* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Microeconomics, marginal costs, value, and revenue, final exam

Comparative advantage wikipedia , lookup

Public good wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Economic equilibrium wikipedia , lookup

Middle-class squeeze wikipedia , lookup

Supply and demand wikipedia , lookup

Marginal utility wikipedia , lookup

Marginalism wikipedia , lookup

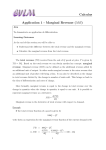

Microeconomics, marginal costs, value, and revenue, final exam practice problems (The attached PDF file has better formatting.) *Question 1.1: Effects on Marginal Cost Which of the following is most likely to increase a firm’s marginal cost? A. B. C. D. E. A change from factory labor to automated manufacturing A lump-sum tax imposed on suppliers of the product. An increase in the cost of a government license to sell the product An increase in the cost of raw materials used to manufacture the goods. An increase in the percentage of fixed expenses. Answer 1.1: D A lump-sum tax and the cost of government licenses do not affect the marginal cost. A decrease in labor (a variable cost) and an increase in automation or other fixed costs reduce the marginal cost. Variable costs are labor, raw materials, supplies, and taxes. Jacob: Are insurers’ costs fixed or variable? Rachel: For insurers, most costs (benefits, losses, expenses) are variable. *Question 1.2: Increasing Marginal Cost If marginal cost rises sharply when demand increases, then probably A. B. C. D. E. The industry is competitive. The industry is monopolistic. The firm in a cartel. The firm is in the short run. The firm is in the long run. Answer 1.2: D In the short run, marginal cost rises when demand increases: ! The firm works its production process at more than capacity. ! Labor costs increase because of overtime. ! The ratio of labor to capital is higher than optimal. In the long-run, the firm acquires new factors (new capital). The marginal cost may remain flat, increase, or decrease in the long-run, depending on the type of industry. Jacob: In an increasing cost industry, won’t marginal cost increase as demand increases even in the long-run? Rachel: In the long-run, marginal cost increases slowly, not sharply. ~Question 1.3: Costs Which of the following is true regarding costs? A. The objective of a firm is to maximize sales revenue. B. Increasing marginal cost means that average total (variable plus fixed) costs increases as quantity increases. C. The marginal cost is the reciprocal of the slope of the total cost curve. D. The marginal cost is the slope of the variable cost curve. E. The marginal cost is the slope of the average cost curve. Answer 1.3: D *Question 1.4: Costs All but which of the following are true regarding costs? A. The objective of a firm is to maximize profits (in this microeconomics course). B. Increasing marginal costs mean that each additional unit of an activity is more expensive than the previous one. C. The marginal cost is the slope of the total cost curve. D. The marginal cost is the slope of the variable cost curve. E. All of A, B, C, and D are true. Answer 1.4: E *Question 1.5: Shutdown Price A competitive firm has the following variable and fixed costs: Quantity Variable Cost Fixed Cost 1 2 3 4 5 6 9 14 18 21 25 33 10 10 10 10 10 10 7 8 42 52 10 10 Average Variable Cost What is the competitive firm’s short-run shutdown price? The shutdown price is the minimum average variable cost. A. B. C. D. E. 3 4 5 6 7 Answer 1.5: C *Question 1.6: Shut down Prices All but which of the following are true regarding the short run shutdown price? A. The shutdown price is the minimum price at which the firm covers variable costs. B. The shutdown price is where the marginal cost curve intersects the average cost curve. C. The shutdown price is where the marginal cost curve intersects the average variable cost curve. D. The shutdown price is not the same as the break-even price. E. For a firm with positive fixed costs, the shutdown price is less than average total costs. Answer 1.6: B *Question 1.7: Slope of Marginal Cost Curve In the short run, as more output is produced, a manufacturing firm’s marginal cost tends to A. B. C. D. E. Decrease First decrease and then remain level Increase Remain constant First increase and then decrease Answer 1.7: C In the short run, as quantity increases, the firm must run its factories at greater than capacity, using overtime to produce more goods. The higher cost of labor (overtime pay) and the increased cost from using a ratio of labor to capital that is higher than optimal causes marginal cost to rise. At very low output, marginal cost may also be high, since there is too little output for the optimal ratio of labor to capital. Were the choice of “first decrease and then increase” provided, it would also be a correct answer. Jacob: Is this true only for a manufacturing firm? Rachel: Manufacturing firms are the best examples, though it is true for most firms. *Question 1.8: Marginal Value All but which of the following are true regarding value and marginal value? A. B. C. D. The value of a good is the maximum a consumer is willing to pay for it. As a consumer acquires more of an item, its marginal value decreases. The marginal value curve for a good corresponds to the demand curve for the good. In a competitive market, a good’s marginal value is the same for all consumers, regardless of their tastes or income. E. The value of good does not depend on the cost of producing the good. Answer 1.8: D The price is the same for all consumers. But consumers have different tastes, so the marginal value differs by consumer. Some consumers buy none of the good, since its value for them is lower than the equilibrium price. Jacob: What is the relation between the value to consumers and consumers’ surplus? Rachel: Consumers’ surplus is the value minus the amount paid. *Question 1.9: Study Time The value of passing Course M is $30,000. The probability of passing (P) Course M depends on the hours the candidate studies (S) as P = S0.5 / 30, with a maximum of 100%. For example, if the candidate studies 400 hours, the chance of passing is 20 / 30 = 66.7%. The cost of S hours of study is $2 × S1.5. For example, the cost of 400 hours of study is $2 × 4001.5 = $16,000. How many hours does the candidate study? A. B. C. D. E. 166.7 225.0 333.3 625.0 900.0 Answer 1.9: A We derive the marginal cost and benefit curves and equate marginal cost to marginal benefit. The marginal cost is $2 × 1.5 × S0.5 = $3 × S0.5. The marginal benefit of each additional hour of study is 0.5 × ($30,000 / 30) × S–0.5 = $500 × S–0.5. Equating marginal cost and marginal benefit gives S = $500 / $3 = 166.7 hours.