* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download profit and loss account - State Bank of Pakistan

Survey

Document related concepts

Investment banking wikipedia , lookup

Short (finance) wikipedia , lookup

History of investment banking in the United States wikipedia , lookup

Asset-backed commercial paper program wikipedia , lookup

Investment management wikipedia , lookup

Quantitative easing wikipedia , lookup

Currency intervention wikipedia , lookup

Deposit Insurance and Credit Guarantee Corporation wikipedia , lookup

Security (finance) wikipedia , lookup

Securities fraud wikipedia , lookup

Capital gains tax in Australia wikipedia , lookup

Auction rate security wikipedia , lookup

Investment fund wikipedia , lookup

Mark-to-market accounting wikipedia , lookup

Transcript

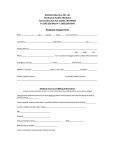

PROFIT AND LOSS ACCOUNT NAME OF THE BANK/NBFI_____________ QUARTER ENDED _________________ FOR THE CURRENT QUARTER YEAR TO DATE .........Rupees in’000.............. Mark up Interest and discount and/or return earned xxxxxx xxxxxx Less: Cost/Return on deposits, borrowings etc. (xxxxxx) (xxxxxx) Net xxxxxx xxxxxx Operating Income: Service charges on deposit accounts xxxxxx Fees & Commission Dividend income xxxxxx Other operating income Plus Sub total xxxxxx Operating Expenses: Administrative expenses (Note 7) xxxxxx Provisions against non-performing advances xxxxxx Provision for diminution in value of investments xxxxxx Provision against other assets xxxxxx Bad debts written off directly Less (xxxxxx) Sub total xxxxxx Other Income xxxxxx Other expenses xxxxxx Plus Sub total xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxxxxxxxx xxxxxx xxxxxx xxxxxx (xxxxxx) xxxxxx xxxxxx Less Plus/Loss Sub total xxxxxx xxxxxx Sub total xxxxxx Extra ordinary/unnaual items xxxxxx Profit before taxation xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx Taxation-current xxxxxx deferred xxxxxx xxxxxx xxxxxx x Less (xxxxxx) Total xxxxxx (xxxxxx) Profit after taxation xxxxxx Appropriations: Proposed dividend/remittances to Head Office xxxxxx Other appropriations (to be specified) Total appropriations Less (xxxxxx) xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx (xxxxxx) Un-appropriated/Unremitted profit carried forward xxxxxx xxxxxx The annexed notes form an integral part of this Report. Authorised Signatory Signatory (Name and Designation) Designation) Authorised (Name and NOTES TO THE QUARTERLY REPORT OF CONDITION AS ON THE QUARTER ENDED _______ --------- Rupees in ‘000-------Estimated Book Value Market Value 1. INVESTMENTS: Investment Dealing Investment Securities Dealing Securities Total Securities Securities Federal and Provincial Governments Securities: -Federal Investment Bonds - Short Term Federal Bonds - Market Treasury Bills - Other (to be specified) Investments in subsidiary companies and associated undertakings Fully paid up ordinary shares - listed companies - unlisted companies Debentures, Bonds, Participation Term Certificates and Term Finance Certificates Other Investments (to be specified) Gold _______ _______ _______ _______ _________ _______ _________ _______ Less: Provision for diminution in the value of Investments. _______ _________ _______ _______ _______ _________ _______ _______ Note: Dealing securities are marketable securities that are acquired and held with the intention of reselling them in the short term. Investment securities are acquired and held for yield or capital growth purposes and are usually held maturity 2. ADVANCE: Advances (Net of Provisions) Rupees in ‘000 Gross Advances (Please specify type-wise break-up of advances) ____________ Sub-Total LESS: Provisions held: Specific General _____________ Sub-Total _____________ Advances (net _____________ of provisions) Give details on how the provisions were calculated. Advance include Rs. ____________ which have been placed on non performing status, i.e. past due 90 days or more as detailed below: Classified Advances ‘000 OAEM Substandard Doubtful Loss Rupees Total ___________ ___________ 3. Other Assets Income/mark up accrued on advances and investments, Rupees in ‘000 Taxation (payments less provisions) Branch adjustment account Suspense account ____________ Others (describe items that exceed 25% of this amount) Total ____________ Less: Provisions held against classified other assets Other assets (net of provisions) “Other Assets” include Rs. ______ which have been classified as ______ _____________ please indicate category of classification viz. QAEM. Substandard. _____________ doubtful loss. 4. DEPOSITS and other accounts Rupees in’00 Fixed Deposits Saving Deposits Current Deposits Others (to be specified) Deposits and other accounts of banks ______________ Total Deposits ______________ 4.1 Particulars of DEPOSITS and other accounts In local currency In foreign currencies ______________ ______________ 5. BORROWING FROM OTHER BANKS, AGENTS ETC. in In Pakistan Outside Pakistan ______________ ______________ 6. OTHER LIABILITIES: Mark-up/interest on/loans/borrowings Profit payable on PLG deposits and other accounts Interest on foreign currency deposits Others (describe item that exceed 25% of this amount) ______________ ______________ 7. ADMINISTRATIVE EXPENSES: Salaries, allowances etc. Staff retirement benefits Others (describe item that exceed 25% of this amount) ______________ ______________ 8. AVERAGE Assets for the quarter Rs. ________ Represents the average to the total assets as of the close of business on each Saturday during the quarter. 9. Report on the following format any class of BUSINESS, e.g. textile, cement, etc, whose (a) deposits exceed 10% of total deposits; or (b) advances exceed 10% of total advances, as of the quarter and. 10. Number Employees: Permanent Temporary /on contractual basis Daily Wagers Others (piease specify) Total No. Of employees ______________ ______________ 11. NUMBER OF BRANCHES: Branches at the begining of the quarter Add: Opened during the quarter Less: Closed/Merged during the quarter ______________ ______________ Total branches at the end of the quarter ______________ ______________ 12. SCHEDULE OF MATURITY DISTRIBUTION OF MARKET RATE ASSETS & LIABILITIES As on the Quarter Ended __________ Rupees in ‘000 UPTO ONE MONTH OVER 1 MONTH UPTO 6 MONTHS OVER 6 MONTHS UPTO 1 YEAR OVER 1 YEAR Market Rate Assets Advance & Lease Financing Investments Other earning assets Total Market Rate Assets Other non-earning Assets Total assets Market Rate Liabilities Large time deposits above 5 Million Rupees All other time deposits (includes fixed rate deposits) Other cost bearing deposits Borrowings Other Cost bearing Liabilities Total Market Rate Liabilities Other non-cost bearing Liabilities Total Liabilities Note: Some assets of a bank do not have a contractual maturity date. The period in which these assets are assumed to mature should be taken as the expected date on which the assets will be realized.