* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

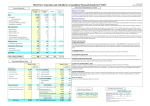

Download CEDAR REALTY TRUST, INC.

Survey

Document related concepts

Security interest wikipedia , lookup

Federal takeover of Fannie Mae and Freddie Mac wikipedia , lookup

Business valuation wikipedia , lookup

Syndicated loan wikipedia , lookup

Present value wikipedia , lookup

History of pawnbroking wikipedia , lookup

Interest rate wikipedia , lookup

Household debt wikipedia , lookup

First Report on the Public Credit wikipedia , lookup

Securitization wikipedia , lookup

Global saving glut wikipedia , lookup

Financial Crisis Inquiry Commission wikipedia , lookup

Transcript