Fear and loathing of negative yielding debt: bond investor`s

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

... there are few good options left. Even in the U.S., long the destination of choice in times of stress, Treasuries are in such demand that when their cash flows are converted into euros, yields are even worse than the scant returns on German bunds. For euro-based buyers of 10-year Treasuries, swapping ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Notes chapter 5

... All the applications and concepts covered in the PowerPoint notes The numerical problems on the exam will be similar to the ones in the notes How does the present value of an amount in the future change as the time is extended and as the interest rate increases? DO NOT need to prepare Annuity Due, s ...

... All the applications and concepts covered in the PowerPoint notes The numerical problems on the exam will be similar to the ones in the notes How does the present value of an amount in the future change as the time is extended and as the interest rate increases? DO NOT need to prepare Annuity Due, s ...

The Ralston Company/The Balboa Company

... company’s products are profitable and well-established in their various markets, and from all indications Ralston will continue to expand at a respectable, but not abnormally high, growth rate for the foreseeable future. I anticipate that a steady stream of additional financing will be required to s ...

... company’s products are profitable and well-established in their various markets, and from all indications Ralston will continue to expand at a respectable, but not abnormally high, growth rate for the foreseeable future. I anticipate that a steady stream of additional financing will be required to s ...

Source: Barron`s 7/4/2016 - Academy of Preferred Financial Advisors

... The Fed is expected to keep the cost of borrowing money lower for longer than was previously expected. If rates remain low, then savers will suffer longer with low returns on their accounts. (Source: CNBC.com 7/1/2016) ...

... The Fed is expected to keep the cost of borrowing money lower for longer than was previously expected. If rates remain low, then savers will suffer longer with low returns on their accounts. (Source: CNBC.com 7/1/2016) ...

UNITED KINGDOM

... quantitative easing measures are transferred to the budget. The government has appropriately indicated that it is no longer targeting a budget surplus by the end of the decade and has signalled that the automatic stabilisers will be allowed to work. Some discretionary fiscal measures will be used to ...

... quantitative easing measures are transferred to the budget. The government has appropriately indicated that it is no longer targeting a budget surplus by the end of the decade and has signalled that the automatic stabilisers will be allowed to work. Some discretionary fiscal measures will be used to ...

The Financial Industry as a Catalyst for

... II. Financial system and economic growth • The important conclusions from the empirical evidence are: – Countries with better-developed financial systems tend to grow faster – The levels of banking development and stock market liquidity each exerts a positive influence on economic growth – Better-f ...

... II. Financial system and economic growth • The important conclusions from the empirical evidence are: – Countries with better-developed financial systems tend to grow faster – The levels of banking development and stock market liquidity each exerts a positive influence on economic growth – Better-f ...

DEBT - Association for Financial Professionals of Arizona

... Statements in this report are based on the opinions of UMB Capital Markets and the information available at the time this report was published. All opinions represent our judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a ...

... Statements in this report are based on the opinions of UMB Capital Markets and the information available at the time this report was published. All opinions represent our judgments as of the date of this report and are subject to change at any time without notice. You should not use this report as a ...

Increased Capital and Financial Stability

... *Related to Sarin, Natasha, and Lawrence H. Summers. BPEA 2017. "Understanding Bank Risk through Market Measures." Lawrence H. Summers ...

... *Related to Sarin, Natasha, and Lawrence H. Summers. BPEA 2017. "Understanding Bank Risk through Market Measures." Lawrence H. Summers ...

here - Lakes Area Tea Party

... who receive the new money last to those who receive the new money first. This transfer is called a “Cantillon effect,” for Richard Cantillon, who is credited as the first to describe this process. Money is injected at specific points into the economy. Those who receive the new money first are able t ...

... who receive the new money last to those who receive the new money first. This transfer is called a “Cantillon effect,” for Richard Cantillon, who is credited as the first to describe this process. Money is injected at specific points into the economy. Those who receive the new money first are able t ...

Assessment pdf

... ♦ A bank is a for-profit company that is in the business of taking deposits, lending and providing other financial services. There are different kinds of banks, including national banks, state-chartered banks, savings and loan associations and savings banks (Banking Basics, 2002). Most banks and sav ...

... ♦ A bank is a for-profit company that is in the business of taking deposits, lending and providing other financial services. There are different kinds of banks, including national banks, state-chartered banks, savings and loan associations and savings banks (Banking Basics, 2002). Most banks and sav ...

bicycles and accessories

... should make a good contribution to the second half of the financial year. Although in difficult circumstances new product development helped to maintain margins in the sports, leisure and toys businesses, the main improvement to profitability was as a result of overhead savings. The increase towards ...

... should make a good contribution to the second half of the financial year. Although in difficult circumstances new product development helped to maintain margins in the sports, leisure and toys businesses, the main improvement to profitability was as a result of overhead savings. The increase towards ...

... In an economy, turning points of the consumer loan margins should be analyzed in conjunction with the events shaping the economic climate of the country (See chart). In Turkey, it can be observed that margins jumped sharply after the 2008 global crisis mainly owing to banks’ tightening supply condit ...

Shifts in Supply and Demand

... about their ability to earn income in the future. If consumers feel that they will be making more income in the future and more likely to hold a well paying job, consumer confidence has risen. When consumer confidence rises, consumers, optimistic about the future, will start consuming more now and s ...

... about their ability to earn income in the future. If consumers feel that they will be making more income in the future and more likely to hold a well paying job, consumer confidence has risen. When consumer confidence rises, consumers, optimistic about the future, will start consuming more now and s ...

Private Equity / Venture Capital Conceitos e perspectivas de

... Stable economy de-linked from politics Falling interest rates and country-risk Social inclusion of low-income families Source: BACEN; Social Security Ministry; IBGE ; CVM; Interviews with PE / VC specialists; BOVESPA; ANBID; BEST ...

... Stable economy de-linked from politics Falling interest rates and country-risk Social inclusion of low-income families Source: BACEN; Social Security Ministry; IBGE ; CVM; Interviews with PE / VC specialists; BOVESPA; ANBID; BEST ...

stance of monetary policy

... Eventually, after further monetary base expansions, when inflation did move a bit higher, the BoJ promptly increased interest rates, proving traders more or less right as the higher rates implied the bank was unhappy by the increase in spending betokened by the higher inflation. The central bank is ...

... Eventually, after further monetary base expansions, when inflation did move a bit higher, the BoJ promptly increased interest rates, proving traders more or less right as the higher rates implied the bank was unhappy by the increase in spending betokened by the higher inflation. The central bank is ...

Separating out Households and NPISH data in the National Accounts

... • Sample size of around to 40k individuals ...

... • Sample size of around to 40k individuals ...

Audited group results for the year ended 30 June 2002

... the kulula.com "no frills" air service launched in August 2001. The overall load factors for Comair improved from 60% last year to 63% but yields remained under pressure. Cash generated by operations was positive at R46 million contributing towards a healthy R175 million cash balance at financial ye ...

... the kulula.com "no frills" air service launched in August 2001. The overall load factors for Comair improved from 60% last year to 63% but yields remained under pressure. Cash generated by operations was positive at R46 million contributing towards a healthy R175 million cash balance at financial ye ...

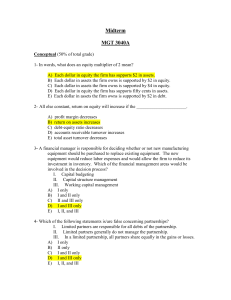

Answers to Midterm 3040A

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

... E) liabilities; sales 15- All else the same, which of the following occurs when a firm buys inventory with cash? A) The quick ratio goes up if it was greater than one before the change. B) The current ratio goes down if it was greater than one before the change. C) The current ratio goes down if it ...

Chapter 2

... Transaction of sales can be fallen into following two categories: 1. Sales for cash or cash sales 2. Sales on credit. Conventionally, there is no special distinguish between term of “cash” and “bank” in international accounting community, so, in the case of cash sale, it will include sales for actua ...

... Transaction of sales can be fallen into following two categories: 1. Sales for cash or cash sales 2. Sales on credit. Conventionally, there is no special distinguish between term of “cash” and “bank” in international accounting community, so, in the case of cash sale, it will include sales for actua ...

74 KB - Financial System Inquiry

... plain in the light of recent history, and were, to some extent, explored in Bird et al. (2010). Members of the Review would be well aware how research can be influenced by prior beliefs. The way in which the analysis is set up can heavily influence, or in extreme cases completely pre-determine, part ...

... plain in the light of recent history, and were, to some extent, explored in Bird et al. (2010). Members of the Review would be well aware how research can be influenced by prior beliefs. The way in which the analysis is set up can heavily influence, or in extreme cases completely pre-determine, part ...