* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Group Activity 4 Key - Seattle Central College

Survey

Document related concepts

Transcript

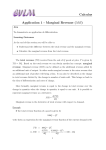

Eco 200 Group Activity 4 Key Chap 13 & 14 & 15 Chapter 13: 1. 4th Edition: p. 285, Problems and Applications, Q4 3rd Edition: p. 286, Problems and Applications, Q4 a. The following table shows the marginal product of each hour spent fishing: Hours Fixed Cost Fish 0 1 2 3 4 5 0 10 18 24 28 30 Variable Marginal Cost Total Cost Product 10 10 10 10 10 10 0 5 10 15 20 25 10 15 20 25 30 35 10 8 6 4 2 b. Figure 7 graphs the fisherman's production function. The production function becomes flatter as the number of hours spent fishing increases, illustrating diminishing marginal product. 30 Quantity of Fish 20 10 1 2 3 4 Hours Spent Fishing 5 Figure 7 c. The table shows the fixed cost, variable cost, and total cost of fishing. Figure 8 shows the fisherman's total-cost curve. It has an upward slope because catching additional fish takes additional time. The curve is convex because there are diminishing returns to fishing time because each additional hour spent fishing yields fewer additional fish. 40 Total Cost of Fishing 30 20 10 10 20 30 40 Quantity of Fish Figure 8 1 2. 4th Edition: p. 287, Problems and Applications, Q11 3rd Edition: p. 288, Problems and Applications, Q11 The following table shows quantity (Q), total cost (TC), and average total cost (ATC) for the three firms: Firm A Firm B Firm C Quantity Total Cost Average Total Cost Total Cost Average Total Cost Total Cost Average Total Cost 1 2 3 4 5 6 7 60 70 80 90 100 110 120 60 35 26.7 22.5 20 18.3 17.1 11 24 39 56 75 96 119 11 12 13 14 15 16 17 21 34 49 66 85 106 129 21 17 16.3 16.5 17 17.7 18.4 Firm A has economies of scale because average total cost declines as output increases. Firm B has diseconomies of scale because average total cost rises as output rises. Firm C has economies of scale for output from one to three and diseconomies of scale for levels of output beyond three units. Chapter 14: 3. 4th Edition: p. 308, Problems and Applications, Q5 3rd Edition: p. 309, Problems and Applications, Q6 Here is the table showing costs, revenues, and profits: Quantity Total Cost Marginal Cost Total Revenue Marginal Revenue Profit 0 1 2 3 4 5 6 7 8 9 10 11 13 19 27 37 1 1 1 2 6 8 10 0 8 16 24 32 40 48 56 8 8 8 8 8 8 8 -8 -1 6 13 19 21 21 19 a. The firm should produce five or six units to maximize profit. b. Marginal revenue and marginal cost are graphed in Figure 4. The curves cross at a quantity between five and six units, yielding the same answer as in Part (a). 10 Marginal Cost Revenue & 8 Costs 6 Marginal Revenue 4 2 1 2 3 4 5 Figure 4 6 7 Quantity 2 c. This industry is competitive because marginal revenue is the same for each quantity. The industry is not in long-run equilibrium, because profit is not equal to zero. 4. 4th Edition: p. 309, Problems and Applications, Q10 Not in 3rd Edition, see Practice Test #1 Question #2 for question… a. The firms' variable cost (VC), total cost (TC), marginal cost (MC), and average total cost (ATC) are shown in the table below: Quantity 1 2 3 4 5 6 Variable Total Cost Cost 1 4 9 16 25 36 Marginal Average Cost Total Cost 17 21 26 32 41 52 1 3 5 7 9 11 17 10.5 8.67 8 8.2 8.67 b. If the price is $10, each firm will produce five units, so there will be 5 × 100 = 500 units supplied in the market. c. At a price of $10 and a quantity supplied of five, each firm is earning a positive profit because price is greater than average total cost. Thus, entry will occur and the price will fall. As price falls, quantity demanded will rise and the quantity supplied by each firm will fall. d. Figure 10 shows the long-run industry supply curve, which will be horizontal at minimum average total cost. Firm Industry MC Price and Costs ATC P1 Price and Costs S Quantity Quantity Figure 10 Chapter 15: 5. 4th Edition: p. 340, Problems & Applications, Q1 3rd Edition: p. 342, Problems & Applications, Q1 The following table shows revenue, costs, and profits, where quantities are in thousands, and total revenue, total cost, and profit are in millions of dollars: 3 Quantity Total Marginal Total Price (1000s) Revenue Revenue Cost Profit 100 0 0 2 -2 90 100 9 9 3 6 80 200 16 7 4 12 70 300 21 5 5 16 60 400 24 3 6 18 50 500 25 1 7 18 40 600 24 -1 8 16 30 700 21 -3 9 12 20 800 16 -5 10 6 10 900 9 -7 11 -2 0 1000 0 -9 12 -12 a. A profit-maximizing publisher would choose a quantity of 400,000 at a price of $60 or a quantity of 500,000 at a price of $50; both combinations would lead to profits of $18 million. b. Marginal revenue is always less than price. Price falls when quantity rises because the demand curve slopes downward, but marginal revenue falls even more than price because the firm loses revenue on all the units of the good sold when it lowers the price. c. Figure 2 shows the marginal-revenue, marginal-cost, and demand curves. The marginal revenue and marginal-cost curves cross between quantities of 400,000 and 500,000. This signifies that the firm maximizes profits in that region. 100 Price, Revenue, Costs DWL MC Demand 400 500 1000 MR Quantity Figure 2 d. The area of deadweight loss is marked “DWL” in the figure. Deadweight loss means that the total surplus in the economy is less than it would be if the market were competitive, because the monopolist produces less than the socially efficient level of output. e. If the author were paid $3 million instead of $2 million, the publisher would not change the price, because there would be no change in marginal cost or marginal revenue. The only thing that would be affected would be the firm’s profit, which would fall. f. To maximize economic efficiency, the publisher would set the price at $10 per book, because that is the marginal cost of the book. At that price, the publisher would have negative profits equal to the amount paid to the author. 4 6. 4th Edition: p. 342, Problems & Applications, Q13 Not in 3rd Edition, see Practice Test 2, Question #3 for the question… a. The marginal revenue from selling to each type of consumer is shown in the following tables: Price 10 9 8 7 6 5 4 3 2 1 0 Price 10 9 8 7 6 5 4 3 2 1 0 b. c. Marginal Quantity Total Revenue Revenue from of Adult from Sale of Sale of Adult Tickets Adult Tickets Tickets 0 100 200 300 300 300 300 300 300 300 300 0900 1600 2100 1800 1500 1200 900 600 300 0 9 7 5 -3 -3 -3 -3 -3 -3 -3 Marginal Quantity Total Revenue Revenue from of Child from Sale of Sale of Child Tickets Child Tickets Tickets 0 0 0 0 0 100 200 200 200 200 200 0 0 0 0 0 500 800 600 400 200 0 0 0 0 0 5 3 -2 -2 -2 -2 To maximize profit, you should charge adults $7 and sell 300 tickets. You should charge children $4 and sell 200 tickets. Total revenue will be $2,100 + $400 = $2,500. Because total cost is $2,000, profit will be $900. If price discrimination were not allowed, you would want to set a price of $7 for the tickets. You would sell 300 tickets and profit would be $100. The children who were willing to pay $4 but will not see the show now that the price is $7 will be worse off. The producer is worse off because profit is lower. Total surplus is lower. There is no one that is better off. 5