* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Notes2

Survey

Document related concepts

Transcript

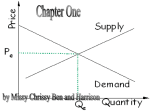

Chapter 1: Ten Principles of Economics 8/24/2011 • • • • • • • • Economy: Greek, to manage a household. Economics: the study of decisions made when dealing with scarcity. Scarcity: Not enough resources to satisfy *Margin: “step, by step” changes. Rationality: making decisions based on all of the information you have. In economics we assume rationality. Incentive: Something that induces a person to act. Market: a place buyers and sellers meet to exchange goods and services Inflation: general increase in price level 10 Economic Principles (Micro Economics) • People face trade offs • Efficiency: getting the highest benefit from scarce resources • Equity: equal shares from different groups • Opportunity Cost (OC): What you give up to get something else. • People make choices at the margin. • People respond to incentives. • Weighing costs and benefits • Increase the cost -> less likely to do something • Decrease benefits -> less likely to do something • Trade can make everyone better off • Allows specialization • Markets are usually a good way to organize economic activity • Governments can sometimes improve market outcomes (Macro Economics) • A country’s standard of living depends on its ability to produce goods and services (G&S) • Prices rise when government prints too much money • Short-run tradeoff between inflation and unemployment • When one goes up the other goes down Chapter 2: Thinking Like an Economist 08/26/2011 • • Microeconomics: Decisions by households or firms and interactions between households and firms in the marketplace Macroeconomics: Studies the forces and trends that affect the economy as a whole The Economist as a Scientist • • Use models to simplify reality Use scientific method • Use observations to develop theory • Collect and analyze data • • • • Observe natural experiments to test theory Use assumptions: limits (ex: It is summer in Texas) Goal of a model is to simplify reality to increase understanding 2 models • Circular Flow Diagram: • 3 Different Actors • Households = Consumers • Firms = Producers • Government (Taxation/Regulation) • Factors of Production: Inputs or resources into production • Capital (K) • Land/Nature Resources • Human Capital • Technology (A) • • • • Positive Statement: “What is; fact” • Economics Normative Statement: “What should be; opinions” • Political Science • Social Sciences Much disagreement in Economics • Production Possibility Frontier (PPF): Shows the combinations of output an economy can produce with given inputs • • • • Production: What firms produce G&S Possibility: Combinations Frontier: limit border Assumptions • Can produce 2 goods • Computers • Cars • Limited number of inputs • • • • • Produce on PPF (F,A,B,E): Efficiency D: can produce, but inefficient C: cannot produce Economics • Graph with 2 variables • Looking at the relationship between 2 variables • • • • Omitted Variables • Changes do to variable not on graph Reverse Causality • Does A cause B • Does B cause A • Neither? Correlation: A and B happen at the same time Demand Curve • • Supply Curve • • Chapter 3: 08/31/2011 • • • • • • Absolute advantage: The ability to produce a good using fewer inputs than another producer Comparative Advantage: The ability to produce a good at a lower opportunity cost than another producer Opportunity Cost (OC): what you must give up to get something else 2 basic ways to satisfy wants • Economic self-sufficiency: Produce everything you want to consume • Specialize in the production of a good and trade for other goods Trade will only happen if it makes people better off Ex: 2 Individuals, Rancher and farmer. Produce 2 products: Meat and Potatoes. • • • • • With no trade, PPF is the person’s Consumption possibility frontier. Imports (M): Goods produced abroad and sold domestically Exports (X): Goods produced domestically and sold abroad Trade: Importing one product and exporting another Chapter 4: 9/9/11 • • • • • • • • • Market: a place where buyers and sellers get together to exchange goods and services Competitive Market: A market which there are many buyers and many sellers and no one can affect the price • Goods sold are exactly the same Price Takers: take the market price as given Demand (D): a relationship between the price and the quantity demanded a each price • Any relationship can be put on a graph Quantity Demanded (QD): the quantity that buyers are willing and plan to buy at a given price Law of Demand: other things being equal (ceteris paribus) the quantity demanded falls when the price rises Market Demand: The total quantity demanded by all buyers in the market at each price Horizontal Summation: at each price what is the total quantity demanded? Change in Price • Move along demand curve • • • • • • • • • • • Change quantity demanded Changes in demand • Increase in demand (D1 to D2) • At each Px QD is higher • Shift D curve to right • Decrease in demand • At each price, QD is lower • Shift D curve left Reasons for changes in Demand (All shift Demand Curve) • Price of related Goods • Substitutes: If the price of a substitute increases, the demand for the original good increases • Compliments: If the price of a Compliment increases, the demand for the original good decrease • Income • Normal Good: When income increases, demand for a normal good increases • Inferior Goods: When income increases, demand for an inferior good decreases • Tastes • Expectations • Future Income: changes current demand • Future Prices: changes current demand • Number of Buyers Supply (S):the relationship between the price and the quantity supplied by sellers at each price Quantity Supplied (QS): the quantity of a good or service that firms are willing and able to sell at each price Law of Supply: All else equal (ceteris paribus) as the price increases the quantity supplied increases Changes in Quantity supplied (QS) • P => QS UP • P => QS DOWN Changes in Supply (S) • Increases in supply: QS UP at each P; S Curve shifts Rights • Decrease in Supply: QS DOWN at each P; S Curve shifts Left Reasons the supply curve shifts • Changes in input prices • Ex: Up P of Wood for tables the firm produces • Technology • Ex: better machines to produce goods • Expectations • Ex: Businesses trends the firm expects • Number of Sellers • Sellers UP => Market Supply UP Equilibrium Price: the rpice at which quantity supplied equals quantity demanded in the market Equilibrium Quantity (Qe): where QS = QD Ch 5: • Elasticity €: responsiveness • A measure of responsiveness of quantity demanded (QD) or quantity supplied (QS) to on of its determinants • Price Elasticity of Demand €P: the measure of how much the QD of a good responds to a change in price of that good • • €P = %Change QD/%Change P • (Q2-Q1)/(Q1+Q2)/2/(P2-P1)/(P1+P2)/2 When €P, Demand is elastic. • • When €P=1, Demand is unit elastic. • • IF P UP by 1% => QD DOWN by 1% When €P<1, Demand is inelastic • • IF P UP by 1% => QD DOWN by > 1% IF P UP by 1% => QD DOWN by < 1% If demand is inelastic, then the percent change price is greater than the percent change in Quantity demanded • UP P by 1% => DOWN QD by < 1% => UP TR • DOWN P by 1% => UP QD by < 1% • IF D is unit elastic => no change in TR • Profit: Total revenue (TR) – Total Cost (TC) • Total Revenue = Price (P) X Quantity (Q) • TR = P x Q • IF TR UP => UP Profit (if costs fixed) • IF demand is elastic, than the percent change in price is less than the percent change in quantity demanded • • UP P by 1% => QD by> 1% • DOWN by 1% => UP QD by > 1% For price Elasticity of Demand, take the absolute value (drop the minus sign) • €P = abs(%CHANGE QD / %CHANGE P) • Price Elasticity of Demand: €P = %Change QD/%Change P • Income Elasticity of Demand: €I = %Change QD/%Change I • The measure of how the QD responds to the change in Income (I) • • Normal Good: UP QD when UP I • €I > 0 • Necessities: Small income elasticity • Luxury Goods: large income elasticity Inferior Good: DOWN QD when UP I • €I < 0 • Cross - Price Elasticity of demand: €X = %CHANGE QD1 / %CHANGE P2 • The measure of how much the QD of one good responds to the change in price of another good • Substitute: UP P2 => UP QD • • Compliments: UP P2 => DOWN QD1 • • €X < 0 Price elasticity of supply (€PS): the measure of how quantity supplied of a good responds to a change in the price of that good, what the seller receives • • €X > 0 (€PS) = %CHANGE QS / %CHANGE P Determinants of €PS • Flexibility of sellers (EX: Complicated production) • Time horizon: Supply is usually more elastic in the short run Ch 6: Government Policy • • Price Ceiling: a legal maximum on the price at which a good can be sold • Price is below Pe • Causes Shortage • Ex: Rent Control Price Floor: a legal minimum on the price at which a good can be sold • Price is Above Pe • Causes Surplus • Ex: Minimum Wage • • Tax Incidence: the manner in which the burden of the tax is shared among participants in the market Tax incentive: who pays the tax • Tax on buyers shifts demand curve • If tax changes, it changes QD to bottom of tax • Original Price = Pe • Both households and firms pay part of tax(T) • Now households pay Pg > Pe, but PB < T • Now sellers reveve PS < Pe, but PS < T • Tax on sellers (Adds cot to sellers) • Shifts supply curve to the top of supply curve to top of tax • Government can tax buyers or sellers and both will still pay part of tax • More elastic (more responsive) => flatter the curve • Buyers pay more of tax when supply is elastic • Sellers pay more of tax when demand is elastic CH 7: • • • • • • • • • Welfare Economics: the study of how allocation of resources affects economic well being Consumers – buyers • Demand Curve • Willingness to pay: the maximum amount a buyer will pay for a good • Consumer Surplus (CS): the amount a buyer is willing to pay for a good minus the amount the buyer actually hast to pay for it • CS = WTP-P • Found below demand curve and above price to buyers Sellers – firms • Supply curve • Cost: the value of everything a producer must give up to produce a good • Input cost • Opportunity cost <- included in economics but not in accounting • Economic profit • Producer Surplus (PS): the amount a seller is paid for a good (P) minus the seller’s cost of producing the good As Price falls, Consumer surplus increases for 2 reasons • Original consumers (QD) paying lower price • New Consumers (QD2-QD1) now enter market and buy the good Height of Demand Curve = Willingness to Pay As price rises, Producer surplus increases for 2 reasons • Original sellers (QS) receive a higher price • New sellers (QS2-QS1) enter the market and sell the good Efficiency: resources allocation on that maximizes total surplus received by all members of society Where is the most efficient allocation of S & D graph? • Equilibrium Quantity and Price => Maximize total surplus Equity: the fairness of the distribution of well-being Chapter 10: Externality • • • • • • • Externality: the uncompensated impact of one person’s actions on the well-being of a bystander Private Cost: individual firm’s cost to produce and supply a good • Supply Curve • Under supply curve is Total Cost Social Cost: Private Cost + Cost of negative externality Internalizing an externality: Altering incentives so that people take account of the external effects of their actions • Makes people pay social cost rather than Private Cost Negative Externality: The effect on the bystander is adverse (negative) • Ex: Pollution, Neighbors’ Pets, Health risk • Positive Externality: The effect on the bystander is beneficial (positive) • Private Venefit: benefit on an individual of an action • Social Benefit: private benefit from external benefit • • Externalities • Negative: • Private quantity > Social Quantity • Private price < Social Price • Positive: • Private Quantity < Social Quantity • Private Price < Social Price • Internalizing on Externality • Tax goods with negative externalities • Subsidizing (grants) goods with positive externalities • Private Solutions to Externalities • Moral codes and social sanctions • Charities (EX: sierra club) • Contracts between market participants and bystanders • Coase Theorem: If private parties can bargain without cost, over the allocation of resources, they can solve the externality problem on their own. • Problems with coase Theorem • Transaction Costs: Costs that partners incur in the process of bargaining • Both parties hold out for a better deal • Number of parties is large • Public Policies Toward Externalities • Command and control policies • Regulates behavior directly (EX: Speed Limit) • Market based policies • Provides incentives for private decision makers (EX: Pay as you go insurance) • 2 market based approaches • Corrective (Pigouvian) Tax: Designed to make decision makers take account for their actions • Corrective tax used when there is an external cost • Corrective Subsidy used when there is an external cost • • Tradable Permits: Issue permits to decision makers • Permits can be bought and sold • Sets up a market for externality Need information on demand for the externality Ch 11: Public Goods and Common Resources • • • • • Private goods: exclusive use to resource Public goods: anyone can use the resource Characteristics of Goods • Excludable: if a person can be prevented from using the good • Rival to Consumption: if one person’s use diminishes another person’s use Excludable Not Excludable Rival to Consumption Private Goods Common Resources Not Rival to consumption Natural Monopolies Public Goods • Externalities: bystander affected by someone else’s actions • Arise because something with no market value has a value attached to it • Private decisions about production and consumption can lead to externalities • Free-Rider Problem: a person receives the benefit of a good but avoids paying for it • When a good is not excludable Public Goods • If the benefit of providing a public good exceeds the cost, the government should provide the good and pay for it with a tax on the people who are going to benefit from the good • Cost-Benefit Analysis: a study that compares the costs and benefits of providing a good/ doing an action • If Cost > Benefit => Don’t provide good/ don’t do the action • Benefit > Cost => Provide goods/ do action • Knowledge created through basic research • Fighting Poverty Common Resources • Not excludable • Cannot prevent free riders • Government has a role in providing common resources • Preventing its overuse • Tragedy of the Commons: Private incentives (using the product for free) outweigh the social incentives (using the land carefully). • Common resources • Common grazing land for cattle • Common hiking trail • Overuse and destruction of the resources • Amount of resources is fixed • Can lead to the destruction of a whole industry • Why?: people don’t look at the external cost of their actions • Policies to prevent overuse • Regulate use of resource • Use corrective tax to internalize externality • Auction off permits to use the resource • Convert it to a private good Ch 13: Costs of Production • • • • • • • • • • • • Firms produce goods and services in order to achieve a maximum profit. Total Revenue (TR): The amount a frim receives from the sale of its output • TR = P X Q = Price x Quantity Total Cost (TC): The market value of inputs a firm uses in production Profit = Total Total Revenue – Total Cost • TT = TR – TC • Accounting Profit = TR – Total Explicit Costs • Economic Profit = TR – Total Explicit Costs – Total Implicit Costs 2 kinds of costs: • Explicit: requires an out lay of money • Implicit Cost: do not require an out lay of money Need 100,00 to start a business • Borrow 100,000 at 5% • Explicit cost = $5,000 Borrow $60,000 @ 5% and use $40,000 from your savings • Explicit Cost = $3,000 interest • Implicit Cost = $2,000 interest we could have earned Diminishing returns: added input creates more output at a decreasing rate • Only adding one input • Other inputs are fixed Marginal Product of Labor (MPL): the additional output from one extra unit of labor input MPL = Change in Q / Change in Labor Fixed Costs: Same cost regardless of inputs • Ex: Land costs $1,000 per month Variable Cost: Depends on Quantity of input • Wage of a worker = $2,000 per month Labor Output (Q) Cost of Land (FC) Cost of Labor (VC) 0 0 1,000 0 1 1,000 1,000 2,000 2 1,800 1,000 4,000 3 2,400 1,000 6,000 4 2,800 1,000 8,000 5 3,000 1,000 10,000 • TC = VC + FC • Marginal Cost is the change in total cost divided by the change in output • MC = Change TC / Change in Q • Average fixed cost (AFC) = FC / Q • decreasing • downward sloping • Average variable cost (AVC) = VC / Q • U-Shaped Curve • Average Total Cost (ATC) = TC / Q = AFC + AVC • U-Shaped • Short Run: Some costs are fixed • Ex. Lease on building • Total Cost (TC) 1,000 3,000 5,000 7,000 9,000 11,000 • • • • Long Run: All inputs are variable • To maximize profit, ATC ar any Qunatity of output is the cost per unit using the most efficient mix of inputs => factory size with lowest ATC Profit maximization implies cost minimization Economies of scale: Occurs when increasing production allow for greater specialization. This makes workers more efficient Diseconomies of Scale: Due to coordination problems wihin larger organizations Ch 15: Monopolies Monopoly: one producer of a product Without close substitutes Key difference between monopoly and perfect competition Market power: ability to influence the price in a market Why do monopolies exist? Barriers to entry: other firms cannot enter the market Firm owns a key resource Government can give exclusive rights to produce a product EX: patents, copyrights Natural Monopoly: A single firm can produce the entire market quantity at a lower ATC than several firms Economies of scale Monopoly: only producer facing total market demand so demand curve is demand for the monopolies its product To sell a larger quantity monopolist must decrease price (P). MR != P Increasing Q produced has 2 effects Output Effect: the more output sold(Q), the greater the revenue (PxQ) Price Effect: As monopolist produces more, price falls which decreases revenue Monopoly Perfect Competition One firm/producer (S) Many firm & producers (S) Man consumers (D) Many consumers (D) P > MR P = MR Monopolist is only demand curve Supply and Demand Curve because they can set whatever price MR = MC (Max Profit) they wants MR = MC Choose Q to produce Go to D curve and find price (willingness to pay by consumers Goal is to maximize profit MC = Supply curve Goal of monopoly: Maximize profit => MR = MC A monopoly takes quantity of where MC = MC but the price of that quantity and the demand curve. This generally lets them produce less and charge more. Profit = TR – TC Profit = (Pm * Qm) – (ATCm * Qm) Profit = (Pm – ATCm) Qm Public Policy toward monopolies Increasing competition with trust laws ban certain competitive practices Sherman antitrust act of 1890 Clayton act 1914 Regulations Example p = ATC => zero economic profit public ownership Ex: US mail Do Nothing Discrimination: treating people differently based on the same characteristic Price Discrimination: Selling the same product or service at a different prices to different customers Firms use buyers’ willingness-to-pay (height of Demand Curve) to price discriminate If perfect price discrimination occurs the firm would charge each person the max that they would be willing to pay Examples of price discrimination Movie tickets Airline prices Discount coupons Need-based financial aid Quantity discounts Ch 16: Monopolistic Competition: A market structure which there are many firms that sell similar, but different products or services Short Run: Monopolistically competitive firm may have a profit or a loss Profit: P>ATC at Qm Loss: P<ATC at Qm MR = MC Long Run: more firms will enter market if there is a profit (=> P DOWN). more firms exit the market there is a loss (=> P UP) (=> ZERO Economic Profit P = ATC @ Qm) Characteristic # of Sellers # of buyers Importance of Strategic Interaction between firms Likelihood of fierce Competition Free entry & Exit LR Economic Profit Products Perfect Competition Many Many Yes Zero Identical Monopolistic Competition Many Many Yes Zero Differentiated Monopoly Oligopoly One Many Low Few Many High Low High No Profit One Product Market Power? NO Yes Yes (Can they effect Price) Demand Curve Horizontal Downward sloping Downward Sloping facing Firm Perfect competition => max ts LR Monopolistic Competition: Not Producing at lowest ATC Not maximizing TS In the long run, firms enter the monopolistic competition if there is profit Product variety externality: the consumer surplus buyers get from the introduction of new products Business stealing externality: losses incur to existing firms curve shifts left when new firms enter the market Advertising: the more differentiated the product, the more advertising firms buy Economist disagree about the social value of advertising As a signal of quality Advertising is expensive Producers must maintain a high quality Critiques Wasting resources that could be used for production Main palate people’s tastes Decreases competition Make up price of product Defense Provides useful information to buyers If buyers have information they can take advantage of price differences Promotes competition and reduces market power Brand Names Many brand name goods and many generics Brand name companies spend more on advertising and charge higher prices Critiques Cause consumers to perceive differences that do not exist Consumers’ willingness to pay for brand name goods is irrational Eliminating government protection of trademarks would reduce use of brand names Defense Provide information about quality to consumers Companies with brand names have incentive to maintain quality Reputation Perfect Competition Many buyers Many sellers Individual Supply curve Price = MR Max profit = MC P = MR - MC Monopolistic Many buyers Many sellers Individual Demand Curve For the firm’s market Max profit: MR = MC => P + Q Yes short run profit No long run profit (entry and exit) Advertising Brand Name Oligopoly Many buyers Few sellers Monopoly Many buyers One seller Individual Demand Curve Whole Market Supply curve => MC Short run Econ profit Long run Econ Profit Price Discrimination: S curve => MC Charge different => short run economic profit