* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Demand Curve AP Microeconomics II. Nature and Function of

Survey

Document related concepts

Transcript

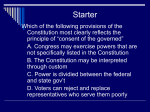

Demand Curve AP Microeconomics II. Nature and Function of Product Markets A. Supply and Demand 4. Elasticity Substitution Effect. Change in the price of a good is the change in the quantity of that good demanded as the consumer substitutes the good that has become relatively more expensive. Substitution effect of a lower price creates an increase in QD. Income Effect. Change in the price of a good is the change in the quantity of that good demanded that results from a change in the consumer's purchasing power when the price of the good changes. Combining substitution and income effects, lower prices create increased QD, thus explaining the law of demand. Note on inferior and normal goods. If the good is an inferior good then a lower price creates an income effect to purchase less of such a good. In order for demand curves to be downward sloping, the substitution effect must dominate the income effect for inferior goods. Law of demand states that consumers will respond to a decrease in price by buying more of a product (other things remaining constant), but it does not tell us how much more. That's where elasticity comes in. Price elasticity of demand. Ratio of the percent change in QD to percent change in P as we move along demand curve. Sensitivity of consumers to a change in price is measured by price elasticity of demand. The terms elastic or inelastic describe the degree of responsiveness. 1. If consumers are relatively responsive to price changes, demand is said to be elastic. 2. If consumers are relatively unresponsive to price changes, demand is said to be inelastic. 3. With both elastic and inelastic demand consumers behave according to the law of demand-they are responsive to price changes. Elastic: ED > 1 Inelastic: ED < 1 Unit elastic: ED = 1 Calculating the Price Elasticity of Demand: ED = %ΔQD/%ΔP Example. P of digital cameras increases by 1% and QD decreases by 2%. ED = -2%/1% = -2 ED = 2 Ignore negative sign because downward sloping demand curves will insure a negative price elasticity, what’s important is the magnitude of that elasticity. For the digital camera, the % decrease in QD (the effect) was twice as large as the % increase in P (the cause). Consumers have exhibited an elastic response to a higher price. 1 Demand Curve AP Microeconomics Example. P of milk increases by 10% and QD decreases by 5%. ED = -5%/10% ED = - 1⁄2 OR 0.50 For the milk, the % decrease in QD (the effect) was only half the size as the % increase in P (the cause). Consumers have exhibited an inelastic response to a higher price. % change equation--NOOO! (new number - old number/old number) %ΔP = 100*(New Price – Old Price)/Old Price %ΔQD = 100*(New Quantity – Old Quantity)/Old Quantity Example. The price of a doughnut rises from $1.00 to $1.15 and Shane reduces his weekly doughnut consumption from 20 to 19. %ΔP = 100*(New Price – Old Price)/Old Price %ΔP = 100*(1.15 – 1)/1 = 15% increase %ΔQD = 100*(New Quantity – Old Quantity)/Old Quantity %ΔQD = 100*(19 – 20)/20 = 5% decrease Shane's ED for doughnuts is 5%/15% = 1/3 OR 0.33. Midpoint Method. Elasticity computations change if the new and old prices (or quantities) are reversed. Example. If a variable goes from a value of 100 to a value of 110, it is a 10% increase. If the variable were to go from a value of 110 to a value of 100, it is a 9.1% decrease. Because of this, the value of the price elasticity will change, depending upon whether the price is increasing or decreasing. In order to account for this, economists sometimes use the average price and average quantity between two points on a demand curve. %ΔP = 100*(New Price – Old Price)/Average Price %ΔQD = 100*(New Quantity – Old Quantity)/Average Quantity Example. Tuition at UF increases from $20,000 to $24,000 per year. UF discovers that the entering class of first-year students declined from 500 to 450. %ΔP = 100*(New Price – Old Price)/Average Price %ΔP = 100*($4000)/$21,000 = 19% %ΔQD = 100*(New Quantity – Old Quantity)/Average Quantity %ΔQD = 100*(-50)/475 %ΔQD = - 10.5% ED = 19%/10.5% = 1.8 Tuition at UF is elastic response between these two points on the demand curve. 2 Demand Curve AP Microeconomics Perfectly Inelastic and Perfectly Elastic Demand Example. ED is equal to 0.25. ED = %ΔQD/%ΔP = 0.25. Assume P increases by 1%. Since, ED = %ΔQD/1% = 0.25, it can be predicted that QD will decrease by only 0.25%, which is a small response. The smallest response to a price increase is no response at all. If P increased 1%, and there was no change to QD, %ΔQD = 0 so ED = 0. As a matter of algebra, D is vertical, or perfectly inelastic. Consumers have no response to higher or lower prices. Example. ED = 10. ED = %ΔQD/%ΔP = 10. Assume P increases by 1%. Since, ED = %ΔQD/1% = 10, it can be predicted that QD will decrease by a 10%, which is a big response. The largest response to a price increase would be that consumers immediately decrease consumption to zero. The largest response to a price decrease would be that consumers immediately increase consumption to 3 Demand Curve AP Microeconomics an infinitely large amount. If P increased 1%, and there was an enormous change to QD, %ΔQD = ∞ so ED = ∞. As a matter of algebra, D is horizontal, or perfectly elastic. Consumers have an infinitely large response to higher or lower prices. Quick read of elasticity graphs: If D is closer to vertical (steeper), it will tend to be less elastic than D that is closer to horizontal (flatter). Total Revenue and Elasticity. When a firm sells products to consumers, the firm earns revenue. Total revenue (TR) earned by a firm is equal to P of product multiplied by Q sold at P. TR = (P)(QD) Assume that a firm wants to increase TR by increasing P. QD will decrease. Increasing P and decreasing QD both influence TR, but in opposite directions. It ultimately depends upon which effect, higher P or lower Q, is stronger--price effect or quantity effect. Price effect. After an increase in P, each unit sold sells at a higher price, which tends to increase revenue. Quantity effect. After an increase in P, fewer units are sold, which tends to lower revenue. Example. P increases 1%, QD decreases 5%, elastic. TR will decrease, because downward quantity effect is stronger than upward price effect. Example. P increases 10%, QD decreases 5%, inelastic. TR will increase, because downward quantity effect is weaker than upward price effect. Example. P increases 10%, QD decreases 10%, unit elastic (ED = 1). TR will not change, because downward quantity effect is equal to upward price effect. 4 Demand Curve AP Microeconomics Example. Initial price of pizza slices is equal to $2 and 50 slices are sold every day. This is point A on D. TR = (P)(QD) = ($2)(50) = $100 This is the area marked TR on the graph, the rectangle below D. Pizzeria wishes to increase P of a slice to $3 and estimates that 40 slices will be sold each day. This is point B on D. TR = (P)(QD) = ($3)(40) = $120 The $20 gain can be seen through both P and Q effects. Area L is revenue lost due to decreased Q. Ten slices were lost, at $2 each, so area L represents $20 of lost revenue. Area G is revenue gained due to increased P. Forty slices were sold, at a price $1 higher than before, so area G represents $40 of gained revenue. Area G – Area L = $40 - $20 = $20, which is the total increase from the higher price. If upward price effect is stronger than downward quantity effect, demand must be inelastic. If upward price effect is weaker than downward quantity effect, demand must be elastic. 5 Demand Curve AP Microeconomics Elasticity Along Demand Curve As P increases, initially TR increases because of inelastic response in QD. However, further price increases eventually cause TR to decrease because of a larger elastic response. Along the same D curve, ED is inelastic at low prices and grows more elastic at higher prices. Factors Determining ED 1. Substitutes for the product. More substitutes, more elastic the demand. If a product has many substitutes, and P increases, consumers will have an elastic response because they can easily find alternatives. 2. Luxury or a necessity. Less necessary the item, more elastic the demand. n the case of a luxury, if P increases, consumers will not buy the product and have an elastic response. 3. Percentage of income spent on good. Larger the expenditure relative to a budget, more elastic the demand, because buyers notice the change in price more. 4. Amount of time. Longer the time period involved, more elastic the demand becomes. 6 Demand Curve AP Microeconomics Cross-Price Elasticity of Demand. Between two goods, this measures the effect of change in one good's P on the QD of other good. It is equal to percent change in QD of one good divided by percent change in other good's P. Another way, the effect of a change in a product's P on QD for another product. In other words, complements and substitutes. Exy = (%ΔQD of product X)/(%ΔP of product Y) Substitutes --> cross-elasticity is positive. P of Nikes increase by 2% and QD for Converse increases by 4%. Exy = 4%/2% = 2. Nikes and Converse are substitutes. Complements --> cross-elasticity is negative. P of gas increases 20% and QD for large SUVs decreases by 5%. Exy = -5%/20% = -0.25. Gas and SUVs are complements. Unrelated --> cross-elasticity is zero. P of Cinnamon Toast Crunch increases. Hollister tshirts are unaffected. Income Elasticity of Demand. Percent change in QD of good when a consumer's income changes divided by the percent change in consumer's income. In other words, normal and inferior goods. EI = (%ΔQD of good X)/(%ΔI) Normal good --> income elasticity is positive. American consumer income decreases by 2% and quantity of flights to Europe declines by 8%. EI = 8%/2% = 4. Normal good. Incomeelastic response. Luxury. o Consumer income rises by 4% and quantity of fresh vegetables purchased increases by 1%. EI = 1%/4% = 0.25. Normal good. Income-inelastic response. Necessity. Inferior good --> income elasticity is negative. Consumer income decreases by 5% and consumers increase consumption of Blech, a meat substitute, by 4%. EI = 4%/-5% = -0.80. Inferior good. o For inferior goods, there is no distinction between luxuries and necessities. Income-elastic. Demand for good is income-elastic if EI for that good is greater than 1. Income-inelastic. Demand for good is income-inelastic if EI for that good positive but less than 1. Price Elasticity of Supply. Measure of the responsiveness of the QS of a good to P of that good. It is the ratio of the percent change in QS to percent change in price as it moves along the S curve. ES = %ΔQS/%ΔP Elastic: ES > 1 Inelastic: ES < 1 Unit elastic: ES = 1 7 Demand Curve AP Microeconomics Perfectly Inelastic and Elastic Supply. Same analysis as in elasticity of demand. This graph shows an upward sloping supply curve, a perfectly elastic supply curve, and a perfectly inelastic supply curve. A vertical S curve like S3 implies that even at the highest of prices, there is something that prevents firms from increasing QS. (e.g., technological problem or seasonal issue). A horizontal S curve like S2 implies that even smallest increase in P would dramatically increase QS. A small decrease in P would decrease Qs to zero. Factors Determining ES 1. Availability of inputs. If a firm can get inputs (labor, capital, raw materials) into and out of production quickly, ES will be more elastic. 2. Time period Market period. Market period is so short that ES is inelastic, possibly perfectly inelastic. Short-run ES is more elastic than market period and will depend on ability of producers to respond to P changes as to how elastic it is. Long-run ES is most elastic, because more adjustments can be made over time and Q can be changed more relative to a small change in P (e.g., agriculture). Example. July 2010, and P of soybeans is increasing. Farmers would love to supply more soybeans at a higher price, but soybean crops have already been planted. QS of soybeans at harvest 2010 was basically determined months previously during the spring planting season. The immediate soybean S curve is very inelastic or nearly vertical and farmers are incapable of responding to higher But, if high P continue in early 2011, farmers will plant more acres of soybeans next year and will supply more soybeans. Increase in QS is greater as more time passes and farmers are able to respond. 8 Demand Curve AP Microeconomics 5. Consumer surplus, producer surplus, and market efficiency. Consumer surplus. Net gain to an individual buyer from the purchase of a good. It is equal to the difference between the buyer's willingness to pay and the price paid. Total consumer surplus is sum of the individual consumer surpluses of all the buyers of a good in a market. Willingness to pay. Consumer's willingness to pay for a good is the maximum price at which he or would buy that good. Total CS generated by purchase of a good at a given P equals the area below the D curve but above P. Example. Demand curve for a product is given by the equation P = -2QD + 40. Current price for the product is $20. The formula for CS is the formula for the area of a triangle. CS = (1/2)bh CS = (1/2)(20)(10) CS = $100. If P is lowered, this would expand CS, and make a bigger triangle. If P is raised, this would contract CS, and make a smaller triangle. On past AP Micro exams, some problems regarding CS have been based on calculating individual CS. To do this, you simply do basic arithmetic for each individual above price. In the graph here, $29 + $15 + $5 = $59 for total CS. Darren and Edwina are not included because they are unwilling to pay the price of $30. 9 Demand Curve AP Microeconomics Other AP problem that typically shows up will ask about the difference between one CS vs. another after a price change. Or what the gain or loss in CS would be if it changed. To solve these problems, use basic geometry after identifying the change in CS. Producer Surplus. Net gain to an individual seller from selling a good. It is equal to the difference between the price received and the seller's cost. Total producer surplus in a market is the sum of the individual producer surpluses of all the sellers of a good in a market. Cost. Seller's cost is the lowest P at which he is willing to sell a good. Total PS generated from sales of a good at a given P equals the area above S curve but below P. Example. Supply curve for a particular product is P = 2QS. If current price equals $60, what is the PS? PS can be found by the area of the triangle. PS = (1/2)bh PS = (1/2)(60)(30) PS = $900 If P is lowered, this would contract PS, and make a smaller triangle. If P is raised, this would expand PS, and make a larger triangle. 10 Demand Curve AP Microeconomics On past AP Micro exams, some problems regarding PS have been based on calculating individual PS. To do this, you simply do basic arithmetic for each individual above price. In the graph here, $25 + $15 + $5 = $45 for total PS. Donna and Engelbert are not included because they are unwilling to supply the good at at P of $30. Gains from trade. Any time a consumer makes a purchase from a producer, a trade has been made and both parties expect to gain. These gains are the concepts of CS and PS. Economists state that markets provide the most efficient outcome. A market is efficient if, once the market has produced its gains from trade, there is no way to make some people better off without making other people worse off. Efficient markets perform four functions: 1. It allocates consumption of good to potential buyers who most value it, indicated by fact that they have highest willingness to pay. 2. It allocates sales to potential sellers who most value right to sell good, indicated by fact that they have lowest cost. 3. It ensures that every consumer who makes a purchase values good more than every seller who makes a sale, so that all transactions are mutually beneficial. 4. It ensures that every potential buyer who doesn’t make a purchase values the good less than every potential seller who doesn’t make a sale, so that no mutually beneficial transactions are missed. AP Note. Efficiency is just one outcome. Not all markets are efficient, and not all market outcomes are fair. AP Micro test will give scenarios where solution is not necessarily fair. 6. Tax Incidence and Deadweight Loss Types of taxes Progressive tax. A tax that rises more than in proportion to income, so that high-income taxpayers pay a larger percentage of their income than low-income taxpayers. Regressive tax. A tax that rises less than in proportion to income, so that high-income taxpayers pay a smaller percentage of their income than low-income taxpayers. Proportional tax. A taxes that rises in proportion to income, so that all taxpayers pay the same percentage of their income. 11 Demand Curve AP Microeconomics 12 Demand Curve AP Microeconomics Taxes and Total Surplus. Excise taxes are taxes levied on each unit of gold sold. In the U.S., and on the AP exam, typically the examples are gasoline, tobacco, alcohol and hotel rooms. Example. Suppose the market for gasoline in Orlando is free of any taxes. PE is $2 per gallon, and 1 million gallons are sold every day. CS = (1/2)($3)(1 million) = $1.5 million PS = (1/2)($2)(1 million) = $1 million TS = $2.5 million Now, politicians in Orlando decide to impose on gasoline sellers a $1 tax on every gallon of gasoline sold. For sellers, this means that to continue to sell 1 million gallons per day, they must receive $3 per gallon because $1 must be sent to the government. In other words, S curve shifts upward by $1, the amount of the tax. After the tax, only 0.8 million (or 800,000) gallons of gasoline are exchanged and the price paid by consumers at the pump has risen to $2.60. The price sellers actually receive is equal to $2.60 - $1.00 = $1.60 because they send $1 to the government for every gallon that they sell. The tax creates a wedge between P buyers pay ($2.60) and P sellers actually receive ($1.60). Who is really paying the tax? Consumers see a price that is $.60 higher than before. Sellers receive, after tax, a price that is $.40 lower than before. We can determine that consumers are paying $.60 of a $1 tax (60%) and sellers are paying $.40 (40%) of the $1 tax. As such, the tax incidence falls on the consumers. Tax incidence is the distribution of the tax burden. Now, politicians in Orlando decide to impose the $1 tax on gasoline buyers, rather than sellers. Buyers must pay $1 to government for every gallon of gasoline that they purchase. This would lower consumer willingness to pay by $1 for each gallon purchased, which serves to shift D curve downward by the amount of the tax. 13 Demand Curve AP Microeconomics After the tax, 800,000 gallons are exchanged. Sellers receive $1.60 for each gallon of gasoline sold, and buyers pay a total of $1.60 + $1 = $2.60 for each gallon purchased. Tax has created a wedge between P received by sellers and P paid by buyers. Who is really paying the tax? Buyers are still paying 60% and sellers are still paying 40% of a $1 tax. Tax incidence falls on the consumers. Note: This result in both taxes is due to elasticity of demand and supply here. Price Elasticities and Tax Incidence. Tax incidence really depends upon the shape of D and S curves. This shape, steep vs. flat, depends upon ED and ES. Excise Tax Paid Mainly by Consumers. If tax of $T is imposed on the sellers, S curve will shift upward by $T and the new price P2 is the entire amount of $T higher than the original price P1. If D curve is relatively inelastic and the supply curve is relatively elastic, consumers will pay larger share of excise tax. In the second graph here, the steep D curve has a low ED for gasoline. The flat S curve has a high ES. Pre-tax price of a gallon of gas is $2.00, and a tax of $1.00 per gallon is imposed. Price paid by consumers increases by $0.95 to $2.95. Tax incidence falls on consumers. Only a small portion of the tax is paid by the producers. 14 Demand Curve AP Microeconomics Excise Tax Paid Mainly by Producers. P increases slightly to P2. Sellers must then pay $T of tax so the after-tax price sellers receive is nearly $T lower than the original price P1. If D curve is relatively elastic and S curve is relatively inelastic, sellers will pay larger share of the excise tax. In this graph, the relatively flat D curve has a high ED, and the relatively steep S curve has a low ES. Pre-tax price is $6 and a tax of $5 is imposed. P received by producers falls to $1.50. Producers have tax incidence. Price paid by consumers increases a small amount, but they have little of the burden. Tax Revenue. After the gasoline tax in Orlando, buyers are paying higher prices and sellers are receiving lower prices, for the gasoline they exchange. However, Orlando city government is collecting TR. This can be figured out by finding the area of the rectangle created by the wedge. TR = (#gallons sold)(tax) TR = (800,000)($1) TR = $800,000 This graph just gives you a general idea of where TR is in a graph. Finding the area of the rectangle will give you the TR created by the excise tax. It's the wedge. 15 Demand Curve AP Microeconomics Costs of Taxation. Notice in this graph that the excise tax creates a loss in both CS and PS. You can calculate the individual losses in CS and PS by the area of the rectangles and triangles. Triangles B and F represent deadweight loss. Deadweight loss is the decrease in total surplus resulting from the tax, minus the tax revenues generated. Example. From the example above, TS was CS = (1/2)($3)(1 million) = $1.5 million PS = (1/2)($2)(1 million) = $1 million TS = $2.5 million After the $1 tax was imposed, consumers are now paying $2.60 for only 800,000 gallons of gasoline. New CS = (1⁄2)($2.40)(800,000) = $960,000 Sellers are now receiving $1.60 for those 800,000 gallons. New PS = (1⁄2)($1.60)(800,000) = $640,000 Now, add the area of government TR, $800,000. CS + PS + Revenue = $2.4 million. Um, what happened to the other $100,000? This is the DWL, labeled in the graph. It exists because there are 200,000 gallons of gasoline that go unsold because tax moved the after-tax quantity away from the market equilibrium quantity. For example, there is a consumer out there who is willing to pay $2.50 for a gallon of gas, but no seller can afford to offer that gallon for sale. This is a transaction that goes unmade and thus efficiency is lost. If the tax had NOT reduced the quantity of gasoline exchanged, there would have been no DWL. B. Theory of Consumer Choice Utility and Consumption. Assumption: Individuals try to maximize some personal measure of satisfaction gained from consumption. • Utility. Measure of satisfaction. • Utils. Unit of utility. • Utility function. Shows relationship between consumer’s utility and combination of goods and services (consumption bundle) he consumes. 16 Demand Curve AP Microeconomics Example. Cassie likes to eat clams at an all-you-can-eat buffet. Her utility function slopes upward, but gets flatter as the number of clams increases, eventually turning downward because of diminishing marginal utility. Adding each additional clam makes Cassie worse off—it lowers her total utility. Acting rationally, Cassie will stop at 8. To make this decision, she must consider the change in her total utility from consuming one more clam. 17 Demand Curve AP Microeconomics Key point: To maximize total utility, consumers most focus on marginal utility. Marginal utility. Change in total utility generated by consuming one additional unit of a good or service. Marginal utility curve. Shows how marginal utility depends on quantity of a good or service consumed. Looking at the table, marginal utility per clam changes with the consumption of each additional clam. According to this table, Cassie should stop consuming clams at 8. With each clam consumed, her marginal utility decreases more and more. After her 8th clam, she actually sees a negative marginal utility in clam consumption. The marginal utility schedule can be graphed as the marginal utility curve. The curve slopes downward because each clam decreases the total utility than the previous one. Consumption of most goods and services is subject to diminishing marginal utility. Principle of Diminishing Marginal Utility. The additional satisfaction a consumer gets from one more unit of a good or service declines as the amount of that good or service consumed rises. Optimal Consumption. It costs some additional resources to consume more of a good, and consumers must take that cost into account when making choices. The fundamental measure of cost is opportunity cost. Because the amount of money a consumer can spend is limited, a decision to consume more of one good is also a decision to consume less of another good. Example. Sammy likes both clams and potatoes. Whatever he chooses, the cost of his consumption bundle can not exceed the amount of money he has to spend. Budget constraint. Limits cost of a consumer’s consumption bundle to no more than the consumer’s income. Expenditure on clams + Expenditure on potatoes ≤ Total Income Consumption possibilities. Set of all consumption bundles that affordable given the consumer’s income and prevailing prices. Possibilities depend on consumer’s income and prices of g/s. 18 Demand Curve AP Microeconomics Budget line. Shows consumption bundles available to a consumer who spends all of his income. We assume that consumption bundles are made along the budget line so long as his marginal utility from consuming either good is still positive. Note. Analyze this in the same way you would analyze a PPC. Optimal Consumption Bundle. Consumption bundle that maximizes consumer’s total utility given his budget constraint. Examining the first table here, there are 6 possible combinations. The more of either good he consumes, the higher Sammy’s utility. However, Sammy’s got a limited budget, so he’s got to make a trade off between clam and potato consumption. Notice that the utils are inverse for clams and potatoes. This is due to the opportunity cost--the budget constraints force Sammy to make a choice. At bundle C, we see total utility maximized. 19 Demand Curve AP Microeconomics Graphing out the budget line and utility function together, we see that the more clams Sammy consumes, the less potatoes, and vice versa. It's an inverse relationship. C is the optimal consumption bundle because this is where total utility is maximized given Sammy's budget. Marginal Utility per Dollar. Dollar spent on a g/s is the additional utility from spending one more dollar on that g/s. This is how to allocate an additional dollar between g/s in a way that maximizes utility. 20 Demand Curve AP Microeconomics Marginal utility per dollar for each good is found by dividing the marginal utility of the good by its price in dollars. Marginal utility of clams is decreasing because of diminishing marginal returns. MU per dollar = MUgood/Pgood This graph sets out the two tables on marginal utility per dollar above. Notice that the two curves, MUc/Pc and MUp/Pp intersect at the optimal consumption bundle, point C, consisting of 2 pounds of clams and 6 pounds of potatoes. When Sammy consumes 2 pounds of clams and 6 pounds of potatoes, his marginal utility per dollar spent is the same for both goods: 2. At the optimal consumption bundle, MUc/Pc = MUp/Pp = 2. Now, assume Sammy’s marginal utility per dollar for clams is higher than potatoes. He can fix this by spending $1 less on potatoes and $1 more on clams. He becomes better off and stays within his budget. If Sammy has chosen the optimal consumption bundle, his marginal utility per dollar spent on clams and potatoes must be equal. 21 Demand Curve AP Microeconomics Optimal Consumption Rule. When a consumer maximizes utility in the face of a budget constraint, the marginal utility per dollar spent on each good or service in the consumption bundle is the same. That is, for any two goods C and P, at the optimal consumption bundle MUC MU P = PC PP This rule applies no matter how many g/s a consumer buys. The marginal utilities per dollar spent for each and every good or service in the optimal consumption bundle are equal. 22