* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Economics

Survey

Document related concepts

Transcript

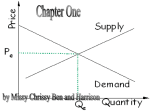

Economics Economics with Emphasis on the Free Enterprise System and Its Benefits is the culmination of the economic content and concepts studied from Kindergarten through required secondary courses. The focus is on the basic principles concerning production, consumption, and distribution of goods and services in the United States and a comparison with those in other countries around the world. Students examine the rights and responsibilities of consumers and businesses. Students analyze the interaction of supply, demand, and price and study the role of financial institutions in a free enterprise system. Types of business ownership and market structures are discussed, as are basic concepts of consumer economics. The impact of a variety of factors including geography, the federal government, economic ideas from important philosophers and historic documents, societal values, and scientific discoveries and technological innovations on the national economy and economic policy is an integral part of the course. Students apply critical-thinking skills to create economic models and to evaluate economic-activity patterns. Economics with Emphasis on the Free Enterprise System and Its Benefits builds upon the foundation in citizenship; economics; geography; government; history; culture; social studies skills; and science, technology, and society laid by the social studies essential knowledge and skills in Kindergarten-Grade 12. The content enables students to understand the importance of patriotism, function in a free enterprise society, and appreciate the basic democratic values of our state and nation as referenced in the Texas Education Code, §28.002(h). Absolute and Comparative Advantage International trade is based on resources or products which one country needs and another can provide. A country has an absolute advantage when it can produce more of a given product than other countries using a given amount of resources. A country has a comparative advantage in the product that it can produce most efficiently given all of the products it could choose to produce. Each country must determine if it is reasonable to try to produce the product. To do so, the country assesses the opportunity cost and if it is low. it may choose to produce instead of import. Therefore, countries specialize in the goods they can produce most efficiently. The United States markets wheat and farm tractors, not items it cannot produce such as coffee or diamonds. Balance of Trade Nations seek to maintain a balance of trade with values of imports equal to exports. By balancing trade, a nation can protect the value of its currency on the international market. If a trade imbalance continues, with one country importing more than it is exporting, the value of its currency falls. In the 1980s the United States imported considerably more than it exported, and the foreign exchange market was glutted with dollars. As the value of the dollar fell, the prices of imports increased and consumers paid more for the goods. The imbalance can be corrected by limiting imports or increasing the number and/or quality of exports. Both of these actions affect trading partners which may retaliate by raising tariffs. Maintaining a balance of trade requires international cooperation and fair trade. Business Cycle There are two phases of business cycles. Recession is a period of decline gauged by changes in real Gross Domestic Product (GDP). A recession occurs when the real GDP declines over two quarters or six months. It begins when the GDP reaches its highest point prior to a steady decline over at least six months. A recession continues until the GDP reaches a low point, the trough. The second phase of a business cycle, expansion, starts when the GDP rebounds after hitting a trough. Business Property A business is an economic institution which seeks a profit by allocating resources to satisfy customers. There are three types of businesses: sole proprietorships, partnerships, and corporations. Sole proprietorships, businesses owned by an individual, account for 75 percent of all businesses. The individual 92 Economics controls the property of the business and receives all profits as personal income. Partnerships are owned by two or more people who jointly own and share in the management and financing of the business. They must agree on the use of property. Corporations are businesses which are chartered by the state and recognized as a separate legal entity with the right to buy and sell property, enter into legal contracts, and sue and be sued. A corporation has stockholders who elect a board of directors to run the business. Ninety percent of all business in the United States is conducted by corporations. Circular-Flow Model In the circularflow model, money flows through the system one way and goods, services, and factors of production flow the other. Economists use the circular-flow model to visualize the interdependent relationship of buyers and sellers within a market. Whether the market is local, regional, national, or global, the activity of the market follows a circular flow with individuals earning their income in factor markets and spending it in product markets. The markets link individuals with business organizations and other economic institutions. Consumer Economics In a free enterprise economy, consumers ultimately determine what goods or services are produced. Their choices depend on several factors including income, personal and family needs, debt, advertising, and culture. The economic choices they make depend on their abilities to spend, save, lease, invest, insure, and/or use credit financing. Producers prosper if consumers choose to buy the product, and they fail if their product has no appeal. They strive to entice consumers to invest in their companies, save at their banks, or spend money on their products. Consumers determine the amount they can invest and the type of investment, either expendable goods or services, low-risk saving options, or high-risk exchanges. Each choice has an economic impact on the consumer, not all of which are obvious when the decision is made. Corporation A corporation is a business which is recognized by law as a separate legal entity with all the rights and responsibilities of an individual including the right to buy and sell property, enter into legal contracts, and to sue and be sued. Those seeking to form a corporation seek permission from the state and may issue stock and pay dividends. It is easy to raise financial capital for a corporation by selling stock or issuing bonds. The business can continue even if the ownership changes, and transferring ownership is relatively easy. Corporations can be expensive to start, and stockholders have little control in the operation beyond the election of a board of directors. Corporations are also subject to governmental regulations. Determinates of Supply and Demand Non-price determinates of demand are those things which are not related to the price of a good or service but which alter our ability or willingness to purchase the item. These defy the law of demand and cause the demand curve to shift, thus changing the equilibrium price. Change in our income either increases or decreases our ability and willingness to purchase. If our income increases we tend to purchase more products and we tend to purchase more expensive products. The price of related goods affects our demand. If the price of steak increases, we may instead purchase chicken, or if the price of hot dog buns decreases, we tend to buy hot dogs to go with them! Our tastes and preferences determine our demand. We may buy name brands instead of the cheaper generic brands. The number of buyers in the market affects demand when we buy fad items. Our expectations of price increases or decreases will also alter demand. Non-price determinates of supply are those things which are not related to price but do alter supply. They cause the supply curve to shift and thus change the equilibrium price. When the costs of inputs increase, a business can not produce the same number of items at the same price. When the number of suppliers increase, more items will be produced. Years ago there were only a few computer manufacturers and now there are many in the market. Taxes and subsidies also alter the costs of production and therefore the number of items produced. Economic Activity Patterns Five major economic activities are producing, exchanging, consuming, saving, and investing. Patterns of production, distribution, and use develop as the economic activities become concentrated in urban, industrial, or agricultural areas. Geographic and human factors also influence patterns of economic activity. Ski resorts develop in the mountains, fanning in the valleys, and mining where there are ore deposits. Saving and investment also follow patterns, becoming concentrated in areas of potential growth. Economic Systems (traditional, command, market) Economic systems are organized sets of procedures used within or between communities to govern the production and distribution of goods and services. Economists identify three types of economic systems: traditional (known as subsistence), command (also known as planned), and market (commercial). In a traditional economy, goods and services are produced by a family for their personal consumption. There is little surplus and little exchange of goods. There is only a limited need for markets (places to buy and sell goods and services). This is the type of economy found in less developed nations, usually in rural areas. The economy reflects the customs, habits, laws, and religious beliefs of the area, and these control decisions. Most less developed nations today are 93 Economics a mix of traditional and either market or command economies. In a command economy, the government regulates economic activity, making decisions about what and how much to produce, where to locate economic activities, and what prices to charge for goods and services. These economic decisions are often made to further social goals. Communism is one example of a command economy; socialism is another. In a command economy, the price of goods including agricultural products are controlled by the government, not market forces. Production costs are not reflected in prices. For example, it may cost $1.00 to produce a loaf of bread, but the price may be set at $.25 to ensure customers are able to afford adequate provisions. The price also may be set over production costs given demand. In a market economy, elements of which may be considered a free enterprise economic system, the laws of supply and demand and "the market" determine decisions about what and how much to produce, where to locate economic activities, and what prices to charge for goods and services. Profit drives decisions in a market economy. A mixed economy combines elements of these three systems. Economic Rights and Responsibilities of Individuals and Business Economic rights of individuals include the right to work, guaranteed by the Taft-Hartley Act of 1947, which allowed states to formulate laws making it illegal to require workers to join unions. Another economic right of individuals is the right to own private property, that is, the right to hold and exchange goods and services. This is defined and protected by government legislation. Economic rights of businesses include the right to participate in markets for the purpose of exchanging goods and services. This right is also defined and protected by government. Economic responsibilities of individuals include making effective decisions in comparing economic alternatives of consumption, investment, and allocation of goods and services. Economic responsibilities of businesses include engaging in fair labor practices and fair competition. Both contribute to the economic health of an economic community. Exchange Rates In international finance, foreign currency is called foreign exchange and the currency is bought and sold on a foreign exchange market. The rate of exchange is based on the amount of foreign currency in circulation. For instance, if the United States seeks to import Volvos from Sweden, the importer pays for the automobile with U.S. dollars. If the car costs 35,000 kroner (Swedish currency) but the U.S. dollar is worth six Swedish kroner, the Volvo costs approximately $5,100. As more U.S. currency enters the Swedish market, and as the demand for Volvos increases, the Swedish kroner becomes more valuable when compared to the U.S. dollar. Thus the foreign exchange rate changes from $1.00 = 6 K to $1.00 = 4.5 K. The car now costs an American importer approximately $7,000. Exchange rates are published in major newspapers. Federal Reserve System The Federal Reserve System is the privately owned, publicly controlled central bank of the United States. It was created in 1913 by Congress to lend to other banks in times of need. Each national bank is required to join the Federal Reserve System (FRS), and state-chartered banks are allowed to do so. The member banks own the FRS. The Federal Reserve regulates the supply of money in the economy through interest notes or by altering the reserve requirement, discount rate, and openmarket options. The Federal Reserve also supplies paper currency, called Federal Reserve Notes, holds banks' reserves, provides check clearing services, and supervises member banks. Fiscal Policy Fiscal policy is the use of government spending and revenue collection to influence the economy. These policies are used to achieve economic growth, full employment, and price stability. Two automatic stabilizers which stimulate the economy include unemployment insurance and federal entitlement programs including social welfare, pensions, and Social Security. International Free-Trade Agreements An international free-trade agreement results from cooperation between at least two countries to reduce trade barriers and tariffs and to trade with each other. Developing countries have designated free-trade areas which do not set uniform tariffs for nonmembers. The North American Free Trade Agreement (NAFTA) is the largest free-trade area in the world. Other countries have formed customs unions, agreements which abolish tariffs and trade restriction among union members, and which adopt uniform tariffs for nonmember countries. The most successful example of a regional customs union currently is the European Union (EU). A cartel is also a union of producers or sellers who limit production or sales to control prices. The Organization of Petroleum Exporting Countries (OPEC) is an example of a cartel. Level of Economic Development Economic development occurs in stages. Countries do not necessarily move through these stages in any order. The first stage is called "primitive equilibrium" and applies to nations with no monetary system or other formal economic organization. Rules pass from generation to generation and the economy exists in equilibrium based on tradition. The second state is one of transition when cultural traditions begin to crumble and people adopt new patterns of living. The third state is "takeoff and occurs when 94 Economics primitive equilibrium breaks down. During takeoff a nation spends more of its national income, new industries grow, and profits are reinvested. Both the agricultural and the industrial sectors expand. The fourth stage is "semidevelopment," a time when a nation's economy expands significantly. Core industries develop and the rates of technological development and capital investment increase. The nation enters the international economy, making goods and services for other nations. The final stage is "highly developed" in which the basic human needs are met easily and economic efforts turn toward production of consumer goods and public services. The service and manufacturing sectors of the economy mature during this stage. Monopolistic Competition Monopolistic competition is a market structure similar to that of pure competition except that all products are not identical. A monopolistic competitor will modify the product to appeal to more customers and thereby monopolize a part of the market. Breakfast cereals are similar but when one competitor frosts flakes and captures a part of the market, the producer participates in monopolistic competition. The monopoly continues until other companies frost their flakes. The same is true in the fast food industry. The products — tacos, hamburgers, or chicken — are different, but the producers capture hungry customers by charbroiling or adding seasonings or sauces. This process of changing a product is called product differentiation. Grocery chains are also monopolistic. Even though they offer similar products, the chains can sell for less and offer more services or greater variety, thus undercutting sole proprietorships. Monopoly A monopoly is a market situation dominated by one firm which sets prices for the product. It is nearly impossible for competitors to enter the market. A pure monopoly does not exist, but producers of electricity are close to monopolizing the market. Oligopoly An oligopoly is a market situation dominated by a few large producers who can affect prices in the industry. The firms in an oligopoly so dominate the market that changes made by one firm can cause the industry to change output, sales, and prices. The American automotive and airline industries are oligopolies dominated by firms with an international reputation. The soft drink industry is the same. Oligopolies can differentiate products or can standardize them. All members of an oligopoly are powerful, and entry into the market is difficult. Opportunity Costs and Scarcity When an economist considers the cost of an item, he or she considers more than the price tag. Economists also consider the opportunity cost or the cost of the next best alternative use of money, time, or resources when one choice is made over another. For instance, a student with $25 to spend can choose between several options, a CD, a new shirt, movie tickets, or restringing a tennis racket. The student decides that restringing the racket is the most important need at the moment. The opportunity cost includes the items and activities the student gave up when he or she did not buy tickets to the movies, a favorite CD, or new clothes. Economists also consider the relationship of the scarcity of a good or service to its cost. In economics, scarcity is the condition of not being able to have all of the goods and services one wants. Resources do not exist in sufficient quantities to satisfy all desires to use them. Scarce items may have a higher value and the value may fluctuate depending on availability. People recognize scarce items carry a higher opportunity cost; they give up more alternatives to purchase shrimp off-season than they would during the shrimping season. Partnerships A partnership is an unincorporated business owned and operated by two or more people who share the profits and have unlimited liability for the debts and obligations of the firm. A partnership is easy to start and if partners cooperate, it is easy to manage. Partners share financial and legal responsibilities for the business, and the business legally ceases to exist if a partner leaves. Private Property Private property includes goods like automobiles and homes as well as personal skills and knowledge. The right and the privilege to control personal possessions is a feature of capitalism and the free enterprise system. People can sell or give their property away as they wish. This encourages investment and use of the property and thus stimulates the economy. The rights of private property owners are guaranteed in the 5th and 14th Amendments to the U. S. Constitution. Production-Possibilities Curve A productionpossibilities curve is a diagram which shows the maximum production of goods and/or services which an economy can attain if all productive resources are fully employed. For instance, a country can produce 2,000 tons of iron if all resources are concentrated on the production of iron, but the population would starve if some were not growing wheat for food. Therefore, economists can figure the amount of productive resources used to plant and harvest wheat and develop a formula which shows the relationship of the production of wheat compared to iron. The difference between concentrating all resources on iron and dividing them between iron and wheat is called an opportunity cost. That is the cost in money, time, or resources when one choice is made rather than another. For instance, if the country grows wheat to satisfy food demands, the opportunity cost is the income it will not receive for the iron it is not producing. The productionpossibilities curve is used by economists to chart the 95 Economics relationship of choices and costs. Profit Motive Profit motive is the force which motivates people and organizations to improve their material well-being. The profit motive is a characteristic of the free-enterprise system and capitalism and is the main reason people start businesses. To a business, profit means the difference between revenues and costs. The freeenterprise system uses supply, demand, and the profit motive to determine the answers to the four basic economic questions: "what to produce," "how to produce," "how many to produce," and "for whom to produce." Pure Competition Pure competition is a market structure consisting of a large number of independent and well-informed buyers and sellers of an identical product. None of the buyers or sellers is powerful enough to influence the price, and more buyers and sellers are able to enter the market easily. This is an idealistic situation. There are no examples of a pure competition, although market gardeners and truck farmers operate in a market which is close to it. Societal Values Each society identifies values that everyone within the society is expected to uphold. Societal values vary among cultures within nations and among nations. These influence public behavior including business dealings. For instance, some cultures expect to barter as a part of normal business transactions while others may view bartering as insulting. Business people must understand the societal values of all trading partners to be most effective. Sole Proprietorship A sole proprietorship is an unincorporated business which is owned and managed by one person. The sole proprietor enjoys the rights to all profits and bears the responsibility for all debts and other liability. It is the most common form of business organization in the United States and is the easiest to start and stop. Stocks and Bonds A stock is a certificate of ownership in a corporation. If the corporation is profitable, stockholders are paid a dividend, or their portion of corporate earnings. A bond is a formal contract to repay borrowed money and interest on the borrowed money at regular future intervals. Stocks and bonds are two ways that businesses and industry can finance operations. and the ability to pay for it. The time of year affects the supply and the demand of some goods. For instance, watermelons ripen in the summer at the same time people crave them. The two forces of supply and demand combine in the laws of supply and demand: more will be bought at lower prices and less at higher prices and more will be offered for sale at high prices than at lower prices. The laws are presented visually in supply and demand graphs. A supply curve illustrates the relationship of supply and price based on the way a business distributes goods. When the price of a good is low, supply is limited; as prices increase, the supply increases. A demand curve illustrates the relationship of demand and price. As price decreases, demand increases. A demand schedule shows the quantity demanded at a range of market prices at a given time. The relationship of supply and demand is presented in a supply-and-demand graph depicting equilibrium or market-clearing price. This is the price at which the supply curve and the demand curve will intersect. This is the price at which all that is supplied will be bought and all that is demanded will be offered. The law of supply and demand applies only in a market free from price regulations imposed by government. Taxes Local, state, and national governments generate revenue by charging taxes. A tax levied on a person's earnings is an income tax. Income taxes provide the largest source of revenue to the national government. A general revenue tax levied on the manufacture or sale of items such as cigarettes, gasoline, or alcohol is called an excise tax. Property tax is levied on property owners in local communities to offset expenses of services provided including street construction or maintenance. School tax is also collected on the local level to help pay for public education. Tariffs are another form of tax levied against importers of goods. Some goods and income are tax-exempt (not subject to a local, state, or federal tax). Trade Barriers Barriers to trade include quotas of imports and protective tariffs. Health and safety regulations and requirements are often used by governments as more subtle trade barriers. Voluntary Exchange Buyers and sellers are free to engage in market transactions with few outside restrictions. Voluntary exchange is a characteristic of the freeenterprise system and capitalism, and through this market mechanism, consumers control the market. Supply, Demand, and Price Supply is the amount of goods available. Demand is the desire to own something 96