* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download Ch13 - OCCC.edu

Survey

Document related concepts

Transcript

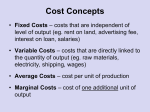

Chapter 13 Technology, Production, and Costs A. General Terms 1. Business Firm – an organization owned and operated by private individuals that specialize in production 2. Production – the process of combining inputs to make output Illustration: input Process production output 3. Decision Maker- person in the firm that decides on day to day actions of firm. If we are considering corporations this would be management. 4. Customer – purchasers of goods and services. It should be noted that they are HH, gov’t, and firms. 5. Profit – Total Revenue – Total Costs = Profit **We assume that firms are profit maximizers. They are not revenue or sales maximizers. 6. Stakeholder vs. Shareholder Model a. Stakeholder Model – in this model firms seek to maximize the benefit of all those that have an interest in the firm and not just the share price of the owners. Some goals are: -employment for people in the area -taxes for government -low pollution -sustainable business -maximize profit for owners b. Shareholder Model – this is what we typically assume. Those firms are in business to make profits for the owners. Although other interests might be considered it is all in attempt to earn higher profits. 7. Problems in Firms that Inhibit Profit Max a. Communication difficulty as the size becomes larger. So deciding on the optimal size is very important. b. Monitoring workers; this is the principal-agent problem that was discussed earlier. 1 B. Production 1. Technology – the means by which you combine inputs to produce output. We are not concerned with innovation unless is serves to increase productivity. -it is assumed fixed at a given point in time. 2. Short-Run vs. Long-Run a. Short-Run (SR) – a time horizon that has at least one variable fixed. For our purposes we assume that it is K. Generally only labor can change in the SR. b. Long-Run (LR) – When all variables are allowed to change. The time is arbitrary and depends on the industry or market. 3. Type of Inputs a. Fixed Input – input whose quantity does not vary as output goes up. In the SR we assume that K is fixed. b. Variable Input – input whose quantity changes as output goes up. 4. Production Function – This is a function that gives us the maximum output that can be produced for different combinations of inputs. It is over some specified period of time. In general: Q = f (K, L) if we look in the SR we look at Q = f (L) 5. Total Product Curve – (TPC) – this shows the maximum output graphically that can be obtained from a given combination of inputs. Graphically: Output (Q) Total Product (TP) Labor (L) L* Properties: (a) The curve increases at an increasing rate and then at a decreasing rate. This gives us MP and returns to scale 2 (b) The curve begins to slope back on itself beyond L*. So adding more labor beyond this only serves to drop productivity. We can say we max out productivity at L*. 6. Marginal Productivity of Labor and Average Product of Labor(MPL APL) – MPL -The additional output that results from increasing one more unit of labor. Note that one unit might not necessarily be one person. -we get this due to the fact that capital is fixed. After we move beyond the optimal K/L ratio marginal productivity starts to drop. APL – this is the average output per person. This is what a person produces on average. a. Mathematically: MPL = ∆ Q / ∆ L & APL = Q / L b. Finding with the Total Product Curve: Step 1: Draw and Label TP curve Step 2: Label 1-unit increments on the horizontal axis Step 3: Draw up to the curve and over to the Q-axis Step 4: Label MP’s on the vertical axis Graph 1: Getting MP Output (Q) MP4 Total Product (TP) MP3 MP2 MP1 Labor (L) L* Graph 2: Graph of MP’s and AP Output (Q) Marginal Product (MP) Average Product (AP) Labor (L) 3 7. Increasing and Decreasing Marginal Returns to Labor a. Increasing Marginal Returns to Labor – this is when the curve is increasing and an increasing rate (i.e. steep slope) and we get increasing MP’s. This can be seen above from MP1-MP3. b. Decreasing Marginal Returns to Labor – this is when the curve is increasing at a decreasing rate and we get MP’s dropping. This can be seen from MP3-MP4. C. Costs -Main objective of a firm is to maximize profits. This is the same thing as minimizing costs. Also, note that OC’s are included in costs for an economist. 1. Sunk Costs – cost that was paid in the past and cannot be recovered. It should not enter into present decisions. It might be more appropriate to model a cost as partially sunk rather than completely sunk. 2. Explicit vs. Implicit Cost a. Explicit – money paid for an input. This would be something like wages or rent. These costs include both direct and indirect accounting costs. b. Implicit – cost for an input that there is not a direct money payment. This is the OC for owners using resources. 3. Fixed vs. Variable Costs a. Fixed- cost of a fixed input. This is capital in the SR; rent of capital = r b. Variable – cost of an input that is allowed to vary with Q. This is labor in the SR; wages = w 4. Short Run (SR) vs. Long Run (LR) a. SR – this is the timeframe that is required to make at least one input fixed. We generally fix capital, due to its relative inability to change quickly. The time is completely arbitrary and depends on the market or industry. b. LR – this is the time that is required to make all inputs variable (both K, L). 5. Total Cost (SR) - this is the total cost associated with production. It included both fixed and variable components. a. mathematically: TC = TFC + TVC TFC - total cost of fixed inputs TVC - total cost of variable inputs 4 Total Cost (TC) Cost (C) b. graphically: Total Variable Cost (TVC) Total Fixed Cost (TFC) Output (Q) Note: the fixed cost is the distance between the TVC and TC. We know this due to the expression of TC - TVC = TFC 6. Average Costs (SR): To obtain average costs we simply divide by Q for all the total cost components. Mathematically: 1/Q * [TC = TFC + TVC] TC/Q = TFC/Q + TVC/Q ATC=AFC + AVC Note: we still have that total cost is a function of both the fixed and variable components. a. AFC - the fixed cost component of each unit of production. As Q ↑ we find that AFC ↓. This is due to the fact that Q increases TFC remains constant. b. AVC – the variable costs component of each unit production. We can also derive the shape form the TVC curve. We see that TVC flattens out, so AVC must be getting smaller and eventually reach a low point. As Q ↑ we see that TVC rises quickly, so AVC must rise. This gives us a typical U-shape. c. ATC – the total cost per unit of production. It is u-shaped and mimics the shape of the AVC curve. Note: that ATC and AVC get closer together as Q ↑ due to the fact that ATC=AFC + AVC and AFC is getting smaller (i.e. getting closer to 0) as Q ↑. Graphically: MC Cost/Unit ATC AVC AFC Q 5 7. Marginal Cost (MC) – this is the additional cost associated with one more unit of production. It might not be the case that 1-unit = 1 (i.e. 1-unit could be 25 pieces of output). a. mathematically: MC = ∆ Total Cost / ∆ Q = ∆ Total Variable Cost / ∆ Q b. note that MC intersects AVC and ATC at their lowest point. This all stems from the fact that: marginal > avg avg ↑ marginal < avg avg ↓ marginal = avg same c. The curve looks the way it does based on the productivity of labor. If we look at the APL we can see that as it tops out we get MC hitting its lowest point. Q MC Cost APL L Q L* Q* If we look at the curves above we note that as average product is at its max we get marginal costs as their lowest points. This is due to the expressions below. 8. LR Costs -Recall that in the LR we have that all inputs are allowed to vary. So due to this fact we make certain assumptions about our LR cots. a. Least Cost Rule – at any level of Q, a firm chooses the mix of K, L that minimizes cost for that level of Q. We assume that there is some positive level of production or Q > 0. b. LR Total Cost (LRTC) – the cost of producing at each level of output. Recall that in the LR we have no FC, so if Q = 0, then there is no cost. c. Long Run Average Cost- (LRAC) – this is the LR cost per unit. It is the minimum of all SRATC curves due to the fact that in the LR each firm will choose the least cost amount of K, L to produce at each unit. So given this choice once you choose output, you choose the K, L that minimizes this cost due to the profit maximizing assumption. Mathematically: LRAC = LRTC / Q 6 d. Long Run Marginal Cost – (LRMC) – this is the marginal cost per unit. It is LRTC mathematically: MC = ∆ LR Total Cost / ∆ Q note: It is derived in the same way as all MC’s and has the same relationship to LRAC as we defined earlier for the SR curve. Comparing SR vs. LR LR cost curves are different from the SR because we have both K and L able to vary in the LR, while in the SR we must include fixed costs. When a decision-maker chooses in the LR all possible combinations of K, L and scales of production are possible for the goal of profit maximization. Note: A LRTC curve starts at (0, 0) while a SRTC curve does not. This is due to no sunk costs in the LR. Cost/Unit LRMC LRAC LRTC Q Q The LTC illustrates total cost in the LR. Costs go up and then begin to increase less rapidly and then increase in rate past a certain point. This is directly due to the U-shape of the LRAC. After LRAC begins to increase the LTC begins to increase faster. This is due to the fact that the cost per unit is going up. The LRAC has its shape because of the LRMC. We get an increase in MC because productivity begins to drop as we use inputs more intensively. The LRMC intersect the LRAC at its lowest point. If LRMC<LRAC then LRAC is decreasing and when it is greater LRAC is increasing. Note: (1) Show how to derive the LRAC & (2) Show how to go from LR to SR back to LR. 9. Returns to Scale – refers to how costs are affected as we increase or decrease output level. a. Economies of Scale - Economies of scale refer the decreasing costs on a LRAC curve. The costs decrease for two reasons: (i) as scale increases the costs decrease due to use of larger or more efficient capital 7 (ii) as there is an increase in production there are decrease in costs due to specialization and learning. b. Diseconomies of Scale - refer the increasing costs on a LRAC curve. The costs increase for two reasons: (i) as scale increases the costs increase due to the fact that communication and cohesion between departments and units becomes more difficult. (ii) as there is an increase in production it becomes more difficult to oversee workers. There is little oversight or the principal-agent problem. Note: Constant returns to scale can also occur. This is when we have costs constant as Q increases LRAC Cost/Unit Economies of scale Diseconomies of scale Q D. Profit Maximization in General -assume that firms are profit maximizers. This is the goal of all firms which is akin to cost minimization. 1. Types of Profit a. accounting profit – this does not include OC. b. economic profit – this is TR-TC (explicit and implicit costs) -explicit costs – where money is paid for the use of resources -implicit costs – the OC that is incurred for using your resources of production Note: to determine how firms operate and make decision we assume that they look at economic profit and not accounting profit. ** we can look at economic profit as the above normal rates of return that are gained by going into business. 8 2. Reasons for Profit a. risk-taking – people are rewarded for the risks that they bear while going into business. b. innovation – people are rewarded for new ideas and thoughts. This means that property rights somehow have to be enforced. Ex. New technology or method of production, new location, etc… 3. Firms Constraints and How they Factor into Profit -these are the things that limit a firm in production a. Demand or Quantity Constraint – this is the Qd that will be demanded by consumers from a firm. We should note that once a Q is chosen the price that firms can charge is automatically determined by finding the corresponding P on the demand curve. - a firm can choose either P or Q, but not both. b. Total Revenue – This is the total amount received by selling output. It would be summing up all the prices of G/S sold or if price is the same: TR = P * Q c. Cost Constraint – This is the budget that a firm has. We assume that a firm is only spending on K, L for simplicity. TC = r*K + w*L -after a firm determines Q it determines the optimal amount of K, L to produce that Q at the least cost. -both of these constraints give us profit 4. Profit Maximization: Two Methods a. Total Approach – this uses both TC and TR to find the optimal Q that gives the most profit for a firm. We simply find where TR and TC are the farthest distance apart. Graphically: TC C, R or $ TR (Market) Q Q* 9 Profit Max = Q* We can see it is the farthest distance between TR and TC. It is also the case at Q* that the tangent lines are parallel at Q*. b. Marginal Approach – Here we use marginal cost and marginal revenue to find profit max. This comes directly out of the fact that the tangent lines are parallel at profit max output in the total approach. i. Marginal Cost – The change in total cost by selling one more unit. ii. Marginal Revenue – The change in TR that occurs when we sell one more unit. Mathematically: MR = ∆ TR / ∆Q -we note that MR is dropping since by the law of demand we must drop price to sell more Q. iii. MR vs. MC MR > MC the increase Q since you are earning profit MR < MC decrease Q since you are losing money on these units sold MR = MC Stop! Any Q beyond this point will result in less profit and any point before this will imply you could earn more by selling more. Graphically: C, R or $ MC Profit Q Q* MR -this is going to be the method that we employ most often in future lectures Note: if the MC hits the MR curve twice then use the second point. Also, the Q* from both approaches gives you the same results. The methods just differ in how they arrive at the same conclusion. 5. Motivation for Firms to Profit Maximize -if they didn’t they would have to face these actions a. Other firms entering the market and selling a similar or same product at a lower price. b. Other firms could take over the existing firm and use their set-up to operate more efficiently and earn greater profits. c. S/h could rebel and demand that MGT is changed by going through the BOD. This would ensure that the people that run the company are striving for profit max. 10 6. Shutdown Rule a. SR- If a firm is not covering costs (i.e. P < ATC) then it must decide whether to continue production or not. This is the shutdown decision. Rule: (1) If we have P > AVC then keep producing. This is due to the fact that they are covering costs of production of the units and on top of that they are recouping some of the fixed/sunk costs that were incurred to start production. This is the same as loss minimization. (2) If we have P < AVC stop production b/c you are not even covering the costs of producing the units. This means you are furthering your losses, so you should shutdown. b. LR – If a firm cannot cover costs in the LR even if it can choose the optimal K, L to produce a given quantity then either don’t start producing or stop producing. Note: it could be the case that market changes (i.e. P changes) or that costs change thereby changing the results above. This might lead to a different conclusion. 7. Principal-Agent Problem – this is when we have agents of the firm that have a different objective than profit max. They want to keep their job and might try to maximize something other than profit. To solve for this it is generally the case that you either: a. Tie compensation back into profitability. This ensures that s/h goals and MGT goals are the same. b. Give the workers a stake in the Co. This gives them the same motivation as s/h and will motivate them to gear their work towards this goal. 11