Causes and Consequences of Persistently Low Interest Rates

... This report explores the underlying factors behind this decline in global real interest rates and some of the possible consequences, including for policy. While there are several competing explanations, whose effects are not easy to disentangle, our analysis of the evidence suggests that an increase ...

... This report explores the underlying factors behind this decline in global real interest rates and some of the possible consequences, including for policy. While there are several competing explanations, whose effects are not easy to disentangle, our analysis of the evidence suggests that an increase ...

I. International and Domestic Developments Affecting Financial Stability

... outlook in economic activity and the fall in oil prices. Although ...

... outlook in economic activity and the fall in oil prices. Although ...

3354:1-20-07 Investment policy

... an eligible institution referenced in section 135.03 of the Ohio Revised Code (2) The primary objective will always be the long-term preservation of the corpus, followed by the growth of the corpus. (3) The minimization of idle cash while simultaneously providing adequate liquidity for the College t ...

... an eligible institution referenced in section 135.03 of the Ohio Revised Code (2) The primary objective will always be the long-term preservation of the corpus, followed by the growth of the corpus. (3) The minimization of idle cash while simultaneously providing adequate liquidity for the College t ...

UnitedHealth Group Second Quarter 2016 Form 10-Q

... Share-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net change in other operating items, net of effects fr ...

... Share-based compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Net change in other operating items, net of effects fr ...

Can Low Interest Rates be Harmful: An Assessment of the Bank Risk

... introduction of the euro. They find that low interest rates affect the risk of bank loan portfolio in two opposing ways. In the short-term, low interest rates reduce the probability of default of the outstanding loans; in the medium term, however, banks act more aggressively, that is, they lend to b ...

... introduction of the euro. They find that low interest rates affect the risk of bank loan portfolio in two opposing ways. In the short-term, low interest rates reduce the probability of default of the outstanding loans; in the medium term, however, banks act more aggressively, that is, they lend to b ...

Table of Contents - Maryland Public Service Commission

... I will recommend a rate of return on rate base for Baltimore Gas and Electric Company (BGE), and comment ...

... I will recommend a rate of return on rate base for Baltimore Gas and Electric Company (BGE), and comment ...

GAAP - Office of Superintendent of Public Instruction

... Property taxes are recognized as revenues in the year for which they are levied. Grants and similar items are recognized as revenue as soon as all eligibility requirements imposed by the provider have been met. Governmental fund financial statements are reported using the current financial resources ...

... Property taxes are recognized as revenues in the year for which they are levied. Grants and similar items are recognized as revenue as soon as all eligibility requirements imposed by the provider have been met. Governmental fund financial statements are reported using the current financial resources ...

Global Market Outlook 2017 - State Street Global Advisors

... corresponds to the blip in productivity growth — world trade grew at an average 6.7% a year as value chains linking suppliers in many countries formed. This effectively forced firms to become super-efficient because they faced global, not just domestic, competition. Since the GFC, world trade has gr ...

... corresponds to the blip in productivity growth — world trade grew at an average 6.7% a year as value chains linking suppliers in many countries formed. This effectively forced firms to become super-efficient because they faced global, not just domestic, competition. Since the GFC, world trade has gr ...

Global Market Outlook 2017 - State Street Global Advisors

... corresponds to the blip in productivity growth — world trade grew at an average 6.7% a year as value chains linking suppliers in many countries formed. This effectively forced firms to become super-efficient because they faced global, not just domestic, competition. Since the GFC, world trade has gr ...

... corresponds to the blip in productivity growth — world trade grew at an average 6.7% a year as value chains linking suppliers in many countries formed. This effectively forced firms to become super-efficient because they faced global, not just domestic, competition. Since the GFC, world trade has gr ...

De Nederlandsche Bank Monetary and Economic Policy

... With the tearing down of the Berlin Wall in 1989, Central and Eastern European (CEE) countries began a process of profound economic transition. Socialist institutions disappeared, whereas new capitalist inspired institutions – such as well-functioning legal systems – were introduced later. Moreover, ...

... With the tearing down of the Berlin Wall in 1989, Central and Eastern European (CEE) countries began a process of profound economic transition. Socialist institutions disappeared, whereas new capitalist inspired institutions – such as well-functioning legal systems – were introduced later. Moreover, ...

Reversing Worrisome Trends How to Attract and Retain Investment in a

... since the annual value of U.S. inward FDI set a record high of $314 billion. Since 2000, annual flows have failed to establish an upward trend. The most recent investment figures indicate that U.S. FDI inflows declined from $227 billion in 2011 to $147 billion in 2012, a drop of over 35 percent.5 To ...

... since the annual value of U.S. inward FDI set a record high of $314 billion. Since 2000, annual flows have failed to establish an upward trend. The most recent investment figures indicate that U.S. FDI inflows declined from $227 billion in 2011 to $147 billion in 2012, a drop of over 35 percent.5 To ...

BIS Working Papers Asset prices, financial and monetary stability: exploring the nexus

... understanding the role of equity prices in affecting consumer expenditures, with less attention being ...

... understanding the role of equity prices in affecting consumer expenditures, with less attention being ...

Push Factors and Capital Flows to Emerging Markets

... (2014) did not find that better macroeconomic fundamentals (e.g., lower public debt, a higher level of reserves, or higher economic growth) provided insulation during the tantrum episode. Rather, larger markets experienced more pressures, as investors were better able to rebalance their portfolios i ...

... (2014) did not find that better macroeconomic fundamentals (e.g., lower public debt, a higher level of reserves, or higher economic growth) provided insulation during the tantrum episode. Rather, larger markets experienced more pressures, as investors were better able to rebalance their portfolios i ...

$doc.title

... market indexes fell sharply in countries that suffered Sudden Stops. By the end of January 1995, nearly a month after the devaluation of the peso, Mexico’s stock market index had fallen by more than 50 percent in dollar terms relative to November 1, 1994. The indexes in Brazil and Argentina fell abo ...

... market indexes fell sharply in countries that suffered Sudden Stops. By the end of January 1995, nearly a month after the devaluation of the peso, Mexico’s stock market index had fallen by more than 50 percent in dollar terms relative to November 1, 1994. The indexes in Brazil and Argentina fell abo ...

mergers and acquisitions in indian pharmaceutical industry: a case

... Danzon et al. (2007) explained in the case of pharmaceutical industries that firms with foreign affiliation are more likely to merge in order to access foreign markets and these firms are less likely to be acquired than domestic firms. Beena (2008) argued that foreign affiliation of firms also impa ...

... Danzon et al. (2007) explained in the case of pharmaceutical industries that firms with foreign affiliation are more likely to merge in order to access foreign markets and these firms are less likely to be acquired than domestic firms. Beena (2008) argued that foreign affiliation of firms also impa ...

Does Dividend Policy Enhance Shareholder Value?

... However, difficulties arise in trying to link dividend policy directly to shareholder value. First, in measuring shareholder value, suppose we simply use the share price. Despite the clarity, standard theory would lead us to only one conclusion—that dividend policy has no effect on share price—leavi ...

... However, difficulties arise in trying to link dividend policy directly to shareholder value. First, in measuring shareholder value, suppose we simply use the share price. Despite the clarity, standard theory would lead us to only one conclusion—that dividend policy has no effect on share price—leavi ...

Returning Cash to the Owners: Dividend Policy

... Assume that you run a phone company, and that you have historically paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and ...

... Assume that you run a phone company, and that you have historically paid large dividends. You are now planning to enter the telecommunications and media markets. Which of the following paths are you most likely to follow? Courageously announce to your stockholders that you plan to cut dividends and ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... investment. Second, the expansions have been accompanied by a more favorable situation in the trade balance. Third, one could argue that fundamentals improved with the change in the fiscal policy regime and the adoption of inflation targeting. 5. Sudden stops are more pronounced when the crisis is m ...

... investment. Second, the expansions have been accompanied by a more favorable situation in the trade balance. Third, one could argue that fundamentals improved with the change in the fiscal policy regime and the adoption of inflation targeting. 5. Sudden stops are more pronounced when the crisis is m ...

Fiscal Year July 1, 2011 - June 30, 2012

... The statement of net assets and statement of revenues, expenses, and changes in net assets report the College’s net assets and how they have changed. Net assets - the difference between assets and liabilities - is one way to measure the College’s financial health, or position. Over time, increases o ...

... The statement of net assets and statement of revenues, expenses, and changes in net assets report the College’s net assets and how they have changed. Net assets - the difference between assets and liabilities - is one way to measure the College’s financial health, or position. Over time, increases o ...

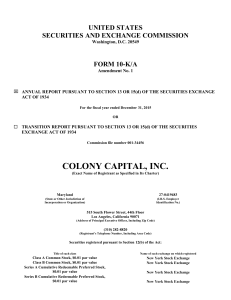

colony capital, inc. - corporate

... Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically ...

... Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically ...