* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download market signals

Survey

Document related concepts

Transcript

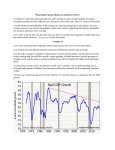

MARKET SIGNALS Source: The New Yorker THE MATERIAL COVERED IN THIS PRESENTATION IS THE OPINION OF THE PRESENTER AND SHOULD NOT BE CONSTRUED AS A RECOMMENDATION TO BUY OR SELL ANY OF THE SECURITIES MENTIONED. INVESTORS SHOULD SEEK THE COUNSEL OF THEIR FINANCIAL ADVISOR BEFORE MAKING ANY KIND OF INVESTMENT. THE PRESENTER MAY OR MAY NOT HOLD LONG OR SHORT POSITIONS IN ANY OF THE SECURITIES MENTIONED. The Facts • We are not entering another Great Depression. Following the Stock Market crash of 1929 the government: -raised taxes, increased interest rates -Today we are doing just the opposite A Typical Recession • Averages 14 months in length • Economic activity declines by 2.5% • Unemployment rises by 2% • - If unemployed, the average tenure is six weeks. • We’ve had two recessions in the last 25 years (early 1990’s and 2000 – 2001). • They always end and the economy always rises to a higher plateau. Stimulating Enough? Spring 2008 $170 Billion Tax Rebates Fall 2008 $350 Billion Drop in gas prices January 2009 $790 Billion Economic Stimulus Plan Since World War II We’ve had 10 Recessions •24 stock declines of 10% or greater •13 stock declines of 20% or greater What Counts is Corporate Earnings Since WW II •Corporate profits up 63 fold •Stock prices have risen 71 fold Darts vs. Professional Stock Pickers Oil Wells Often Overlooked Oil Oil Dreco Energy Services Price Graph 31 May 26June 26th July 23rd Aug 20th Sept. 19th Oct. 15th Nov 29Nov Hang In There Over the past 30 years the stock market has produced an average annual rate of return around 10%. If you were out of the market during the best 30 months your return would drop to just 3%. Bad Timing? “People generally feel a stronger impulse to avoid losses than acquire gains.” Michael Pompian, CFA S&P 500 Index Average Equity Investor Return Data through 12/31/2008 3-yrs. 5-yrs. 10-yrs. 20-yrs. -8.36% -10.38% -2.19% -2.84% -1.38% -1.57% 8.43% 1.87% Sources of Long-Term Performance Stock, Fund or Money Manager Selection 5-10% Asset Allocation 90-95% Portfolio Rebalancing Makes a Big Difference The Root of the Problem •It all started with the housing bubble •We have about 1.5 million too many homes •This is about 12 months worth of sales •Much of the problem is regionally based •A dramatic slowdown in building and an increase in housing affordability is what eventually will solve the problem. HEADLINE: Lou Dobbs Hosts Moneyline From Window Ledge Source: www.theonion.com Relevant Economic/Financial Issues 1. Energy Issues 2. Interest Rates 3. Domestic Politics 4. Valuation Levels 5. Investing Demographics Energy Issues • Oil & Gas Prices will remain stubbornly high • Demand Strong – Especially China and India • Daily World demand dropped from 86 million to 81 million barrels in the past year. • Supply Weak – – Increasing reserve “decline rates” – Shortage of new prospects New Refineries? • NIMBY • BANANA • NOPE Pricing: Oil vs. Natural Gas •A barrel of oil usually sells at about 8 times an mcf of natural gas. That ratio is now 20 times. Either oil prices are too high or natural gas prices are too low. •The past weakness in energy prices is causing a big decrease in drilling plans and lays the groundwork for future price spikes. •There seems to be an inverse relationship between oil prices and world peace. Gulf Coast Wetlands Of Critical Importance: •1/3 of the nation’s energy production •Bulk of Country’s refining capacity •30% of America’s Seafood •South Louisiana is the Nation’s largest port •Wetlands are a buffer against storms The Yield Curve As Prophet Fall 2000 3 month 6.00% 10 year 5.70% Slope -30 basis points Predicting a sharp decline in corporate earnings. Summer 2003 3 month 0.95% 10 year 4.35% Slope +340 basis points Predicting a huge increase in corporate earnings growth. Summer 2006 3 month 5.10% 10 year 4.50% Slope -60 basis points Projected an end to double digit EPS growth. Important Yield Curve Spreads Current Slope +335 Basis Points Ten year treasury note (3.50%) minus 3-month treasury bill (0.15%) Consumer Confidence Vs. Reality The 1982 recession was the worst since the Great Depression. Consumer confidence is now 20% below the level it was back then. Unemployment Inflation Ten-yr. USTN 1982 11.0% +10.0% 14.0% Now 9.7% + 2.0% 3.50% Typical Recovery • Painful Layoffs • Credit Markets Gradually Thaw • Merger and Acquisition Activity Heats Up • Newly Streamline Companies. Small Improvement in Business Brings Much Larger Improvement in Profits Political Performance Standard & Poor’s 500 +99% +83% -6% -26% Bush’s First Term Bush’s Second Term +26% Stock Market and Business Cycle Many stocks are cyclical in nature. They tend to perform better in specific stages of business cycles. Forecasting these cycles can help to put you in the right stocks at the right time. Consumer Staples Excel Source: Fortune Magazine: 3/21/94 HEADLINE: ‘Wheel of Fortune’ Contestants Hit Hard as Vowel Prices Skyrocket Worker Blues • THE BAD NEWS: 40% of the Country’s skilled workers will be eligible for retirement in 2010. • THE GOOD NEWS?: Thanks to declining 401K accounts most everyone will keep coming to work. • PERHAPS consider a “sabbatical” Federal Reserve Valuation Model EPS for S&P 500 Price of S&P 500 $50.00* 10025.00 = = Yield on 10 Year Treasury Note 4.85% The 10 yr. Treasury Currently Yields 3.50% *Forecasted 12 month EPS. 9/09/09 Fear Index In February of 2009 Gold sold at $1000 an ounce and could then be exchanged for some pretty useful stuff. -150 shares of General Electric or 25 barrels of oil -Today an ounce of gold could be exchanged for 67 shares of General Electric or 13 barrels of oil. HEADLINE: Mason-Dixon Line Renamed IHOP-Waffle House Line Source: www.theonion.com “Tis Double Death To Drown In Ken of Shore” -Shakespeare -Twelve other Bear Markets since 1955 -Average decline was 22% and lasted 11 months -These were followed by recoveries averaging 12-month in length and producing 35.0% returns. -This is about 1.5 times the decline -There are Trillions of investable dollars waiting on the sidelines. Investing Demographics • “The Pig and the Python” • Very high birth rates from 1946 – 1964 • Investing Concepts - Financial Services - Healthcare - Leisure What Drives A Stock? Price Earnings Per Share = P/E ratio Using Home Depot for Example: $27.50 $1.45 08/12/09 = 19.0x Wal-Mart 2001-2006 Wal-Mart Stock P/E’s vs. Earnings Per Share 2007 $43.00 = A PE of 13.0x $ 3.30 2001 $43.00 = A PE of 29.0x $ 1.50 The stock has remained flat as EPS growth has mirrored the decline in its PE ratio. In 2001 Wal-Mart shares were “ahead of themselves”. Three Stages of a Bear Market Stage Characteristics 1. DENIAL Economy shows signs of slowing and stocks fall from their highs, sometimes sharply. Investors shrug it off and act as though the bull market will last forever. Stocks continue to decline. Investors start to realize how weak the economy really is. 2. REALITY 3. SURRENDER Fear of deeper losses and a recession become so worrisome that investors give up on stocks, setting the stage for a rebound. Started In Economic Downturns • Procter & Gamble: The Panic of 1837 • General Electric: The Panic of 1837 • General Motors: the Panic of 1907 • United Technologies: The Great Depression 1929 • Fed Ex: The Oil Crisis of 1973 • Microsoft: 1973 – 1974 Recession GNP vs. Stock Market Valuation The Future Has Not Been Cancelled • Our economic problems are not insurmountable. • Have patience, this turnaround will not happen overnight. • The stock market is about 6-9 months ahead of the economy. • Capitalism Works. The human drive to succeed is very powerful. Great Reading/Sources Popular Books One Up On Wall Street, Peter Lynch (Simon & Schuster) A Zebra in Lion Country, Ralph Wanger (Simon & Schuster) The Money Masters, John Train (Harper & Row) The Little Book That Beats The Market, Joel Greenblatt Analytical Books The Intelligent Investor, Benjamin Graham (Harper & Row) Security Analysis, Benjamin Graham (McGraw-Hill) Sophisticated and Well Written Common Stocks and Uncommon Profits, Phillip A. Fisher (Harper & Row) The Contrarian Investment Strategy, David Dremen (Random House) Great Investment Websites Bloomberg.com Investopedia.com NPR.org (Planet Money) MotleyFool.com Seekingalpha.com YahooFinance.com www.burkenroad.org