* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 97 Shocks - supply

Survey

Document related concepts

Transcript

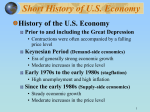

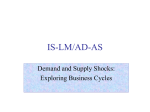

97. Shocks: Supply-side 1. Fill in the missing words Economic shocks occur ______________________ and supply-side shocks will impact the economy through their effect on __________________ supply. Shocks can be negative, and so shift aggregate supply to the __________ or they can be _______________, shifting aggregate supply to the right. The cause of the shock is often external, such as a sudden rise in oil prices, which will increase production ____________ and so shift short-run aggregate supply to the left. This would lead to ____________________, where the price level rises while real output falls. Choose words from: stagflation, left, aggregate, costs, unexpectedly, positive. 2. Complete the transmission mechanisms for the two supply-side shocks below: 2.1 OPEC decided to cut oil production in 1973/4 causing oil prices to rise roughly triple: 2.2 In the early 1990s, China, India and post Soviet countries entered the global economy, doubling the size of the global labour force, and so driving down global wages. 3. Evaluation – how can the following determine the impact of an oil price rise: 3.1 The importance of the manufacturing sector: __________________________________________________ 3.2 If a country is a net importer or exporter of oil:________________________________________________ 3.3 The volatility in oil prices: ________________________________________________________________ 3.4 The value of the exchange rate:____________________________________________________________ 4. Data response – Average UK Petrol and Diesel Prices 1999 to May 2008 Source: BBC News 23/5/2008 4.1 Describe the trend in petrol and diesel prices over the period shown. ______________________________________________________________________________________ 4.2 Assess the polices that might be introduced to reduce the inflationary pressures stemming from this? ______________________________________________________________________________________ ______________________________________________________________________________________ www.a-zbusinesstraining.com 97. ANSWERS: Shocks: supply-side 1. Unexpectedly, aggregate, left, positive, costs, stagflation, 2.1 Production costs rise, transport costs rise, shifts left, cost-push inflation 2.2 Falling, right, economic growth rises and inflation falls 3.1 Manufacturing is more reliant on oil than the service sector and so will suffer more from higher oil prices. 3.2 A net importer will see AD shift left as import spending rises (price inelastic demand for oil) whereas a net exporter would see AD shift right as export earnings rise. 3.3 Speculation causes oil price volatility and so higher oil prices might not be permanent and so will not lead to sustained inflation but only a temporary rise. 3.4 A country with a strong currency will be able to buy oil imports priced in dollars relatively more cheaply than another country with a weaker currency. 4.1 Both petrol and diesel prices have risen, with petrol and diesel rising from around 70p a litre in May 1999 to over 114p in May 2008 4.2 The government might employ tight fiscal policy, and so cut government spending or raise taxes, although higher indirect taxes would raise firms’ costs and cause cost-push inflation. Thus the government could cut excise duties on petrol and diesel to bring the price down. Alternatively, the MPC might raise interest rates to lower AD. There will be a time lag before this has an effect on AD though and thus inflation. It will also not be a policy that can be targeted specifically at the problem of high oil prices feeding into high petrol and diesel prices and so will instead cause all spending in the economy to fall. www.a-zbusinesstraining.com