* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Scientific Method, Models, and Gains to Trade

Survey

Document related concepts

Transcript

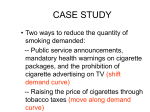

Economic Thinking • Economics as a social Science • The scientific method – Observation, Theory, and Testing – Assumptions and ceteris paribus – Avoiding flaws in logical thinking • Ergo hoc post proper hoc • Fallacy of Composition/Division • Microeconomics vs. Macroeconomics Economics Models • The art of making: simple and effective • Example: circular flow – overall economy, role of economic agents, output and income, product and factor markets • Example: production possibilities frontier (PPF) -efficiency, tradeoffs, opportunity costs, economic growth, law of increasing costs Economics and Economists • • • • Positive versus normative Avoiding unintended consequences Scientist, advisor and citizen Scientific judgment, values, perception versus reality The Power of Trade • Voluntary versus involuntary exchange • An intuitive approach to gains in trade • Using an economic model to demonstrate the gains from trade Voluntary Exchange • All parties to a voluntary exchange must be made better off • Allow for specialization and division of labor • Increase interdependence • Promote cooperation rather than conflict An intuitive Approach to Gains From Trade • Self-sufficiency – Pros: independence – Cons: loss of efficiency, variety in consumption and production • Trade with Yakima? • Trade with other states? • Trade with other nations? Gains from Trade: An Economic Model • Good model building: prove the point and make it simple • Assumptions = things held true during the analysis = simplification • Assumptions can be changed later to explore their implications The Model • Assumptions: – – – – Two individuals – rancher and a farmer Two goods – meat and potatoes Each work eight hours a day Farmer takes 60min/oz meat and 15min/oz potatoes – Rancher takes 20min/oz of meat and 10min/oz of potatoes • Absolute advantage – Rancher than farmer is more efficient and producing both meat and potatoes • Comparative advantage – The farmer is comparatively better at producing potatoes than the rancher. • Comparative advantage and opportunity cost – The person with the lower opportunity cost has a comparative advantage – Someone always has a comparative advantage in the production of a least one thing PPF and Production in a Simple Economy • How much can be produced? • Need to know: – Total time divided by time/output = total output, or – output/time multiplied by total time = total output Table 1 The Production Opportunities of the Farmer and Rancher Farmer (8 hours = 480/min)/ (60 min/oz of meat) = 8 oz of meat Rancher (480min/20min/oz of meat)=24 oz of meat Copyright © 2004 South-Western Figure 1 The Production Possibilities Curve (a) The Farmer ’s Production Possibilities Frontier Meat (ounces) If there is no trade, the farmer chooses this production and consumption. 8 4 0 A 16 32 Potatoes (ounces) Copyright©2003 Southwestern/Thomson Learning Figure 1 The Production Possibilities Curve (b) The Rancher ’s Production Possibilities Frontier Meat (ounces) 24 If there is no trade, the rancher chooses this production and consumption. 12 0 B 24 48 Potatoes (ounces) Copyright©2003 Southwestern/Thomson Learning Slope of the PPF • In math, slope = Δy/Δx but in this case meat is on the y-axis and potatoes are on the x-axis, so it become ΔM/ΔP • E.g. Rancher ΔM/ΔP = -24/48 =-1/2 , but it is help to think of this as -1/2/1. Why? +1P → -½ M • E.g. Farmer ΔM/ΔP =- 8/32 =-1/4 , but it is help to think of this as 1/4/1. Why? +1P → -1/4 M • To get 1 P the rancher gives up 1/2M and the farmer gives up 1/4M • Slope = opportunity cost (an example of making math meaningful to real world situations) • Reverse directions – Rancher to get 1M → -2P – Farmer to get 1M → -4P • Conclusions: – Rancher has a comparative advantage in producing meat (1M costs 2P or 1P costs 1/2M) – Farmer has a comparative advantage in producing potatoes (1P costs 1/4M or 1M costs 1/4P) • The rancher should specialize in producing meat and the farmer should specialization in producing potatoes. Gains to Trade • Marginal versus Complete Approach • Marginal adjustment – – – – – – Farmer -1M → +4P Rancher +1M → -2P Total 0M +2P, or Rancher -1P → +1/2M Farmer +1P → -1/4M Total 0P +1/4M • Either way specializing and trading means either more meat or potatoes The Total Approach • Mankiw explains gains a bit differently and perhaps in a more complicated way – Farmer only produces potatoes and rancher produces a combination of meat and potatoes – Trade takes place with equal amounts for each – New totals lie outside the old PPF and represents a point on a consumption possibilities frontier – Let’s see how he does it…. Table 2 The Gains from Trade: A Summary Copyright © 2004 South-Western Figure 2 How Trade Expands the Set of Consumption Opportunities (b) The Rancher’s Production and Consumption Meat (ounces) Rancher's production with trade 24 Rancher's consumption with trade 18 13 B* B 12 0 12 24 27 Rancher's production and consumption without trade 48 Potatoes (ounces) Copyright © 2004 South-Western Figure 2 How Trade Expands the Set of Consumption Opportunities (a) The Farmer’s Production and Consumption Meat (ounces) 8 Farmer's consumption with trade A* 5 4 Farmer's production and consumption without trade A Farmer's production with trade 0 32 16 Potatoes (ounces) 17 Copyright©2003 Southwestern/Thomson Learning Distribution of Gains to Trade • Voluntary exchange results in gains to trade, but who gets the gains? • Positive analysis = gains exist so efficiency improvements can occur • Normative analysis = who should get the gains • Normative analysis involves value judgments and therefore must be made by others History of Trade • Tribal to feudal times • Adam Smith (1776) and David Ricardo (1817) • The costs of not trading (e.g. lamb example) • Distribution impacts: consumers win but some producers and workers lose • The cost of protectionism Markets: The power of Demand and Supply • Competitive Markets – – – – identical or homogeneous goods many sellers and buyers perfect Information free entry and exit • Non-Competitive Markets – Monopoly – one seller – Oligopoly – few sellers – Monopolistically Competitive – differentiated products Demand • The demand curve – Price and the quantity demanded • Rational behavior – Utility maximization (MB=MC all over again) • Income and substitution effects – Demand schedule – Individual demand curve – Market demand curve Catherine’s Demand Schedule Figure 1 Catherine’s Demand Schedule and Demand Curve Price of Ice-Cream Cone $3.00 2.50 1. A decrease in price ... 2.00 1.50 1.00 0.50 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity of Ice-Cream Cones 2. ... increases quantity of cones demanded. Copyright © 2004 South-Western • The demand function – Income – Price of related goods • Complements • Substitutes – Tastes – Expectations – Number of Buyers • Movement along and shifts of the demand curve – Curve versus function – Schedules – Graphs Figure 3 Shifts in the Demand Curve Price of Ice-Cream Cone Increase in demand Decrease in demand Demand curve, D2 Demand curve, D1 Demand curve, D3 0 Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Supply • Price and the quantity supplied – Rational behavior an the profit motive – Law of diminishing returns • Supply schedule • Individual supply curve • Market supply curve Ben’s Supply Schedule Figure 5 Ben’s Supply Schedule and Supply Curve Price of Ice-Cream Cone $3.00 1. An increase in price ... 2.50 2.00 1.50 1.00 0.50 0 1 2 3 4 5 6 7 8 9 10 11 12 Quantity of Ice-Cream Cones 2. ... increases quantity of cones supplied. Copyright©2003 Southwestern/Thomson Learning • The supply function – – – – Input prices technology expectations number of sellers Figure 7 Shifts in the Supply Curve Price of Ice-Cream Cone Supply curve, S3 Decrease in supply Supply curve, S1 Supply curve, S2 Increase in supply 0 Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Market Equilibrium • Equilibrium price and quantity = market clearing price and quantity • Disequilibrium prices and quantities – Shortage – Surplus • Comparative static analysis: changes in equilibrium prices and quantities • Shifts in curves versus movement along revisited • Changes in demand and supply Figure 8 The Equilibrium of Supply and Demand Price of Ice-Cream Cone Supply Equilibrium Equilibrium price $2.00 Equilibrium quantity 0 1 2 3 4 5 6 7 8 Demand 9 10 11 12 13 Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Figure 9 Markets Not in Equilibrium (a) Excess Supply Price of Ice-Cream Cone Supply Surplus $2.50 2.00 Demand 0 4 Quantity demanded 7 10 Quantity supplied Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Figure 8 The Equilibrium of Supply and Demand Price of Ice-Cream Cone Supply Equilibrium Equilibrium price $2.00 Equilibrium quantity 0 1 2 3 4 5 6 7 8 Demand 9 10 11 12 13 Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Figure 9 Markets Not in Equilibrium (a) Excess Supply Price of Ice-Cream Cone Supply Surplus $2.50 2.00 Demand 0 4 Quantity demanded 7 10 Quantity supplied Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Figure 9 Markets Not in Equilibrium (b) Excess Demand Price of Ice-Cream Cone Supply $2.00 1.50 Shortage Demand 0 4 Quantity supplied 7 10 Quantity of Quantity Ice-Cream demanded Cones Copyright©2003 Southwestern/Thomson Learning Figure 10 How an Increase in Demand Affects the Equilibrium Price of Ice-Cream Cone 1. Hot weather increases the demand for ice cream . . . Supply New equilibrium $2.50 2.00 2. . . . resulting in a higher price . . . Initial equilibrium D D 0 7 3. . . . and a higher quantity sold. 10 Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning Figure 11 How a Decrease in Supply Affects the Equilibrium Price of Ice-Cream Cone S2 1. An increase in the price of sugar reduces the supply of ice cream. . . S1 New equilibrium $2.50 Initial equilibrium 2.00 2. . . . resulting in a higher price of ice cream . . . Demand 0 4 7 3. . . . and a lower quantity sold. Quantity of Ice-Cream Cones Copyright©2003 Southwestern/Thomson Learning The Invisible Hand • Economic Agents are motivated by self-interest – consumers by utility maximization – Producers by profit maximization • Market prices as signals for resource allocation and coordinate consumer and producer behavior • Market or the Price System and Efficiency