* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Ind.

Debt settlement wikipedia , lookup

Financial economics wikipedia , lookup

Syndicated loan wikipedia , lookup

Debtors Anonymous wikipedia , lookup

Investment management wikipedia , lookup

Financialization wikipedia , lookup

Systemic risk wikipedia , lookup

Pensions crisis wikipedia , lookup

Government debt wikipedia , lookup

Early history of private equity wikipedia , lookup

Private equity secondary market wikipedia , lookup

International asset recovery wikipedia , lookup

Private equity wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Securitization wikipedia , lookup

Private equity in the 2000s wikipedia , lookup

Business valuation wikipedia , lookup

Household debt wikipedia , lookup

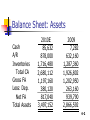

CHAPTER 4 Analysis of Financial Statements Ratio Analysis Du Pont system Effects of improving ratios Limitations of ratio analysis 4-1 Balance Sheet: Assets Cash A/R Inventories Total CA Gross FA Less: Dep. Net FA Total Assets 2010E 85,632 878,000 1,716,480 2,680,112 1,197,160 380,120 817,040 3,497,152 2009 7,282 632,160 1,287,360 1,926,802 1,202,950 263,160 939,790 2,866,592 4-2 Balance sheet: Liabilities and Equity 2010E Accts payable 436,800 Notes payable 300,000 Accruals 408,000 Total CL 1,144,800 Long-term debt 400,000 Common stock 1,721,176 Retained earnings 231,176 Total Equity 1,952,352 Total L & E 3,497,152 2009 524,160 636,808 489,600 1,650,568 723,432 460,000 32,592 492,592 2,866,592 4-3 Income statement Sales COGS Other expenses EBITDA Depr. & Amort. EBIT Interest Exp. EBT Taxes Net income 2010E 7,035,600 5,875,992 550,000 609,608 116,960 492,648 70,008 422,640 169,056 253,584 2009 6,034,000 5,528,000 519,988 (13,988) 116,960 (130,948) 136,012 (266,960) (106,784) (160,176) 4-4 Other data No. of shares EPS DPS Stock price Lease pmts 2010E 250,000 $1.014 $0.220 $12.17 $40,000 2009 100,000 -$1.602 $0.110 $2.25 $40,000 4-5 Why are ratios useful? Ratios standardize numbers and facilitate comparisons. Ratios are used to highlight weaknesses and strengths. Ratio comparisons should be made through time and with competitors Peer (or Industry) analysis Trend analysis 4-6 Ratios facilitate comparisons Firm A (RM) Sales 5,000,000 T. Assets 3,500,000 Firm B (RM) 4,850,000 3,200,000 4-7 Turnover ratio Firm A 5,000,000 = 1.428x 3,500,000 Industry analysis Firm B 1.52x Firm B 4,850,000 = 1.52x 3,200,000 Industry 1.729x 4-8 Trend Analysis Turnover ratio firm’s B 1.256 1.276 1.325 1.346 1.426 1.457 Year 2000 2001 2002 2003 2004 2005 4-9 1.5 1.45 1.4 1.35 Series1 1.3 1.25 1.2 1.15 1 2 3 4 5 6 4-10 What question do they answer? Liquidity Ratio: Can we make required payments? 4-11 Calculate forecasted current ratio and quick ratio for 2010. Current ratio = = = Quick ratio = = = Current assets / Current liabilities $2,680 / $1,145 Industry 2.34x 2.70x (CA – Inventories) / CL ($2,680 – $1,716) / $1,145 0.84x Industry 1.0x 4-12 Comments on liquidity ratios 2010E 2009 2008 Ind. Current Ratio 2.34x 1.20x 2.30x 2.70x Quick Ratio 0.84x 0.39x 0.85x 1.00x Expected to improve but still below the industry average. Liquidity position is weak. 4-13 What question do they answer? Asset management ratios: right amount of assets vs. sales? 4-14 What is the inventory turnover vs. the industry average? Inv. turnover Inventory Turnover = Sales / Inventories = $7,036 / $1,716 = 4.10x 2010E 2009 2008 Ind. 4.1x 4.70x 4.8x 6.1x 4-15 Comments on Inventory Turnover Inventory turnover is below industry average. Company might have overstocked of inventory or insufficient sales 4-16 DSO is the average number of days after making a sale before receiving cash. DSO = Receivables / Avg sales per day = Receivables / (Annual sales/365) = $878 / ($7,036/365) = 45.6 days 4-17 Appraisal of DSO DSO 2010E 2009 2008 Ind. 45.6 38.2 37.4 32.0 Company collects on sales too slowly, and is getting worse. Company has a poor credit policy. 4-18 Fixed assets and total assets turnover ratios vs. the industry average FA turnover = Sales / Net fixed assets = $7,036 / $817 = 8.61x TA turnover = Sales / Total assets = $7,036 / $3,497 = 2.01x 4-19 Evaluating the FA turnover and TA turnover ratios 2010E 2009 2008 Ind. FA TO 8.6x 6.4x 10.0x 7.0x TA TO 2.0x 2.1x 2.3x 2.6x FA turnover projected to exceed the industry average. TA turnover below the industry average. Caused by excessive currents assets (A/R and Inv). 4-20 what question do they answer? Debt management: Right mix of debt and equity? 4-21 Effects of Financial Leverage on Stockholder Returns Current assets Fixed assets FIRM U [UNLEVERAGED (NO DEBT)] $50 Debt 50 Common Equity Total Assets $100 Total liabilities and equity Good Sales revenues Operating costs Fixed Variable Total Operating costs Operating income (EBIT) Interest (Rate = 10%) Earnings before taxes (EBT) Taxes (Rate = 40%) Net income (NI) ROEu $0 100 150.0 45.0 60.0 105.0 45.0 0.0 45.0 18.0 27.0 27.0% BUSINESS CONDITIONS Expected 100.0 45.0 40.0 85.0 15.0 0.0 15.0 6.0 9.0 9.0% $100 Bad 75.0 45.0 30.0 75.0 0.0 0.0 0.0 0.0 0.0 0.0% 4-22 FIRM L [UNLEVERAGED (SOME DEBT)] Current assets $50 Fixed assets 50 Total Assets $100 Debt $50 Common Equity 50 Total liabilities and equity Good Sales revenues Operating costs Fixed Variable Total Operating costs Operating income (EBIT) Interest (Rate = 10%) Earnings before taxes (EBT) Taxes (Rate = 40%) Net income (NI) ROEL 150.0 45.0 60.0 105.0 45.0 5.0 40.0 16.0 24.0 48.0% BUSINESS CONDITIONS Expected 100.0 45.0 40.0 85.0 15.0 5.0 10.0 4.0 6.0 12.0% $100 Bad 75.0 45.0 30.0 75.0 0.0 5.0 -5.0 0.0 -5.0 -10.0% 4-23 Leverage( debt) and the advantages ? Imagine that the company have RM 50 million to pay for the new building It is insufficient to buy the building for the company expansion plan, so the company use that money as a deposit on the loan and get a loan for the rest of the money due. If the building price is RM250 M, and the company put down RM50 M, the company can use the loan to leverage that cash so the 4-24 company can afford the building. Leverage( debt) and the advantages ? In this case the loan covers 80% of the purchase price. The company now can use any cash the company earn beyond the monthly loan repayment to pay other company’s expenditure. The real benefits of leverage is seen when the building price goes up over time. 4-25 Leverage( debt) and the advantages ? Suppose the building value increases by 20% to RM300 M at which point the company sell it and pay back the loan of RM 200 M. The company capital now has doubled from RM 50 M to RM 100M 4-26 Calculate the debt to equity ratio, debt ratio, times-interest-earned coverage ratios. Debt to Equity= Total debt / Total equity = ($1,145 + $400) / 1,721 +231 Ind. = 0.79 0.83 4-27 Calculate the debt to equity ratio, debt ratio, times-interest-earned coverage ratios. Debt ratio = Total debt / Total assets = ($1,145 + $400) / $3,497 Ind. = 44.2% 50% TIE = EBIT / Interest expense = $492.6 / $70 = 7.0x Ind. 6.2% 4-28 How do the debt management ratios compare with industry averages? 2006E 2005 2004 Ind. D/A 44.2% 82.8% 54.8% 50.0% TIE 7.0x -1.0x 4.3x 6.2x D/E 0.79 4.79 1.21 0.81 D/E, D/A and TIE are compatible with the industry 4-29 What questions do they answer? Profitability ratios: These ratios enable the investors to evaluate the firm’s profit with respect to a given level of sales, a certain level of assets, or the owners’ investments? 4-30 Profitability ratios: Profit margin and Basic earning power Profit margin = Net income / Sales = $253.6 / $7,036 = 3.6% Ind. 3.5% BEP = EBIT / Total assets = $492.6 / $3,497 = 14.1% Ind. 19.1% 4-31 Profitability ratios: Return on assets and Return on equity ROA = Net income / Total assets = $253.6 / $3,497 = 7.3% Ind. 9.1% ROE = Net income / Total common equity = $253.6 / $1,952 = 13.0% Ind. 18.2% 4-32 Appraising profitability with the return on assets and return on equity 2010E 2009 2008 Ind. ROA 7.3% -5.6% 6.0% 9.1% ROE 13.0% -32.5% 13.3% 18.2% Both ratios rebounded from the previous year, but are still below the industry average. More improvement is needed. 4-33 Problems with ROE ROE and shareholder wealth are correlated, but problems can arise when ROE is the sole measure of performance. ROE could not capture accounting manipulation risk. 4-34 High ROE Net income Capital structure policy ROE= Net Income Common equity Equity Liability High risk of financial distress 4-35 Market value ratios A set of ratios that relate the firm’s stock price to its earnings, cash flow, and book value per share. 4-36 Calculate the Price/Earnings, Price/Cash flow, and Market/Book ratios. Share price= $12.17, Earnings= $253,584 # 0f shares= 250,000 P/E = Price / Earnings per share = $12.17 / $1.014 = 12.0x Ind. 14.2x P/CF = Price / Cash flow per share = $12.17 / [($253.6+$117.0) ÷ 250] Ind. = 8.21x 11.0x 4-37 Calculate the Price/Earnings, Price/Cash flow, and Market/Book ratios. M/B = Market price / Book value per share = $12.17 / ($1,952 / 250) = 1.56x Ind. 2.4x 2010E 2009 2008 Ind. P/E 12.0x -1.4x 9.7x 14.2x P/CF 8.21x -5.2x 8.0x 11.0x M/B 1.56x 0.5x 1.3x 2.4x 4-38 Analyzing the market value ratios P/E: How much investors are willing to pay for $1 of earnings. P/CF: How much investors are willing to pay for $1 of cash flow. M/B: How much investors are willing to pay for $1 of book value equity. For each ratio, the higher the number, the better. 4-39 The Du Pont system Equity Profit Total assets ROE margin turnover multiplier ROE (NI/Sales) (Sales/TA) (TA/Equity) Focuses on expense control (PM), asset utilization (TA TO), and debt utilization (Equity multiplier.) 4-40 Extended DuPont equation: Breaking down Return On Equity ROE = = = (NI / Sales) x (Sales/TA) x (TA/Equity) 3.6% 13.0% x 2 x 1.8 PM TA TO EM ROE 2008 2009 2010E 2.6% -2.7% 3.6% 2.3 2.1 2.0 2.2 5.8 1.8 13.3% -32.5% 13.0% Ind. 3.5% 2.6 2.0 18.2% Ind. 18.2% 4-41 Potential problems and limitations of financial ratio analysis Comparison with industry averages is difficult for a conglomerate firm that operates in many different divisions. “Average” performance is not necessarily good, perhaps the firm should aim higher. “Window dressing” techniques can make statements and ratios look better. Different operating and accounting practices can distort comparisons. 4-42 Electronic 1) Firm A Firm B N. Income = RM1m T. Assets = RM4m Return on = 1m Total asset 4m = 0.25 ≈ 25% Subs A Subs B N. Income = RM5m T. Assets = RM15m Subs C Return on = 5m total asset 15m = 0.33 ≈ 33% 4-43 2) ROE ROA Firm A 13% 5.9% Industry average 13.2% 5.9% 4-44 3) Window Dressing ROE Firm A 12.6% Firm B ROE = Net income Equity 10.5% ; A= L+E 4-45 Different accounting practice Sales COGS Depreciation Net income Firm A xxx (xx) (x) xx straight line method Firm B xxx (xx) (xx) x Accelerated method 4-46 Potential problems and limitations of financial ratio analysis It is difficult to generalize about whether a particular ratio is good or bad. For example, a high current ratio may indicate a strong liquidity position (which is good) or excessive cash ( which is bad) because excess cash is non earning assets. Example 2, high fixed turnover ratio may indicate either the firm uses its assets efficiently, or that it is short of cash and cannot afford to make the needed investment in fixed assets. 4-47 Potential problems and limitations of financial ratio analysis Inflation can badly distort many firms’ balance sheet data. Thus the recorded values are often substantially different from “true” values Seasonal factors can distort ratio analysis. For example the inventory turnover ratio for a food processor will be radically different if the balance sheet figure used for inventory is the one just before versus just after the close of the canning season. 4-48