* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Survey

Document related concepts

Transcript

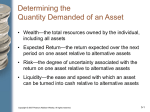

Chapter Eight Competitive Firms and Markets Application • Cheap handheld video cameras have revolutionized the hard-core pornography market. Previously, making movies required expensive equipment and some technical expertise. Now anyone with a couple of thousand dollars and a moderately steady hand can buy and use a video camera to make a movie. Consequently, many new firms have entered the market, and the supply curve of porn movies has slithered substantially to the right. Whereas only 1,000 to 2,000 video porn titles were released annually in the United States from 1986 to 1991, the number grew to nearly 10,000 by 1999 (“Branded Flesh,” Economist, August 14, 1999: 56). © 2007 Pearson Addison-Wesley. All rights reserved. 8–2 Competitive Firms and Markets • In this chapter, we examine five main topics – Competition – Profit maximization – Competition in the short run – Competition in the long run – Zero profit for competitive firms in the long run © 2007 Pearson Addison-Wesley. All rights reserved. 8–3 Competition • Competition is a common market structure that has very desirable properties, so it is useful to compare other market structures to competition. © 2007 Pearson Addison-Wesley. All rights reserved. 8–4 Price Taking • Economists say that a market is competitive if each firm in the market is a price taker: a firm that cannot significantly affect the market price for its output or the prices at which it buys its inputs. © 2007 Pearson Addison-Wesley. All rights reserved. 8–5 Why the Firm’s Demand Curve is Horizontal • Consumers believe that all firms in the market sell identical products. • Firms freely enter and exit the market. • Buyers and sellers know the prices charged by firms. • Transaction costs—the expenses of finding a trading partner and making a trade for a good or service other than the price paid for that good or service—are low. © 2007 Pearson Addison-Wesley. All rights reserved. 8–6 Why the Firm’s Demand Curve is Horizontal • We call a market in which all these conditions hold a perfectly competitive market. In such a market, if a firm raised its price above the market price, the firm would be unable to make any sales. © 2007 Pearson Addison-Wesley. All rights reserved. 8–7 Why We Study Perfect Competition • Perfectly competitive markets are important for two reasons. First, many markets can be reasonably described as competitive. Many agricultural and other commodity markets, stock exchanges, retail and wholesale markets, building construction markets, and others have many or all of the properties of a perfectly competitive market. © 2007 Pearson Addison-Wesley. All rights reserved. 8–8 Why We Study Perfect Competition • Second, a perfectly competitive market has many desirable properties. Economists use this model as the ideal against which real-world markets are compared. © 2007 Pearson Addison-Wesley. All rights reserved. 8–9 Profit Maximization • Profit – A firm’s profit, , is the difference between a firm’s revenues, R, and its cost, C: R C. If profit is negative, 0 , the firm makes a loss. © 2007 Pearson Addison-Wesley. All rights reserved. 8–10 Application (Page 223) Breaking Even on Christmas Trees © 2007 Pearson Addison-Wesley. All rights reserved. 8–11 Two Steps to Maximizing Profit • A firm’s profit varies with its output level. The firm’s profit function is (q) R(q) C (q). To maximize its profit, any firm (not just competitive, price-taking firms) must answer two questions: – Output decision: If the firm produces, what output level, q*, maximizes its profit or minimizes its loss? – Shutdown decision: Is it more profitable to produce q* or to shut down and produce no output? © 2007 Pearson Addison-Wesley. All rights reserved. 8–12 π, Profit Figure 8.1 Maximizing Profit π* Profit Dπ < 0 Dπ> 0 1 0 © 2007 Pearson Addison-Wesley. All rights reserved. 1 q* Quantity, q, Units per day 8–13 Output Rules • marginal profit – the change in profit a firm gets from selling one more unit of output • marginal revenue (MR) – the change in revenue a firm gets from selling one more unit of output © 2007 Pearson Addison-Wesley. All rights reserved. 8–14 Output Rules • Output Rule 1: The firm sets its output at when its profit is maximized. • Output Rule 2: A firm sets its output where its marginal profit is zero. Marginal profit(q) MR(q) MC (q). Because profit is (q) R(q) C (q) , marginal profit is the difference between marginal revenue and marginal cost: d (q) dR(q) dC (q) MR MC. dq dq dq © 2007 Pearson Addison-Wesley. All rights reserved. 8–15 Output Rules • Output Rule 3: A firm sets its output where its marginal revenue equals its marginal cost MR(q) MC (q). © 2007 Pearson Addison-Wesley. All rights reserved. 8–16 Shutdown Rules • Shutdown Rule 1: The firm shuts down only if it can reduce its loss by doing so. The firm compares its revenue to its variable cost only when deciding whether to stop operating. Because the fixed cost is sunk— the expense cannot be avoided by stopping operations (Chapter 7) —the firm pays this cost whether it shuts down or not. The sunk fixed cost is irrelevant to the shutdown decision. © 2007 Pearson Addison-Wesley. All rights reserved. 8–17 Shutdown Rules • Shutdown Rule 2: The firm shuts down only if its revenues is less than its avoidable cost. © 2007 Pearson Addison-Wesley. All rights reserved. 8–18 Competition in the Short Run • Short-Run Output Decision – Because a competitive firm’s marginal revenue equals the market price, a profit-maximizing competitive firm produces the amount of output at which its marginal cost equals the market price: MC (q ) p. © 2007 Pearson Addison-Wesley. All rights reserved. 8–19 Figure 8.2 How a Competitive Firm Maximizes Profit (a) Cost, C 4,800 1 2,272 MR = 8 π* 1,846 426 100 0 – 100 Revenue π(q ) π* = $426,000 140 284 q, Thousand metric tons of lime per year (b) MC 10 AC e 8 p = MR π* = $426,000 6.50 6 0 © 2007 Pearson Addison-Wesley. All rights reserved. 140 284 q, Thousand metric tons of lime per year 8–20 Solved Problem 8.1 • If a specific tax of is collected from only one competitive firm, how should that firm change its output level to maximize its profit, and how does its maximum profit change? 1. How the tax shifts the marginal cost and average cost curves? 2. Determine the before-tax and after-tax equilibria and the amount by which the firm adjusts its output. 3. How the profit changes after the tax? © 2007 Pearson Addison-Wesley. All rights reserved. 8–21 Page 229 Solved Problem 8.1 MC 2 = MC1 + MC1 AC2 = AC1 + AC1 e2 p e1 p = MR A AC2 (q 2) B AC1(q 1) q2 © 2007 Pearson Addison-Wesley. All rights reserved. q1 q, Units per year 8–22 Short-Run Shutdown Decision • The firm can gain by shutting down only if its revenue is less than its short-run variable cost: pq VC. (8.3) By dividing both sides of Equation 8.3 by output, we can write this condition as p AVC (q ). A competitive firm shuts down if the market price is less than the minimum of its short-run average variable cost curve. © 2007 Pearson Addison-Wesley. All rights reserved. 8–23 Short-Run Shutdown Decision • In summary, a competitive firm uses a twostep decision-making process to maximize its profit. • First, the competitive firm determines the output that maximizes its profit or minimizes its loss when its marginal cost equals the market price (which is its marginal revenue): MC p. • Second, the firm chooses to produce that quantity unless it would lose more by operating than by shutting down. The firm shuts down only if the market price is less than the minimum of its average variable cost, p AVC. © 2007 Pearson Addison-Wesley. All rights reserved. 8–24 Figure 8.3 The Short-Run Shutdown Decision MC AC b 6.12 6.00 AVC A = $62,000 5.50 B = $36,000 5.14 5.00 a 0 50 p e 100 © 2007 Pearson Addison-Wesley. All rights reserved. 140 q, Thousand metric tons of lime per year 8–25 Short-Run Firm Supply Curve • Tracing Out the Short-Run Supply Curve – The competitive firm’s short-run supply curve is its marginal cost curve above its minimum average variable cost. © 2007 Pearson Addison-Wesley. All rights reserved. 8–26 Figure 8.4 How the Profit-Maximizing Quantity Varies with Price S e 4 p4 8 e 3 AC 7 p AVC e2 6 e 1 p p 5 3 2 1 MC 0 q 1 = 50 q 2 = 140 © 2007 Pearson Addison-Wesley. All rights reserved. q 3 = 215 q4 = 285 q, Thousand metric tons of lime per year 8–27 Figure 8.5 Effect of an Increase in the Cost of Materials on the Vegetable Oil Supply Curve S2 S1 AVC 2 AVC 1 e 12 2 e 1 p 8.66 7 MC 2 MC 1 0 100 © 2007 Pearson Addison-Wesley. All rights reserved. 145 178 q, Hundred metric tons of oil per year 8–28 Short-Run Market Supply Curve • Short-Run Market Supply with Identical Firms. – The market supply curve flattens as the number of firms in the market increases because the market supply curve is the horizontal sum of more and more upwardsloping firm supply curves. – The more identical firms producing at a given price, the flatter (more elastic) the short-run market supply curve at that price. © 2007 Pearson Addison-Wesley. All rights reserved. 8–29 Figure 8.6 Short-Run Market Supply with Five Identical Lime Firms (a) Firm (b) Market S1 7 7 S1 S2 S3 S4 6.47 AVC 6.47 S5 6 6 5 5 MC 0 50 140 175 q, Thousand metric tons of lime per year © 2007 Pearson Addison-Wesley. All rights reserved. 0 50 150 250 100 200 700 Q, Thousand metric tons of lime per year 8–30 Short-Run Market Supply Curve • Short-Run Market Supply with Firms That Differ. – Where firms differ, only the low-cost firm supplies goods at relatively low prices. As the price rises, the other, higher-cost firm starts supplying, creating a stairlike market supply curve. The more suppliers there are with differing costs, the more steps there are in the market supply curve. – Differences in costs are one explanation for why some market supply curves are upward sloping. © 2007 Pearson Addison-Wesley. All rights reserved. 8–31 Figure 8.7 Short-Run Market Supply with Two Different Lime Firms S2 8 S1 S 7 6 5 0 25 50 100 140 165 © 2007 Pearson Addison-Wesley. All rights reserved. 215 315 450 q, Q, Thousand metric tons of lime per year 8–32 Short-Run Competitive Equilibrium • By combining the short-run market supply curve and the market demand curve, we can determine the short-run competitive equilibrium. © 2007 Pearson Addison-Wesley. All rights reserved. 8–33 Figure 8.8 Short-Run Competitive Equilibrium in the Lime Market (a) Firm (b) Market 8 e 7 6.97 A S 8 S1 1 D1 7 E AC B 1 D2 6.20 6 AVC 6 C 5 5 e 2 0 q = 50 2 q = 215 1 q, Thousand metric tons of lime per year © 2007 Pearson Addison-Wesley. All rights reserved. 0 E 2 Q = 250 2 Q = 1,075 1 Q, Thousand metric tons of lime per year 8–34 Solved Problem 8.3 • What is the effect on the short-run equilibrium of a specific tax of per unit that is collected from all n firms in s market? What is the incidence of the tax? 1. How the tax shifts a typical firm’s marginal cost and average cost curves and hence its supply curve? 2. How the market supply curve shifts?. 3. Determine how the short-run market equilibrium changes. 4. The incidence of the tax: The equilibrium price increase, but by less than the full amount of the tax: p p . 2 1 © 2007 Pearson Addison-Wesley. All rights reserved. 8–35 Page 238 Solved Problem 8.3 (a) Firm (b) Market S1 + S1 S+ AVC + AVC e2 p 2 p E2 p + 1 E1 e1 1 S D MC + MC q q 2 1 © 2007 Pearson Addison-Wesley. All rights reserved. q, Units per year Q = nq Q = nq 2 2 1 1 q, Units per year 8–36 Competition in the Long Run • Long-run competitive profit maximization – In the long run, typically all costs are variable, so the firm does not have to consider whether fixed costs are sunk or avoidable. © 2007 Pearson Addison-Wesley. All rights reserved. 8–37 Long-Run Output Decision • The firm picks the quantity that maximizes long-run profit, the difference between revenue and long-run cost. • Equivalently, it operates where long-run marginal profit is zero and where marginal revenue equals long-run marginal cost. © 2007 Pearson Addison-Wesley. All rights reserved. 8–38 Long-Run Shutdown Decision • After determining the output level, q*, that maximizes its profit or minimizes its loss, the firm decides whether to produce or shut down © 2007 Pearson Addison-Wesley. All rights reserved. 8–39 Long-Run Firm Supply Curve • A firm’s long-run supply curve is its long-run marginal cost curve above the minimum of its long-run average cost curve (because all costs are variable in the long run). © 2007 Pearson Addison-Wesley. All rights reserved. 8–40 Figure 8.9 The Short-Run and Long-Run Supply Curves S SR S LR LRAC SRAC SRAVC p 35 B A 28 25 24 20 LRMC SRMC 0 50 © 2007 Pearson Addison-Wesley. All rights reserved. 110 q, Units per year 8–41 Long-Run Market Supply Curve • The competitive market supply curve is the horizontal sum of the supply curves of the individual firms in both the short run and long run. • In the long run, firms can enter or leave the market. Thus before we can add all the relevant firm supply curves to obtain the longrun market supply curve, we need to determine how many firms are in the market at each possible market price. © 2007 Pearson Addison-Wesley. All rights reserved. 8–42 Role of Entry and Exit • The number of firms in a market in the long run is determined by the entry and exit of forms. – A firm enters the market if it can make a long-run profit, 0 . – A firm exits the market to avoid a long-run loss, 0. © 2007 Pearson Addison-Wesley. All rights reserved. 8–43 Table 8.1 Average Annual Entry and Exit Rates in Selected U.S. Industries, 1989–1996 © 2007 Pearson Addison-Wesley. All rights reserved. 8–44 Long-Run Market Supply with Identical Firms and Free Entry • The long-run market supply curve is flat at the minimum long-run average cost if firms can freely enter and exit the market, an unlimited number of firms have identical costs, and input prices are constant. © 2007 Pearson Addison-Wesley. All rights reserved. 8–45 Figure 8.10 Long-Run Firm and Market Supply with Identical Vegetable Oil Firms (a) Firm (b) Market S1 LRAC 10 Long-run market supply 10 LRMC 0 150 q, Hundred metric tons of oil per year © 2007 Pearson Addison-Wesley. All rights reserved. 0 Q, Hundred metric tons of oil per year 8–46 Long-Run Market Supply When Entry is Limited • If the number of firms in a market is limited in the long run, the market supply curve slopes upward. © 2007 Pearson Addison-Wesley. All rights reserved. 8–47 Long-Run Market Supply When Firms Differ • A second reason why some long-run market supply curves slope upward is that firms differ. • Firms with relatively low minimum longrun average costs are willing to enter the market at lower prices than others, resulting in an upward-sloping long-run market supply curve. © 2007 Pearson Addison-Wesley. All rights reserved. 8–48 Application (Page 246) Upward-Sloping Long-Run Supply Curve for Cotton Iran S 1.71 United States 1.56 Nicaragua, Turkey 1.43 Brazil 1.27 1.15 1.08 0.71 0 Australia Argentina Pakistan 1 2 © 2007 Pearson Addison-Wesley. All rights reserved. 3 4 5 6 6.8 Cotton, billion kg per year 8–49 Long-Run Market Supply When Input Prices Vary with Output • A third reason why market supply curves may slope is nonconstant input prices. • In conclusion, the long-run supply curve is upward sloping in an increasing-cost market and flat in a constant-cost market. © 2007 Pearson Addison-Wesley. All rights reserved. 8–50 Figure 8.11 Long-Run Market Supply in an Increasing-Cost Market (a) Firm (b) Market MC 2 MC 1 AC 2 S AC 1 e E 2 p 2 2 e p E 1 1 1 q q 1 2 q, Units per year © 2007 Pearson Addison-Wesley. All rights reserved. Q =n q Q =n q 1 1 1 2 2 2 Q, Units per year 8–51 Figure 8.12 Long-Run Market Supply in a Decreasing-Cost Market (a) Firm (b) Market MC 1 MC 2 AC1 AC 2 e p 1 p E 1 e 1 E 2 2 2 S q1 q2 q, Units per year © 2007 Pearson Addison-Wesley. All rights reserved. Q1 = n1q1 Q2 = n2q 2 Q, Units per year 8–52 Long-Run Competition Equilibrium • The intersection of the long-run market supply and demand curves determines the long-run competitive equilibrium. © 2007 Pearson Addison-Wesley. All rights reserved. 8–53 Figure 8.14 The Short-Run and Long-Run Equilibria for Vegetable Oil (a) Firm (b) Market D1 MC D2 AC S SR f2 11 10 7 0 AVC e f1 100 150165 q, Hundred metric tons of oil per year © 2007 Pearson Addison-Wesley. All rights reserved. F2 11 10 7 0 E1 E 2 S LR F1 1,500 2,000 3,300 3,600 Q, Hundred metric tons of oil per year 8–54 Zero Profit for Competitive Firms in the Long Run • Competitive firms earn zero profit in the long run whether or not entry is completely free. © 2007 Pearson Addison-Wesley. All rights reserved. 8–55 Zero Long-Run Profit with Free Entry • The long-run supply curve is horizontal if firms are free to enter the market, firms have identical cost, and input prices are constant. • All firms in the market are operating at minimum long-run average cost. • The are indifferent between shutting down or not because they are earning zero profit. © 2007 Pearson Addison-Wesley. All rights reserved. 8–56 Zero Long-Run Profit When Entry is Limited • In some markets, firms cannot enter in response to long-run profit opportunities. • One reason for the limited number of firms is that the supply of an input is limited. © 2007 Pearson Addison-Wesley. All rights reserved. 8–57 Zero Long-Run Profit When Entry is Limited • One might think that firms could make positive long-run economic profits in such markets; however, that’s not true. • The reason why firms earn zero economic profits is that firms bidding for the scarce input drive its price up until the firms’ profits are zero. © 2007 Pearson Addison-Wesley. All rights reserved. 8–58 Figure 8.15 Rent MC AC (including rent) AC (excluding rent) p* π* = Rent q* © 2007 Pearson Addison-Wesley. All rights reserved. q, Bushels of tomatoes per year 8–59