* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download LM Curve

Survey

Document related concepts

Transcript

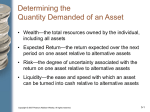

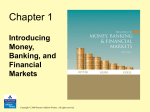

Chapter 4 Strong and Weak Policy Effects in the IS-LM Model Copyright © 2012 Pearson Addison-Wesley. All rights reserved. The Definition of Money • Money is defined as any good or asset that serves the following three functions: – Medium of Exchange – Store of Value – Unit of Account • The Money Supply (MS) is equal to currency in circulation plus checking accounts at banks and thrift institutions. – The Fed is assumed to determine the money supply (see Chapter 13 for more details) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-2 Money Demand • The demand for money is determined by people’s need for money to facilitate transactions. – If Income (Y) Md – If the Price Level (P) Md M • Notice: Real money demand = P d is unaffected by P • The demand for money also depends negatively on the cost of holding money, the interest rate (r). – If r Md as people switch out of money into interest-bearing savings accounts or other financial assets • Algebraically, the general linear form of Md is: d M hY fr P Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-3 Figure 4-1 The Demand for Money, the Interest Rate, and Real Income Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-4 The demand for real money balances (M/p)d = .5Y – 200r Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-5 Figure 4-2 Effect on the Money Demand Schedule of a Decline in Real Income Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-6 Effect on the Money Demand Schedule of a Decline in Real Income from $8,000 to $6,000 Billion Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-7 What Shifts Money Demand? • The main shift factor for real Md is income (Y). • Additional shift factors include: – Wealth: If people become wealthier, some of the additional wealth may be held as money, so Md rises. – Expected future inflation: If people expect P to rise quickly in the future, they will try to hold as little money as possible. – Payment technologies: Any technological development that alters how people pay for goods and services, or the ease of switching between money and non-money assets can change Md • Examples: Credit Cards and ATM’s Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-8 The LM Curve • The LM Curve shows all the possible combinations of Y and r such that the money market is in equilibrium. • Algebraic Derivation: At equilibrium, real MS equals real Md: MS P hY fr Solving for r yields: Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 1 M S r f P h Y f 4-9 Figure 4-3 Derivation of the LM Curve Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-10 Figure 4-3 Derivation of the LM Curve Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-11 What shifts and rotates the LM Curve? 1 M S h Y r f P f • Anything that only affects the intercept term will shift the LM curve: • Recall: – If MS LM shifts → – If P LM shifts → – Not captured by slope term: Md LM shifts ← • Anything that affects the slope term will cause a rotation of the LM curve: – If h LM becomes steeper – If f LM becomes flatter Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-12 The General Equilibrium • A General Equilibrium is a situation of simultaneous equilibrium in all of the markets of the economy. • How does the economy adjust to the general equilibrium? – If the goods market is out of equilibrium involuntary inventory decumulation or accumulation occurs firms respond by increasing or decreasing production Y moves to equilibrium – If the money market is out of equilibrium pressure on interest rates will bring back monetary equilibrium Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-13 Figure 4-4 The IS and LM Schedules Cross at Last Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-14 The IS/LM Model and the Global Economic Crisis • How can the Global Economic Crisis be modeled using the IS/LM model? • During the crisis, the IS curve shifted left. Why? – Household wealth and consumer optimism Cα – Business pessimism I – Greater difficulty in obtaining loans Cα and I • Summary: Private spending IS shifts Y, r Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-15 Monetary Policy • An expansionary monetary policy is one that has the effect of lowering interest rates and raising GDP • Suppose that desired (natural) level of Y = Y* (not Y). There is gap between actual and natural. To raise GDP the CB must increase money supply (expansionary monetary policy). • A contractionary monetary policy is one that has the effect of raising interest rates and lowering GDP • If natural real GDP is lower than actual real GDP, the CB must decrease MS (contractionary monetary policy). Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-16 Figure 4-5 The Effect of an Increase in the Money Supply With a Normal LM Curve Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-17 Fiscal Policy and “Crowding Out” • An expansionary fiscal policy is one that has the effect of raising GDP, but also raising interest rates – Note: r Private Autonomous Spending • The reduction in the amount of consumption and/or investment spending due to an increase in G (or fall in T) is known as “Crowding Out” Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-18 Figure 4-6 The Effect on Real Income and the Interest Rate of an Increase in Government Spending Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-19 • Can crowding out be avoided? – Yes! – If the Fed simultaneously MS r – If the IS is vertical. – If the LM is horizontal. Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-20 • • • • Strong effects of monetary expansion. The answer depends on the slopes of the IS and LM curves. If they have normal shapes (top frame). Higher Ms boasts Y and lowers r, which boasts Md by the amount needed to match Ms. • If LM is steep (low Md responsiveness to r) (bottom frame), where LM curves are vertical, Y increases twice as much as the case in the top frame. Strong effects of monetary expansion Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-21 Figure 4-7 The Effect of an Increase in the Money Supply With a Normal LM Curve and a Vertical LM Curve Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-22 • • • • Weak effects of monetary policy. Steep IS curve: zero interest responsiveness of Ap to r. (top frame in figure). Y does not change, the only effect is a lower r. Weak effects of monetary policy • Flat LM curve: • Md is extremely responsive to r. (bottom frame in figure 4-8). • The equilibrium of the economy hardly move at all. In the extreme case of horizontal LM, CB loses control over both Y and r. This case is called the liquidity trap. Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-23 Figure 4-8 Effect of the Same Increase in the Real Money Supply with a Zero Interest Responsiveness of Spending and with a High Interest Responsiveness of the Demand for Money Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-24 • Strong and weak effects of fiscal policy • The fiscal policy stimulus on Y depends on the slope of IS and LM. • Fiscal policy is strong when the demand for money is highly interest-responsive. (look to top frame of figure). Note that there are no crowding out effect since r remains constant. • The opposite occurs when the interest responsiveness of money demand is zero. Look at the lower frame of the figure. as long as Ms is fixed, Y can’t be increased. Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-25 Figure 4-9 Effect of a Fiscal Stimulus when Money Demand Has an Infinite and a Zero Interest Responsiveness Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-26 Figure 4-10 The Effect on Real Income of a Fiscal Stimulus With Three Alternative Monetary Policies (1 of 3) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-27 Figure 4-10 The Effect on Real Income of a Fiscal Stimulus With Three Alternative Monetary Policies (2 of 3) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-28 Figure 4-10 The Effect on Real Income of a Fiscal Stimulus With Three Alternative Monetary Policies (3 of 3) Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-29 Monetary and Fiscal Policy Effectiveness • Monetary policy is strong when: – The IS curve is relatively flat and/or – The LM curve is steep • Monetary policy is weak when: – The IS curve is very steep and/or – The LM curve is relatively flat • Fiscal policy is strong when: – The IS curve is very steep and/or – The LM curve is relatively flat • Fiscal policy is weak when: – The IS curve is relatively flat and/or – The LM curve is steep Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-30 The Liquidity Trap • A Liquidity Trap occurs when investors are indifferent between holding money and short-term assets – Why might investors be indifferent? • Because the nominal interest rate on short-term assets is close to zero! – Why is a liquidity trap a problem? • Because the interest rate is close to zero, the Fed can no longer use monetary policy to lower the interest rate to boost output. • How is a liquidity trap represented? – The LM curve starts off horizontal at very low interest rates before having its normal upward slope Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-31 International Perspective Monetary and Fiscal Policy Paralysis in Japan’s “Lost Decade” Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-32 International Perspective Monetary and Fiscal Policy Paralysis in Japan’s “Lost Decade” Copyright © 2012 Pearson Addison-Wesley. All rights reserved. 4-33