July 29, 2008 THE PERFORMANCE OF BUSINESS GROUP FIRMS

... Research Question/Issue: Institutional and transaction costs theories highlight the idea that group affiliated firms outperform unaffiliated firms in emerging economies. The persistence of superior performance for group affiliated firms is, however, questioned by the fast and recent development of m ...

... Research Question/Issue: Institutional and transaction costs theories highlight the idea that group affiliated firms outperform unaffiliated firms in emerging economies. The persistence of superior performance for group affiliated firms is, however, questioned by the fast and recent development of m ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... 1959 Radcliffe Report-rather than on the quantity of money contributed to its poor postwar performance (1987, ch. 5 [ 19691). Similar evidence on central banks’ choice of inappropriate policy targets is found ...

... 1959 Radcliffe Report-rather than on the quantity of money contributed to its poor postwar performance (1987, ch. 5 [ 19691). Similar evidence on central banks’ choice of inappropriate policy targets is found ...

A new architecture for public investment in Europe

... of market failures. Third, public impact increase in public investment investment could serve as a worth 1% of GDP boosts GDP growth by 1.42% financial trigger for private sector financiers to initially. The fiscal multiplier gains momentum engage in projects they would not have engaged over the sub ...

... of market failures. Third, public impact increase in public investment investment could serve as a worth 1% of GDP boosts GDP growth by 1.42% financial trigger for private sector financiers to initially. The fiscal multiplier gains momentum engage in projects they would not have engaged over the sub ...

Chaebol, Financial Liberalization, and Economic Crisis

... objective: NBFIs’ share in total deposits increased from less than 30 percent up to 1980 to more than 60 percent by the early 1990s. In fact, in 1990 their share of deposits surpassed that of banks, accounting for almost 60 percent of total deposits. The same can be said about their share of loans, ...

... objective: NBFIs’ share in total deposits increased from less than 30 percent up to 1980 to more than 60 percent by the early 1990s. In fact, in 1990 their share of deposits surpassed that of banks, accounting for almost 60 percent of total deposits. The same can be said about their share of loans, ...

A Study on the Relationship between the Family Control and

... the highest percentage of family-controlled listed companies are in France (64.82%), and the lowest are in UK (23.68%). These studies show that family-controlled listed companies exist so commonly around the world. Compared to East Asian and Western European countries, family or individual-controll ...

... the highest percentage of family-controlled listed companies are in France (64.82%), and the lowest are in UK (23.68%). These studies show that family-controlled listed companies exist so commonly around the world. Compared to East Asian and Western European countries, family or individual-controll ...

Capital Formation Agenda - Small Business Investor Alliance

... Eisenhower to stimulate the flow of long-term patient capital to domestic small businesses. Today, there are over 240 licensed SBICs across the country with over $22 billion in total assets. In Fiscal Year 2014, SBICs invested more than $5.2 billion in new capital to small businesses nationwide. Sin ...

... Eisenhower to stimulate the flow of long-term patient capital to domestic small businesses. Today, there are over 240 licensed SBICs across the country with over $22 billion in total assets. In Fiscal Year 2014, SBICs invested more than $5.2 billion in new capital to small businesses nationwide. Sin ...

PowerPoint

... “Corporations do not have net worth as this should belong to the final owners of the corporations”: how to distribute it to the HH and Government sector is not mentioned(?): • NFCs often have a negative net worth, because “net assets < market value of equity issued” • This reflects that shareholde ...

... “Corporations do not have net worth as this should belong to the final owners of the corporations”: how to distribute it to the HH and Government sector is not mentioned(?): • NFCs often have a negative net worth, because “net assets < market value of equity issued” • This reflects that shareholde ...

NBER WORKING PAPER SERIES INFLATION, TAX RULES AND THE ACCUMULATION

... The important question, however, is whether the neutrality of anticipated changes in money and in the price level are relevant to the actual econoIrr ...

... The important question, however, is whether the neutrality of anticipated changes in money and in the price level are relevant to the actual econoIrr ...

Systemic banks, capital composition and CoCo bonds issuance: The

... effects it has on its behavior is important. We propose a difference in difference estimation, using an approach similar to that of Schepens (2016) that was first fleshed out by Rosenbaum and Rubin (1985). A flurry of new regulation has affected banks since 2009. Of particular importance have been t ...

... effects it has on its behavior is important. We propose a difference in difference estimation, using an approach similar to that of Schepens (2016) that was first fleshed out by Rosenbaum and Rubin (1985). A flurry of new regulation has affected banks since 2009. Of particular importance have been t ...

Bank-based versus Market-based Financial Systems

... In Holmstrom and Tirole (1997), bank- and market-finance are distinguished according to their information content. Bank monitoring resolves moral-hazard problems at the level of the firm. Firms with lower marketable collateral and higher incentive problems borrow from banks, while wealthier firms rely ...

... In Holmstrom and Tirole (1997), bank- and market-finance are distinguished according to their information content. Bank monitoring resolves moral-hazard problems at the level of the firm. Firms with lower marketable collateral and higher incentive problems borrow from banks, while wealthier firms rely ...

Comparison of regulatory capital and economic

... large amount of capital as companies can have alternative use of the fund to engage in risk-taking business initiative(s) with a view to create profits. Also, raising capital dilutes the return for existing shareholders and senior management of companies who have share options. This can create disin ...

... large amount of capital as companies can have alternative use of the fund to engage in risk-taking business initiative(s) with a view to create profits. Also, raising capital dilutes the return for existing shareholders and senior management of companies who have share options. This can create disin ...

FM11 Ch 14 Instructors Manual

... a. The operating plan provides detailed implementation guidance designed to accomplish corporate objectives. It details who is responsible for what particular function, and when specific tasks are to be accomplished. The financial plan details the financial aspects of the corporation’s operating pla ...

... a. The operating plan provides detailed implementation guidance designed to accomplish corporate objectives. It details who is responsible for what particular function, and when specific tasks are to be accomplished. The financial plan details the financial aspects of the corporation’s operating pla ...

BIS 76th Annual Report - June 2006

... Exchange rates of other industrial countries . . . . . . . . . . . . . . . . . . . . . Exchange rates in emerging markets . . . . . . . . . . . . . . . . . . . . . . . . . . . Current real effective exchange rates in a long-term perspective . . . . Exchange rates and interest rate differentials . . ...

... Exchange rates of other industrial countries . . . . . . . . . . . . . . . . . . . . . Exchange rates in emerging markets . . . . . . . . . . . . . . . . . . . . . . . . . . . Current real effective exchange rates in a long-term perspective . . . . Exchange rates and interest rate differentials . . ...

Can Financing Constraints Explain the Asset Pricing Puzzles in Production Economies? ∗

... strong business cycle pattern. In fact the correlation with GDP growth is nearly zero. As indicated on Figure (1), the contemporaneous and lagged correlation between long term debt and GDP is 0.03 and 0.15 respectively. Firms can issue short term debt in the model, however they face a liquidity cons ...

... strong business cycle pattern. In fact the correlation with GDP growth is nearly zero. As indicated on Figure (1), the contemporaneous and lagged correlation between long term debt and GDP is 0.03 and 0.15 respectively. Firms can issue short term debt in the model, however they face a liquidity cons ...

West African Economic and Monetary Union: Common Policies

... Despite the fragile security situation in some member countries and a less favorable external environment in 2015, economic growth exceeded 6 percent for the second consecutive year, driven by ongoing infrastructure investments, solid private consumption, and favorable agricultural campaigns. Inflat ...

... Despite the fragile security situation in some member countries and a less favorable external environment in 2015, economic growth exceeded 6 percent for the second consecutive year, driven by ongoing infrastructure investments, solid private consumption, and favorable agricultural campaigns. Inflat ...

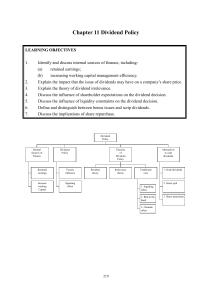

Chapter 11 Dividend Policy

... 2.3.2 Investors usually expect a consistent dividend policy from the company, with stable dividends each year or, even better, steady dividend growth. A large rise or fall in dividends in any year can have a marked effect on the company’s share price. 2.3.3 Stable dividends or steady dividend growth ...

... 2.3.2 Investors usually expect a consistent dividend policy from the company, with stable dividends each year or, even better, steady dividend growth. A large rise or fall in dividends in any year can have a marked effect on the company’s share price. 2.3.3 Stable dividends or steady dividend growth ...

International Reserves and Gross Capital Flows Dynamics.

... net aimed at limiting countries’ incentives to accumulate reserves. As such, the exercise also provides new insights to the growing literature on the dynamic behavior of gross capital flows documented above. In particular, the robust link we find between the level of reserves and the behavior of dom ...

... net aimed at limiting countries’ incentives to accumulate reserves. As such, the exercise also provides new insights to the growing literature on the dynamic behavior of gross capital flows documented above. In particular, the robust link we find between the level of reserves and the behavior of dom ...