INF2570 AR10 cover AW05.indd

... 100 exhibitions around the world, from the recently acquired Anti-Ageing show to Arab Health in the Middle East. Our diverse range of robust and market-leading events include large, full-scale exhibitions and conferences through to extremely niche training courses and seminars and represent an excel ...

... 100 exhibitions around the world, from the recently acquired Anti-Ageing show to Arab Health in the Middle East. Our diverse range of robust and market-leading events include large, full-scale exhibitions and conferences through to extremely niche training courses and seminars and represent an excel ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... environmental equipment, computers and electronics, printing machinery, paint mixing machinery, packaging machinery, graphic arts and industrial manufacturing. Gast is based in Benton Harbor, Michigan, with additional facilities in England. In February 2006, IDEX acquired JUN-AIR International A/S ( ...

... environmental equipment, computers and electronics, printing machinery, paint mixing machinery, packaging machinery, graphic arts and industrial manufacturing. Gast is based in Benton Harbor, Michigan, with additional facilities in England. In February 2006, IDEX acquired JUN-AIR International A/S ( ...

Financing Durable Assets

... pledgeability increases the extent to which assets support borrowing and unambiguously facilitates financing. Hart and Moore’s (1994) results should be interpreted in terms of the effect of pledgeability, as they consider the effect of the liquidation value of assets, not in terms of durability. Our ...

... pledgeability increases the extent to which assets support borrowing and unambiguously facilitates financing. Hart and Moore’s (1994) results should be interpreted in terms of the effect of pledgeability, as they consider the effect of the liquidation value of assets, not in terms of durability. Our ...

Expropriation of foreign direct investments: sectoral patterns from 1993 to 2006

... expropriation is less likely after 1980 in comparison to the 1960s and early 1970s, both in terms of frequency and the share of the total stocks of developing country FDI affected. However, the number of expropriations has risen since the mid-1990s, with a large proportion occurring in Latin America ...

... expropriation is less likely after 1980 in comparison to the 1960s and early 1970s, both in terms of frequency and the share of the total stocks of developing country FDI affected. However, the number of expropriations has risen since the mid-1990s, with a large proportion occurring in Latin America ...

The Detection of Earnings Manipulation Messod D. Beneish* June

... manipulation is an annual report or a 10-K for about two-thirds of the sample and a security offering prospectus (initial, secondary, debt offering) for the remaining third. Sample manipulators are relatively young, growth firms as such characteristics make it more likely that firms come under the ...

... manipulation is an annual report or a 10-K for about two-thirds of the sample and a security offering prospectus (initial, secondary, debt offering) for the remaining third. Sample manipulators are relatively young, growth firms as such characteristics make it more likely that firms come under the ...

BIS 85th Annual Report - June 2015

... The dollar soars, the euro plunges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Oil plunge puts energy sector under pressure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Falling yields, flattening curves . . . . . . . . . . . . . . . . . . . . ...

... The dollar soars, the euro plunges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Oil plunge puts energy sector under pressure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Falling yields, flattening curves . . . . . . . . . . . . . . . . . . . . ...

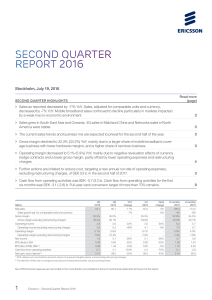

Second quarter report 2016

... comparable units and currency, decreased by -7%. Segment Networks sales declined YoY mainly due to lower mobile broadband sales in markets with a weak macroeconomic environment. A further delayed spectrum auction in India and completion of major projects in Europe in 2015 impacted mobile broadband s ...

... comparable units and currency, decreased by -7%. Segment Networks sales declined YoY mainly due to lower mobile broadband sales in markets with a weak macroeconomic environment. A further delayed spectrum auction in India and completion of major projects in Europe in 2015 impacted mobile broadband s ...

Contributed Session 45 - Financial Systems and Banking II

... the organization of these sessions. The following led the way in organizing invited sessions; Governor Durmuş Yılmaz a Central Bank of TR session, Undersecretary İbrahim Çanakcı a Treasury of TR session, Yılmaz Akyüz and Martin Khor of South Center a TWN session on Asian economies, Governor Ahmet Tu ...

... the organization of these sessions. The following led the way in organizing invited sessions; Governor Durmuş Yılmaz a Central Bank of TR session, Undersecretary İbrahim Çanakcı a Treasury of TR session, Yılmaz Akyüz and Martin Khor of South Center a TWN session on Asian economies, Governor Ahmet Tu ...

2014 Annual Report - McDonald`s Corporation

... us to achieve restaurant performance levels that are among the highest in the industry. Franchisees are also responsible for reinvesting capital in their businesses over time. In addition, to accelerate implementation of certain initiatives, the Company frequently coinvests with franchisees to fund ...

... us to achieve restaurant performance levels that are among the highest in the industry. Franchisees are also responsible for reinvesting capital in their businesses over time. In addition, to accelerate implementation of certain initiatives, the Company frequently coinvests with franchisees to fund ...

1 SMEs IN ASIA AND THE PACIFIC

... factors and conditions. Here in Asia, Infosys of India was started with capital of just $250, but has risen to become a business with revenues of $4 billion, and is listed on NASDAQ in the United States of America. Similarly, the bursting of the “dot.com” bubble in 2001 provides evidence that perils ...

... factors and conditions. Here in Asia, Infosys of India was started with capital of just $250, but has risen to become a business with revenues of $4 billion, and is listed on NASDAQ in the United States of America. Similarly, the bursting of the “dot.com” bubble in 2001 provides evidence that perils ...

NBER WORKING PAPER SERIES THE MARGINAL PRODUCT OF CAPITAL Francesco Caselli James Feyrer

... We close the paper by returning to Lucas’ question as to the sources of differences in capital-labor ratios. Lucas proposed two main candidates: credit frictions – about which he was skeptical – and differences in complementary inputs (e.g. human capital) and TFP. Our analysis highlights the wisdom ...

... We close the paper by returning to Lucas’ question as to the sources of differences in capital-labor ratios. Lucas proposed two main candidates: credit frictions – about which he was skeptical – and differences in complementary inputs (e.g. human capital) and TFP. Our analysis highlights the wisdom ...

Official PDF , 53 pages - World bank documents

... risks that the law may get misapplied and become a vehicle for unnecessary intervention in markets, corruption and bribery.These risks are undeniable but they also equally apply to other important areas of government services such as customs, tax collection, education, health and safety among others ...

... risks that the law may get misapplied and become a vehicle for unnecessary intervention in markets, corruption and bribery.These risks are undeniable but they also equally apply to other important areas of government services such as customs, tax collection, education, health and safety among others ...

Competition Report

... activities and the real difference they make to ensure competition benefits UK consumers, financial services and our wider economy. ...

... activities and the real difference they make to ensure competition benefits UK consumers, financial services and our wider economy. ...

Strategy: The Investment Outlook

... RBC Capital Markets’ (RBC CM) Strategy publication is the outcome of senior representatives of the firm regularly meeting to compare and contrast their views on the investment outlook. Strategy consists of three parts: first, the consensus strategy resulting from these discussions; second, a series ...

... RBC Capital Markets’ (RBC CM) Strategy publication is the outcome of senior representatives of the firm regularly meeting to compare and contrast their views on the investment outlook. Strategy consists of three parts: first, the consensus strategy resulting from these discussions; second, a series ...

call-for-input on the crowdfunding rules

... requests otherwise. We will not regard a standard confidentiality statement in an email message as a request for non-disclosure. Despite this, we may be asked to disclose a confidential response under the Freedom of Information Act 2000. We may consult you if we receive such a request. Any decision ...

... requests otherwise. We will not regard a standard confidentiality statement in an email message as a request for non-disclosure. Despite this, we may be asked to disclose a confidential response under the Freedom of Information Act 2000. We may consult you if we receive such a request. Any decision ...

Accounting for Financial Instruments: Difficulties with Fair Value

... government’s ongoing push for increased homeownership since the early 1990’s (Carney). Favorable government policies mandated for mortgage lenders to provide “affordable housing” to homebuyers with median or below median income (Carney).When the initial period for favorable lending rates ended in 20 ...

... government’s ongoing push for increased homeownership since the early 1990’s (Carney). Favorable government policies mandated for mortgage lenders to provide “affordable housing” to homebuyers with median or below median income (Carney).When the initial period for favorable lending rates ended in 20 ...

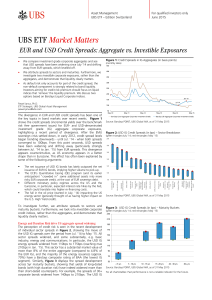

Market Matters EUR and USD Credit Spreads

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

... For marketing and information purposes by UBS. For qualified investors only. The information and opinions contained in this document have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith, but is not guaranteed as being accurate, nor i ...

SIFMA AMG Submits Comments to the Basel Committee on Banking

... members’ ability to hedge risk and reduce volatility through the use of cleared derivatives. AMG members are U.S. asset management firms whose combined global assets under management exceed $34 trillion. The clients of AMG member firms include, among others, tens of millions of individual investors, ...

... members’ ability to hedge risk and reduce volatility through the use of cleared derivatives. AMG members are U.S. asset management firms whose combined global assets under management exceed $34 trillion. The clients of AMG member firms include, among others, tens of millions of individual investors, ...

Americas Real SnapShot

... insights on ever-changing markets and opportunities across the Americas region. We examine in detail the key real estate sector markets in the US, Canada, Mexico and Brazil and the diverse factors forging each country’s current investment climate. In the US, the sentiment is one of cautious optimism ...

... insights on ever-changing markets and opportunities across the Americas region. We examine in detail the key real estate sector markets in the US, Canada, Mexico and Brazil and the diverse factors forging each country’s current investment climate. In the US, the sentiment is one of cautious optimism ...

uba capital plc - The Nigerian Stock Exchange

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

... in an orderly transaction in the principal (or most advantageous) market at the measurement date under current market conditions. Fair value under IFRS 13 is an exit price regardless of whether that price is directly observable or estimated using another valuation technique. Also, IFRS 13 includes e ...

World Economic Situation and Prospects 2012

... Among developed economies, inflation rates in the United States and Europe edged up during 2011, moving from the lower to the upper bound of the inflation target bands set by central banks. This increase was in line with the policy objective in these economies to mitigate the risk of deflation in th ...

... Among developed economies, inflation rates in the United States and Europe edged up during 2011, moving from the lower to the upper bound of the inflation target bands set by central banks. This increase was in line with the policy objective in these economies to mitigate the risk of deflation in th ...

Overborrowing, Financial Crises and ‘Macro-prudential’ Policy ∗ Javier Bianchi

... and thus neutralize the credit externality, by imposing state-contingent taxes on debt and dividends of about 1 and -0.5 percent on average respectively. This paper contributes to the recent literature in the intersection of Macroeconomics and Finance by developing a quantitative framework suitable ...

... and thus neutralize the credit externality, by imposing state-contingent taxes on debt and dividends of about 1 and -0.5 percent on average respectively. This paper contributes to the recent literature in the intersection of Macroeconomics and Finance by developing a quantitative framework suitable ...