* Your assessment is very important for improving the workof artificial intelligence, which forms the content of this project

Download EOCT Review Unit One - Mr. Zittle`s Classroom

Survey

Document related concepts

Transcript

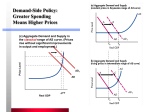

Spring 2012, Economics EOCT Review Unit One Chapters 1, 2, 3 Fundamental Economic Concepts 1. What is Economics? 2. What is Scarcity? 3. What are the 4 factors of Production? 4. What are the 3 basic questions of economics? 5. What is the difference between consumer and producer goods? 6. Explain the paradox of value. 7. Define Utility. 8. Draw and explain the Circular Flow of Economic Activity 9. Define trade offs. 10. Define opportunity cost. 11. Draw and explain a production possibilities curve/frontier. 12. How is cost-benefit analysis used in economic decision making? 13. Complete the chart Economic System Traditional Market Command Definition Advantages Disadvantages Examples 14. List and explain the United States’ SEVEN Economic and Social Goals 15. What are the five key Characteristics of Capitalism and Free Enterprise 15 What is the role of the Consumer, Government, and Entrepreneur in Capitalism? 16 Complete the chart Sole Proprietorships Limited partnerships General partnerships Corporations Definition Advantages Disadvantages 17. What are the reasons a company would merge with another company? 18. What is the difference between a vertical and a horizontal merger and a conglomerate? 19. What is the purpose of the Chamber of Commerce? 21. How do labor and professional unions use collective bargaining? Unit 2 Ch. 4,5,6,7 Microeconomics 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. What is microeconomics? What are the three criteria a person must meet in order to be in demand for a product? Explain the law of demandWhat is marginal utility? Explain the concept of diminishing marginal utility. Illustrate the difference in a change in demand and a change in quantity demanded. Explain how income effect and substitution effect will cause a change in quantity demanded. What are the 6 determinates (factors) that will cause a change in demand. What is demand elasticity? Define and draw a demand curve to illustrate the following: Elastic Demand, Inelastic Demand, Unit Elastic Demand What are the three questions you can use to determine demand elasticity? Explain the Law of supplyWhat is the difference between a market supply curve and an individual supply curve? Define and illustrate the difference between a change in supply and quantity supplied. What are the 8 determinates (factors) that cause a change in supply? What are the questions that you would ask to determine elasticity of supply? 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. What is the theory of production? What is the difference between the long and the short run? Explain and illustrate the 3 Stages of Production What is the difference between total and marginal product? What is the difference between fixed and variable cost? What is the difference between total and marginal cost? Where are profits maximized? What is the difference between total revenue and marginal revenue? What are the advantages of having a price system? What is rationing and what problems may occur under a rationing system? Define and illustrate market equilibrium, surplus, shortage, equilibrium price, price floor, price ceilingExplain how the government aids the agriculture industry by stabilizing price and guaranteeing a specific price level for their products. Explain the phrase “Laissez-faire”What are the 5 conditions needed in order for a market to be perfectly competitive? What is monopolistic competition? Why and how do producers use product differentiation and non-price competition to try and gain an advantage in the market? How might the few large firms in a oligopoly work together to control the market? What are the different types of monopolies (4) Are all monopolies bad for consumers? Explain What is a market failure? What are public goods? How can externalities be positive and negative? Provide an example of each What is price discrimination? What is a Trust? Why is it said that we in the USA have a modified Free enterprise economy List a few examples of how our government regulates our economy. How does our government try to internalize externalities? Unit 3a Macroeconomics: Institutions Chapter 8 1. What is Macroeconomics? 2. What is the civilian labor force? 3. Define the following terms: Strike, Picket, Boycott, Lockout? 4. What is the difference between mediation and arbitration? 5. What are the 4 categories of labor? 6. What is minimum wage? 7. What is the difference between real and current dollars? Chapter 9 8. What are the 4 different types of taxes? Define and Explain. 9. What is the IRS? 10. Define the following types of taxes: Estate, Excise, Gift, Luxury, Sin 11. What is a Flat tax? Chapter 10 12. What is the private sector? 13. What are the two types of Government spending? 14. What is a transfer payment? What is grant in aid? 15. What are the three main impacts of government spending? 16. What is the difference between mandatory and discretionary spending? 17. What are the three largest spending categories within the federal budget? 18. What are intergovernmental expenditures? 19. What is deficit spending? 20. What is the difference between public and private debt? 21. What is a line item veto? 22. What are entitlements? 23. What are the three functions of money? 24. What are the four characteristics of money? 25. What is fiat money? 26. What is the Federal Reserve System? 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. What is the FDIC? Describe each of the following: Savings Banks, Credit Unions, Savings and Loan Associations. Explain the circular flow of funds on page 315. What is a mutual fund? What is a 401k? Discuss the bond rating system. What is the difference between a treasury bond and treasury note? What is the NYSE? What is the Dow-Jones Industrial Average? What is the difference between a bear and a bull market? Describe the different types of markets: futures, spot, option. Unit 3b Macroeconomic Policies Chapter 13 1. What is Gross Domestic Product? 2. What are the 4 main transactions not included in GDP? 3. What is Gross National Product? 4. What is not included in GNP? 5. What is inflation? 6. What is a price index? What are the main two price indexes? How do you construct a price index? 7. What is the difference in Real GDP and Current GDP? 8. How has the population of the United States changed over time? 9. What is per capita GDP? 10. What is standard of living? 11. Draw and label the different phases of the business cycle. Describe characteristics in each phase. 12. What are the five things that can cause the business cycle to change phases? 13. Who is considered to be unemployed? 14. How do you calculate unemployment rate? Who is left out? 15. What is full employment? 16. What are the five types of unemployment? Describe each. 17. What is deflation? 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. List the causes of inflation. What are the main reasons for income inequality? Discuss 6 different types of anti-poverty programs. Describe the structure of the Federal Reserve. Include the Board of Governors, Federal Reserve District Banks, FOMC, Advisory Committees, Member banks What is monetary policy? What is the difference between tight and easy money policies? What are the 6 tools of monetary policy the FED can use? Describe how each is used in as part of a tight and easy money policy. What is stagflation? What is misery index? Explain aggregate demand and aggregate supply? How do you find Macroeconomic equilibrium? What is fiscal policy? Explain the difference between Supply-side and Demand-side policies? What is Keynesian Economics? Unit 4 International Trade 1. 2. 3. 4. 5. 6. 7. 8. 9. What is the difference between absolute and comparative advantage? What is the key to a nation having comparative advantage? How does specialization affect world output? Define a balance of trade. Define a balance of payment. What is the difference between the two balances above? Define: Tariff, Quota, Embargo, Subsidies What is the difference between protectionism and free trade? What are the benefits and costs of the trade policies above? 10. 11. 12. 13. 14. 15. 16. 17. Identify the purpose and membership of the following trade blocs: EU, NAFTA, ASEAN What is meant by exchange rate? What things affect a currency’s exchange rate? When a nation’s currency appreciates, who benefits and who loses? A meal that costs 3,000 Japanese Yen would cost ___________ in U.S. Dollars. A BMW that costs 85,000 Euros would cost _____________ in U.S. Dollars. To a Canadian tourist in the United States, a $9 movie ticket would be worth __________ Canadian dollars. Use an exchange rate table (like below) to calculate the value of currency. US Dollar 1 US Dollar = 1 Euro 0.78877 1 Japanese Yen British Pound Swiss Franc Canadian Dollar 91.97000 0.68559 1.21820 1.29580 116.91000 0.86660 1.53800 1.63540 0.00738 0.01297 0.01381 1.75740 1.87048 1 Euro = 1.26780 1 Japanese Yen = 0.01087 0.00855 1 British Pound = 1.45860 1.15393 135.44812 1 Swiss Franc = 0.82088 0.65020 77.07285 0.56902 1 1 Canadian Dollar = 0.77172 0.61147 72.41371 0.53462 0.93955 1 1 1.06434 1 Unit 5 Personal Finance 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. What role do incentives play in rational economic decision-making when deciding answer to problems like; Buy now or buy later? Put money in savings account or spend it? Go to college or get a job? What services are offered by the different financial institutions? What is the difference between a commercial bank, savings and loan association and a credit union? What purpose does the FDIC serve? How do banks make a profit? What is the difference between interest charged and interest earned? With investments, what is the relationship between risk and return? Explain the difference between stock and bonds. Rank the following investments from most risky to least risky. Savings account, government bonds, corporate bonds, junk bonds, common stock. What is a mutual fund? Compare and contrast this to purchasing stock. Who benefits, and who loses from inflation? Define progressive, regressive and proportional taxes. How does a sales tax affect different income groups? What factors affect a person’s credit? What is the difference between simple and compound interest? List types of insurance. What costs and benefits are associated with the types of insurance? What is an insurance premium? Identify skills which are required to be successful in the workplace. Why is investment in education, training and skill development important?