* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Short run - TerpConnect

Fiscal multiplier wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Nominal rigidity wikipedia , lookup

Full employment wikipedia , lookup

Gross domestic product wikipedia , lookup

Early 1980s recession wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Long Depression wikipedia , lookup

Economic growth wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

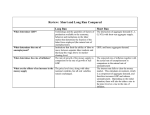

Introduction to Economic Fluctuations Sections 1 and 2 Chapter 10, 8th and 9th edition Chapter 9, 7th edition IN THIS CHAPTER: facts about the business cycle how the short run differs from the long run an introduction to aggregate demand an introduction to aggregate supply in the short run and long run how the model of aggregate demand and aggregate supply can be used to analyze the short-run and long-run effects of “shocks.” 1 Facts about the business cycle GDP growth averages 3–3.5 percent per year over the long run with large fluctuations in the short run. Consumption and investment fluctuate with GDP, but consumption tends to be less volatile and investment more volatile than GDP. Unemployment rises during recessions and falls during expansions. Okun’s law: the negative relationship between GDP and unemployment. Growth rates of real GDP, consumption Percent 10 change from 4 8 quarters earlier Real GDP growth rate Consumption growth rate 6 Average 4 growth rate 2 0 -2 -4 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Growth rates of real GDP, consump., investment Percent change 40 from 4 quarters 30 earlier Investment growth rate 20 Real GDP growth rate 10 0 Consumption growth rate -10 -20 -30 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Unemployment Percent 12 of labor force 10 8 6 4 2 0 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Okun’s Law: Growth Rate Version Percentage 10 change in real GDP 8 1951 Y 3 2 u Y 1966 1984 6 2003 1971 4 1987 2 1975 2001 0 2009 2008 -2 1991 1982 -4 -3 -2 -1 0 1 2 3 Change in unemployment rate 4 Index of Leading Economic Indicators Published monthly by the Conference Board. Aims to forecast changes in economic activity 6-9 months into the future. Used in planning by businesses and govt, despite not being a perfect predictor. Components of the LEI index Average workweek in manufacturing Initial weekly claims for unemployment insurance New orders for consumer goods and materials New orders, nondefense capital goods Vendor performance New building permits issued Index of stock prices M2 Yield spread (10-year minus 3-month) on Treasuries Index of consumer expectations Index of Leading Economic Indicators, 1970-2012 120 110 2004 = 100 100 90 The index turns downward a few months to a year before almost every recession. It also turns upward just prior to the end of almost every recession. 80 70 60 50 40 30 20 10 Source: 0 Conference 1970 Board 1975 1980 1985 1990 1995 2000 2005 2010 Time horizons in macroeconomics Long run Prices are flexible, respond to changes in supply or demand. Short run Many prices are “sticky” at a predetermined level. The economy behaves much differently when prices are sticky. Recap of classical macro theory Output is determined by the supply side: supplies of capital, labor technology Changes in demand for goods & services (C, I, G ) only affect prices, not quantities. Assumes complete price flexibility. Applies to the long run. When prices are sticky… …output and employment determined bydemand, which is affected by: fiscal policy (G and T ) monetary policy (M ) other factors, like exogenous changes in C or I Aggregate supply in the long run Recall from Chap. 3: In the long run, output is determined by factor supplies and technology Y F (K , L ) Y is the full-employment or natural level of output, at which the economy’s resources are fully employed. • “Full employment” means that unemployment equals its natural rate (not zero). • Some textbooks also use the term “potential GDP” to mean the full-employment level of output. The long-run aggregate supply curve P LRAS Y does not depend on P, so LRAS is vertical. Y F (K , L ) Y The short-run aggregate supply curve The SRAS curve is horizontal: The price level is fixed at a predetermined level, and firms sell as much as buyers demand. P P SRAS Y