* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Detailed SUCRA Brochure

Microsoft Access wikipedia , lookup

Oracle Database wikipedia , lookup

Entity–attribute–value model wikipedia , lookup

Extensible Storage Engine wikipedia , lookup

Microsoft SQL Server wikipedia , lookup

Open Database Connectivity wikipedia , lookup

Concurrency control wikipedia , lookup

Microsoft Jet Database Engine wikipedia , lookup

Relational model wikipedia , lookup

ContactPoint wikipedia , lookup

SUCRA

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

System for Universal Compliance Reporting & Analytics for HR and Payroll

Copyright © 2015 Deji Akadiri

All Rights Reserved.

SUCRA ENABLES

COMPANIES OF ALL SIZES

TO AUDIT THEIR HR AND

PAYROLL DATA AND

TRANSACTIONS, ENFORCE

COMPANY BUSINESS

RULES AND REGULATORY

COMPLIANCE, AND

GENERATE EXCEPTION

REPORTS, REGARDLESS OF

PAYROLL/HR VENDOR OR

DATABASE REPOSITORY.

Our Patent-pending Data-Mapping technology works with any

HR or Payroll system with a relational database back-end. An

intuitive GUI interface makes SUCRA easy to use, even for

non-technical users.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 1

THE CHALLENGE

Companies in every region of the globe, ranging from small companies with less than 10 employees, to

mega-corporations with hundreds of thousands of employees, almost all use the following software

packages:

o

o

o

o

Office Productivity (email, word processing, spreadsheets, web browsers)

HR/Payroll systems

ERP/CRM (Enterprise Resource Planning, Customer Relationship Management)

Accounting Packages

THE HR/PAYROLL SYSTEM

If we look at HR/Payroll systems, the most common challenges involve keeping track of who your

employees are, how and when they are being paid, and how your processes comply with company

business rules and policies, as well as the growing number of external regulatory and legal imperatives.

Addressing these challenges requires an end-to-end understanding of the components that make up

your HR/Payroll environment.

You need to be intimately familiar with your HR/Payroll provider’s data structures, database schema and

business entities, and the relationships between these entities, including Employees, Salaries, Banks,

tables, columns, views, primary keys and foreign keys, to name just a few.

THE DATABASE MANAGEMENT SYSTEM

In addition to the details of your HR/Payroll vendor’s technical details, you will also need to have the

technical skills and knowledge to query the particular brand of proprietary database engine

underpinning your HR/Payroll system. Typically, this would be Oracle, Microsoft SQL Server, IBM DB2,

SQLite, or other Relational Database Management System.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 2

You will need to be familiar with the syntax and conventions of your database vendor’s dialect of the

SQL query language.

THE RULES

Finally, you will need to define, develop and maintain a set of business rules, data validation criteria, and

compliance checks. Your HR/Payroll data must be regularly tested for compliance against these business

rules, and exception reports must be produced.

CURRENT STATE OF THE INDUSTRY

Given the proliferation of HR/Payroll vendors in the market, combined with the wide range of available

Database Management Systems, it is clear that developing a generic or universal solution to the problem

of HR/Payroll Compliance Reporting is extremely challenging. In fact, to date, no such Universal Solution

exists. Most companies either ignore or de-prioritize the need for regular compliance reporting, or they

expend valuable resources and time trying to invent and build their own in-house solutions.

The absence of a structured and repeatable packaged process for HR/Payroll data Compliance

Management and Reporting leaves companies vulnerable to Payroll fraud, “ghost” employees, and

invalid or corrupt corporate data.

This threat is not hypothetical. It is very real, and costs companies billions of dollars annually.

The 2013 Annual Fraud Indicator report by the UK Government’s National Fraud Authority (NFA)

concludes that in the UK Public Sector alone, Payroll Fraud amounts to £ 335 MILLION annually.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 3

Other regions are equally vulnerable to fraud.

According to a PwC Middle East Economic Crime

Survey published in 2014, the following trends

can be seen for HR/Payroll fraud in the Middle

East Region.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 4

Discovering and addressing HR/Payroll fraud is notoriously difficult, as fraudsters devise new methods

and strategies to steal from companies by data manipulation. Companies must remain vigilant, flexible

and intelligent in their efforts to combat fraud and non-compliance.

A 2011 Report by Ernst & Young proposes the following roadmap for implementing an internal

Compliance and Auditing process:

This roadmap illustrates the processes and phases that must be included as part of the company’s

internal data compliance, analytics and auditing exercise. Without the adoption of intelligent tools and

automation, most companies would be overwhelmed by these requirements and would lack the

resources required to perform these tasks on a continuous basis.

SUCRA helps companies to encapsulate, implement and automate the process map shown above.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 5

THE SOLUTION

To address the absence of a structured and repeatable packaged process for HR/Payroll data

Compliance Management and Reporting, we developed SUCRA.

As described in the previous sections, the main obstacles that have historically prevented the

development of a Universal Solution are as follows:

DIFFERENT HR/PAYROLL SYSTEMS

Each HR/Payroll vendor has their own proprietary data structures, logical schema and business entities.

There is no industry standard for Employees, Salaries, Banks, tables, columns, views, relationships, etc.

DIFFERENT DATABASE MANAGEMENT SYSTEMS

Each HR/Payroll system sits on top of a back-end data repository, which is usually a database vendor’s

proprietary database engine. This is usually Oracle, Microsoft SQL Server, IBM DB2, SQLite, or other

relational database management system. Each of these products offers their own ‘flavor’ or

implementation of the SQL database language. Syntax, conventions and extensions are often

incompatible with other vendors’ database offerings.

COMPLIANCE RULES IMPLEMENTATION

An expanding and evolving collection of Company Business Rules and Policies, and external Regulatory

and Legal Compliance imperatives must be defined, tested and maintained. There is no universally

recognized industry-standard for describing and defining these Business Rules.

SUCRA HR/PAYROLL VENDOR INDEPENDENCE

SUCRA addresses these obstacles with a patent-pending integrated solution that enables HR/Payroll –

independent Business Rules and Database – Independent Queries and Reports.

SUCRA does not reference the HR/Payroll vendor’s physical data entities directly. Instead, SUCRA

Business Rules reference high-level, abstract universal logical entity aliases such as

{EMPLOYEE_BIRTHDATE}, {CHEQUE_NUMBER}, or {EMPLOYEE_NUMBER}.

SUCRA: HR/Payroll Data Compliance and Analytics

Page 6

These aliases represent universal business entities which are present in all HR/Payroll systems,

regardless of vendor data structure, schema, or SQL syntax.

The SUCRA user does not need to know that the SUCRA expression {EMPLOYEE_BIRTHDATE} actually

refers to their HR system’s DATE_OF_BIRTH column, in the PERSONS table, in the dbo schema in the

SQL Server HRMS database, otherwise known as dbo.PERSONS.DATE_OF_BIRTH.

This abstraction of SUCRA Logical data entity aliases, masking and hiding the underlying HR/Payroll

physical database entities, allows the development of truly generic, universal queries and Business

Rules, without the need for intimate knowledge of the specific HR/Payroll platform, schema or language.

We refer to this as Platform – Independent Business Rules and Reporting. Using an intuitive Graphical

User Interface, SUCRA enables the user to map the logical business entities to the associated back-end

database tables and columns. See Figure 1.

Figure 1. Logical Business Entity mapping

SUCRA DATABASE VENDOR INDEPENDENCE

SUCRA addresses the problem of database incompatibility by adopting Database Federation technology.

SUCRA’s federated database treats all HR/Payroll database tables and columns as if they were simply

extensions of the SUCRA database. The heterogeneous HR/Payroll database environment is

transformed into a homogeneous single-database environment.

This means that all HR/Payroll database tables and columns are accessible to SUCRA, seamlessly and

transparently. A single SQL syntax can be used to query all HR/Payroll data, regardless of the database

SUCRA: HR/Payroll Data Compliance and Analytics

Page 7

vendor. The EMPLOYEE table in the Oracle HR database and the PAYMENTS table in an IBM DB2 Payroll

database are viewed simply as tables belonging to SUCRA’s federated database.

SUCRA BUSINESS RULE DEFINITIONS

SUCRA is bundled with over 30 pre-defined Business Rules. These ready-to-run queries include:

o

o

o

o

o

Employees that are present in the Payroll system, but are absent from the HR system

Payroll deposits that exceed $10,000 (or any user-defined figure and currency)

Employees that continue to be paid after retirement or dismissal

Employees that are paid more than 40% above the median salary for their job grade

Payroll deposits to Employees with no valid residential address or National ID number

Each Business Rule is expressed in a language we call SUCRA SQL. SUCRA SQL is an extension of

standard (ANSI) SQL. The syntax is the same as ANSI SQL, but instead of referencing physical database

Tables and Columns, SUCRA SQL references logical universal data entity aliases, such as

{EMPLOYEE_SURNAME} or {PAYROLL_DEPOSIT_DATE}.

At Report run-time, these SUCRA logical entity aliases are substituted with the actual physical database

entity, such as dbo.EMPLOYEES.SURNAME.

Users can also easily create their own Business Rules, according to their company’s requirements, with

criteria based on any data contained in their HR and Payroll databases.

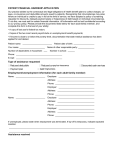

The SUCRA Business Rules List form is shown in Figure 2.

Figure 2. Business Rules List

SUCRA: HR/Payroll Data Compliance and Analytics

Page 8

SUCRA REPORTING

SUCRA exception reports are generated as Microsoft Excel spreadsheets, which allow users to sort,

filter, format and analyse the data as they require. The report spreadsheets are secured from viewing or

editing by password-protection. Reports can also be produced in the format of a Company-Specific

Payroll Registry.

SUCRA exception reports can be produced on an ad-hoc or batch basis. The user can test and report a

single Business Rule, or run a report that tests and reports all Business Rules, with the results being

displayed as a single report.

Sample report outputs are shown in Figures 3, Figure 4 and Figure 5.

Figure 3. Exception Report Summary Page

SUCRA: HR/Payroll Data Compliance and Analytics

Page 9

Figure 4. Exception Report Detail. Employees with Non-residential Address

SUCRA: HR/Payroll Data Compliance and Analytics

Page 10

Figure 5. Exception Report Detail. Employee Salary distribution broken down by Job Grade

SUCRA: HR/Payroll Data Compliance and Analytics

Page 11