* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Corporate Finance: Modigliani and Miller

Survey

Document related concepts

Present value wikipedia , lookup

Land banking wikipedia , lookup

Systemic risk wikipedia , lookup

Financialization wikipedia , lookup

Private equity wikipedia , lookup

Investment fund wikipedia , lookup

Global saving glut wikipedia , lookup

Syndicated loan wikipedia , lookup

Corporate venture capital wikipedia , lookup

Private equity secondary market wikipedia , lookup

Stock valuation wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Business valuation wikipedia , lookup

Early history of private equity wikipedia , lookup

Stock selection criterion wikipedia , lookup

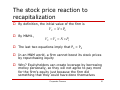

Financial economics wikipedia , lookup

Transcript

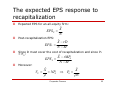

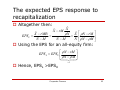

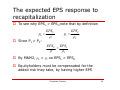

Corporate Finance: Modigliani and Miller Yossi Spiegel Recanati School of Business The M&M 1958 setting A firm operates for infinitely many periods Each period, the firm generates a random cash flow, X, distributed over the interval [X0, X1] according to some distribution function Assumptions: A1 - No transactions costs for buying and selling securities and no bid-ask spreads (i.e., buying and selling prices are the same). A2 - The capital market is perfectly competitive A3 - No bankruptcy costs A4- No corporate or personal taxes A5 - All agents (firms and investors) have the same information Corporate Finance 2 The market value of an all-equity firm Since the market is perfectly competitive: Xˆ Xˆ Xˆ Xˆ VU 2 3 1 1 1 1 1 1 1 2 1 1 z Now z 1 1 1 1 z 2 1 1 1 1 1 1 1 1 2 1 1 z Hence z 1 Corporate Finance 3 The market value of an all-equity firm Since the market is perfectly competitive: Xˆ Xˆ Xˆ VU 2 3 1 1 1 Xˆ 1 1 1 2 1 1 1 1 Xˆ Xˆ 1 Corporate Finance 4 The market value of an all-equity firm – another derivation Since the market is perfectly competitive: 1 Xˆ Xˆ Xˆ Xˆ VU 1 1 2 1 3 1 1 Xˆ Xˆ 2 1 1 VU Hence V Xˆ U VU 1 1 VU Corporate Finance Xˆ 5 The market value of a leveraged firm The market value of debt: rD rD rD BL 2 3 1 r 1 r 1 r 1 1 rD 1 2 1 r 1 r 1 r rD 1 r D 1 r r The market value of equity EL Xˆ rD L Corporate Finance 6 The market value of a leveraged firm The total value of the firm: VL BL EL D Corporate Finance Xˆ rD L 7 The M&M propositions M&M Proposition 1 Given Assumptions A1-A5, the market values of U and L are equal: VU = VL The proof of M&M1 uses a noarbitrage argument Under Assumptions A1-A5, investors in U can replicate the cash flows of investors in L and vice versa so the prices of U and L must be same Corporate Finance 9 Proof of M&M1 – part 1 Suppose by way of negation that VU > VL Consider an investor who holds a fraction of firm U The investor’s payoff is X and the market value of his portfolio is VU Consider the following investment strategy: “Sell the holdings in firm U and buy a fraction of firm L's equity and debt” Corporate Finance 10 Proof of M&M1 – part 1 The investor’s payoff X rD rD X The investor’s wealth: VU VL 0 The strategy yields the same payoff but a higher wealth so all investors should follow it; but then, it’s no longer true that VU > VL Corporate Finance 11 Proof of M&M1 – part 2 Suppose by way of negation that VU < VL Consider an investor who holds a fraction of firm L The investor’s payoff is (X-rD) and the market value of his portfolio is VL Consider the following investment strategy: “Sell the holdings in firm L and buy a fraction of firm U's equity and borrow D at an interest rate r” Corporate Finance 12 Proof of M&M1 – part 2 The investor’s payoff X r D X rD The investor’s wealth: EL D VU EL D VU 0 VL The strategy yields the same payoff, but a higher wealth, so all investors should follow it; but then, it’s no longer true that VU < VL Corporate Finance 13 M&M Proposition 2 Given Assumptions A1-A5, the discount rate for a leveraged firm is r D L EL The expression (-r)D/EL can be thought of as a financial risk premium Corporate Finance 14 Financial risk premium Why is the equity of a leveraged firm “risky”? Consider an investment of 100 which yields either 100 or 300 with equal probabilities Under all equity financing, the net return is prob. 50%: (100-100)/100 = 0% prob. 50%: (300-100)/100 = 200% Corporate Finance 15 Financial risk premium Suppose now the firm issued debt with face value 80 If r = 0, investors pay 80 for the debt so the firm finance the remaining 20 with equity The net return is prob. 50%: (100-80-20)/20 = 0% prob. 50%: (300-80-20)/20 = 1000% The net return is much more volatile If investors do not like volatility they will require a higher return as compensation Corporate Finance 16 Proof of M&M2 From the market value of equity: EL Xˆ rD L Xˆ rD L EL By M&M1, VL VU Hence L Xˆ EL D rD EL Xˆ EL D VL r D Corporate Finance EL 17 The implications of the M&M propositions WACC In practice, investors often discount the cash flows from projects using a weighted average cost of capital: D EL WACC r L VL VL By M&M2, D r D EL EL D WACC r VL E L VL VL L WACC is independent of capital structure (otherwise it would have affected investment decisions) Corporate Finance 19 The stock price reaction to recapitalization An all-equity firm with N outstanding shares priced at P0 issues debt with market value D and uses the proceeds to repurchase M shares for a price Pr. What’s the post-recapitalization price, P1? P1= Pr, otherwise all shareholders tender or no shareholder does D must cover the cost of recapitalization: D M Pr M P1 The value of the shares that are not tendered: E L N M P1 The post-recapitalization value of the firm: VL D E L M P1 N M P1 N P1 Corporate Finance 20 The stock price reaction to recapitalization By definition, the initial value of the firm is VU N P0 By M&M1, VU VL N P1 The last two equations imply that P1 = P0 In an M&M world, a firm cannot boost its stock prices by repurchasing equity Why? Equityholders can create leverage by borrowing money personally, so they will not agree to pay more for the firm's equity just because the firm did something that they could have done themselves Corporate Finance 21 The expected EPS response to recapitalization Expected EPS for an all-equity firm: Xˆ EPSU N Post-recapitalization EPS: Since D must cover the cost of recapitalization and since P1 = P0 : Xˆ rD EPS L N M Xˆ rMP0 EPS L N M Moreover: VU Xˆ NP0 Xˆ P0 N Corporate Finance 22 The expected EPS response to recapitalization Altogether then: ˆ X ˆ rM X Xˆ rMP0 N Xˆ N rM EPS L N M N M N N M Using the EPS for an all-equity firm: N rM EPS L EPSU N M Hence, EPSL >EPSU Corporate Finance 1 23 The expected EPS response to recapitalization To see why EPSL > EPSU note that by definition p0 EPSU p1 Since P1 = P0: EPSU EPS L L EPS L L By M&M2, L > , so EPSL > EPSU Equityholders must be compensated for the added risk they take, by having higher EPS Corporate Finance 24 M&M and EPS-price ratios Practitioners often compare earnings-price ratios across firms in the same industry and use the rule: "buy firms with higher EPS-price ratios" The logic: stocks with higher EPS-price ratios yield a higher returns and must be better Since firms are in the same industry, their risks are presumably the same What is ignored is financial risk: leverage raises EPS but not prices so it raises EPS-price ratios even of values are the same Corporate Finance 25 M&M 1963: corporate taxes M&M with corporate taxes Instead of Assumption A4, assume now that there’s a corporate tax rate tc The market value of an all-equity firm: Xˆ 1 tc Xˆ 1 tc Xˆ 1 tc Xˆ 1 tc VU 2 3 1 1 1 Corporate Finance 27 M&M Proposition 1 with corporate taxes Proposition: VL = VU+tcD To prove the proposition, consider anall-equity firm and a leveraged firm which are identical, save for their capital structures The market values are VU and VL = EL+D Corporate Finance 28 Proof of M&M1 – part 1 Consider two investments: Buy a fraction of firm U Buy a fraction of firm L’s equity and a fraction (1-tc) of firm L’s debt The annual payoff from investment 1: X 1 tC The annual payoff from investment 2: X rD 1 tC rD1 tC X 1 tC Corporate Finance 29 Proof of M&M1 – part 1 Since the two investments yield the same payoff, they must have the same value: VU EL D1 tC VU EL D tC D VL Intuition: with leverage, the firm saves on corporate taxes, so its value increases by the present value of the tax shield on future interest payments Corporate Finance 30 M&M Proposition 2 Proposition: r D1 tC L EL By definition: Xˆ 1 tC VU L Xˆ rD 1 t C EL Combining the two: VU rD 1 tC 1 tC VU rD1 tC L EL EL Corporate Finance 31 M&M Proposition 2 By M&M1: VL = VU + tCD VL EL D tC D rD1 tC VU rD1 tC L EL EL D1 tC rD1 tC EL r D1 tC EL Corporate Finance 32 Interpretation of M&M Proposition 2 We can rewrite L as follows: r D1 tC EL tC D r D tC rD L EL EL (EL-tCD) – a return on invested equity -r)D – financial risk premium tCrD – per-period tax saving Corporate Finance 33