* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Financial Crisis in Korea

Survey

Document related concepts

Nouriel Roubini wikipedia , lookup

Pensions crisis wikipedia , lookup

Monetary policy wikipedia , lookup

Exchange rate wikipedia , lookup

Balance of payments wikipedia , lookup

Foreign-exchange reserves wikipedia , lookup

Fear of floating wikipedia , lookup

Globalization and Its Discontents wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

Early 1980s recession wikipedia , lookup

Great Recession in Russia wikipedia , lookup

Global financial system wikipedia , lookup

Transcript

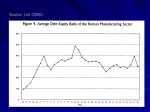

Sun Ho Choi, Soon Sam Kang Ki Seok Yang, Sang Jun Yeo Overview • • • • Introduction Causes of the Crisis Policy Response Policy Lessons I. Introduction • Background (Until 1997) – After Korean war, Economic growth like miracle after 1960’s. – Korea’s Growth rate surpassed 7% – Inflation remained at moderate levels – Domestic saving increasingly financed the rapidly rising investment rate II. Effects of the Crisis • • • • • Recession and terms of trade deterioration Corporate Bankruptcy Banking Crisis Contagion from foreign currency crises Currency crisis II. Effects of the Crisis Recession and terms of trade deterioration GDP Q. Deterioration? A. The structure of Korean Economy Problem Inventories up, Demand down Cause production cost 8.0 4.8 1994 1995 1996 II. Effects of the Crisis Major Economic Indicators in Korea around 1997 1993 1994 1995 1996 1997 1998 GDP growth rate 1) (%) 5.7 8.4 8.2 4.8 2.4 -7.1 CPI (rate of change, %) 4.8 6.3 4.5 4.9 4.4 7.5 Current account (bill. US$) 1.0 -3.9 -8.5 -23.0 -8.2 40.3 Unemployment rate (%) 2.9 2.5 2.1 2.0 2.6 7.0 Budget balance/GDP 2)(%) 0.08 0.53 0.45 0.03 -0.02 -2.97 II. Effects of the Crisis Corporate Bankruptcy • the chaebols (Korean big business groups) went bankrupt. • The portion of non-performing loans In total loans of banks rose from 4.1 percent at the end of 1996 to 6.0 percent at the end of 1997. II. Effects of the Crisis Banking Crisis • Under these circumstances, • the Thailand Baht suddenly plummeted on July, 1997 • signaling the beginning of currency crises in South East Asian countries. => No longer loan from abroad II. Effects of the Crisis Currency crisis •The nation's stock of foreign reserves was rapidly depleted •Financial institutions failed to recover credit-worthiness. In consequence, •the Korean government asked the International Monetary Fund for emergency credits. (IMF) II. Effects of the Crisis Check Point Korean Economy in 1997 •Overinvestment Excessive competition, Expand Area. More and more, low profit •Maturity Mismatches => No choice, firms rely on short term foreign debt. •Lack of Disciplines => Rapidly change but over control II. Effects of the Crisis • External shocks were weaker, but their effects were much stronger External •Unstable international international oil prices •Turmoil in the international financial market •World-wide economic economic recession Internal •Bad harvest •Political and social unrest III. Policy Response • Methods molded after general IMF crisis resolution (Stand-by Agreement) – Macroeconomic stabilization policy: Restructuring policy – Microeconomic Structural adjustment Policy: Structural Adjustment Policy by two stages III. Policy Response Macroeconomic stabilization • Goals – Restriction of domestic demand and expenditureswitching – Preventing capital inflows – Correct the balance of payment deficits • Exchange rates were allowed to depreciate freely and reflect market forces fully • Money market rates were raised sharply to control the inflationary impact of won depreciation III. Policy Response Microeconomic Structural Adjustment • Goal – Resolve structural problems in each market – Establish the institutional Setting for a well Functioning market mechanism • Two stages – First: Establishing basic institutions needed for smooth operation of a market economic system – Second: Improving the management and governance of firms and banks through their initiatives III. Policy Response First, Institution • three existing financial supervisory agencies into one agency ① The Financial Supervision Commission ② Expanded the function of Korea Deposit Insurance Corporation (KDIC). ③ Establishing Korea Asset Management Corporation (KAMCO) to dispose of non-performing loans. III. Policy Response • Amended Bankruptcy law provisions • Eased M&A restrictions • Strengthened disclosure requirements for accounting information • Introduced measures to improve corporate governance • Provided better monitoring and supervision of corporate or bank managers • Devised measures to restrain over-borrowing by firms • Government forced extremely troubled banks to exit the market • Used public funds to buy non-performing loans • Allowed main creditor banks lead the debt workout programs resolved delinquent firms III. Policy Response Second, Improving management and governance • Includes efforts to correct problems in the financial, enterprise, labor, and public service sectors. • Addresses issues of regulating the undesirable behavior of economic agents, like moral hazards. – Adopting the global accounting standards – Strengthening the rule of law IV. Policy Lesson 1) Problems intrinsic to the economic system should be cured fundamentally to prevent recurrence 2) Fixed or managed fixed exchange rates can be dangerous 3) Strengthen financial systems against external financial shocks 4) Deliberate approach on financial liberalization 5) Proper post-crisis resolution policies by a competent government is important