Comments Before the Local Donor Mee by Drs. Kwik Kian Gie

... past two years, with the public-debt-to GDP ratio increasingfrom less than 25%;otoaround 100%. Most of this increasehas been due to growing domestic debt arising from the bank restructuring process, but external debt has also increased. This large increasein public debt imposes a significant burden ...

... past two years, with the public-debt-to GDP ratio increasingfrom less than 25%;otoaround 100%. Most of this increasehas been due to growing domestic debt arising from the bank restructuring process, but external debt has also increased. This large increasein public debt imposes a significant burden ...

Impact of financial and debt crisis on local and regional authorities

... Employer, service provider, economic agent, investor and national solidarity player Expenditure : ≈ 17% of GDP and ≈ 34% of public spending Direct investment : ≈ 65% of public sector Subnational expenditure by economic function in the EU27 (% of total expenditure) ...

... Employer, service provider, economic agent, investor and national solidarity player Expenditure : ≈ 17% of GDP and ≈ 34% of public spending Direct investment : ≈ 65% of public sector Subnational expenditure by economic function in the EU27 (% of total expenditure) ...

Federative Republic of Brazil - Secretaria Do Tesouro Nacional

... – Latin America: # Argentina: limited effects in 2002; # Mexico,Chile: good growth perspectives # Political issues. ...

... – Latin America: # Argentina: limited effects in 2002; # Mexico,Chile: good growth perspectives # Political issues. ...

Article by Nicholas Dietrich of Gowlings expanding on comments

... markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it seems clear that any potential regulatory response would be addressing yesterday’s probl ...

... markets. Just as the federal government and some senior and influential business leaders have lamented the hollowing-out of public corporate Canada through take-private acquisitions, many by foreign entities, it seems clear that any potential regulatory response would be addressing yesterday’s probl ...

Honoring public debts

... The granting of foreign credit is a first step toward the establishment of an aggressive foreign policy, and, under certain conditions, leads inevitably to conquest and occupation. Adams (1887, p. 25) Adams’s remark came from his having observed many 19th century incidents in which loans from privat ...

... The granting of foreign credit is a first step toward the establishment of an aggressive foreign policy, and, under certain conditions, leads inevitably to conquest and occupation. Adams (1887, p. 25) Adams’s remark came from his having observed many 19th century incidents in which loans from privat ...

Honoring public debts - Becker Friedman Institute

... The granting of foreign credit is a first step toward the establishment of an aggressive foreign policy, and, under certain conditions, leads inevitably to conquest and occupation. Adams (1887, p. 25) Adams’s remark came from his having observed many 19th century incidents in which loans from privat ...

... The granting of foreign credit is a first step toward the establishment of an aggressive foreign policy, and, under certain conditions, leads inevitably to conquest and occupation. Adams (1887, p. 25) Adams’s remark came from his having observed many 19th century incidents in which loans from privat ...

dave janny march two 2017 investment letter

... 40 years all around the world (according to IMF and McKinsey). In my opinion, the 2007-2009 financial crisis set off some alarm bells on debt with the blow up of the U.S. mortgage market, but it was not ...

... 40 years all around the world (according to IMF and McKinsey). In my opinion, the 2007-2009 financial crisis set off some alarm bells on debt with the blow up of the U.S. mortgage market, but it was not ...

2015-19 - University of Glasgow

... measures of private debt, relating both to its level and to its rate of change, are powerful predictors not only of the occurrence, but also the duration and severity of financial crises. 2 What's more, large debt build-ups seem to result in economic recessions via a negative effect on aggregate dem ...

... measures of private debt, relating both to its level and to its rate of change, are powerful predictors not only of the occurrence, but also the duration and severity of financial crises. 2 What's more, large debt build-ups seem to result in economic recessions via a negative effect on aggregate dem ...

AP Gov. Exam Review Congress, the President and the Budget Se

... deficit; the government is spending tremendous amounts of money on the military and homeland security, while many citizens of the country are enjoying a reduction in income taxes. g. ...

... deficit; the government is spending tremendous amounts of money on the military and homeland security, while many citizens of the country are enjoying a reduction in income taxes. g. ...

Essay questions for Chapter 3

... that the high debt to GDP ratio of the bailout recipient countries would decline as the real GDP was expected to increase. Greece, however, is in its sixth year of recession, and its public debt to GDP ratio has drastically increased particularly after Greece received its first bailout in 2010 (see ...

... that the high debt to GDP ratio of the bailout recipient countries would decline as the real GDP was expected to increase. Greece, however, is in its sixth year of recession, and its public debt to GDP ratio has drastically increased particularly after Greece received its first bailout in 2010 (see ...

Why Have Debt Ratios Increased for Firms in Emerging Markets?

... Estimated impact on debt ratio ...

... Estimated impact on debt ratio ...

Document

... – Take representative person in each generation, compute present value of all taxes paid. ...

... – Take representative person in each generation, compute present value of all taxes paid. ...

INTERNATIONAL

... The debt to be restructured increased from the 81.2 billion dollars in bonds announced in Dubai to 99.4 billion if acceptance of the proposal is less than 70% of the creditors, or to 104.1 billion if it is equal to, or higher than, that percentage (See Table No. 2). Maturity of Restructured Debt The ...

... The debt to be restructured increased from the 81.2 billion dollars in bonds announced in Dubai to 99.4 billion if acceptance of the proposal is less than 70% of the creditors, or to 104.1 billion if it is equal to, or higher than, that percentage (See Table No. 2). Maturity of Restructured Debt The ...

Fitch Rating`s rating action commentary

... gives the authorities a greater degree of confidence to proceed with the removal of capital controls on Icelandic households and firms. Paving the way for this, the Icelandic authorities have recently taken measures to reduce the overhang of ISK claims by nonresidents. In June, the central bank he ...

... gives the authorities a greater degree of confidence to proceed with the removal of capital controls on Icelandic households and firms. Paving the way for this, the Icelandic authorities have recently taken measures to reduce the overhang of ISK claims by nonresidents. In June, the central bank he ...

Financing a Small Business 4.00 Explain the fundamentals of

... 2) A line of credit that allows the businesses to borrow a stated amount of money at a stated interest rate to use as the business chooses. 3) Require that money be paid back on a regular basis according to the repayment plan specified. 4) Very conservative and not inclined to lend to businesses tha ...

... 2) A line of credit that allows the businesses to borrow a stated amount of money at a stated interest rate to use as the business chooses. 3) Require that money be paid back on a regular basis according to the repayment plan specified. 4) Very conservative and not inclined to lend to businesses tha ...

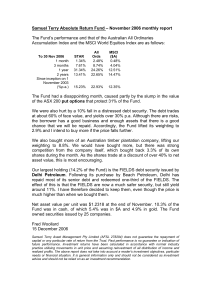

November 2006 - Samuel Terry

... 2.9% and I intend to buy more if the price falls further. We also bought more of an Australian timber plantation company, lifting our weighting to 8.8%. We would have bought more, but there was strong competition from the company itself, which bought back 3.3% of its own shares during the month. As ...

... 2.9% and I intend to buy more if the price falls further. We also bought more of an Australian timber plantation company, lifting our weighting to 8.8%. We would have bought more, but there was strong competition from the company itself, which bought back 3.3% of its own shares during the month. As ...

INST 275 – Administrative Processes in Government

... A type of revenue bond, issued by a municipality or similar government body, which not only gives investors the tax exemption benefits inherent in a municipal bond but also provides an additional moral pledge of commitment against default. The issuing body's commitment is supported via a reserve fun ...

... A type of revenue bond, issued by a municipality or similar government body, which not only gives investors the tax exemption benefits inherent in a municipal bond but also provides an additional moral pledge of commitment against default. The issuing body's commitment is supported via a reserve fun ...

Debt and Asia’s Success*

... credit to GDP of five percentage points or more in a single year signals a heightened risk of an eventual financial crisis. The credit spike occurred in a context where, given the emphasis on fiscal consolidation, credit flow to the government per se was restric ...

... credit to GDP of five percentage points or more in a single year signals a heightened risk of an eventual financial crisis. The credit spike occurred in a context where, given the emphasis on fiscal consolidation, credit flow to the government per se was restric ...

November 15th, 2013

... • For a corporate example, we will examine GE • GE wants to raise capital and issues bonds • Underwritten (think Scott Littlejohn) and offered to the secondary market (public) • Priced through the expected future cash flows from the bond (DCF etc.) • Can be purchased and held or traded, among other ...

... • For a corporate example, we will examine GE • GE wants to raise capital and issues bonds • Underwritten (think Scott Littlejohn) and offered to the secondary market (public) • Priced through the expected future cash flows from the bond (DCF etc.) • Can be purchased and held or traded, among other ...

From Instability to Deflation

... – Decline in risk aversion causes increase in investment – Investment expansion causes economy to grow faster Rising expectations leads to “The Euphoric Economy”… ...

... – Decline in risk aversion causes increase in investment – Investment expansion causes economy to grow faster Rising expectations leads to “The Euphoric Economy”… ...

Promoting the International use of Emerging Country Currencies

... The 1980’s Latin American debt crisis and subsequent lost decade had many origins But one was surely poor risk sharing… Commodity prices were high and plunged US interest rates were low and then soared The dollar appreciated And debt was in dollars ...

... The 1980’s Latin American debt crisis and subsequent lost decade had many origins But one was surely poor risk sharing… Commodity prices were high and plunged US interest rates were low and then soared The dollar appreciated And debt was in dollars ...

Lecture 22 - Nottingham

... • Last time: effect of different forms of taxation on real activity – Labour income and asset income taxes both proved ‘distortionary’ – Cost to society was lower output and income ...

... • Last time: effect of different forms of taxation on real activity – Labour income and asset income taxes both proved ‘distortionary’ – Cost to society was lower output and income ...

The National Debt focus of the chapter

... government itself. The fraction of the debt that is not held by the government itself is called debt held by the public. This is the part that we really have to worry about. The portion of the debt that receives the most attention is the part that is owned by foreign governments, foreign central ban ...

... government itself. The fraction of the debt that is not held by the government itself is called debt held by the public. This is the part that we really have to worry about. The portion of the debt that receives the most attention is the part that is owned by foreign governments, foreign central ban ...

PPT

... • Primary balance (or primary surplus / deficit) • Structural / cyclical balances All these indicators provide an indication of the in-year fiscal position. ...

... • Primary balance (or primary surplus / deficit) • Structural / cyclical balances All these indicators provide an indication of the in-year fiscal position. ...

Government debt

Government debt (also known as public debt, national debt and sovereign debt) is the debt owed by a central government. (In federal states, ""government debt"" may also refer to the debt of a state or provincial, municipal or local government.) By contrast, the annual ""government deficit"" refers to the difference between government receipts and spending in a single year, that is, the increase of debt over a particular year.Government debt is one method of financing government operations, but it is not the only method. Governments can also create money to monetize their debts, thereby removing the need to pay interest. But this practice simply reduces government interest costs rather than truly canceling government debt, and can result in hyperinflation if used unsparingly.Governments usually borrow by issuing securities, government bonds and bills. Less creditworthy countries sometimes borrow directly from a supranational organization (e.g. the World Bank) or international financial institutions.As the government draws its income from much of the population, government debt is an indirect debt of the taxpayers. Government debt can be categorized as internal debt (owed to lenders within the country) and external debt (owed to foreign lenders). Another common division of government debt is by duration until repayment is due. Short term debt is generally considered to be for one year or less, long term is for more than ten years. Medium term debt falls between these two boundaries. A broader definition of government debt may consider all government liabilities, including future pension payments and payments for goods and services the government has contracted but not yet paid.