* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Take-Home Assignmnet-1

Survey

Document related concepts

Transcript

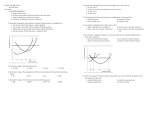

Take-Home Assignmnet-1 1. If a given amount of output can be produced by several small plants or one much larger plant with identical minimum per-unit costs, this long-run situation reflects the existence of: A. B. C. D. Economies of scale. Diseconomies of scale. Constant returns to scale. Diminishing returns. 2. One In the News article reports profit for a Houston-based funeral giant is 31 cents on every dollar vs. a profit of 12 cents for the funeral industry in general. Such profits are most likely the result of: A. B. C. D. Constant return to scale. Economies of scale. Higher minimum average costs. A downward shift in the production function. Figure 6.8 Long-run average total cost curve 3. In Figure 6.8, the long-run average total cost curve is given by the curved line segment: A. B. C. D. ACE. ABFDGE. ABF only. BFD. 1 Use Figure 6.3 to answer the indicated questions. The variable input is labor. Other inputs are fixed. Assume a constant price per unit of labor. Figure 6.3 4. In Figure 6.3, if 2 units of labor are used, marginal costs are: A. B. C. D. Decreasing. Increasing. Zero. Negative. Figure 6.2 5. The marginal physical product of the sixth unit of labor in Figure 6.2 is: A. B. C. D. 4.00. -4.00. 15.00. 2.50. 2 Table 6.1 6. At what output level in Table 6.1 is labor productivity the highest? A. B. C. D. 1. 2. 3. 4. 7. Which of the following are factors of production? A. B. C. D. Output in a production function. Productivity. Land, labor, capital, and entrepreneurship. All of the above. Table 6.4 8. What is the marginal physical product of the fourth unit of labor in Table 6.4? A. B. C. D. 35. 35.75. 58. 41.5. 9. A U-shaped average total cost curve implies: A. B. C. D. First, diminishing returns, and then, increasing returns. First, marginal cost below average total cost, and then marginal cost above average total cost. That total costs are at a minimum at the minimum of the average cost curve. A linear total cost curve. 10. In Figure 6.3, if 3 units of labor are used, marginal costs are: A. B. C. D. Increasing. Decreasing. Zero. Negative. 3 11. Economic and accounting costs will differ whenever: A. B. C. D. There is more than one factor of production. The firm fails to maximize its profits. Any factor of production is not paid an explicit factor payment. Firms operate as proprietorships or partnerships instead of as corporations. 12. The marginal physical product of the first unit of labor in Figure 6.2 is: A. B. C. D. 0.00. 1.00. 2.00. 0.50. 13. The short-run production function shows how output changes when: A. B. C. D. The quantity of labor changes. The quantity of land changes. Technology changes. All of the above. 14. The sum of fixed cost and variable cost at any rate of output is: A. B. C. D. Total variable cost. Total cost. Average total cost. Average marginal cost. 15. In Figure 6.8, diseconomies of scale occur at output rates: A. B. C. D. Up to 400 units per period. Between 400 and 600 units per period. Between 800 and 1000 units per period. Greater than 1000 units per period. 16. An In the News article says General Motors plans to expand its production capacity in China. Which of the following statements is true about the costs of this factory? A. B. C. D. In the planning stage, all construction costs are variable. Once the factory is built, there are fixed costs. Once the factory is built, the ATC and AVC curves are separate. All of the above. 17. Implicit costs: A. B. C. D. Include only payments to labor. Are the sum of actual monetary payments made for resources used to produce a good. Include the value of all resources used to produce a good. Are the value of resources used to produce a good but for which no monetary payment is actually made. 4 Figure 6.6 18. Refer to Figure 6.6. The vertical distance between the AVC and the ATC curves represents: A. B. C. D. Marginal costs. Total fixed costs. Average fixed costs. The increasing efficiency of workers. 19. A firm's productivity will increase if: A. B. C. D. There is an increase in production by the firm. The firm hires more workers. The workers are given additional capital to use. The cost of resources increases. 20. When the wage rate is $7 per hour and the MPP of a worker is 35 units per hour, the unit labor cost is: A. B. C. D. $0.20 per unit. $7.00 per hour. $245 per unit. $245 per hour. 21. Economies of scale: A. B. C. D. Exist in both the short run and the long run. Explain why average variable and average total costs decline in the short run. Explain why average total costs decline as output increases in the long run. Explain why average total costs increase as output increases in the long run. 22. If an additional unit of labor costs $30 and has a MPP of 50 units of output, the marginal cost is: A. B. C. D. $0.60. $1.66. $15.00. $1500.00. 5 23. Profit is: A. B. C. D. The difference between total cost and variable cost. The difference between total revenue and total cost. Earned at all points along the production function. Only possible with technical efficiency. 24. Whenever diminishing returns appear with greater output: A. B. C. D. Marginal cost will be rising. There are diseconomies of scale. MPP will rise. All of the above. Table 6.2 25. What is the marginal physical product of the third unit of labor in Table 6.2? A. B. C. D. 40. 50. 70. 16.67. 26. The difference between the accountant's and the economist's measurement of costs equals: A. B. C. D. Explicit cost. The opportunity cost of unpaid resources. Total revenue minus cost. Marginal cost. 27. Greater labor productivity means: A. B. C. D. Lower output per labor hour. Higher labor cost per unit of output. Lower output per worker. Higher output per worker. 28. Refer to Figure 6.6 at an output of Q4. The ATC at Q4multiplied times Q4equals: A. B. C. D. Marginal costs. Total profit. Total revenue. Total cost. 6 29. If a firm could hire all the workers it wanted at a zero wage (i.e. the workers are volunteers), the firm should hire: A. B. C. D. Enough workers to produce the output where diminishing returns begins. Enough workers to produce the output where worker productivity is the highest. Enough workers to produce where the MPP = zero. All the workers that can fit into the factory. 30. When the production function shifts downward the: A. B. C. D. MC shifts upward. AVC shifts downward. ATC shifts downward. All of the above. Figure 7.4 31. Refer to Figure 7.4 for a perfectly competitive firm. At a market price of $120, total profit is maximized at an output of: A. B. C. D. 400 units. 320 units. 220 units. Zero units. 32. Which of the following characterizes a competitive market? A. B. C. D. A downward-sloping demand curve for the market. A horizontal demand curve facing each firm in the market. All the firms sell at the equilibrium price for the market. All of the above. 7 Figure 7.3 33. Refer to Figure 7.3 for a perfectly competitive firm. The law of diminishing returns takes effect at an output of: A. B. C. D. 39. 31. 25. 13. 34. An essential characteristic of a perfectly competitive firm is that: A. B. C. D. It is a price maker. It is a price taker. The market-demand curve is perfectly elastic. Each firm's demand curve is perfectly inelastic. 35. If a perfectly competitive firm is producing a rate of output for which MC exceeds price, then the firm: A. B. C. D. Must have an economic loss. Can increase its profit by increasing output. Can increase its profit by decreasing output. Is maximizing profit. 36. Which of the following is true about a firm in the long run? A. B. C. D. It is committed to a particular scale of operations. It has both fixed and variable costs. It can choose whatever scale of operations it wishes. It has no variable costs; all costs are fixed. 8 37. Ms. Ha is the owner/operator of an engineering firm. Last year she earned $500,000 in total revenue. Her explicit costs were $300,000 (assume that this amount represents the total opportunity cost of these resources). During the course of the year she received offers to work for other engineering firms. One offer would have paid her $140,000 per year and the other would have paid her $150,000 per year. Ms. Ha's economic profit is equal to: A. B. C. D. $60,000. $50,000. $350,000. $200,000. 38. Refer to Figure 7.4 for a perfectly competitive firm. This firm should shutdown at any price below: A. B. C. D. $400. $300. $200. $100. 39. Many business firms understate costs because they fail to take into account: A. B. C. D. Total costs. Explicit costs. Implicit costs. Accounting costs. 40. LaVon is the owner/operator of a convenience store. Last year he earned $400,000 in total revenue. His explicit costs were $200,000 (assume that this amount represents the total opportunity cost of these resources). During the course of the year he received offers to work for other convenience stores. One offer would have paid him $120,000 per year and the other would have paid him $130,000 per year. Which of the following is true about LaVon's accounting profit? A. B. C. D. Accounting profit = -$50,000. Accounting profit = $0. Accounting profit = $70,000. Accounting profit = $200,000. Tram owns and operates an import/export business. She does not choose to pay herself, but she could receive income of $160,000 by working elsewhere. She pays $800,000 for merchandise, $500,000 for wages, $200,000 for rent and utilities, and $100,000 for taxes each year. She owns four delivery trucks that she uses at this business, but which she could rent out for a payment of $40,000 per year for all four. Answer the indicated questions on the basis of this information. 41. If Tram's firm earned total revenue equal to $2,400,000 last year, then she earned an: A. B. C. D. An economic loss and an accounting loss. An economic loss and an accounting profit. An economic profit and an accounting loss. An economic profit and an accounting profit. 9 42. The marginal cost curve and the supply curve are not the same when price: A. B. C. D. Is above the average total cost curve. Is above the demand curve. Falls below the average variable cost curve. Falls below the demand curve. Consider the following information for a perfectly competitive firm during a one month time period. Assume that Q = the level of output and all costs are economic costs. Market price = $12. Total cost = 60 + 2Q + 0.5Q2 Marginal cost = 3 + Q 43. At an output of 10 units, total variable costs equal: A. B. C. D. $120. $60. $70. $12. 44. A firm that makes zero economic profits: A. B. C. D. Must eventually go bankrupt. Does not cover its variable costs and should shut down. Incurs an accounting loss. Covers all its costs, including a provision for normal profit. 45. Which of the following is true about the demand curve confronting a competitive firm? A. B. C. D. Horizontal, as is market demand. Horizontal, while market demand is downward-sloping. Downward-sloping, while market demand is flat. Downward-sloping as in market demand. 46. Market structure is determined by the: A. B. C. D. Annual income for an industry. Number and relative size of the firms in an industry. Amount of power CEOs have. All of the above. Consider the following information for a perfectly competitive firm during a one-month time period. Assume that Q = the level of output and all costs are economic costs. Market price = $15. Total cost = 25 + 2Q + 0.2Q2 Marginal cost = 1 + Q 47. At an output of 10 units, total fixed costs equal: A. B. C. D. $10. $15. $40. $25. 48. If price is greater than marginal cost, a perfectly competitive firm should increase output because: A. B. C. D. Marginal costs are increasing. Additional units of output will add to the firm's profits (or reduce losses). The price they receive for their product is increasing. Total revenues would increase. 10 49. Under these conditions, the firm should produce an output of: A. B. C. D. Zero (i.e. shutdown). 15. 02. 14. 50. A competitive firm should always continue to operate in the short run as long as: A. B. C. D. P < ATC. P < AVC. MR > AVC. MR > MC. 51. If price is less than marginal cost, a perfectly competitive firm should decrease output because: A. B. C. D. Marginal costs are increasing. Total revenues are decreasing. The firm is producing units that cost more to produce than the firm receives in revenue thus reducing profits (or increasing losses). All of the above are reasons to decrease output. Figure 7.5 52. Refer to Figure 7.5 for a perfectly competitive firm. If this firm produced at an output of C, it would be: A. B. C. D. Maximizing profits. Producing too little because MC would be less than the price. Producing too much because it is producing past the output level where diminishing returns begin. Experiencing zero profits. 11 Figure 7.2 53. Refer to data in Figure 7.2. The profit-maximizing output for this firm is: A. B. C. D. 100 units. Above 280 units. 280 units. 200 units. 54. Hideki is the owner/operator of a flower shop. Last year he earned $250,000 in total revenue. His explicit costs were $175,000 paid to his employees and suppliers (assume that this amount represents the total opportunity cost of these resources). During the course of the year he received three offers to work for other flower shops with the highest offer being $75,000 per year. Which of the following is true about Hideki's accounting and economic profit? A. B. C. D. Accounting profit = $75,000; economic profit = $0. Accounting profit = $175,000; economic profit = $75,000. Accounting profit = $75,000; economic profit = negative $100,000. Accounting profit = $0; economic profit = negative $75,000. 55. An In the News article is titled "GM to Idle Cadillac Plant for Four Weeks." GM has made: A. B. C. D. An investment decision which should shift the supply curve leftward. An investment decision which should shift the supply curve rightward. A production decision which should shift the supply curve leftward. A production decision which should shift the supply curve rightward. 56. If the equilibrium price in a perfectly competitive market for walnuts is $4.99 per pound, then an individual firm in this market can: A. B. C. D. Not sell additional walnuts unless the firm lowers its price. Not sell additional walnuts at any price because the market is at equilibrium. Sell an additional pound of walnuts at $4.99. Only sell more by increasing its advertising budget. 12 57. Refer to Figure 7.3 for a perfectly competitive firm. If the market price is $23: A. B. C. D. The firm should produce 39 units. The firm will have above normal profits. Economic profits are greater than zero. All of the above. 58. Competitive firms cannot individually affect market price because: A. B. C. D. There is an infinite demand for their goods. Demand is perfectly inelastic for their goods. Their individual production is insignificant relative to the production of the industry. The government exercises control over the market power of competitive firms. 59. At the profit-maximizing or loss-minimizing output level, economic profit would equal: A. B. C. D. $92.20. $210.00. $117.80. $14.00. 60. A production decision involves choosing: A. B. C. D. The amount of plant and equipment and is a short-run decision. The amount of plant and equipment and is a long-run decision. A rate of output and is a short-run decision. A rate of output and is a long-run decision. 61. Economic profit: A. B. C. D. Is greater than accounting profit by the amount of implicit cost. Is greater than accounting profit by the amount of explicit cost. Is less than accounting profit by the amount of implicit cost. Is less than accounting profit by the amount of explicit cost. 62. Profit is: A. B. C. D. TR - FC. Q × (P - AVC). (P × Q) -TC. All of the above. 63. If Billy Bob's Bowling Ball Company is thinking about building a new factory, it is making a: A. B. C. D. Long-run decision that will definitely enhance its profit. Long-run decision that may enhance its profit. Short-run decision that will definitely enhance its profit. Short-run decision that may enhance its profit. 64. A firm experiencing economic losses will still continue to produce output in the short run as long as: A. B. C. D. Revenues are greater than total fixed cost. Price is above average variable cost. MR = MC. All of the above. 13 65. A perfectly competitive firm should expand output when: A. B. C. D. P < ATC. P <ATC. P < MC. P > MC. Suppose a firm has an annual budget of $200,000 in wages and salaries, $75,000 in materials, $30,000 in new equipment, $20,000 in rented property, and $35,000 in interest costs on capital. The owner-manager does not choose to pay himself, but he could receive income of $90,000 by working elsewhere. The firm earns revenues of $360,000 per year. Answer the indicated questions on the basis of this information. 66. What is the accounting profit for the firm described above? A. B. C. D. -$90,000. $0. +$90,000. +$200,000. 67. For perfectly competitive firms, price: A. B. C. D. Is greater than marginal revenue. Is less than marginal revenue. Is equal to marginal revenue. And marginal revenue are not related. 68. Which of the following should not be included when calculating accounting profit? A. B. C. D. The cost of taxes. The cost of rent. The return on inventory investment. The cost of utilities. 69. The demand curve confronting a competitive firm: A. B. C. D. Equals the marginal revenue curve. Is horizontal, as is the market demand curve. Slopes downward, while the market demand curve is horizontal. Slopes downward and the marginal revenue curve is below it. 70. In making a production decision, an entrepreneur: A. B. C. D. Decides whether to enter or exit the market. Decides what level of output will maximize profits. Determines plant and equipment. Can change both fixed and variable inputs. 71. The equilibrium price in a competitive market: A. B. C. D. Ensures that anyone who can afford the good can get it. Equates the demand for goods with the supply of goods. Remains unchanged as long as supply and demand do not change. All of the above. 14 72. For a competitive market in the long run: A. B. C. D. Economic losses induce firms to shut down. Economic profits induce firms to enter until profits are normal. Accounting profit is zero. All of the above. Figure 8.3 73. Refer to Figure 8.3 for a perfectly competitive firm. If the market price is B and output is G, which area in the diagram represents the amount the firm can save by producing in the short run rather than shutting down? A. B. C. D. E. ABED. BCFE. ACFD. BOGE. COGF. 74. When an athletic shoe company is producing a level of output where price is greater than MC, from society's standpoint the company is producing too: A. B. C. D. Much because society is giving up more to produce additional shoes than the shoes are worth. Much because society would be willing to give up more alternative goods in order to get additional shoes. Little because society is giving up more to produce additional shoes than the shoes are worth. Little because society would be willing to give up more alternative goods in order to get additional shoes. 15 In Figure 8.1, diagram "a" presents the cost curves that are relevant to a firm's production decision, and diagram "b" shows the market demand and supply curves for the market. Use both diagrams to answer the indicated questions. Figure 8.1 75. In Figure 8.1, the price at which a firm makes zero economic profits is: A. B. C. D. p1. p2. p3. p4. 76. If catfish farmers expect catfish prices to rise in the future, then right now: A. B. C. D. There will be a movement down along the market supply curve for catfish. There will be a movement up along the market supply curve for catfish. The market supply curve for catfish will shift to the left. The market supply curve for catfish will shift to the right. 77. In a competitive market where firms are earning economic profits, which of the following should be expected as the industry moves to long-run equilibrium, ceteris paribus? A. B. C. D. A higher price and fewer firms. A lower price and fewer firms. A higher price and more firms. A lower price and more firms. 16 Figure 8.6 78. Refer to Figure 8.6 for a perfectly competitive firm. Given the current market price of $100, we expect to see: A. B. C. D. Entry into this industry. Exit from this industry. No change in the number of firms in this industry. Costs rise to absorb the profits earned by the firms in the industry. 79. In a competitive market, economic profits will: A. B. C. D. Cause existing firms to expand production. Cause new firms to leave the market. Potentially last a long time. Not be possible, even in the short run. 80. Economic losses are a signal to producers that: A. B. C. D. Consumer demands are being satisfied. Competitive efficiency is being achieved. The market mechanism has failed. They are not using society's scarce resources in the best way. 81. In a competitive market each individual supplier will face the: A. B. C. D. Equilibrium price. Demand price. Supply price. Profit price. 82. To maximize profits, a competitive firm will seek to expand output until: A. B. C. D. Total revenue equals total cost. Price equals marginal cost. The elasticity of demand equals 1. All of the above. 17 Figure 8.4 83. If the firm in Figure 8.4 raised the price of its product above $4, the firm would: A. B. C. D. Increase its profits. Reduce its total revenue to zero. Increase its total revenue but not its profits because costs would increase. Not effect revenues but increase profits because costs would decrease. 84. If economic profits are earned in a competitive market, then over time: A. B. C. D. Additional firms will enter the market. The market supply curve will shift to the right. Equilibrium price will fall as more firms enter. All of the above. 85. Refer to Figure 8.4. In the long run, which of the following would not be expected? A. B. C. D. A decrease in market supply. An increase in total revenue for the remaining firms. An increase in output for the remaining firms. A decrease in MR for the remaining firms. 86. The price signal: A. B. C. D. Is an accurate reflection of opportunity cost. Offers a reliable basis for making choices about the mix of output. Offers a reliable basis for making choices about resource allocation. All of the above. 87. Profit per unit is equal to: A. B. C. D. Price divided by average total cost. Price minus average total cost. Total revenue minus total cost. Total revenue minus variable cost divided by quantity. 18 Figure 8.9 88. Refer to Figure 8.9 for a perfectly competitive firm. If the market price is $20, in the short run this firm will: A. B. C. D. Shut down and produce zero units of output. Produce 100 units of output and experience a loss. Produce 100 units of output and earn a profit. Produce more than 100 units and new firms will be attracted to the industry. 89. In making a production decision, an entrepreneur: A. B. C. D. Decides whether to enter or exit the market. Makes a long-run decision about production. Determines plant and equipment. Decides the short-run rate of output. 90. In Figure 8.1, if market demand is at D1, the firm should: A. B. C. D. Leave the market. Produce q1. Shutdown. Do any of the above depending on the position of the AVC and the length of the time period. 91. A perfectly competitive market promotes efficiency by pushing prices to the minimum of: A. B. C. D. Short-run AVC. Short-run MC. Long-run ATC. Long-run TC. 92. The entry of additional firms into a market, ceteris paribus: A. B. C. D. Shifts the market supply curve to the right. Reduces the equilibrium price. Forces the typical producer to reduce output. All of the above. 93. If the market demand curve is D2in Figure 8.1, then in the long run: A. B. C. D. Economic profit is less than zero and firms will exit. Economic profit is greater than zero and firms will expand production. There are zero economic profits, so there will be no entry or exit. There are zero economic profits so firms will exit. 19 94. Economic losses are a signal to producers: A. B. C. D. That they are using resources in the most efficient way. That they are not using resources in the best way. That consumer demand is being satisfied. That consumers are content with the allocation of resources. 95. Refer to Figure 8.4 for a perfectly competitive market and firm. Which of the following is likely to occur in the market in the long run, ceteris paribus? A. B. C. D. An increase in demand. An increase in supply. A decrease in demand. A decrease in supply. 96. Marginal cost is the increase in total cost associated with a one unit: A. B. C. D. Increase in production. Increase in input usage. Decrease in production. Decrease in input usage. 97. Refer to Figure 8.6 for a perfectly competitive firm. This firm will maximize profits by producing the level of output that corresponds to point: A. B. C. D. A. B. C. D. 98. A competitive market structure includes: A. B. C. D. Many firms. High barriers to entry. Products to which customers have loyalty. All of the above. Figure 8.8 20 99. Refer to Figure 8.8 for a perfectly competitive firm. This firm will maximize profits by producing the level of output that corresponds to point A. B. C. D. A. B. C. D. 100. Billy Bob's Bowling Ball Company produces 800 bowling balls per week. If the firm used marginal cost pricing to determine bowling ball output, they would produce 600 bowling balls. Consumers do not receive the most desirable quantity of bowling balls from Billy Bob's because: A. B. C. D. Economic losses are occurring. The firm must be earning higher than normal economic profits. The cost of producing the additional 200 bowling balls is greater than the amount that consumers are willing to pay for the additional bowling balls. The cost of producing the additional 200 bowling balls is less than the amount that consumers are willing to pay for the additional bowling balls. 101. In the long run, at prices below p2in Figure 8.1: A. B. C. D. There is economic profit. The firm will produce the quantity where MC = MR. Firms will enter the market. Firms will exit the market. 102. Refer to Figure 8.6 for a perfectly competitive firm. If this firm produces the level of output corresponding to point C in the short run, it will earn: A. B. C. D. Zero profit. The maximum profit possible. A profit, although not the maximum profit possible. A loss. 103. Which of the following is characteristic of a perfectly competitive market? A. B. C. D. Differentiated products. A large number of firms. Price below marginal revenue. Significant barriers to entry. 104. Refer to Figure 8.8 for a perfectly competitive firm. Given the current market price, we expect to see: A. B. C. D. Firms exit from the industry, driving up the market price. Firms exit from the industry, driving down the market price. No change in the number of firms in the industry and no change in the market price. Firms enter the industry, driving down the market price. 105. Refer to Figure 8.9 for a perfectly competitive firm. If the market price is $24, in the short run this firm will: A. B. C. D. Shut down and produce zero units of output since economic profit is zero. Produce 100 units of output and experience a loss. Produce more than 100 units of output and earn zero economic profit. Produce 100 units of output and earn an economic profit. 21 106. If a firm finds that its marginal cost is greater than its price, it: A. B. C. D. Should reduce production. Should increase production. Is maximizing its profit. Is maximizing its total revenue. 107. One In the News article reported "Because of Vietnamese fish imports, the US catfish production has plunged in the past year." Which of the following market supply determinants is responsible for the shift in the supply of catfish? A. B. C. D. The number of firms in the market. Technology. Expectations. The price and availability of factors. 108. Examples of barriers to entry include: A. B. C. D. Price taking. Patents. Standardized products. All of the above. 109. Refer to Figure 8.4 for a perfectly competitive market and firm. Which of the following is most likely to occur, ceteris paribus? A. B. C. D. The firm will exit in the long run. The firm will shutdown in the short run. The firm will increase output. The firm will raise its price. 110. Refer to Figure 8.9 for a perfectly competitive firm. If this firm is producing 100 units of output and the market price is $20, it: A. B. C. D. Can reduce its short-run losses by shutting down. Can increase its short-run profit by increasing output. Can increase its short-run profit by decreasing output. Is doing the best it can in the short run. 111. Which of the following statements is not correct? A. B. C. D. A monopolist's ability to act as a price setter guarantees economic profits in the short run. The monopolist's marginal revenue is less the price for any output greater than one. A monopolist's demand curve is the same as the market demand curve for the product. In the long run, a monopolist will experience only positive or zero economic profits. 112. A monopoly: A. B. C. D. Maximizes profits at the output level where MR=MC. Produces less output than a competitive industry, ceteris paribus. Charges a higher price than a competitive industry, ceteris paribus. All of the above. 22 Figure 9.3 113. In Figure 9.3, the profit maximizing level of output is: A. B. C. D. 40 units. 60 units. Between 40 and 60 units. Between 80 and 100 units. 114. In Figure 9.3, marginal cost at the profit maximizing level of output is: A. B. C. D. $7. $6. $11. $10. 115. Price-discriminating firms charge higher prices to those who: A. B. C. D. Have greater incomes. Have many substitutes available to them. Have lower price elasticity's of demand. Want the product less. 23 Figure 9.4 116. In Figure 9.4, marginal revenue at the profit maximizing level of output is approximately: A. B. C. D. $60. $70. $110. $120. 117. If tourists are charged a much higher price than the natives of a country for exactly the same item, what kind of pricing is involved? A. B. C. D. Monopoly pricing. Competitive pricing. Price discrimination. MC = MR pricing. 118. According to the contestable market theory, U.S. auto manufacturers cannot achieve monopoly profits because of: A. B. C. D. Diseconomies of scale. Antitrust enforcement. Foreign competition. All of the above. 119. Which of the following prohibits exclusive dealing? A. B. C. D. The Sherman Act. The Clayton Act. The Federal Trade Commission Act. Case decisions, such as those for AT&T and IBM. 120. In monopoly and perfect competition, a firm should expand production when: A. B. C. D. Marginal revenue is below marginal cost. Marginal revenue is above marginal cost. Price is below marginal cost. Price is above marginal cost. 24 121. The In the News article "Foxy Soviets Pelt the West: Sable Monopoly Traps Hard Currency, Coats Capitalists" provides evidence that: A. B. C. D. Prices are higher than they would be in a competitive sable market. Long-run economic profit is positive. Output of sable is lower than it would be in a competitive market. All of the above. 122. According to the contestable market theory, U.S. auto manufacturers cannot behave like a monopoly because of: A. B. C. D. Foreign competition. Potential competition from new auto manufacturers. Technological changes that create new substitutes such as electric cars and new competitors. All of the above. 123. Microsoft's argument against the government's antitrust suit was that: A. B. C. D. It dominated the computer industry because it produced the best products. It must behave like a competitive firm because of potential competition. The market, rather than the government, could make the best decision for consumers. All of the above were Microsoft arguments. 124. Price discrimination allows a producer to: A. B. C. D. Reap the highest possible average price for the quantity supplied. Increase the elasticity of consumer demand. Minimize marginal costs. Decrease total costs. 125. Compared with a competitive market with the same long-run cost and market-demand circumstances, a monopolist has: A. B. C. D. Less pressure to reduce costs and less reason to improve quality. Less pressure to reduce costs and more reason to improve quality. More pressure to reduce costs and less reason to improve quality. More pressure to reduce costs and more reason to improve quality. 126. Price discrimination allows a producer to: A. B. C. D. Obtain greater total revenue. Obtain higher profits. Charge both higher and lower prices. All of the above. 127. A monopolist maximizes profit by producing at a point where marginal cost equals: A. B. C. D. Price. Average total cost. Marginal revenue, which is greater than price. Marginal revenue, which is less than price. 25 Figure 9.7 128. Refer to Figure 9.7. Which of the following statements is true about the price elasticity of demand at price P2? A. B. C. D. The price elasticity is elastic. The price elasticity is inelastic. The price elasticity is unitary. The price elasticity is zero. 129. Which of the following is not a barrier to entry into a monopoly market? A. B. C. D. Economies of scale. Monopoly profits. Legal harassment. Control of key inputs. 130. The price charged by a profit-maximizing monopolist occurs at: A. B. C. D. The minimum of the average cost curve. The price where MR = MC. A price on the demand curve above the intersection where MR = MC. A price on the average cost curve below the point where MR = MC. 131. The marginal revenue curve is below the demand curve: A. B. C. D. If a firm must lower its price to sell additional output. For a competitive firm. When a market is characterized by economies of scale. All of the above. 26 Figure 9.2 132. In Figure 9.2, total profit at the profit-maximizing rate of output is: A. B. C. D. CDLK. CDHG. ABDLK. GHLK. 133. Refer to Figure 9.7. Suppose this good could some how be produced at no cost (i.e. the total cost at any level of output was zero). This firm would maximize profit by: A. B. C. D. Raising the price as high as possible until the quantity demanded began to decrease. Producing an infinite amount and selling at the highest price possible. Producing Q2and charging P2. Producing Q3and charging P3. 134. If the entire output of a market is produced by a single seller, the firm: A. B. C. D. Is a monopoly. Faces a perfectly inelastic demand. Can charge any price it wants and not lose customers. All of the above. 135. The antitrust experts measure how contestable a market is based on: A. B. C. D. Evidence of excessive entry into the market, which leads to price wars. The amount of output produced relative to what would occur in a competitive market. How much price must fall before there is exit. Barriers to entry. 27 Use Table 9.2 to answer the indicated questions. Table 9.2 Hypothetical monopoly costs and revenue 136. In Table 9.2, according to the profit-maximization rule, at the profit maximizing level of output marginal cost is: A. B. C. D. $200. $250. $300. $350. 137. Refer to Figure 9.4 for a monopoly. If the firm used marginal cost pricing to determine price and output, it would produce: A. B. C. D. 11 units. 14 units. 20 units. 28 units. Figure 9.1 138. In Figure 9.1, total revenue is represented by the area: A. B. C. D. ABFE. CDFE. ABGHE. ABDC. 28 139. The antitrust experts measure the contestability of a market on the basis of: A. B. C. D. Evidence of excessive economic profit. The structure of a market. The amount of output produced relative to what would occur in a competitive market. How high prices must go before there is entry. 140. In Figure 9.2, total cost at the profit-maximizing rate of output is: A. B. C. D. GHL0. CDHG. CDL0. ABDL0. 141. The In the News article "Judge Says Microsoft Broke Antitrust Law." Antitrust laws attempt to: A. B. C. D. Prevent the abuse of market power. Protect producers from too much competition. Protect the government from frivolous law suits. Increase the profitability of monopolies. 142. Contestable market theory relies on: A. B. C. D. Vigorous price rivalry. Government regulation. Potential entry. All of the above. 143. A monopolist will not use marginal cost pricing because at that output: A. B. C. D. MR is greater than MC. MC is greater than MR. MR is below the ATC curve. MC is greater than the monopolist's price. 144. Which of the following contributes to a firm maintaining a monopoly? A. B. C. D. Economies of scale. Lawsuits. Acquisitions. All of the above. 145. In Table 9.2, according to the profit-maximization rule, at the profit maximizing level of output total cost is: A. B. C. D. $900. $1200. $650. $950. 29 Figure 9.6 146. Refer to Figure 9.6 for a monopolist in the short run. If this monopoly were divided into many small companies producing identical products, these competitive firms in total would produce: A. B. C. D. 65 units at a market price of $13. 65 units at a market price of $31. 74 units at a market price of $28. 109 units at a market price of $23. 147. A monopoly: A. B. C. D. Maximizes profits at the output where P = MC. Is one of many sellers in a given market. Charges higher prices than competitive firms, ceteris paribus. All of the above. 148. In Figure 9.3, the profit maximizing monopolist will charge a price of: A. B. C. D. $6.00. $7.00. $10.00. $11.00. 149. Although a domestic can producer controls most of the domestic can market, it may be unable to charge monopoly prices because: A. B. C. D. Its canning customers can easily produce their own cans. It may face a perfectly inelastic demand. The structure of the industry indicates that the market is not contestable. The can company must pay high prices for aluminum materials and machine tools to make cans. 150. Economies of scale over the entire range of market output: A. B. C. D. Lead to natural monopoly. Mean that the long-run average total cost curve is downward-sloping. Mean that marginal costs are below average costs. All of the above. 30