* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

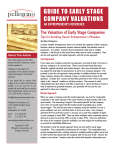

Download sample presentation - Wisconsin Investment Partners

Survey

Document related concepts

Advertising campaign wikipedia , lookup

Darknet market wikipedia , lookup

Global marketing wikipedia , lookup

Service parts pricing wikipedia , lookup

Marketing channel wikipedia , lookup

Market analysis wikipedia , lookup

Grey market wikipedia , lookup

Dumping (pricing policy) wikipedia , lookup

Product lifecycle wikipedia , lookup

Perfect competition wikipedia , lookup

Predictive engineering analytics wikipedia , lookup

Pricing strategies wikipedia , lookup

First-mover advantage wikipedia , lookup

Market penetration wikipedia , lookup

Product planning wikipedia , lookup

Transcript

Wisconsin Investment Partners 15-minute presentation template. Use this as a guide when creating your business presentation for early-stage investors. Each slide has a recommended amount of time to spend on it; there is a built in two-minute buffer in the presentation. Not all slides may fit your business model while others may need to be expanded to best communicate the business and strategy. Suggestions/comments are included on several slides. Remember to delete comments, time estimates and other misc items. <estimated time to spend on slide> Presentation suggestions: Not all slides may be applicable to your business model. Keep in mind the time allotments for each section, don’t over/under emphasize key points of the business. Many entrepreneurs spend too much time explaining their technology, science or product and not enough time explaining how they will make money. Keep slides simple and uncluttered, use as few words as possible—just bullet point the general idea you are addressing, leaving the in-depth explanation to the presenter. The main goal of the presentation is to communicate your vision and strategy enough to capture the investors’ attention and interest. There will be a number of follow-up meetings and information requests, but only if the investors are first excited and motivated by you, the business and strategy. Company Name/Logo Short Positioning Statement Your Name Title Give the audience a short explanation of the company’s main objective and who you are. Only include a “positioning statement” if it is very short, 3-5 words. <15 seconds> Business Overview and Strategy What do you do - what is your product/service/technology/science? What makes it different? What problem(s) are you solving? Give a road map of the business: we’re here now and are going in this direction. By end of slide your audience should know what you are selling and why people will buy it. Do not go into a lot of detail—this is a “bite-sized” overview. Keep in mind that you are setting the stage for the rest of the presentation. <30 seconds> “Business LogoTM” The Market – Our Solution Description of Current Market, Customer Needs Problem to Be Solved, what is creating the demand for your solution Key Feature – Solution to Problem How will the customer use your solution What is the economic benefit your offering delivers? Describe the customers’ needs for your product/service. What is the “problem” with the market as it is and how are you fixing that problem. Be clear and concise, this is a critical part of your business proposition and must grab an investor’s attention. Give just enough of an overview to build up to the next slide, which describes the Product/Service. This will give the investor-audience a general understanding of the market and why the product was created. <90 seconds> “Business LogoTM” Product/Service Product/Service Description 1 What is the product/service Key Feature – Value Proposition Science and technology behind the product/service Defensibility: IP protection/Patents, Barriers to entry Product/Service Description 2 (if needed) … Describe your product/service; what is your customer buying? Focus on what attributes make your product/service better and different than alternatives, even if there is not a direct comparable product/service. Defensibility may require its own slide. Many entrepreneurs focus too long on the product, especially if it is a technology or based on scientific data. Keep the science and technology light and easy—most investors are not PhD’s and will lose interest if the presentation gets too technical. <2 minutes> “Business LogoTM” Market Opportunity Target customer profile Describe the targeted customers Market size Quantify the target market through sizing the servable market by applying the above profile to the relevant market/segments If the market will be growing/expanding, explain Explain the size of the market that you are targeting. Remember to build your credibility – how do you know the market? Take care not to erode your credibility by overstating the market. Use good sources of information and statistics, such as trade organizations and marketing studies. Describe how your product/service fits into the market and what share of the market you will capture from launch through the first several years of business. If necessary, segment the market. Segmenting the market means you identify the specific portion of the market that contains those buyers that meet your targeted customer profile. If you have multiple market segments or targeted customers, repeat this slide as necessary. <90 seconds> “Business LogoTM” Sales Model Distribution Channels Channel 1 to market Channel 2 to market (if needed) … Sales cycle What are the general steps in the sales process How long does it take Describe how these channels successfully get your product into the hands of your customers—if necessary, describe for each segment. If possible/helpful, include an illustration How long is the sales cycle for your product(s)—being able to describe the sales cycle emphasizes your understanding of making the sale. <45 seconds> “Business LogoTM” You vs. the Competition Product 1 Your competitive advantage Competitors Competition’s response Product 2 (if needed) … Explain why your product(s) will succeed in the market place. What is your competitive advantage? List your competition; if numerous pick the top companies you compete against. Explain their products, market share, and how each one does not meet the needs that your product does—hit the same points as those for existing market alternatives in the “Product or Service Description” that explained why your product/service is better than these alternatives. How will your competitors react to your entering the market? Your competition might not be obvious, such as supplemental products or customer inaction. <1 minute> “Business LogoTM” Management Team Existing team and relevant experiences Include business and start-up experience Gaps in team experience and how being filled Many investors believe the management team is more important than the technology/product or the market opportunity. Explain how the management team’s experience and expertise is key to the company’s success. This slide can be moved to the front of the presentation, explain how the team’s experiences are relevant to the company and its strategy. <1 minute> “Business LogoTM” Advisors/Professionals Advisory Board (or Board of Directors) Short Description of Positions and Industry Experience Professional Team Attorney Accountant Banker <30 seconds> “Business LogoTM” Milestones accomplished Past Milestone 1 Past Milestone 2 … What have you accomplished so far? Brag a bit if you can— this could be stages of product development, major or pending sales, completing regulatory requirements, etc. The next slide covers the $ you are asking for, try to build up momentum for the “ask” by showing the company has already accomplished some goals. <30 seconds> “Business LogoTM” Financing Funding Sought - $X Use of Funds 1 Use of Funds 2 … Explain in general terms what the funding will be used for, examples are: sales and marketing, inventory, R&D, general and administrative, regulatory requirements, etc. <30 seconds> “Business LogoTM” Milestones after Funding Development Plan Milestone 1 Detail Milestone 2 Detail ... Critical Success Factors Critical Success Factor 1 What must happen for MS1 Critical Success Factor 2 What must happen for MS1 … What progress will investors see for their investment? What must go right to be successful? If this financing round gets you to cash flow positive, mention that as a milestone or in conjunction with a milestone. Are there any contingency plans if a Critical Success Factor does not happen? <1 minute> “Business LogoTM” Future Financing Future Funding Round 1 Expected Valuation Future Funding Round 2 Expected Valuation Milestones that must be completed to achieve expected valuation in FFR1 Milestones that must be completed to achieve expected valuation in FFR2 Describe the projected funding rounds with the expected valuations. Include milestones that must be completed to achieve expected valuations. This will give investors a sense of value creation and if/how much dilution they should expect in future rounds. <<Use this slide if you anticipate needing future funding rounds.>> <30 seconds> “Business LogoTM” Cash Flow Projections Table of Cash Flow Projections, example below <30 seconds> Company XYZ Cash Flows - in 000's Revenue Units sold Gross Margin % Gross Margin Operating Expenses Operating Income Funding Cash Flow Cumulative Cash Flows Year 1 100 10 10 10% 250 (240) 540 300 300 Year 2 200 20 50 25% 350 (300) (300) 0 Year 3 300 35 100 33% 400 (300) 400 100 100 Year 4 650 80 460 71% 450 10 Year 5 1200 1000 900 75% 600 300 10 110 300 410 “Business LogoTM” Ownership - Valuation Current ownership Debt structure Owners and their equity % Current valuation (Pre-money Valuation) Outstanding balance and terms (time and interest) Post investment ownership Owners and their equity % Valuation (Post-money Valuation) Valuation is often one of the most contentious discussions an entrepreneur will have with potential investors. It’s best to be prepared to discuss; however, only discuss Valuation if you are ready and can back up your assumptions. Many investors do not expect an entrepreneur to discuss valuation during their presentation, though it often comes up during the question and answer session afterwards. A back-up answer, if investors are pushing for one, could be to suggest a range the valuation could fall within, though that can result with investors focusing on the low-end of the range given. <30 seconds> “Business LogoTM” Exit Strategy Exit Strategy When/How can your investors cash out Expected valuation <15 seconds> “Business LogoTM” Company Name/Logo Short Positioning Statement Contact Name, Title Email Address Phone Number www.web-address.com Wrap up by restating the company’s main objective. <15 seconds>