* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Nominal rigidity wikipedia , lookup

Non-monetary economy wikipedia , lookup

Ragnar Nurkse's balanced growth theory wikipedia , lookup

Full employment wikipedia , lookup

Pensions crisis wikipedia , lookup

Monetary policy wikipedia , lookup

Phillips curve wikipedia , lookup

Fear of floating wikipedia , lookup

Okishio's theorem wikipedia , lookup

Business cycle wikipedia , lookup

Exchange rate wikipedia , lookup

Fiscal multiplier wikipedia , lookup

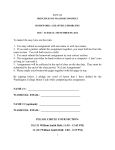

Selva Demiralp/ Erhan Artuc Econ 202, Midterm 2 April 24, 2007 DO NOT open the cover page until you are told to do so. You have 90 minutes. DO NOT cheat. If I or one of the proctors suspect that you are cheating or trying to cheat we will mark your exam right away and if you get two marks, your test will be sent to the Dean’s Office. You are NOT allowed to ask any questions during the exam. The questions are clear. If you cannot understand the question it means you don’t know the material well enough. You can only ask a question regarding the dictionary meaning of a word (but we will not explain technical terms which are the subject material of this course). You are NOT allowed to leave the room during the exam. If you need to use the restroom, do it before the test starts. Name: _________________________________________ Questions 1-3 are based on to the information below, however they are not interdependent and you can solve them separately. Consider a world in which all goods, services, capital, and money can be transferred from one country to another without any costs, barriers, tariffs or quotas. In this world, a large and powerful country called Bullyland invades another country called Farland, which increases Bullyland’s military spending substantially. Meanwhile, in another small country called Smalland economists are unpleasantly surprised by the increase in their real interest rates following this seemingly irrelevant war in Farland. 1. a) Graphically explain how the war affected real interest rates Smalland? (8 points) First draw the market for loanable funds for the world economy. Savings decline, and world interest rate increases. Next, draw the market for loanable funds for Smalland. They experience an increase in world interest rates, which increases their trade balance (i.e. NX increases). b) Predict what will happen to the real exchange rate of Smalland currency against Bullyland. A verbal answer is sufficient but you can use additional graph(s) if you think is necessary. (7 points) Draw the market for the real exchange rate (with S-I and NX). When investment declines, S-I shifts right, and the real exchange rate declines (depreciation). Intuitively, as investment declines, the supply of domestic currency increases, Exports increase, imports decline, and NX increases. 2. Now consider the following production function for Smalland: Y=K0.5L0.5 (Hint: MPL= 0.5 K0.5 / L0.5 and MPK = 0.5 L0.5 / K0.5) Before the war, total labor supply in Smalland is L=100, and total capital is K=16. a) State the labor demand and labor supply curves for Smalland mathematically, and calculate the equilibrium real wage. Next, plot labor supply and demand graphically, mark the equilibrium point. Finally calculate the equilibrium level of output. (10 points) Labor demand=MPL=0.5 K0.5 / L0.5 MPL=0.5 (16)0.5 / (100)0.5 =0.2 Real wage=MPL=0.2 Y=K0.5L0.5 =160.51000.5 = 40 Draw the labor market with vertical labor supply curve and downwards sloping labor demand curve, plot the equilibrium L=100 and real wage=0.2 b) If we know that real interest rates have doubled in Smalland after the war, what happens to nominal wages? (Hint: Assume that real interest rate is equal to the real rental rate) Give a numerical answer and illustrate it graphically in the labor market. Calculate the new level of output consequently. (10 points) r1=MPK=0.5 L0.5 / K0.5=0.5 (100)0.5 / (16)0.5=5/4 r2=2r1=5/20.5 L0.5 / K0.5=5/2 (0.5).10/ K0.5=5/2K=4 Y=K0.5L0.5 =40.51000.5 = 20 MPL=0.5 K0.5 / L0.5 =(0.5) 40.5/1000.5 =0.1 3. Assume that output and wages decreased in Smalland after the war. a) Do you think this war will affect job finding (f), and job separation (s) rates? (5 points) s: ratio of people who move from E to U: increases f: ratio of people who move from U to E: decreases b) Show how these rates will determine the equilibrium unemployment rate (u). Derive the relationship between u, s and f . Do not write the formula only. (5 points) If the unemployment rate remains constant (i.e. at steady state): fU = sE Substitute E = L – U into (1): fU = s(L – U) Divide both sides by L f (U/L) = s [1- (U/L)] (U/L)(f + s) = s U/L = s / (s + f) c) Will the unemployment rate increase or decrease? (5 points) As s↑, U/L↑ As f↓, U/L↑ ( U / L f > 0) s (s f) 2 (1) 4) Suppose that you are an economist working for the central bank when droughts across the country substantially reduce food production. a. Use the Aggregate Demand-Aggregate Supply model to illustrate graphically your policy recommendation to accommodate this adverse supply shock, assuming that your top priority is maintaining full employment in this economy. Be sure to label the axes, the curves, the initial equilibrium values, the direction the curves shift, and the final equilibrium values. State in words your policy recommendation as well as what happens to prices and output as a combined result of the supply shock and central bank policy. (10 points) Start with an initial SR and Long run equlibrium and shift SRAS up. The policy recommendation would be expansionary MP that shifts AD to the right. Output increases to potential GDP in the short run. Prices increase due to the price shock in the short run. Prices stay higher permanently. b. Would your recommentation change if your top priority was to keep prices stable ? Explain clearly using graphs as well as verbally as in part a. (10 points) This time, we would recommend doing nothing. In the long run. The economy will return to its initial equilibrium level with a decline in the price level and increase in the level of output. 5) Suppose the government decides to reduce the budget deficit by cutting government spending. a. Use the Keynesian-cross model to illustrate graphically the impact of a reduction in government purchases in equilibrium level of income in the short run. Be sure to label the axes, the curves, the initial equilibrium values, the direction the curve shifts and the final equilibrium values. (10 points) E line shifts down, reducing equilibrium Y. b. How does the size of change in government spending compare to the size of change in income. Explain clearly. (5 points) ∆Y > ∆G ∆Y/∆G = 1/ (1 – mpc) > 1 6 c. Graphically illustrate the impact of this reduction in government purchases in the loanable funds and IS framework. State in words and explain intuitively what happens to equilibrium levels of saving, investment, and the interest rate. (10 points) First, draw the initial equilibrium in the market for loanable funds and the IS curve side by side. The decline in G increases S for a given level of income and shifts the S curve to the right, reducing equilibrium real interest rate. On the right hand side, IS curve shifts down. d. What is the impact of this cut in government spending in the long-run? Simply explain in words. No graphics are necessary. (5 points) In the LR, prices decline, output returns to potential GDP. 7