* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Aggregate Supply and Aggregate Demand

Pensions crisis wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Fei–Ranis model of economic growth wikipedia , lookup

Non-monetary economy wikipedia , lookup

Economic growth wikipedia , lookup

Fiscal multiplier wikipedia , lookup

Full employment wikipedia , lookup

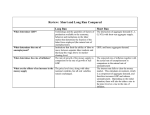

Ch. 10: Aggregate Supply and Demand Derive AS/AD model Understand cause & consequences of change in AS/AD • Short run vs Long run • Effects on economic growth, prices, unemployment. Different schools of thought in macroeconomics Macroeconomic Long Run and Short Run The Macroeconomic LR a time frame that is sufficiently long for the real wage rate to have adjusted to achieve full employment: Real GDP = potential GDP. Unemployment=natural unemployment rate. Price level determined by quantity of money (equation of exchange) Inflation rate =money growth rate minus the real GDP growth rate. The Macroeconomic SR a period during which some prices or wages are sticky so Real GDP might be below, above, or at potential GDP. The unemployment rate might be above, below, or at the natural unemployment rate Aggregate Supply The quantity of real GDP supplied is the total quantity that firms plan to produce during a given period. It depends on The quantity of the labor employed The quantity of physical and human capital State of technology Two time frames associated with different states of the labor market: Long-run aggregate supply Short-run aggregate supply Aggregate Supply Long-Run Aggregate Supply (LAS) the relationship between the quantity of real GDP supplied and the price level when real GDP equals potential GDP. Potential GDP is determined by •Production function •Labor market •Independent of price level LR aggregate supply curve (LAS) is vertical at potential GDP. Determinants of LAS Real Wage Labor market Price Level LAS Labor hours Real GDP Production function Real GDP Labor hours Determinants of LAS Change in labor supply • immigration • taxes on employees • transfers (UI, SS) • population growth • retirement Change in labor demand • worker productivity (also affects PF) • taxes on employer payroll Shifts in Production Function • capital/technology (also affects LD) • human capital Graphic analysis of changes in LAS (Change in Labor Supply) Effect on •Real wage •Employment •productivity Graphic analysis of changes in LAS (increase in labor productivity) Effect on •Real wage •Employment •Productivity Aggregate Supply Short-Run Aggregate Supply (SAS) Shows relationship between real GDP supplied and the price level, ceteris paribus A rise in the price level with no change in the money wage rate and other factor prices increases the quantity of real GDP supplied. • as P rises, real wage declines, firms want to hire more employees (movement along labor demand curve) The short-run aggregate supply curve (SAS) is upward sloping. Short Run Aggregate Supply Labor market SAS Production function As P rises, RW falls, L rises; RGDP rises Aggregate Supply Along the SAS curve, real GDP supplied might be above potential GDP… or below potential GDP. Aggregate Supply An increase in potential GDP shifts the LAS curve and the SAS curve shifts along with the LAS curve. Aggregate Supply A rise in the money wage rate Decreases short-run aggregate supply and shifts the SAS curve leftward. Has no effect on longrun aggregate supply. Aggregate Demand AD is the total amount of final goods and services produced in the United States that people, businesses, governments, and foreigners plan to buy. AD= C + I + G + (X – M.) AD depends on The price level Expectations about future Changes in wealth Fiscal and monetary policy The world economy Aggregate Demand The Aggregate Demand Curve plots the quantity of real GDP demanded against P. slopes downward for 2 reasons: Wealth effect Substitution effects Aggregate Demand Wealth Effect P increases real wealth decr C decr AD decr Substitution Effects •Intertemporal P incr int rate incr C & I decr AD decr • International P incr imports incr, exports decr AD decr Shifts in Aggregate Demand Expectations about future • Increases in expected future income increases C today increases AD. • Increase in expected future inflation buying goods cheaper today increases AD. • Increase in expected future profits investment increases increases AD Shifts in Aggregate Demand Fiscal Policy setting and changing taxes, transfer payments, and purchasing goods and services. An income tax cut or increase in transfers increases disposable income (income-taxes+ transfers) increases C increases AD An increase in government spending increases G increases AD Shifts in Aggregate Demand Monetary policy changes in interest rates and the quantity of money in the economy. An increase in the money supply reduces interest rates and increases aggregate demand. Shifts in Aggregate Demand Summary: Fiscal policy Monetary policy Value of $ Foreign income Macroeconomic Equilibrium SR Equilibrium: SAS=AD GDP can be above, below, or at potential GDP LR equilibrium LAS=SAS=AD Macroeconomic Equilibrium Graphical illustration of SR equilibria with 1. GDP>potential GDP (inflationary gap) 2. GDP<potential GDP (recessionary gap) 3. GDP=potential GDP (LR equilibrium) •Transition from GDP>potential GDP to LR equilibrium (inflationary gap) •Initially: • empl > equil. Empl • unempl < natural rate • R-wage < equil. R-wage • upward pressure on R-waqes • SAS shifts left until GDP=potential GDP •As economy moves to LR Equilibrium: Employment falls, Unemployment rises, Real wage rises, Real GDP falls •Transition from GDP<potential GDP to LR equilibrium (recessionary gap) •Initially: • empl < equil. Empl • unempl > natural rate • R-wage > equil. R-wage • downward pressure on R-waqes • SAS shifts left until GDP=potential GDP •As economy moves to LR Equilibrium: Employment rises Unemployment falls Real wage falls Real GDP rises SR/LR effect of changes in AD Effect of Increase in AD on real wage, prices, real GDP unemployment and employment.