* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Regional Economics

Steady-state economy wikipedia , lookup

Economic democracy wikipedia , lookup

Economics of fascism wikipedia , lookup

Non-monetary economy wikipedia , lookup

Economic growth wikipedia , lookup

Business cycle wikipedia , lookup

Transformation in economics wikipedia , lookup

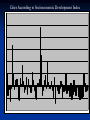

Regional Economics Lecture 1 Sedef Akgüngör Class Objectives The aim of the course is to explore and discuss the problem of regional economic disparities. Theories of migration, location and regional economic growth will be introduced. Techniques for analyzing aspects of the regional problem, including cost-benefit analysis, regional accounting, shift share analysis, multiplier analysis will be presented. The course will cover current issues on regional economic policy and development particularly with respect to Turkey-EU relations. Reading Materials There is no specific textbook for the class, we will be using articles and reports as well as parts from a web text book : Edgar M. Hoover and Frank Giarratani. An Introduction to Regional Economics (1999). The Web book of Regional Science. Regional Research Institute. West Virginia University. (http://www.rri.wvu.edu/WebBook/Giarratani/prefac e.htm) Additional Readings are available on the course web site. Regional Economics Economic systems are dynamic entities and they affect the well being of the ndividuals as well as social and political fabric. Regional economics represents a framework within which spatial character of an economic system can be understood. Regional science is a field of social science concerned with analytical approaches to problems that are specifically regional. Location theory Spatial economics Location modelling Transportation Migration Location of economic activity …… Or any social science analysis that has a spatial dimension. Origins of Regional Science Founded in the late 1940s. Wide variety of disciplines To promote the “objective” and “scientific” analysis of settlement, industrial locaton and urban development Regional Science Association was founded in 1954 to expand this science beyond the restrictive world of economics. Regional Science is concerned with: The determinants of industrial location The regional economic impact of the arrival or departure of a firm Immigration patterns Regional specialization and exchange Environmental impacts Geographic association of economic and social conditions Spatial character of Economics What is where, why and so what? What: refers to every type of economic activity Where: refers to location and involves questions of proximity, concentration, dispersion and similarity/disparity of spatial patterns. Why and so what refers to political implications. Three Foundation Stones Underlying The Pattern of Economic Activity 1) Natural resource advantages 2) Economies of concentration 3) Transportation costs Or more formally: • Imperfect factor mobility • Imperfect divisibility • Imperfect mobility of goods and services Discussion Why are some regions more developed than the others? What factors affect differences in regional development patterns?? Write down three most important reasons that first comes to your mind. Analysis of Regions: Statistical Foundations The Nomenclature of Territorial Units for Statistics (NUTS) is defined and developed according to a number of basic principles. Favors institutional breakdown – according to normative criteria and has three levels: NUTS 1, 2 and 3 Normative regions are the expression of a political will; according to the sizes of population necessary to carry out these tasks efficiently and economically, and according to historical, cultural and other factors; Analytical (or functional) regions are defined according geographical criteria (e.g., altitude or type of soil) or using socio-economic criteria (e.g., homogeneity, complementarily or polarity of regional economies). NUTS 2 Regions in Turkey Ön Ulusal Kalkınma Planında belirlenen 12 öncelikli Düzey 2 Bölgesi Ranking of Cities on Socioeconomic Development Indicators Five cities with highest socioeconomic development index: İstanbul, Ankara, İzmir, Bursa, Kocaeli Contribution to GDP: %21.3, %7.6, %7.5, %5.2, %7.6 Per capita GDP index: 143, 128, 150, 117, 191 Unemployment rate: %12.3, %14.8, %14.3, %8.8, %12.0 Five cities with lowest socioeconomic development index: Van, Ağrı, Mardin, Şanlı Urfa, Erzurum Contribution to GDP : %1, %0.6, %1.2, %2.2, %1.0 Per capita GDP index : 35, 34, 46, 54, 50 Unemployment rate : %11, %1.7, %6.1, %10.8, %4.1 Cities According to Socioeconomic Development Index 6 5 4 3 2 1 0 DÜZCE KİLİS YALOVA ARDAHAN ŞIRNAK KIRIKKALE BAYBURT ZONGULDAK VAN ŞANLIURFA TRABZON TEKİRDAĞ SİNOP SAMSUN RİZE NİĞDE MUŞ MARDİN MANİSA KÜTAHYA KOCAELİ KIRKLARELİ KASTAMONU İZMİR MERSİN HATAY GÜMÜŞHANE GAZİANTEP ERZURUM ELAZIĞ DİYARBAKIR ÇORUM ÇANAKKALE BURDUR BİTLİS BİLECİK AYDIN ANTALYA AMASYA -2 AFYON ADANA -1 Basic Questions Some regions have higher income levels and better job prospects than the others.Why should this be so? What factors determine the income level and job prospects of regions? So then the next question is: Is it possible to construct general models that can be used to explain the determinants of income and employment in all types of regions regardless of vast differences between them? Two main routes have been taken , one based on the Keysnesian income-expenditure approach to modelling the national economy, and the other based on input-output analysis. Kenesian Model The Keynesian approach to modelling the regional economy is virtually identical to teh simplest open economy version of the keynesian income-expenditure model, the only difference being that all the expenditure variables refer to the regional or local economy instead of to nation. The model begins with the familiar income-expenditure identity: Y=C+I+G+X-M Y : Regional income C : Regional consumption I : Regional investment G : Government expenditure X : Regional exports M : Regional imports I = I0 , G = G0 , X = X0 C = C0 + cDY M = M0 + mDY Where DY is disposable income and given by DY = Y-tY Where t is the rate of income tax Y = k (C0 +I0+X0+M0) Where, k is the Keynesian regional multiplier and is given by: k=1/ 1-(c-m)(1-t) (c-m) =the marginal propensity to consume locally produced goods. t= tax rate The multiplier is clearly sensitive to changes in c - m, rising quite rapidly as it increases. Since the marginal propensity to consume locally produced goods (c - m) has a crucial effect on the magnitude of the regional multiplier. This model says that the regional income can be magnified by the Keynesian regional multiplier. To obtain higher regional income, we wish to have a bigger multiplier. The strategical implications from this model are to lower the income tax rate and promote the propensity to consume locally produced goods. This model justifies the demand-side policies by showing that promoting the demand, consumption of locally produced goods in this case, can boost the regional economy. These are the sorts of questions that regional economic models are designed to address. Regional models vary tremendously in detail and complexity. They range from very aggregative, demand-driven explanations based upon simplistic interpreations of the Keynesian macro model to more sophisticated approaches which allow for the supply side to respond to changes in capital and labour markets. Export demand and cumulative growth model This model says that if the world income grows, the region's exports will increase which will lead to the region's output to increase. The region will be more productive in production. Thus, the region's competitiveness will increase which will decrease the region's price and increase the exports. Another round of productivity increase and competitiveness increase begin. Other cumulative growth models Growth pole: Perroux (1950), Myrdal (1957), and Hirschman (1958) The theory says that if an indstry is subject to significant internal economies of scale, the firms grow quickly and will gain a competitive advantage over rivals and growth will be cumulative. Localization economies: Localization economies result from the geographical concentration of plants in the same industry at the locality. Located close to each other, the firms with input-output ties can enjoy benefits, such as the low costs of transportation, quick exchange of information, ideas and knowledge, and the spillover effects of cross-fertilization. Clustering allows individual plants to specialize more than they would if firms are wildly apart. The increase in specialization will increase the productivity and competitiveness of the industry. Regional Competitiveness Economic growth; economic development and innovation Economists have recognized the central importance of technological innovation for economic progress Adam Smith “Wealth of Nations” Marx’s model of capitalist economy Marshall considers knowledge as chief engine in progress THE GLOBAL COMPETITIVENESS REPORT Growth Competitiveness Index Technology Index Macroeconomic Environment Index Public Institutions Index Innovation Sub-Index Macroeconomic Stability Sub-Index Contracts and Law Sub-Index Technology Transfer Sub-Index Country Credit Rating Corruption SubIndex Information & Communications Technology Sub-Index Government Waste Kaynak: WEF, 2003 THE GLOBAL COMPETITIVENESS REPORT Business Competitiveness Index Factor (Input) Conditions Company Operations & Strategy Demand Conditions Related and Supporting Industries Context for Firm Strategy and Rivalry Kaynak: WEF, 2003 Business Competitiveness Rank Kaynak: WEF, 2003 Türkiye (65,52) Growth Competitiveness Business Competitiveness index (2001) Kaynak: WEF, 2003 National Innovation Capacity Index (2001) GDP Per Capita (2001) (PPP) Kaynak: WEF, 2003 National Innovation Capacity Index (2001)