FREE Sample Here

... LOC: acquire knowledge of financial markets and interest rates 36. What is a fiduciary? a. Someone who performs ratio analysis for a corporation. b. Someone who invest and manages money on someone else’s behalf. c. Someone who manages the release of a initial public offering. d. Someone who evaluate ...

... LOC: acquire knowledge of financial markets and interest rates 36. What is a fiduciary? a. Someone who performs ratio analysis for a corporation. b. Someone who invest and manages money on someone else’s behalf. c. Someone who manages the release of a initial public offering. d. Someone who evaluate ...

DOC - Investor Relations

... The Company provides for income taxes at the end of each interim period based on the estimated effective tax rate for the full year in addition to discrete events which impact the interim period. The Company’s effective tax rate differs from the U.S. statutory rate principally due to the rate impact ...

... The Company provides for income taxes at the end of each interim period based on the estimated effective tax rate for the full year in addition to discrete events which impact the interim period. The Company’s effective tax rate differs from the U.S. statutory rate principally due to the rate impact ...

csx corporation - corporate

... In June 2011, the Financial Accounting Standards Board issued an Accounting Standards Update to the Comprehensive Income Topic in the ASC aimed at increasing the prominence of items reported in other comprehensive income in the financial statements. This update requires companies to present comprehe ...

... In June 2011, the Financial Accounting Standards Board issued an Accounting Standards Update to the Comprehensive Income Topic in the ASC aimed at increasing the prominence of items reported in other comprehensive income in the financial statements. This update requires companies to present comprehe ...

Glove Manufacturers

... Source: AllianceDBS, Bloomberg Finance L.P. Closing price as of 6 Jan 2017 Hartalega Holdings Berhad : Hartalega is a niche player in nitrile gloves (94% of sales volume). It has the largest nitrile glove capacity among the glove makers under our coverage. Top Glove Corporation : Top Glove is the wo ...

... Source: AllianceDBS, Bloomberg Finance L.P. Closing price as of 6 Jan 2017 Hartalega Holdings Berhad : Hartalega is a niche player in nitrile gloves (94% of sales volume). It has the largest nitrile glove capacity among the glove makers under our coverage. Top Glove Corporation : Top Glove is the wo ...

FSB Securities Lending and Repos: Market Overview and Financial

... At the Cannes Summit in November 2011, the G20 Leaders agreed to strengthen the regulation and oversight of the shadow banking system, and endorsed the Financial Stability Board (FSB)’s initial recommendations 1 with a work plan to further develop them in the course of 2012. 2 Five workstreams have ...

... At the Cannes Summit in November 2011, the G20 Leaders agreed to strengthen the regulation and oversight of the shadow banking system, and endorsed the Financial Stability Board (FSB)’s initial recommendations 1 with a work plan to further develop them in the course of 2012. 2 Five workstreams have ...

four cornerstones of financial literacy

... If You Can’t Pay All your Bills this Month, PRIORITIZE. 1. Start with food and medical essentials. Groceries are essentials, but meals out are not. Doctor visits or prescriptions to treat medical problems are priority, but paying old doctor bills are not. (Eventually, you must deal with these, but t ...

... If You Can’t Pay All your Bills this Month, PRIORITIZE. 1. Start with food and medical essentials. Groceries are essentials, but meals out are not. Doctor visits or prescriptions to treat medical problems are priority, but paying old doctor bills are not. (Eventually, you must deal with these, but t ...

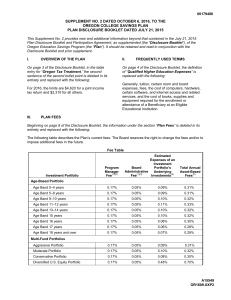

Disclosure Booklet - Oregon College Savings Plan

... Changes in interest rates can change the price of fixed-income investments. In general, changing interest rates could have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. The risk is heightened to the extent a mutual fund invests in long ...

... Changes in interest rates can change the price of fixed-income investments. In general, changing interest rates could have unpredictable effects on the markets and may expose fixed-income and related markets to heightened volatility. The risk is heightened to the extent a mutual fund invests in long ...

Returning Cash to the Owners: Dividend Policy

... The Signalling Story: Dividends can be signals to the market that you believe that you have good cash flow prospects in the future. The Wealth Appropriation Story: Dividends are one way of transferring wealth from lenders to equity investors (this is good for equity investors but bad for lenders) ...

... The Signalling Story: Dividends can be signals to the market that you believe that you have good cash flow prospects in the future. The Wealth Appropriation Story: Dividends are one way of transferring wealth from lenders to equity investors (this is good for equity investors but bad for lenders) ...

INFORMATION STATEMENT of BNP Paribas, a French incorporated

... regulator, the Financial Stability Board, the French deposit guarantee fund and, potentially, the European Central Bank) to prevent and/or resolve banks’ financial difficulties, such as the power to require banks to adopt structural changes, issue new securities, cancel existing equity or subordinat ...

... regulator, the Financial Stability Board, the French deposit guarantee fund and, potentially, the European Central Bank) to prevent and/or resolve banks’ financial difficulties, such as the power to require banks to adopt structural changes, issue new securities, cancel existing equity or subordinat ...

WHEDA Advantage Policies and Procedures Manual

... Becoming a WHEDA Lender ............................................................................................................ 14 ...

... Becoming a WHEDA Lender ............................................................................................................ 14 ...

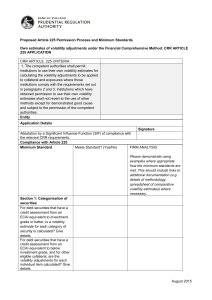

Proposed Article 225 Permission Process and

... length of the effective observation period is at least one year. The data sets and calculated volatility adjustments are updated at least once every three months. Data sets are also reassessed whenever market prices are subject to material changes. Indicate whether intend to use an internal model fo ...

... length of the effective observation period is at least one year. The data sets and calculated volatility adjustments are updated at least once every three months. Data sets are also reassessed whenever market prices are subject to material changes. Indicate whether intend to use an internal model fo ...

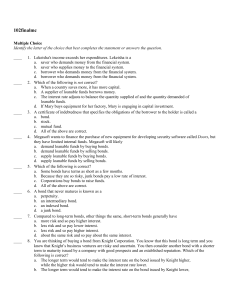

102finalmc

... a. demand for and the supply of loanable funds to the right. b. demand for and the supply of loanable funds to the left. c. supply of loanable funds to the right and the demand for loanable funds to the left. d. None of the above is correct. ____ 40. An increase in an investment tax credit would cre ...

... a. demand for and the supply of loanable funds to the right. b. demand for and the supply of loanable funds to the left. c. supply of loanable funds to the right and the demand for loanable funds to the left. d. None of the above is correct. ____ 40. An increase in an investment tax credit would cre ...

Best Practice Risk Management

... Dr. Robert M. Mark is a Senior Executive Vice President and Chief Risk Officer (CRO) at the Canadian Imperial Bank of Commerce (CIBC). Dr. Mark reports directly to the Chairman and Chief Executive Officer of CIBC, and is a member of the Senior Executive Team (Management Committee). Dr. Mark has glo ...

... Dr. Robert M. Mark is a Senior Executive Vice President and Chief Risk Officer (CRO) at the Canadian Imperial Bank of Commerce (CIBC). Dr. Mark reports directly to the Chairman and Chief Executive Officer of CIBC, and is a member of the Senior Executive Team (Management Committee). Dr. Mark has glo ...

Fiscal developments and financial stress: a threshold VAR analysis

... as far as the effect of government expenditures is concerned, e.g. the shock to government expenditures is likely to increase output. However, results are strongly diverging regarding the responses to changes in taxes.2 Romer and Romer (2007) applied a narrative approach in a similar fashion as they ...

... as far as the effect of government expenditures is concerned, e.g. the shock to government expenditures is likely to increase output. However, results are strongly diverging regarding the responses to changes in taxes.2 Romer and Romer (2007) applied a narrative approach in a similar fashion as they ...

Draft ITS on the approval to establish special purpose vehicles

... (5) The provisions in this Regulation are closely linked to each other, since they deal with the supervisory authorisation of special purpose vehicles as well as the cooperation and exchange of information between supervisory authorities regarding special purpose vehicles. ...

... (5) The provisions in this Regulation are closely linked to each other, since they deal with the supervisory authorisation of special purpose vehicles as well as the cooperation and exchange of information between supervisory authorities regarding special purpose vehicles. ...

Why do Spanish firms rarely use the bankruptcy

... financial creditors of the distressed company act in a coordinated manner to either restructure its debt, so that the company can be kept as a going concern, or to liquidate the company’s assets in a orderly manner. Regardless of its potential advantages vis-à-vis formal bankruptcy -cost savings, avo ...

... financial creditors of the distressed company act in a coordinated manner to either restructure its debt, so that the company can be kept as a going concern, or to liquidate the company’s assets in a orderly manner. Regardless of its potential advantages vis-à-vis formal bankruptcy -cost savings, avo ...

Household Debt, Adjustable-Rate Mortgages, and the Shock

... Theory predicts that the adverse effects of increases in the risk-free rate on homeowners’ default rates would be significantly stronger if interest rates paid on mortgages were variable and initial household debt burden were higher. Given the direct negative relationship between these default rates ...

... Theory predicts that the adverse effects of increases in the risk-free rate on homeowners’ default rates would be significantly stronger if interest rates paid on mortgages were variable and initial household debt burden were higher. Given the direct negative relationship between these default rates ...

2010-III CENTRAL BANK OF THE REPUBLIC OF TURKEY

... downward trajectory, which in turn, have triggered capital outflows from emerging markets and increased risk premiums. While risk premium indicators have increased, particularly across some European countries, during this period, the increases in emerging market risk premiums—especially in Turkey—we ...

... downward trajectory, which in turn, have triggered capital outflows from emerging markets and increased risk premiums. While risk premium indicators have increased, particularly across some European countries, during this period, the increases in emerging market risk premiums—especially in Turkey—we ...

Household Debt, Adjustable-Rate Mortgages

... Theory predicts that the adverse effects of increases in the risk-free rate on homeowners’ default rates would be significantly stronger if interest rates paid on mortgages were variable and initial household debt burden were higher. Given the direct negative relationship between these default rates ...

... Theory predicts that the adverse effects of increases in the risk-free rate on homeowners’ default rates would be significantly stronger if interest rates paid on mortgages were variable and initial household debt burden were higher. Given the direct negative relationship between these default rates ...

Chapter 002 Financial Statements, Taxes, and Cash

... a. must record income and expenses whenever cash flows are affected. B. still have some discretion over the timing of recording both revenue and expense items. c. must record all expenses when incurred. d. only record income when payment in full is received. e. record both income and expenses as soo ...

... a. must record income and expenses whenever cash flows are affected. B. still have some discretion over the timing of recording both revenue and expense items. c. must record all expenses when incurred. d. only record income when payment in full is received. e. record both income and expenses as soo ...

Download attachment

... result, if interest rates decline, the value of the swap contract increases (a gain), while at the same time the fixed-rate debt obligation increases (a loss). The swap is an effective risk management tool in this setting because its value is related to the same underlying (interest rates) that will ...

... result, if interest rates decline, the value of the swap contract increases (a gain), while at the same time the fixed-rate debt obligation increases (a loss). The swap is an effective risk management tool in this setting because its value is related to the same underlying (interest rates) that will ...

Information Memorandum

... GENERAL RISKS Investment in debt and debt related securities involve a degree of risk and investors should not invest any funds in the debt instruments, unless they can afford to take the risks attached to such investments. For taking an investment decision, the investors must rely on their own exam ...

... GENERAL RISKS Investment in debt and debt related securities involve a degree of risk and investors should not invest any funds in the debt instruments, unless they can afford to take the risks attached to such investments. For taking an investment decision, the investors must rely on their own exam ...

Guidelines on Risk Based Capital Adequacy

... the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. “Basel III: A global regulatory framework for more resilient banks and banking systems” (known as Basel II ...

... the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy. “Basel III: A global regulatory framework for more resilient banks and banking systems” (known as Basel II ...