* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Savings and Investment

Survey

Document related concepts

Quantitative easing wikipedia , lookup

Environmental, social and corporate governance wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Investment banking wikipedia , lookup

Interbank lending market wikipedia , lookup

Auction rate security wikipedia , lookup

Investment management wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Hedge (finance) wikipedia , lookup

Private money investing wikipedia , lookup

Stock exchange wikipedia , lookup

Socially responsible investing wikipedia , lookup

Securities fraud wikipedia , lookup

Stock trader wikipedia , lookup

Transcript

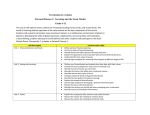

T009-01.01 9.01 Summarize the various types of short-term and long-term investments. H3 T009-01.02 Investing Putting your money to use in order to make money on it. Simple Interest vs. Compound Interest Simple – interest that is computed only on the amount saved. Compound – interest that is computed on the amount saved plus interest previously earned. Securities refers to bonds, stocks, and other documents sold by corporations and governments to raise large sums of money. H4 T009-01.03 Savings is money put aside for future use. Most common reasons to save are: –Major purchases –Emergencies •Saves money for a “rainy day” –Retirement H5 T009-01.04 Investing Through Banks •Savings Account –Simplest form of saving –Offered by all institutions (banks, credit unions, etc.) –Generally, a low minimum deposit is required –Interest is low and varies from institution to institution •Certificate of Deposit –Requires a minimum deposit for a minimum amount of time –Interest rates are higher than a savings account H6 T009-01.05 Investing Through Banks Continued Money Market Fund –Kind of mutual fund, or pool of money, put into a variety of short-term debt by business and government. H7 T009-02.01 9.02 Summarize the investing in stocks and bonds. H17 T009-02.02 Investing in Bonds Bonds Promise to pay a definite amount of money at a stated interest rate on a specified maturity date. Bondholder Individual who lends money to a corporation. H18 T009-02.03 Bond Terms Face Value Amount being borrowed by the seller of the bond. Coupon Rate Rate of interest on the bond. H19 T009-02.04 Types of Bonds Corporate Issued by corporations Used to finance buildings and equipment. Municipal Bonds Bonds Issued by local and state governments. Used to finance schools, roads, airports, etc. H20 Types of Bonds Treasury T009-02.05 Bonds Issued by federal government. Known as Savings or Federal Bonds Types: Series EE Bonds Cost half the face value. After a specified number of years the bond becomes worth the face value. Treasury Issued for three months to one year. Treasury Notes Issued for two to ten years. Treasury Bills Bonds Issued for ten or more years. H21 T009-02.06 Investing in Stocks Stock Share of ownership in a business. Stock Certificate Proof of ownership in a corporation Market Value Price at which a stock can be bought or sold. Dividends Part of profits shared with stockholders. H22 T009-02.07 Types of Stocks Preferred Priority over common stockholders in the payment of dividends. No voting rights. Common General ownership in a corporation and a right to share in the corporation’s profits Right to vote at shareholder meetings One vote per share. H23 T009-02.08 Reading a Stock Quotation Table 52 Week Hi – Highest price during previous 52 weeks 52 Week Lo – Lowest price during previous 52 weeks Stock – Company name abbreviated Stock Symbol – Ticker symbol Dividend – Current dividend in dollars per share based on the last dividend paid Yield – Dividend yield based on the current selling prices per share H24 T009-02.09 Reading a Stock Quotation Table PE – (Price/Earnings ratio, comparing the price of the stock with earnings per share). Volume – Number of shares traded. High – Highest price during the day. Low – Lowest price during the day. Close – Closing price for the day. Net Change – Change in the closing price today compared with closing price on the previous day. H25 T009-02.10 Typical transactions follow these steps: 1. Account executive receives your order to sell stock and relays to the brokerage firm’s representative at the stock exchange. 2. Floor broker (buyer) goes to the trading post at which time this specific stock is traded. It is traded with the floor broker (seller) who has an order to buy. 3. A clerk signals the transaction to a floor broker on the stock exchange floor. H26 T009-02.11 4. Floor broker (buyer) signals the transaction back to the clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account executive, who then notifies you of the completed transaction. H27 T009-02.12 Brokerage Firm Sells stocks for consumers Broker Person who acts as a go between for buyers and sellers of securities. Commission Fee charged by a brokerage firm for the buying and/or selling of a security. H28 T009-02.13 Stock Exchanges Marketplace where brokers who represent investors meet to buy and sell securities. Examples: NYSE NASDAQ AMEX Exchanges in San Francisco, Boston, Chicago H29 T009-02.14 Types of Markets Bull Market Occurs when investors are optimistic about the economy. Bear Market Occurs when investors are pessimistic about the economy. H30 T009-02.15 Numerical Measures for a Corporation Current Yield Annual dividend divided by current market value. Price/Earnings Ratio Price of one share of stock divided by the earnings per share. H31 T009-02.16 Selling a Stock Total Return Calculation that includes the annual dividend as well as any increase or decrease in the original purchase price of the investment. Capital Profit from the sale of an asset such as stocks, bonds, or real estate. Taxed as income. Capital Gains Loss Sale of an investment for less than its purchase price. Subtract up to $3,000 in losses from your income. H32 T009-03.01 9.03 Summarize other types of investments. H48 T009-03.02 Investing Through Insurance Life Insurance Cash-value insurance provides both savings and death benefits. H49 T009-03.03 Investing in Your Future Pension Series of regular payments made to a retired worker under an organized plan. Individual Retirement Account (IRA) Tax sheltered retirement plan in which people can annually invest earnings. Types: 401k or 403b contributions are tax deductible and funds are taxed as regular income when they are withdrawn after age 59 ½. Roth IRA contributions are not tax deductible, but investment gains and all funds on which taxes are prepaid are tax free when they are withdrawn after age 59 ½. H50 T009-03.04 Investing in Your Future Annuity Amount of money that an insurance company will pay at definite intervals to a person who has previously deposited money with the company. H51 T009-03.05 Investing Through Other Sources Real Estate Land and anything that is attached to it. Mortgage Legal document giving the lender a claim against the property. Home Equity Difference between the price at which you could currently sell your house and the amount owed on the mortgage. Appreciation – general increase in value of a property. Depreciation – general decrease in value of a property. H52 T009-03.06 Investing Through Other Sources Types of Property Undeveloped Property (Land) Unused land intended only for investment purposes. Commercial Property Land and buildings that produce lease or rental income. Real Estate Investment Trusts (REITs) Works like a mutual fund. Combines funds to invest in real estate. H53 T009-03.07 Collectibles Items of personal interest to collectors. Rare coins, works of art, antiques, stamps, rare books, comic books, sports memorabilia, rugs, ceramics, paintings, and other items that appeal to collector and investors. H54 T009-03.08 Commodities Include grain, livestock, precious metals, currency, and financial instruments. Futures Commodity contract purchased in anticipation of higher market prices for the commodity in the near future. H55 T009-03.09 Investing With Others Investment Small group of people who organize to study stocks and to invest their money. Mutual Clubs Fund Created by an investment company that raises money from many shareholders and invests it in a variety of stocks. Limit risk by diversifying investment. H56 T009-03.10 Speculative Investment Speculator One that has an unusually high risk. H57 T009-04.01 9.04 Analyze the factors that affect the rate of return on a given savings or investment plan and calculate the rate of return. H65 T009-04.02 Savings Plan Putting money aside in a systematic order. Ways to put money aside: Regular deposit Automatic deposit Electronic funds transfer H66 Starting a Program Factors Safety T009-04.03 determining a program Assurance that the money you have invested will be returned to you. Liquidity Ease with which an investment can be changed into cash without losing any of its value. Yield Rate of return (percentage of interest that will be added to you r savings over a period of time). Diversification Process of spreading your assets among several different types of investments to lessen risk. H67 Factors That Affect the Rate of Return on an Investment T009-04.04 Risk - Chance of loss. Rate of Return (yield) Amount of money the investment earns. Compounding frequency is the interest computed on the amount saved plus the interest previously earned. Liquidity Ease with which an investment can be changed into cash. Resistance Will Tax to inflation rate of return keep up with inflation? H68 considerations Factors that Affect the Selection of Financial Institutions Services offered • Business hours • Location • On line services H69 T009-04.05 T009-04.06 Financial Security Investments (low risk) Cash Savings Accounts Money Market Accounts Certificate of Deposit US Government Bonds Retirement Accounts H70 T009-04.07 Safety and Income Investments US Treasury Securities Conservative Corporate Bonds State and Municipal Bonds Income and Utility Stocks H71 T009-04.08 Growth Investments Income and Growth Stocks Mutual Funds Real Estate Convertible Bonds H72 T009-04.09 Speculation Investments (high risk) Options Commodities Precious Metals and Gems Speculative Stocks Junk Bonds Collectibles H73 T009-04.10 Calculating Rate of Return Rate of Return = Total Interest Earned divide by Original Deposit Example: If you deposited $100 in account that paid $6.18 interest for one year. What is the rate of return? $6.18/$100 = .0618 = 6.18% H74 T009-05.01 9.05 Analyze how saving and investing influences economic growth. H85 T009-05.02 Savings and Economic Growth Individual savings allow: Businesses to expand and create more jobs. Demand for goods and services to increase. Failure to save will cause less money to be invested and the economy may slow as a result. Savings contribute to our economic stability Government uses savings to build highways, schools, and public services H86 T009-06.01 9.06 Describe wills and other legal documents. H89 T009-06.02 Wills Legal document that specifies how you want your property to be distributed after your death. Intestate Die without a legal will State will step in and control the distribution of your estate. Probate Legal procedure of proving a will to be valid or invalid. H90 T009-06.03 Wills Simple Leaves everything to your spouse Formal Will Will Prepared by an attorney. Holographic Will Handwritten will that you prepare yourself Needs to be written, dated, and signed entirely in your own handwriting. H91 T009-06.04 Other Legal Documents Trusts Legal arrangement that helps manage the assets of your estate for you benefit or that of your beneficiaries. Living Will Document in which you state whether you want to be kept alive by artificial means if you become terminally ill and unable to make such a decision. Power Legal of Attorney H92 document that authorizes someone to act on your behalf. Guardian T009-06.05 Person who accepts the responsibility of: 1. Providing children with personal care after their parents’ death 2. Managing the parents’ estate for the children until they reach a certain age H93 T009-07.01 9.07 Explain how agencies regulate financial markets and protect investors. H98 T009-07.02 Regulators Securities and Exchange Commission (www.sec.gov) Protect investors and maintain the integrity of the securities markets. H99 T009-07.03 Regulators NASD (www.nasd.com) Registers member firms, writes rules to govern their behavior, examines them for compliance and disciplines those that fail to comply. Largest private sector provider of financial regulatory services. Has helped bring integrity to the markets and confidence in investors. H100 Protecting Investors T009-07.04 Department of the Secretary of State (www.secretary.state.nc.us /sec ) State Securities Laws Known as “blue sky” laws Intent of laws is to protect the investing public by requiring a satisfactory investigation of both the people who offer securities as investments and of the securities themselves. Securities division addresses investor complaints concerning securities brokers and dealers , investment advisers and commodity dealers as well as complaints about offerings of particular investment H101 vehicles.