form 6-k securities and exchange commission - corporate

... Net income attributable to shareholders in 4Q15 totaled Ch$83,783 million (Ch$0.44 per share and US$0.25/ADR), decreasing 35.2% QoQ and 39.6% YoY. The Bank’s ROAE reached 12.4% in the quarter. 4Q15 results include a non-recurring pre-tax provision of Ch$35,000 million related to the new provisionin ...

... Net income attributable to shareholders in 4Q15 totaled Ch$83,783 million (Ch$0.44 per share and US$0.25/ADR), decreasing 35.2% QoQ and 39.6% YoY. The Bank’s ROAE reached 12.4% in the quarter. 4Q15 results include a non-recurring pre-tax provision of Ch$35,000 million related to the new provisionin ...

The Myth of Home Ownership and Why Home Ownership is Not

... imputed value of the income they receive when they "rent" their homes from themselves. While this owner equivalent rental benefit may be hard to quantify, it is available to all homeowners. In contrast, the most significant tax benefits help only certain homeowners, primarily taxpayers in the highes ...

... imputed value of the income they receive when they "rent" their homes from themselves. While this owner equivalent rental benefit may be hard to quantify, it is available to all homeowners. In contrast, the most significant tax benefits help only certain homeowners, primarily taxpayers in the highes ...

Optimal sovereign debt policy with private trading: Explaining

... growth (slowing down a convergence to the steady state). In this paper, however, we focus on how the market openness can amplify the mechanism of generating negative relationship between growth and public capital flows in Aguiar and Amador (2011). When private agents can access to the international ...

... growth (slowing down a convergence to the steady state). In this paper, however, we focus on how the market openness can amplify the mechanism of generating negative relationship between growth and public capital flows in Aguiar and Amador (2011). When private agents can access to the international ...

Money, Banking, and the Financial System

... •Not surprisingly, many financial advisers have warned investors that buying bonds could be risky. •In this chapter, we study how investors take into account expectations of inflation, as well as other factors, such as risk and information costs, when making investment decisions. •An Inside Look at ...

... •Not surprisingly, many financial advisers have warned investors that buying bonds could be risky. •In this chapter, we study how investors take into account expectations of inflation, as well as other factors, such as risk and information costs, when making investment decisions. •An Inside Look at ...

Diversification, Pricing, Policy and Credit Union Risk

... entering new, high risk, activities. In addition, Jensen (1986) and Stulz (1990) note that diversification of activities may be associated with high agency costs if the diversification arises from the accumulation of excess free cash and resources. This generates an overinvestment problem and may th ...

... entering new, high risk, activities. In addition, Jensen (1986) and Stulz (1990) note that diversification of activities may be associated with high agency costs if the diversification arises from the accumulation of excess free cash and resources. This generates an overinvestment problem and may th ...

`Open Access` in Electricity - Central Electricity Regulatory Commission

... – The calculation of rate base should ensure that the tariff allows a return component which covers both ROE as well as interest cost of debt. – There are various options for calculating the rate base from the asset side & liability side. – The most prudent option would be one which allows flexibili ...

... – The calculation of rate base should ensure that the tariff allows a return component which covers both ROE as well as interest cost of debt. – There are various options for calculating the rate base from the asset side & liability side. – The most prudent option would be one which allows flexibili ...

Grade 9 Lesson #5 Does Money Really Grow on Trees? SS.912.FL

... in a passbook when then customer visits their financial institution, or on a statement issued periodically (often monthly). However certain types of withdrawals on basic savings accounts including checks, debit card purchases and electronic transfers are limited by federal law to just six per month. ...

... in a passbook when then customer visits their financial institution, or on a statement issued periodically (often monthly). However certain types of withdrawals on basic savings accounts including checks, debit card purchases and electronic transfers are limited by federal law to just six per month. ...

Investing in Real Estate in a Shariah Compliant Way

... Halal – that which is permitted or compliant Haram – that which is not permitted Riba – charging of interest Gharar – the taking of unreasonable risk; gambling Sukuk – Shariah compliant debt Ijara – Shariah compliant lease Takaful – Shariah compliant form of insurance Maduraba/Musharaka – forms of p ...

... Halal – that which is permitted or compliant Haram – that which is not permitted Riba – charging of interest Gharar – the taking of unreasonable risk; gambling Sukuk – Shariah compliant debt Ijara – Shariah compliant lease Takaful – Shariah compliant form of insurance Maduraba/Musharaka – forms of p ...

Margin Credit and Stock Return Predictability

... invests 100% in the S&P 500 or 100% in the risk free asset. This strategy can be implemented even by small investors who do not trade in the S&P 500 futures market. We find that this long-only strategy also out-performs the simple buy-and-hold strategy by a large margin. It generates a Sharpe Ratio ...

... invests 100% in the S&P 500 or 100% in the risk free asset. This strategy can be implemented even by small investors who do not trade in the S&P 500 futures market. We find that this long-only strategy also out-performs the simple buy-and-hold strategy by a large margin. It generates a Sharpe Ratio ...

Commercial Law Developments 2010

... at closing, and the debtor claims no DVD was provided, that did not render the collateral description inadequate. However, the collateral description did not cover software and customer lists developed or acquired after the closing. Such things are not “products” even though the debtor could not hav ...

... at closing, and the debtor claims no DVD was provided, that did not render the collateral description inadequate. However, the collateral description did not cover software and customer lists developed or acquired after the closing. Such things are not “products” even though the debtor could not hav ...

Introducing the J.P. Morgan Emerging Markets Bond Index Global

... Current face amount outstanding The list of U.S. dollar-denominated sovereign and quasisovereign issues from index-eligible countries is narrowed further by only considering issues with a current face amount outstanding of US$500 million or more. If an issue’s current face outstanding falls below th ...

... Current face amount outstanding The list of U.S. dollar-denominated sovereign and quasisovereign issues from index-eligible countries is narrowed further by only considering issues with a current face amount outstanding of US$500 million or more. If an issue’s current face outstanding falls below th ...

Financial Statements Mott Community College Flint, Michigan

... Statement of Revenues, Expenses and Changes in Net Assets The Statement of Revenues, Expenses and Changes in Net Assets provides the overall results of the College’s operations. It includes all funds of the College except for activities of Agency Funds. Revenues and expenses are recorded and recogni ...

... Statement of Revenues, Expenses and Changes in Net Assets The Statement of Revenues, Expenses and Changes in Net Assets provides the overall results of the College’s operations. It includes all funds of the College except for activities of Agency Funds. Revenues and expenses are recorded and recogni ...

Firm Dynamics and Financial Development

... robustness of the results, we also include in the investigation measures that control for the two other leading theories for firm dynamics, which are based on selection mechanisms and mean reversion in the accumulation of factors of production. We find that even after introducing these controls, fin ...

... robustness of the results, we also include in the investigation measures that control for the two other leading theories for firm dynamics, which are based on selection mechanisms and mean reversion in the accumulation of factors of production. We find that even after introducing these controls, fin ...

The Tragedy of the Mortgage Commons

... lender evaluates whether the borrower has the income to service the debt, whether he has a good payment history with other debts, and whether he has enough invested in the property so that there is something at stake to prevent non-payment. The lender must also evaluate the property to see if the se ...

... lender evaluates whether the borrower has the income to service the debt, whether he has a good payment history with other debts, and whether he has enough invested in the property so that there is something at stake to prevent non-payment. The lender must also evaluate the property to see if the se ...

Tips for Avoiding a Predatory Mortgage Loan

... ing the home (e.g., real estate agent fees). Such a sale also would allow you to avoid late and legal fees and damage to your credit rating, and protect your equity in the property.. Short Sale: Your servicers may allow you to sell the home yourself before it forecloses on the property, agreeing to ...

... ing the home (e.g., real estate agent fees). Such a sale also would allow you to avoid late and legal fees and damage to your credit rating, and protect your equity in the property.. Short Sale: Your servicers may allow you to sell the home yourself before it forecloses on the property, agreeing to ...

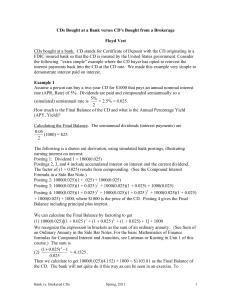

CDs Bought at a Bank verses CD`s Bought from a Brokerage Floyd

... (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2% nominal rate. By this activity, you will be demonstrating earning interest on interest and deriving a formula for calculating the Final Balance. (b) Draw and label a time line. (c) ...

... (a) Do a derivation similar to the above Example 1 for a semiannual two-year bank CD of $10,000 that pays an annual 2% nominal rate. By this activity, you will be demonstrating earning interest on interest and deriving a formula for calculating the Final Balance. (b) Draw and label a time line. (c) ...

Debt Refinancing and Equity Returns

... controlling for the immediacy of debt refinancing. In the model, the firm optimizes its capital structure by jointly choosing the amount of debt as well as the maturity structure of debt. The firm has to refinance debt according to its maturity structure and shareholders commit to cover potential sh ...

... controlling for the immediacy of debt refinancing. In the model, the firm optimizes its capital structure by jointly choosing the amount of debt as well as the maturity structure of debt. The firm has to refinance debt according to its maturity structure and shareholders commit to cover potential sh ...

Government Bonds in Domestic and Foreign Currency

... foreign currency across countries, as well as the share of public bonds denominated in foreign exchange. We also want to cover the largest sample of countries and the longest time period available, comprising both domestic and international issuance, and detailing the currency choices. Data sources ...

... foreign currency across countries, as well as the share of public bonds denominated in foreign exchange. We also want to cover the largest sample of countries and the longest time period available, comprising both domestic and international issuance, and detailing the currency choices. Data sources ...

presentation slides

... Figure 14. This figure depicts the lending relationships examined in the model. A foreign bank branch lends to local borrowers in dollars and finances its lending from the wholesale dollar funding market. ...

... Figure 14. This figure depicts the lending relationships examined in the model. A foreign bank branch lends to local borrowers in dollars and finances its lending from the wholesale dollar funding market. ...