Watani Investment Company K.S.C.C. (“NBK Capital”) and KAMCO

... All interest payment amounts attributable to the Bonds shall be payable subject to and in accordance with the terms and conditions set out in the “Terms and Conditions of the Issue”. Interest on the Bonds will accrue as of the issue date of the Bonds and will be payable semi-annually in arrears comm ...

... All interest payment amounts attributable to the Bonds shall be payable subject to and in accordance with the terms and conditions set out in the “Terms and Conditions of the Issue”. Interest on the Bonds will accrue as of the issue date of the Bonds and will be payable semi-annually in arrears comm ...

A Returns-Based Representation of Earnings Quality

... which are difficult (or not possible) to examine with traditional measures of earnings quality. Our analysis of the properties of e-loadings as measures of earnings quality has four components. First, we investigate whether e-loadings vary cross-sectionally with characteristics expected to be relate ...

... which are difficult (or not possible) to examine with traditional measures of earnings quality. Our analysis of the properties of e-loadings as measures of earnings quality has four components. First, we investigate whether e-loadings vary cross-sectionally with characteristics expected to be relate ...

Liquidity Shocks and the Business Cycle: What next?

... separated by a liquidity frontier. Each region has the properties that KM find for two distinct classes deterministic steady states.4 One region is entirely governed by the dynamics of real business cycle model. In the other region liquidity shocks play the role of shocks to the efficiency of invest ...

... separated by a liquidity frontier. Each region has the properties that KM find for two distinct classes deterministic steady states.4 One region is entirely governed by the dynamics of real business cycle model. In the other region liquidity shocks play the role of shocks to the efficiency of invest ...

CITIGROUP`S 2007 ANNUAL REPORT ON FORM 10-K

... change in estimate of loan losses, along with volume growth and credit weakness in certain countries, the impact of recent acquisitions, and the increase of NCLs in Japan Consumer Finance due to grey zone issues. Markets & Banking credit costs increased $1.0 billion, driven by higher NCLs associated ...

... change in estimate of loan losses, along with volume growth and credit weakness in certain countries, the impact of recent acquisitions, and the increase of NCLs in Japan Consumer Finance due to grey zone issues. Markets & Banking credit costs increased $1.0 billion, driven by higher NCLs associated ...

RIO TINTO PLC

... statements other than statements of historical facts included in this announcement, including, without limitation, those regarding Rio Tinto’s financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio T ...

... statements other than statements of historical facts included in this announcement, including, without limitation, those regarding Rio Tinto’s financial position, business strategy, plans and objectives of management for future operations (including development plans and objectives relating to Rio T ...

2014 IBM Annual Report 2 0 14 IB M A n n u a l R e p o rt

... cloud, analytics, mobile, social and security generated $25 billion of revenue in 2014, growing by 16 percent. Five years ago, these businesses represented just 13 percent of our revenue. Today, that has risen to 27 percent of IBM’s revenue. Big Data and analytics. Our analytics business grew 7 perc ...

... cloud, analytics, mobile, social and security generated $25 billion of revenue in 2014, growing by 16 percent. Five years ago, these businesses represented just 13 percent of our revenue. Today, that has risen to 27 percent of IBM’s revenue. Big Data and analytics. Our analytics business grew 7 perc ...

Podravka Group business results for 1

... optimization puts the focus on supporting certain parts of the programme, which is currently reflected on the level of revenue compared to the comparative period, but in the long term it should result in retaining only those with the potential for growth and expected profitability rates. If the FX e ...

... optimization puts the focus on supporting certain parts of the programme, which is currently reflected on the level of revenue compared to the comparative period, but in the long term it should result in retaining only those with the potential for growth and expected profitability rates. If the FX e ...

Annual Report 2014 - British American Tobacco

... Exchange rates continue to be volatile and in the current year, if rates were to stay where they are today, we would face a substantially larger transactional exchange headwind. This would impact our constant currency performance and would be in addition to any translational impact on reported numbe ...

... Exchange rates continue to be volatile and in the current year, if rates were to stay where they are today, we would face a substantially larger transactional exchange headwind. This would impact our constant currency performance and would be in addition to any translational impact on reported numbe ...

Examining the Impact of the East Asian Crisis on Household

... government ignored many of the economic weaknesses mentioned above for a significant period of time. Moreover, as the downturn began, President Suharto’s continued favors to his family’s businesses further undermined investor confidence (Radelet 2000, 59). In response to the initial economic decline ...

... government ignored many of the economic weaknesses mentioned above for a significant period of time. Moreover, as the downturn began, President Suharto’s continued favors to his family’s businesses further undermined investor confidence (Radelet 2000, 59). In response to the initial economic decline ...

printmgr file - Goldman Sachs

... in fixed income, equity, currency and commodity products, primarily with institutional clients such as corporations, financial institutions, investment funds and governments. The firm also makes markets in and clears client transactions on major stock, options and futures exchanges worldwide and pro ...

... in fixed income, equity, currency and commodity products, primarily with institutional clients such as corporations, financial institutions, investment funds and governments. The firm also makes markets in and clears client transactions on major stock, options and futures exchanges worldwide and pro ...

The Base Rate Book - research-and-analytics.csfb.com.

... value closer to the average. Examining correlations allows us to not only acknowledge the role of regression toward the mean, but also to understand its pace. The data in this book not only offer a basis for an assessment of the rate of regression toward the mean, but also document the mean, or aver ...

... value closer to the average. Examining correlations allows us to not only acknowledge the role of regression toward the mean, but also to understand its pace. The data in this book not only offer a basis for an assessment of the rate of regression toward the mean, but also document the mean, or aver ...

Cypress Capital Management, LLC 1 FIRM

... designed to provide above-average total returns, including both yield and capital appreciation. Maturity schedules are structured on the basis of interest rate anticipation, as well as a client’s desired income. Our fixed income portfolios may utilize U.S. Government obligations and a select group o ...

... designed to provide above-average total returns, including both yield and capital appreciation. Maturity schedules are structured on the basis of interest rate anticipation, as well as a client’s desired income. Our fixed income portfolios may utilize U.S. Government obligations and a select group o ...

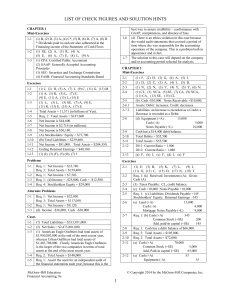

chapter 2 - McGraw Hill Higher Education - McGraw

... frequently. The situation is difficulty personally because of the possible repercussions to you by your boss, Mr. Lynch, if you do not meet his request. At the same time, the ethical and professional response is to follow the revenue recognition rule and account for the cash collection as deferred r ...

... frequently. The situation is difficulty personally because of the possible repercussions to you by your boss, Mr. Lynch, if you do not meet his request. At the same time, the ethical and professional response is to follow the revenue recognition rule and account for the cash collection as deferred r ...

Accruals, Financial Distress, and Debt Covenants Troy D. Janes

... debt covenants of borrowing firms with low accruals are set tightly; however, contrary to expectations, the debt covenants of borrowing firms with high accruals are set relatively loosely. Since prior research has shown that lenders possess unique information about borrowers, this result can be inte ...

... debt covenants of borrowing firms with low accruals are set tightly; however, contrary to expectations, the debt covenants of borrowing firms with high accruals are set relatively loosely. Since prior research has shown that lenders possess unique information about borrowers, this result can be inte ...

Agency costs

... The better performance of outsider systems with technologies that require a large scale of investment, and that of insider systems with technologies that are optimally implemented at small scales, is at the crux of the results in this paper. The intuition for this is that for technologies, which ar ...

... The better performance of outsider systems with technologies that require a large scale of investment, and that of insider systems with technologies that are optimally implemented at small scales, is at the crux of the results in this paper. The intuition for this is that for technologies, which ar ...

optimal capital structure

... Substantial parts of the literature concerning capital structure have dealt with issues regarding the leverage ratios. These leverage ratios have been analyzed in all kinds of ways, where most studies have explained observed patterns. Our research will also deal with leverage ratios but in an entire ...

... Substantial parts of the literature concerning capital structure have dealt with issues regarding the leverage ratios. These leverage ratios have been analyzed in all kinds of ways, where most studies have explained observed patterns. Our research will also deal with leverage ratios but in an entire ...

Debt Structure and Financial Flexibility

... are expropriated less. Leland and Toft (1996) also suggest risk-shifting as an explanation for the observed reliance on short-term debt. They argue that long-maturity debt allows for larger debt capacity and higher tax shields, therefore the propensity for firms to use short term term debt must be ...

... are expropriated less. Leland and Toft (1996) also suggest risk-shifting as an explanation for the observed reliance on short-term debt. They argue that long-maturity debt allows for larger debt capacity and higher tax shields, therefore the propensity for firms to use short term term debt must be ...

The Leverage Effect on Stock Returns-EFMA

... Rajan and Zingales, 1995; Booth, Aivazian, Demiguc-Kunt and Maksimovic, 2001; Lally, 2002), and testing the various well-known theories of capital structure (Frank and Goyal, 2003; Flannery and Rangan, 2006, Dang, 2010). Recent studies have attempted to examine the leverage - return relation (Dimit ...

... Rajan and Zingales, 1995; Booth, Aivazian, Demiguc-Kunt and Maksimovic, 2001; Lally, 2002), and testing the various well-known theories of capital structure (Frank and Goyal, 2003; Flannery and Rangan, 2006, Dang, 2010). Recent studies have attempted to examine the leverage - return relation (Dimit ...