LCwasL8_en.pdf

... measures are implemented in other industrial countries, such as increased investment in Japan or a tax reform in Canada. As a result, real GNP increases in 1994 by 1 1/4 and 1 percent in West Germany and Japan, respectively, as well as between 1 1/4 and 1 3/4 percent in Canada, France, Italy and the ...

... measures are implemented in other industrial countries, such as increased investment in Japan or a tax reform in Canada. As a result, real GNP increases in 1994 by 1 1/4 and 1 percent in West Germany and Japan, respectively, as well as between 1 1/4 and 1 3/4 percent in Canada, France, Italy and the ...

IFC`s Poverty Focus - International Finance Corporation

... reporting system caused the level of portfolio arrears of the MFI lender to decline approximately two percentage points after it was implemented in branch offices. They observe an even more substantial and significant effect of the information system in reducing late payments that occur during the l ...

... reporting system caused the level of portfolio arrears of the MFI lender to decline approximately two percentage points after it was implemented in branch offices. They observe an even more substantial and significant effect of the information system in reducing late payments that occur during the l ...

Unintended Consequences: How higher investor taxes

... but taxable at the investor level, payments to shareholders are not deductible at the corporate level but are still taxed at the personal level. Under the current legislation, tax rates on dividends and capital gains revert to pre-spring 2003 levels, i.e., the ordinary income tax rate for dividends ...

... but taxable at the investor level, payments to shareholders are not deductible at the corporate level but are still taxed at the personal level. Under the current legislation, tax rates on dividends and capital gains revert to pre-spring 2003 levels, i.e., the ordinary income tax rate for dividends ...

The Main Agency Problems and Their Consequences

... compromises, called a “nexus of contracts”, in which the interests of particular groups are agreed. To limit agency conflicts some special costs, called agency costs, have to be incurred. They may be defined in several ways. Ross, Westerfield and Jaffe (2005) define them as additional costs resultin ...

... compromises, called a “nexus of contracts”, in which the interests of particular groups are agreed. To limit agency conflicts some special costs, called agency costs, have to be incurred. They may be defined in several ways. Ross, Westerfield and Jaffe (2005) define them as additional costs resultin ...

annual report - Beige Capital

... He joined the Bank of Ghana in 2000 from the then SSB Bank (now Societe Generale) which he entered as a pioneer staff in 1976. He was the youngest member of the SSB management team at the time and is credited with the establishment of the Bank’s legal department. He served as Secretary to the Board ...

... He joined the Bank of Ghana in 2000 from the then SSB Bank (now Societe Generale) which he entered as a pioneer staff in 1976. He was the youngest member of the SSB management team at the time and is credited with the establishment of the Bank’s legal department. He served as Secretary to the Board ...

Download attachment

... Liquidity has been a major issue in Islamic finance due to the nature of Islamic financial instruments and contracts which tend to be short to medium term given the lack of depth in the long-term liquidity market. Challenges also include a) lack of appropriate standardised liquidity instruments, b ...

... Liquidity has been a major issue in Islamic finance due to the nature of Islamic financial instruments and contracts which tend to be short to medium term given the lack of depth in the long-term liquidity market. Challenges also include a) lack of appropriate standardised liquidity instruments, b ...

Austrian Business Cycle Theory: An Application to New Zealand`s

... The Austrian School of economics is one of the oldest and influential schools of economic thought. However, it is not an area of economic thought in which most economists in New Zealand are familiar. This is unfortunate as the Austrian School has a lot to offer the field of economics, especially mon ...

... The Austrian School of economics is one of the oldest and influential schools of economic thought. However, it is not an area of economic thought in which most economists in New Zealand are familiar. This is unfortunate as the Austrian School has a lot to offer the field of economics, especially mon ...

NBER WORKING PAPER SERIES UNCERTAINTY AND LIQUIDITY Alberto Giovannini Working Paper No. 2296

... This paper studies a model where money is valued for the liquidity services it provides in the future. These liquidity services cannot be provided by any other asset. Changes in expectations of the value of future liquidity services affect the desired proportions of money and other assets in agentst ...

... This paper studies a model where money is valued for the liquidity services it provides in the future. These liquidity services cannot be provided by any other asset. Changes in expectations of the value of future liquidity services affect the desired proportions of money and other assets in agentst ...

An Introduction to the Federal Reserve System

... reduce discount rates used to evaluate expected future dividends on stocks, and thus will generally be associated with higher stock prices, greater wealth, and increased consumption spending. And if lower long-term interest rates increase borrowing to buy houses, and thereby increase the demand for ...

... reduce discount rates used to evaluate expected future dividends on stocks, and thus will generally be associated with higher stock prices, greater wealth, and increased consumption spending. And if lower long-term interest rates increase borrowing to buy houses, and thereby increase the demand for ...

Investment Opportunities, Free-Cash-Flow, and the Market Values of

... Firms in the US hold large amounts of cash on their balance sheets and these amounts have been steadily increasing in recent years. For example, Bates, Kahle, and Stulz (2007) document that the average cash-to-assets ratio for corporations has more than doubled from 10.5% in 1980 to 24% in 2004. And ...

... Firms in the US hold large amounts of cash on their balance sheets and these amounts have been steadily increasing in recent years. For example, Bates, Kahle, and Stulz (2007) document that the average cash-to-assets ratio for corporations has more than doubled from 10.5% in 1980 to 24% in 2004. And ...

NBER WORKING PAPER SERIES TWO EXAMPLES Joshua Aizenman

... The government can acquire international reserves in the first period, let them earn the risk-free rate, and spend them in the second period. One way of acquiring reserves is through sovereign borrowing. Even if reserves are acquired as the counterpart of private-sector borrowing, full sterilization ...

... The government can acquire international reserves in the first period, let them earn the risk-free rate, and spend them in the second period. One way of acquiring reserves is through sovereign borrowing. Even if reserves are acquired as the counterpart of private-sector borrowing, full sterilization ...

PPT

... • Annual current and capital accounts by institutional sectors (2015)- for the period starting from 2010. • Annual stocks and transactions of financial assets and liabilities (2015)- for the period starting from 2010. • Annual stocks of produced nonfinancial assets (2015)- for the period ...

... • Annual current and capital accounts by institutional sectors (2015)- for the period starting from 2010. • Annual stocks and transactions of financial assets and liabilities (2015)- for the period starting from 2010. • Annual stocks of produced nonfinancial assets (2015)- for the period ...

Fingrid Oyj

... indirectly disseminate this document or its contents to "retail clients" within the meaning of section 761G of the Corporations Act 2001. MOODY'S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of secur ...

... indirectly disseminate this document or its contents to "retail clients" within the meaning of section 761G of the Corporations Act 2001. MOODY'S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of secur ...

“Macroeconomics with Financial Frictions”

... increase the interest rate to ensure that markets clear. They face a lemons problem as in Akerlof (1970): Increasing the interest rate would worsen the pool of creditors who apply for a loan such that lenders would lose money. Hence, they ration overall lending and charge a lower interest rate. More ...

... increase the interest rate to ensure that markets clear. They face a lemons problem as in Akerlof (1970): Increasing the interest rate would worsen the pool of creditors who apply for a loan such that lenders would lose money. Hence, they ration overall lending and charge a lower interest rate. More ...

Hometown Investment Trust funds: an Analysis of Credit Risk

... banking system has improved significantly since the Asian crisis, banks have been cautious about lending to SMEs, even though such enterprises account for a large share of economic activity. Startup companies, in particular, are finding it increasingly difficult to borrow money from banks because o ...

... banking system has improved significantly since the Asian crisis, banks have been cautious about lending to SMEs, even though such enterprises account for a large share of economic activity. Startup companies, in particular, are finding it increasingly difficult to borrow money from banks because o ...

SILICON VALLEY BANCSHARES - Investor Relations Solutions

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

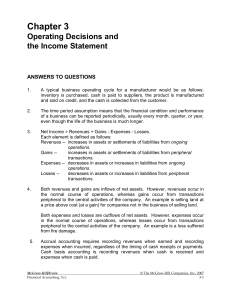

Income Statement

... students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can r ...

... students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can r ...

NBER WORKING PAPER SERIES MACROECONOMICS WITH FINANCIAL FRICTIONS: A SURVEY Markus K. Brunnermeier

... have “skin in the game” he can sell off only a fraction of the risk. In incomplete-markets settings, risk along certain dimensions cannot be sold off at all and hence certain risks remain uninsurable. In models with limited participation certain agents in the economy are excluded from being active i ...

... have “skin in the game” he can sell off only a fraction of the risk. In incomplete-markets settings, risk along certain dimensions cannot be sold off at all and hence certain risks remain uninsurable. In models with limited participation certain agents in the economy are excluded from being active i ...