* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download European housing crisis

Survey

Document related concepts

Transcript

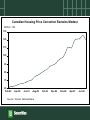

The financial and housing sector correction in Canada and Europe: Why so different? What does this mean for recovery? March 9, 2009 Millan L. B. Mulraine Economics Strategist Key takeaways • The spark for the global financial and economic crises was the sudden and dramatic correction in the U.S. housing sector • Seeds of the crises were sown in the post-tech bubble era of easy credit • It could be argued that the European housing market bubble was much bigger than in the U.S. • Exposure to the Central and Eastern European economies (CEEE) has added another dimension to the European banking system crisis • The Canadian banking and housing sectors have been spared the sudden correction that has plagued their European counterparts U.S. housing bubble • Housing – NINJA (No verification of INcome, Job status, or Assets) loans – High risk borrowers offered exotic loans – Speculation in home prices • Financial alchemy – Old mortgage lending model discarded – Mortgages bundled and sold – The securitization of mortgages led to loose lending standards • The bottom fell off – Mortgage defaults and foreclosures skyrocketed (jingle mail) – Value of mortgage-backed securities (MBS) plunged – MBS went from exotic to toxic The bursting of the bubble U.S. Home Prices 20 15 10 5 0 -5 -10 -15 -20 70 74 78 82 86 90 94 98 02 Median Price of Existing Single-Family Homes (y/y % chg.) 06 Banks take it on the chin Writedowns Due To U.S. Housing Crisis US$ 'billion 1,000 900 $850B 800 700 600 $494B 500 400 $327B 300 200 100 $29B $12B Asia Canada 0 Worldwide Source: Americas Europe Why no Canadian banking crisis? • Market structure – Deposit-oriented – Conservative lending practices – Captive market (oligopolistic in nature) – Competition vs stability • Regulatory environment – No allowance for domestic mergers (or foreign takeovers) – Deposit and mortgage insurance helpful • Hit from subprime crisis manageable – Limited exposure to U.S. MBS – Modest domestic housing correction Canadian Housing Price Correction Remains Modest 2005:6 = 100 135 125 115 105 95 85 75 65 Feb-99 Apr-00 Jun-01 Aug-02 Source: Teranet, National Bank Oct-03 Dec-04 Feb-06 Apr-07 Jun-08 Canadian Mortgage Arrears Remain Low % 0.75 0.65 0.55 0.45 0.35 0.25 0.15 Jan-90 Feb-92 Source: CBA Mar-94 Apr-96 May-98 Jun-00 Jul-02 Aug-04 Sep-06 Oct-08 The bursting of the bubble Canadian Home Sales Crash ' 000 45 40 35 30 25 20 15 Jan-90 Feb-92 Source: CREA Mar-94 Apr-96 May-98 Jun-00 Jul-02 Aug-04 Sep-06 Oct-08 European banks being squeezed US Housing Crisis European Banks’ Pain CEE Economic Crisis Domestic Housing Crisis European housing crisis • Housing boom – Housing sector bubble bigger than the U.S – Deregulation in the 1980s and 1990s, and Euro introduction • Non-banks were able to issue mortgages • Application procedure loosened • Low interest rates – Ireland, Spain and the U.K. main culprits – Spain built more homes in 2006, than Germany, France and (combined) • Credit-powered growth – Credit binge bolstered economic growth – Banks were more leverage than their U.S. counterparts – EU lacks institutional framework to handle banking crisis UK 1983 Source: IMF 1990 N Jap et he an rl an d N s or w ay S pa i U ni S w n te d ede K in n U ni gd te om d S ta te s Ita ly tr al i A a us tr B ia el gi um C an a D da en m ar Fi k nl an d Fr an G ce er m an y Ir el an d A us Mortgage Debt to GDP % 120 100 80 60 40 20 0 2006 European Real Home Prices 1997 = 100 300 Ireland 250 France Spain 200 150 United Kingdom Euro Area 100 50 1995Q1 Source: IMF 1997Q3 2000Q1 2002Q3 United States 2005Q1 2007Q3 Source: IMF U ni Ita ly n ed e w in pa Ja te pa n d S ta te Fi s nl a G nd er m an C y an ad A a us tr ia S S Ir N ela e U th nd ni e te rla d n K ds in gd om A us tr al ia Fr an c N e or w D ay en m a B rk el gi um House Price Gap % 35 30 25 20 15 10 5 0 -5 -10 Economic contagion • CEE growth opportunity – Credit-starved economies seen as “green pastures” – Credit binge: credit flowed like water (over US$1.7T borrowed) – Housing sector boom ensued – Unhedged foreign currency loans soared (Euro or SWF popular) • The hangover – CEE economies slowed – Domestic currencies plummeted – Debt-ridden consumers default – Impact on Western Europe is expected to be profound Liabilities To Foreign Banks % of GDP 160 140 120 Others 100 Italian Austrian 80 German Scandinavian 60 40 20 Source: IMF Tu rk ey bi a Se r d Po la n ia en Sl ov an ia R om ria Bu lg a R ep . . C ze ch ak R ep ia Sl ov ua n Li th ga ry H un ia La tv at ia C ro Es t on ia 0 Response betrays crisis • Fiscal response to CEE crisis – Support for CEE economies an imperative – Political vs economic costs – Fortunes of East and West intertwined • National response to financial crisis inadequate to resolving a Euroean problem – Exposes soft under-belly of the EU financial sector – May be a factor in exacerbating the problem – Small countries suffer from inadequate scale and resources The way forward • Coordinated fiscal response required • Canadian model has virtues that may be relevant • Unified regulatory/supervisory framework a necessity – Financial sector supervisory and regulatory functions remain fragmented and need to be consolidated – “Beggar thy neighbour policies” will lead to “race to bottom” • European financial stability fund? – A number of countries has similar funding vehicles The bottom line • Canadian housing and financial sector correction is expected to be modest • Mitigating the adverse impact of the economic crisis in the CEE will require significant financial resources • Despite the aggressive actions so far, further losses and bank failures remain likely • The way forward for Europe will be increased coordination in both fiscal and prudential policies • A turning point in the financial crisis will come about when home prices begin rising