* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download US-CT-APP-FC, [93-1 USTC ¶50,160], Ocean

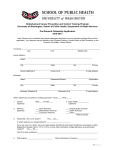

Survey

Document related concepts

Transcript