* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download wiki 2.3

Survey

Document related concepts

Transcript

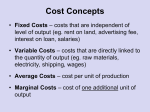

2.3 Wiki Theory of the Firm Cost Theory Fixed costs - costs that do not vary wit the quantity of output produced. They are incurred even if the firm produces nothing at all. Fixed costs are variable in the long run. Ex: rent, salary of employee Variable Cost- costs that do vary wit the quantity of output produced. For example if Susan wants to make more lemonade, she will need more lemons, cups, straws, etc. Ex: amount of workers needed for the job, supplies necessary for production Total Cost- A firm’s total cost is the sum of fixed costs plus variable costs. Ex) Rent+ Lemons+Cups+Salary of Workers = Total Cost Average Total Cost- total cost divided by the quantity of output; Average total cost tells us the cost of a typical unit of output if total cost is divided evenly over all the units produced. AVT= TC/ Q Marginal Cost- the increase of total cost that arises form an extra unit of production; Marginal cost tell us the increase in total cost that arises from producing an additional unit of output MC = Δ TC/ Δ Q Accounting cost + Opportunity Cost = Economic Cost Economists include all opportunity costs when analyzing a firm, whereas accountants measure only explicit costs. Therefore economic profit is smaller than accounting profit. Short Run Because fixed costs are variable in the long run, the average-totalcost curve in the short run differs from the average-total-cost curve in the long run. Law of Diminishing Returns- The law of diminishing returns states that the benefit from an extra unit of an output declines as the quantity of the input increases. Ex) If McDonalds starts out with only 3 workers who can each produce 2 burgers per minute, adding 2 more workers at first will increase the efficiency of the workers because one will be helping with the burgers and other will be on the cashier. After having let’s say 10 workers though, they all start to bump into each other and instead of being more productive, they are actually slowing each other down. Thus, after a certain point, the benefit of the extra unit of input declines as the quantity of the input increases. Total Product- the amount of good produced in a period Average Product- production per worker Marginal Product- the increase in output that arises from an additional unit of input Short Run/ Long Run Cost Curves: Because many decisions are fixed in the short run but variable in the long run, a firm’s long-run cost curves differ from its short run cost curves. As the firm moves to the long run, it is adjusting the size of its factory to the quantity of production. The long run average-total-cost curve is a much flatter U-shape than the short average total cost curve. These properties arise because firms have greater flexibility in the long run. In the long run, the firm gets to choose which short run curve it wants to use but in the short run it ha to use whatever shirt run curve it has chosen in past. Economies of Scale: The property whereby long run average total cost curve falls as the quantity of output increases. Diseconomies of Scale: The property whereby long run average total cost rises as the quantity of output increases. Revenues: Total revenue: the amount a firm receives for the sale of its output Marginal revenue: Marginal revenue is the additional revenue of selling an additional unit of output. MR = ∆TR ∕ ∆Q. Average revenue: Average revenue is a firm’s revenue per unit of output, MR = TR ∕ Q Profit: Zero economic profit (normal profit) - Zero economic profit occurs when a firm’s revenues precisely cover opportunity costs, and is a characteristic of the long run equilibrium in a perfect competition. Abnormal Profit (supernormal) – this is a profit that exceeds the normal profit. Normal profit equals the opportunity cost of labor and capital, while supernormal profit exceeds the normal return from these input factors in production. Abnormal profit is usually generated by an oligopoly or a monopoly In order to maximize total revenue, the firm must maximize its sales and minimize its costs Perfect Competition Assumptions of the model: Many buyers and many sellers; they have a negligible impact on the market price. They have limited control over the price because the products sold by the sellers are very similar. They have similar prices because if one seller chooses to raise its price, buyers will simply go elsewhere to get the same product for less. Buyers and sellers are price takers. There is freedom of entry and exit, but in the long run. An example a perfectly competitive market is the wheat industry; there are many sellers and many consumers. Price MC ATC p=mc p= mr (Demand curve) Quantity produced = Quantity Efficient scale Demand curve: It is horizontal in perfect competition. This is because since the firms are price takers they cannot sell their product for less nor for more but they can sell as much quantity as they want. Profit maximizing level of output and price in the short-run and longrun: In the long and short run price equals marginal cost. In order for a firm to receive the most profit it is important that either marginal cost or marginal revenue is equal, which will give the firm normal profit. If marginal cost is less than marginal revenue the firm will then be able to increase production which means that profits will also increase. However, if marginal cost is more than marginal revenue than the firm has to decrease production in order to increase its profit. In the short run, in order for a firm to receive profit marginal cost must always be above average variable cost. In order to receive positive profit than marginal revenue must be above average cost. The firm will stop producing and exit in the long run when marginal cost is below average variable cost. In the long run, average cost must equal marginal cost. Shut-down price, break even-price: Shut down price is when a firm has enough profit to only cover its total variable cost. Here the firm is not really making any profit of its own since its all being wasted in the total variables costs and this is why some firms choose to “shut down”. Breakeven price is when cost and revenue equal. There are not real gains but there are any losses either, meaning that the firm can stay open. Allocative Efficiency and Productive Efficiency: Allocative efficiency is when resources are allocated in a way that benefits society the most. This is achieved when price equals marginal cost. In productive efficiency each firm must decrease the cost of producing their output. Basically, firms are operating through the production possibilities frontier. Firms try to achieve the production of one good with the lowest cost. Firms try to produce on the lowest point on the average cost curve. Efficiency in perfect competition: Perfect competition is very efficient since it will be both allocative and productive efficient. But perfect competition is impossible to achieve. Monopoly An example of a monopoly would be in a town where there is only one well and it is impossible to get water from somewhere else. Therefore the owner of the well would have a monopoly on water. He or she will have a lot more market power since only they will have the product and no one else, causing them to be price makers and not price takers, unlike in perfect competition. In perfect competition there is only one firm and there are no close substitutes. Sources of monopoly power/ barriers to entry: A key resource is owned by a single firm. The government gives a single firm the exclusive right to produce some good or service. The costs of production make a single producer more efficient than a large number of producers. Some of the barriers of entry are patents, limit pricing, cost advantages, advertising and marketing, international trade restrictions and sunk costs. A patent gives a firm the right to produce a product for a number of years. Limit pricing is when the monopolistic firm has a very low price, that way if any other firms try to enter the market they will end up losing profit .Tariffs and quotas are some trade restrictions that would be a barrier to entry when it comes to domestic markets. Natural Monopoly- A single firm can supply a good or service to an entire market at a lower cost than could two or more firms. It arises when there are economies of scale over the relevant range of output. Price MC ATC P Marginal Cost MR Demand Quantity Efficient Produced Scale Quantity Excess Capacity The demand curve for a monopoly is downward sloping. This is because a monopolist has market power, so they are able to push prices up and limit output. Profit maximizing level of output- It is the same as in perfect competition, marginal cost must equal marginal revenue. This happens because when the producer increases output it lowers the price, therefore marginal revenue is always below price. If MR is greater than MC than the producer will increase profit by increasing output. If MR is less than MC than the producer has to decrease output. Once the firm is at a place where MR equals MC, than it is maximizing profit. In a monopoly, the producer can greatly influence the price of its output. In perfect competition a firm has barely any influence on the price of its output. A monopoly is the sole producer in its market; it can alter the price of its good by adjusting the quantity it supplies to the market. In a monopoly there are no risks of over production and there is also a reduction of price. Resources are also used efficiently. The disadvantages of a monopoly are that there is a restriction of choice and an increase in price of product. Because of the lack of competition there is inefficiency. In perfect competition the advantages are that there is allocative efficiency and the competition in the market increases efficiency. Consumers are also charged a lower price. There are more disadvantages however than there are advantages. There is a lack of product variety unequal distribution of goods and income, insufficient profits for investment and there are certain externalities that arise like pollution. Efficiency in monopoly- A monopoly is not as efficient as in perfect competition. This is because a monopolist will sell less for more. There is also deadweight loss because of the higher price and the less demand. Monopolistic Competition Assumptions of the model: There are many firms and each firm produces a product which is somewhat different in character from other products produced by other firms in the industry, this is one of the differences from perfect competition. Products are also able to be substituted for if one firm chooses to increase its price, just like perfect competition. Free entry and exit of firms and there are economies of scale in production. Short run and long run equilibrium- In short run equilibrium, firms face a downward-sloping demand curve and the marginal revenue curve is below the demand curve. Firms have to produce the quantity where marginal cost equals marginal revenue and charge consumers the highest price. In the long run the profits that are being made encourage other firms to enter the market therefore shifting the demand curve to the left. Equilibrium here occurs when firms no longer have an incentive to enter the market. Product differentiation: This represents the differences between products. It tries its best to make its product more attractive than others by showing some special qualities that is has. If this is successful it creates high competition and some competitive advantages. An example of this could be toothpaste. Some producers will produce it purely white while others will choose to put color in it like red and blue. Efficiency in monopolistic competition: In this type of competition there is neither allocative nor productive efficiency. This is because firms produce at a place where P is greater than MC which means that resources are under allocated. Firms do not produce at the place where price equals the least point on the average total cost curve; therefore there is no productive efficiency. Oligopoly Assumptions of the model: There are few sellers and interdependence exists. This means that each seller must be careful with the actions they make because there is rival competition. There is tension between cooperation and selfinterest. They are best off by acting like a monopolist; producing a small quantity of output and charging a price above marginal cost. The actions of any one seller in the market can have a large impact on the profits of all the other sellers. Collusive and non-collusive oligopoly: In collusive oligopoly producers make a deal and agree on a price for the output and allocation of output. An example of collusive oligopoly is OPEC. This makes them act somewhat as a monopoly. Non-collusive oligopoly is the opposite of this. They do not cooperate with each other which cause them to always have to be aware of what each firm is doing. Cartels: A cartel is a group of firms acting in unison. Once a cartel is formed, the market is in effect is served by a monopoly. They agree on a monopoly outcome because that outcome maximizes the total profit that producers can get from the market. Kinked demand curve is one model to describe interdependent behavior: There is a downward sloping demand curve but the elasticity of the curve depends on the changes in both price and output. Because firms are trying to get the highest profit firms will not follow a price increase done by other firms. This means that the curve will be somewhat elastic. Firms will also try to match a price fall in order to not get a loss when it comes to market share. Importance of non-price competition: This is when firms do not differentiate their product by price, but rather by the looks and qualities of their product. They try their best to distinguish their product through their attributes; this is somewhat like monopolistic competition. Non price competition can be made possible especially through advertisement. It is important because it provides variety and it gives buyers a choice because they are not left with simply buying the same product no matter who they are buying from. It gives product differentiation. Theory of contestable markets: This happens when there is freedom of exit and entrance to a market. It says that long run equilibrium (competitive) is possible and that because of the free exit and entrance there will be low sunk costs. When considering this theory it is important to understand sunk costs, levels of advertising and brand loyalty, profit level, vertical integration and access to technology and skilled labor. Price Discrimination Definition: The business practice of selling the same good at different prices to different costumers. They give different prices even if the cost of producing it is the same. Reasons for price discrimination: Revenue will increase which will let firms stay open in the market since they are no longer making a loss. The increase in revenue can then allow there to be money for research which will in the end benefit consumers. By price discriminating there will be a consumer surplus because there are certain consumers that are willing to pay more for the product than others. Link to Article: http://sanjose.bizjournals.com/sacramento/stories/2009/01/19/story11.html This article discusses the difficult situation which auto companies have found themselves to be in as a result of the economic recession going on right now. With this in mind, we can analyze their fixed and variable costs in the short and long run. In the short run, the fixed costs of the factory and the daily rent are already set therefore the lack of car sales is not affecting those fixed costs. In the long run, the ca manufacturers can take in consideration the decreased number of sales and it can only run for example eight factories instead f ten in order to minimize costs. Variable costs are the wages p[aid to the workers therefore many companies are firing employees or cutting their hours because if there are no customers buying the cars, there is no need for so many employees. In the short run, the companies cannot really do much to minimize costs but those fixed costs will turn into variable costs in the long run and the car dealerships can plan how to maximize their future profit based on the new attitudes of the many citizens who have been affected by the recession and have decided that it is time to save more money and only buy what one can afford.