understanding and connection. the easiest match to make. Our research22 shows that a strong CMO-CIO partnership is imperative for an organization intent on evolving to a “digitized” business model, and thus demands constant attention to produce results. Yet, it is just one of many, and ignoring other dependencies can be detrimental to a company’s success. Winning the digital consumer and maintaining relevance to them depends upon crossfunctional leaders and teams collaborating and sharing information, not just in obvious commercial functions such as marketing and sales, new product development and customer service, but also in HR, finance, supply chain and analytics. To become and stay relevant a CPG company needs enterprise-wide critical capabilities such as: • A flexible, scalable technology platform that can integrate new channels and properties seamlessly. • Advanced eCRM tools that help companies understand and serve digital consumers by control segmenting audiences and targeting messages and offers. • An organizational mindset where employees understand and are able and willing to leverage end-to-end enterprise capabilities, even those not in their purview. • Marketing processes that enable efficient content creation and message targeting and distribution at scale. Ideally these processes would allow marketers and brand managers to segment customers by market, device preference and path to purchase stage. Marketing executives who recognize this have already begun to evolve their marketing organizations from a brandsiloed structure to one that enables a better multichannel consumer experience, and then work to extend that change throughout the company. While brand teams can serve as the connection point, brands can learn from one another and help leadership elevate the 22. See Driving Revenue Through Customer Relevance: Aligning the CMO and CIO to Achieve Agile Intelligent Marketing. 2010, CMO-CIO Alignment Imperative. 14 quality of the company’s relationship with consumers to be an enterprise responsibility. This could entail emulating approaches used at consumer-oriented companies like RitzCarlton or Disney that have made customer service every employee’s responsibility. In addition to executive leadership, new organizational structures and talent management processes that facilitate and reward sharing consumer insights are good first steps. Without such actions CPG companies will lose the ability to effectively cross-sell brands or increase the lifetime value of consumers. Conclusion Today’s digital consumers present CPG companies with more information, opportunities to connect and challenges than ever. With loyalty and sales on the line, companies need to be strategic in how they invest in building their understanding of and relationships with consumers. More focused use of data analytics, better social listening and a comprehensive mobile strategy can all aid in deeper understanding and connection. Optimizing websites to facilitate commerce, and experimentation with digital coupons can also generate insight and sales. Finally, consumers who use multiple channels to make their purchases expect companies to deliver a high-quality, consistent multichannel approach as well. Companies that execute on these dimensions could remain relevant, win sales in the short term, and the loyalty of digital consumers in the long run. To learn more about Accenture’s research and experience helping clients formulate and execute digital strategies, please contact: In North and South America Matthew DeNicola Managing Director—Consumer Goods & Services, Innovation Marketing +1.917.445.5205 [email protected] In Europe and Asia Alessandro Diana Managing Director, Accenture Interactive +39 335 7496716 [email protected] 15 Shaping the Future of High Performance in Consumer Goods Our Consumer Goods industry professionals around the world work with companies in the food, beverages, agribusiness, home and personal care, consumer health, fashion and luxury, and tobacco segments. With decades of experience working with the world’s most successful companies, we help clients manage scale and complexity, transform global operating models to effectively serve emerging and mature markets, and drive growth through evolving market conditions. We provide services as well as individual consulting, technology and outsourcing projects in the areas of Sales and Marketing, Supply Chain, ERP Global Operations and Integrated Business Services. To read our proprietary industry research and insights, visit www.accenture.com/ConsumerGoods. About Accenture Accenture is a global management consulting, technology services and outsourcing company, with approximately 281,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments. The company generated net revenues of US$28.6 billion for the fiscal year ended Aug. 31, 2013. Its home page is www.accenture.com. Copyright © Accenture 2014. All rights reserved. This document is produced by consultants at Accenture as general guidance. It is not intended to provide specific advice on your circumstances. If you require advice or further details on any matters referred to, please contact your Accenture representative. Copyright © 2014 Accenture All rights reserved. Accenture, its logo, and High Performance Delivered are trademarks of Accenture.