This PDF is a selection from an out-of-print volume from the... of Economic Research Volume Title: International Economic Cooperation

... Whereas daily trading volume on the New York Stock Exchange averages less than $10 billion, foreign exchange transactions in Tokyo, New York, and London average more than $100 billion per day. Capital flows were the proximate cause of the death of the Bretton Woods system. They are a major and extra ...

... Whereas daily trading volume on the New York Stock Exchange averages less than $10 billion, foreign exchange transactions in Tokyo, New York, and London average more than $100 billion per day. Capital flows were the proximate cause of the death of the Bretton Woods system. They are a major and extra ...

Financialization and the Crises of Capitalism

... Figure 3 presents net dividend and net interest payments as a share of net operating surplus for US non-financial corporations, 1960-2010. Starting in the 1980s and 1990s, managers increasingly distributed corporate profits to shareholders in the form of dividend payments. Until the mid-1980s, divid ...

... Figure 3 presents net dividend and net interest payments as a share of net operating surplus for US non-financial corporations, 1960-2010. Starting in the 1980s and 1990s, managers increasingly distributed corporate profits to shareholders in the form of dividend payments. Until the mid-1980s, divid ...

Socialist People`s Libyan Arab Jamahiriya: 2009 Article IV

... favorable sovereign ratings assigned to the country earlier this year by international rating agencies. At the same time, important challenges remain to be addressed in order to achieve the authorities’ objectives of increasing non-oil growth and creating viable employment opportunities. These chall ...

... favorable sovereign ratings assigned to the country earlier this year by international rating agencies. At the same time, important challenges remain to be addressed in order to achieve the authorities’ objectives of increasing non-oil growth and creating viable employment opportunities. These chall ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... In a world without money illusion a nominal exchange rate devaluation per se will not have any persistent real effects. Under various plausible circumstances, however, a devaluation may speed up adjustment of the real economy to disturbances, be they exogenous or policy induced. It is in this vein t ...

... In a world without money illusion a nominal exchange rate devaluation per se will not have any persistent real effects. Under various plausible circumstances, however, a devaluation may speed up adjustment of the real economy to disturbances, be they exogenous or policy induced. It is in this vein t ...

Booms and banking crises - Bank for International Settlements

... Rare, large enough, adverse financial shocks can account for the first two properties (see e.g. Gertler and Kiyotaki, 2010). However, by implying that banking crises may break out at any time in the business cycle, they do not seem in line with the fact that the occurrence of a banking crisis is clo ...

... Rare, large enough, adverse financial shocks can account for the first two properties (see e.g. Gertler and Kiyotaki, 2010). However, by implying that banking crises may break out at any time in the business cycle, they do not seem in line with the fact that the occurrence of a banking crisis is clo ...

André Lemelin, INRS-Urbanisation

... financial capital is perfectly mobile between industries and regions. Its allocation is driven by forwardlooking investors who respond to arbitrage opportunities. Intertemporal optimization by households and firms determines saving and investment (the creation of new physical capital). Households ma ...

... financial capital is perfectly mobile between industries and regions. Its allocation is driven by forwardlooking investors who respond to arbitrage opportunities. Intertemporal optimization by households and firms determines saving and investment (the creation of new physical capital). Households ma ...

FRBSF E L CONOMIC ETTER

... alization might affect the process of inflation in the United States, to assess some empirical evidence bearing on the strength of such linkages, and to reflect on the implications for monetary policy. To preview my conclusions, some very tentative evidence supports the proposition that increasing g ...

... alization might affect the process of inflation in the United States, to assess some empirical evidence bearing on the strength of such linkages, and to reflect on the implications for monetary policy. To preview my conclusions, some very tentative evidence supports the proposition that increasing g ...

What is the Appropriate Size of the Banking System?

... implies that during crisis periods more credit can be provided to the private sector before the marginal effect becomes negative. This does not seem very sensible. More research is necessary to reveal which factors determine why some countries have a higher or lower threshold at which the marginal e ...

... implies that during crisis periods more credit can be provided to the private sector before the marginal effect becomes negative. This does not seem very sensible. More research is necessary to reveal which factors determine why some countries have a higher or lower threshold at which the marginal e ...

FDI and Economic Growth: The Role of Local Financial

... that significant FDI arrives through mergers and acquisitions, it is not just easy availability of loans but also well-functioning stock markets that matter. Well-functioning stock markets, by increasing the spectrum of sources of finance for entrepreneurs, play an important role in creating linkage ...

... that significant FDI arrives through mergers and acquisitions, it is not just easy availability of loans but also well-functioning stock markets that matter. Well-functioning stock markets, by increasing the spectrum of sources of finance for entrepreneurs, play an important role in creating linkage ...

6 Stylized steps for developing a macro stress testing framework

... including cross-border risks. • A common COMESA stress testing exercise might be meaningful once the level of financial integration and inter-linkages among financial institutions substantially increases from the current level. • Financial inter-linkages and cross-border exposure of banks within eac ...

... including cross-border risks. • A common COMESA stress testing exercise might be meaningful once the level of financial integration and inter-linkages among financial institutions substantially increases from the current level. • Financial inter-linkages and cross-border exposure of banks within eac ...

Central banks and the global debt overhang

... the crisis, significant progress has been made in reducing leverage in the financial sector by tightening oversight and regulation and by strengthening capital buffers. But the macroeconomic roots of the debt overhang have yet to be addressed. These roots lie partly in the asymmetric conduct or easi ...

... the crisis, significant progress has been made in reducing leverage in the financial sector by tightening oversight and regulation and by strengthening capital buffers. But the macroeconomic roots of the debt overhang have yet to be addressed. These roots lie partly in the asymmetric conduct or easi ...

NBER WORKING PAPER SERIES ON THE IRRELEVANCE OF PUBLIC FINANCIAL POLICY

... This paper establishes conditions under which public financial policy has neither real nor inflationary effects; under which it has inflationary effects, but not real effects; and under which it has real effects. An increase in government debt (keeping real expenditures fixed), accompanied by a decr ...

... This paper establishes conditions under which public financial policy has neither real nor inflationary effects; under which it has inflationary effects, but not real effects; and under which it has real effects. An increase in government debt (keeping real expenditures fixed), accompanied by a decr ...

Financial-Reform-and-Rural-Development

... output in agriculture, thus reinforcing the above findings. We also carry out a nonparametric analysis to show if there is a threshold level of state-level financial development. When credit-GDP ratio exceeds 11%, it has a favourable impact on growth and when it is below 11%, there is a declining ef ...

... output in agriculture, thus reinforcing the above findings. We also carry out a nonparametric analysis to show if there is a threshold level of state-level financial development. When credit-GDP ratio exceeds 11%, it has a favourable impact on growth and when it is below 11%, there is a declining ef ...

EU membership and the Bank of England

... Participation in the single market means that the majority of the legislation and regulation applying to the financial sector in the UK is determined at EU level. Such EU legislation and regulation must balance the achievement of the safety and soundness of firms and overall financial stability of t ...

... Participation in the single market means that the majority of the legislation and regulation applying to the financial sector in the UK is determined at EU level. Such EU legislation and regulation must balance the achievement of the safety and soundness of firms and overall financial stability of t ...

chapter iii balance of payments – theoretical

... balance, or the difference between exports and imports of goods and services (including gifts), or X – M . In a nutshell, the current account balance (CAB) in a balance of payment statement implies – (a) the difference between exports of goods & services & imports of goods & services (X – M), (b) Ne ...

... balance, or the difference between exports and imports of goods and services (including gifts), or X – M . In a nutshell, the current account balance (CAB) in a balance of payment statement implies – (a) the difference between exports of goods & services & imports of goods & services (X – M), (b) Ne ...

Government report - World Trade Organization

... grew significantly from US$216.3 million in 1999 (or approximately 2.8% of GDP) to US$1074.4 million in 2002 (or 13.9% of GDP). A major cause of the deterioration was increases in the trade deficit (goods) from 15.4% of GDP in 1999 to 24.2% of GDP in 2002. The services balance has remained positive ...

... grew significantly from US$216.3 million in 1999 (or approximately 2.8% of GDP) to US$1074.4 million in 2002 (or 13.9% of GDP). A major cause of the deterioration was increases in the trade deficit (goods) from 15.4% of GDP in 1999 to 24.2% of GDP in 2002. The services balance has remained positive ...

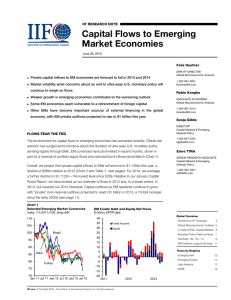

Capital Flows to Emerging Market Economies

... policy in Japan. Additionally, growth in emerging economies has lost some momentum recently, while growth prospects in mature economies have brightened somewhat, thus reducing the relative attractiveness for developed market investors to move capital abroad. Our baseline forecast for capital flows a ...

... policy in Japan. Additionally, growth in emerging economies has lost some momentum recently, while growth prospects in mature economies have brightened somewhat, thus reducing the relative attractiveness for developed market investors to move capital abroad. Our baseline forecast for capital flows a ...

A stages approach to banking development in transition economies

... circulation, they may decide to hoard. Hoarded money holds effective demand back and thus creates the possibility for general overproduction and thus crisis (de Brunhoff, 1976; Sardoni, 1987; Sweezy, 1970). To prevent cyclical crises, communist theorists advocated replacing decentralized markets wit ...

... circulation, they may decide to hoard. Hoarded money holds effective demand back and thus creates the possibility for general overproduction and thus crisis (de Brunhoff, 1976; Sardoni, 1987; Sweezy, 1970). To prevent cyclical crises, communist theorists advocated replacing decentralized markets wit ...

Economic environment

... Suriname is a small, mining-based economy, highly dependent on trade and on a limited basket of goods for export. As a result, Suriname's economy is susceptible to fluctuations in world prices and demand for alumina, its main export. Until recently, poor macroeconomic management, probably exacerbate ...

... Suriname is a small, mining-based economy, highly dependent on trade and on a limited basket of goods for export. As a result, Suriname's economy is susceptible to fluctuations in world prices and demand for alumina, its main export. Until recently, poor macroeconomic management, probably exacerbate ...

CHAPTER– 5 THE NEGATIVE EFFECTS OF MONEY LAUNDERING

... The negative effects of money laundering on economy are hard to put into numbers. However, it is clear that such activities damage not only the financial institutions directly, but also country’s productivity in its various economic sectors, such as real sector, international trade sector and capita ...

... The negative effects of money laundering on economy are hard to put into numbers. However, it is clear that such activities damage not only the financial institutions directly, but also country’s productivity in its various economic sectors, such as real sector, international trade sector and capita ...

G20 - Bundesfinanzministerium

... The G20 – FAQs Who are the G20’s members? The G20 comprises 19 states plus the EU. The countries are: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, and the United Stat ...

... The G20 – FAQs Who are the G20’s members? The G20 comprises 19 states plus the EU. The countries are: Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United Kingdom, and the United Stat ...

Document

... interest rate leads to a decrease in output. This is represented by the IS curve. Equilibrium in financial markets implies that an increase in output leads to an increase in the interest rate. This is represented by the LM curve. Only at point A, which is on both curves, are both goods and financial ...

... interest rate leads to a decrease in output. This is represented by the IS curve. Equilibrium in financial markets implies that an increase in output leads to an increase in the interest rate. This is represented by the LM curve. Only at point A, which is on both curves, are both goods and financial ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.