measures of finance-adjusted output gaps

... market capitalization) matter for output gap, in addition to the conventional indicators such as inflation rate or unemployment. This paper contributes to this on-going research agenda by providing estimates of financeadjusted output gaps and sustainable growth for a large sample of emerging market ...

... market capitalization) matter for output gap, in addition to the conventional indicators such as inflation rate or unemployment. This paper contributes to this on-going research agenda by providing estimates of financeadjusted output gaps and sustainable growth for a large sample of emerging market ...

Price slump in commodities: Financial implications for

... international capital flows and the associated rising borrowing costs during downturns, debt refinancing strategies that rely increasingly on access to largely unregulated international financial markets (including through trading of domestic sovereign bonds in secondary bond markets) bring two furt ...

... international capital flows and the associated rising borrowing costs during downturns, debt refinancing strategies that rely increasingly on access to largely unregulated international financial markets (including through trading of domestic sovereign bonds in secondary bond markets) bring two furt ...

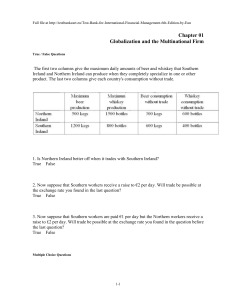

Chapter 01 Globalization and the Multinational Firm

... 41. Since its inception the euro has brought about revolutionary changes in European finance. For example, A. by redenominating corporate bonds and stocks from 12 different currencies into one common currency, the euro has precipitated the emergence of continent wide capital markets in Europe that a ...

... 41. Since its inception the euro has brought about revolutionary changes in European finance. For example, A. by redenominating corporate bonds and stocks from 12 different currencies into one common currency, the euro has precipitated the emergence of continent wide capital markets in Europe that a ...

exchange rate

... Exchange rates that are determined by the unregulated forces of supply and demand. The Market For Foreign Exchange The Supply of and Demand for Pounds Governments, private citizens, banks, and corporations exchange pounds for dollars and dollars for pounds every day. In our two-country case, those w ...

... Exchange rates that are determined by the unregulated forces of supply and demand. The Market For Foreign Exchange The Supply of and Demand for Pounds Governments, private citizens, banks, and corporations exchange pounds for dollars and dollars for pounds every day. In our two-country case, those w ...

Interest rates and financial integration - a long perspective on China

... A major reason for the geographical and temporal biases mentioned above is the difficulty in data collection, especially in China. Thus, secondly, the present paper means to enrich the financial database with new evidence of interest data. China’s commercial and financial data are extremely scattere ...

... A major reason for the geographical and temporal biases mentioned above is the difficulty in data collection, especially in China. Thus, secondly, the present paper means to enrich the financial database with new evidence of interest data. China’s commercial and financial data are extremely scattere ...

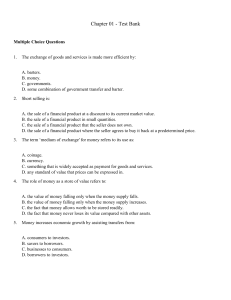

Financial Institutions Instruments and Markets, 5th Edition

... B. offers the greatest number of financial assets. C. involves the sale of existing financial assets. D. offers financial assets with the highest historical return. 35. Purchasing shares on the Australian Securities Exchange is an example of: A. a primary market transaction. B. companies raising fin ...

... B. offers the greatest number of financial assets. C. involves the sale of existing financial assets. D. offers financial assets with the highest historical return. 35. Purchasing shares on the Australian Securities Exchange is an example of: A. a primary market transaction. B. companies raising fin ...

China in the World Economy: The Domestic Policy

... the world’s seventh largest economy and second largest recipient of foreign direct investment. Only Japan and Korea achieved a comparable record of sustained rapid growth during the latter half of the 20th century. China’s performance is all the more remarkable in that its reforms have been gradual ...

... the world’s seventh largest economy and second largest recipient of foreign direct investment. Only Japan and Korea achieved a comparable record of sustained rapid growth during the latter half of the 20th century. China’s performance is all the more remarkable in that its reforms have been gradual ...

Financial Distress

... a Material Sub-contractor’s credit ratings dropping one or more levels below the Sub-contractor Credit Rating Threshold; ...

... a Material Sub-contractor’s credit ratings dropping one or more levels below the Sub-contractor Credit Rating Threshold; ...

Presentation

... Operational flexibility refers to areas such as : scope of activities, supply of product and services, and other flexibilities as may be mutually agred between a host and a home country. ...

... Operational flexibility refers to areas such as : scope of activities, supply of product and services, and other flexibilities as may be mutually agred between a host and a home country. ...

USING THE BALANCE SHEET APPROACH IN FINANCIAL

... analyzing financial stability. Many articles and publications reflect this growing recognition, though the major work on this subject was produced by the IMF in 2002 (See Allen et al., 2002). This paper asserts that the division of the economy into sectors, and viewing assets and liabilities by sect ...

... analyzing financial stability. Many articles and publications reflect this growing recognition, though the major work on this subject was produced by the IMF in 2002 (See Allen et al., 2002). This paper asserts that the division of the economy into sectors, and viewing assets and liabilities by sect ...

The `Great Divide` and the Political Economy

... including explicit or implicit bailout guarantees. In this case, it is the state that captures the banks rather than private interests within the banking sector exercising undue influence over government policy. One factor that can disturb this equilibrium in emerging markets and promote financial r ...

... including explicit or implicit bailout guarantees. In this case, it is the state that captures the banks rather than private interests within the banking sector exercising undue influence over government policy. One factor that can disturb this equilibrium in emerging markets and promote financial r ...

Politics of Banking Reform and Development in the Post

... including explicit or implicit bailout guarantees. In this case, it is the state that captures the banks rather than private interests within the banking sector exercising undue influence over government policy. One factor that can disturb this equilibrium in emerging markets and promote financial r ...

... including explicit or implicit bailout guarantees. In this case, it is the state that captures the banks rather than private interests within the banking sector exercising undue influence over government policy. One factor that can disturb this equilibrium in emerging markets and promote financial r ...

financial stability report

... diminished activity and the low-interest-rate environment, along with certain one-off factors that affected both domestic business (significant losses at the odd institution, regulatory changes in the coverage of foreclosed assets and higher legal costs) and international business (the depreciation ...

... diminished activity and the low-interest-rate environment, along with certain one-off factors that affected both domestic business (significant losses at the odd institution, regulatory changes in the coverage of foreclosed assets and higher legal costs) and international business (the depreciation ...

2015 - MFSA

... directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error, and that comply with the Companies Act, 1995. They are also responsible for safeguarding the assets of the company and hence for taking reasonab ...

... directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error, and that comply with the Companies Act, 1995. They are also responsible for safeguarding the assets of the company and hence for taking reasonab ...

2013 External Balance Assessment (EBA) Methodology

... implies that CA and REER are both endogenous and simultaneously determined as a function of other variables. Hence we make use of the system to derive reduced form equations for CA and REER. The model could be solved for REER and Y given r or for REER and r given Y. If we assume that monetary policy ...

... implies that CA and REER are both endogenous and simultaneously determined as a function of other variables. Hence we make use of the system to derive reduced form equations for CA and REER. The model could be solved for REER and Y given r or for REER and r given Y. If we assume that monetary policy ...

Managing Public Debt and Its Financial Stability Implications

... country’s macroeconomic and financial policy framework. Indeed, past crises have been triggered by debt crises. The recently heightened attention on sovereign risk from policy makers and financial markets stems from the realization that how debt is managed considerably influences the soundness and s ...

... country’s macroeconomic and financial policy framework. Indeed, past crises have been triggered by debt crises. The recently heightened attention on sovereign risk from policy makers and financial markets stems from the realization that how debt is managed considerably influences the soundness and s ...

syllabuses 2017 - University of the Free State

... Major financial and strategic issues affecting the South African and global banking industries. The relationships between the various types of financial risks banks are exposed to. The asset and liability management function banks use to manage financial risk. The evolution of the Basel capi ...

... Major financial and strategic issues affecting the South African and global banking industries. The relationships between the various types of financial risks banks are exposed to. The asset and liability management function banks use to manage financial risk. The evolution of the Basel capi ...

NBER WORKING PAPER SERIES FINANCIAL CRISES AND ECONOMIC ACTIVITY Stephen G. Cecchetti

... Lower equity and property prices drive down firms’ net worth, increasing the problems of adverse selection and moral hazard ...

... Lower equity and property prices drive down firms’ net worth, increasing the problems of adverse selection and moral hazard ...

Currency Outlook-Why the JPY won`t weaken

... cyclical perspective, import demand may weaken when the consumption tax is introduced in April this year. Export demand should pick-up alongside accelerating GDP growth in the bulk of Japan’s main export markets. The US, Germany, Australia and most economies in Asia ex-Japan are forecast to show fas ...

... cyclical perspective, import demand may weaken when the consumption tax is introduced in April this year. Export demand should pick-up alongside accelerating GDP growth in the bulk of Japan’s main export markets. The US, Germany, Australia and most economies in Asia ex-Japan are forecast to show fas ...

A Antonio Martino

... that a gold-backed currency would severely limit the discretion of 3’Proposals for monetary reform usually assume that the public prefers a noninflationary rate of monetary growth. This may be true, but it has not been clemosntrated. Nor has it been shown that the rate of inflation that maximizes we ...

... that a gold-backed currency would severely limit the discretion of 3’Proposals for monetary reform usually assume that the public prefers a noninflationary rate of monetary growth. This may be true, but it has not been clemosntrated. Nor has it been shown that the rate of inflation that maximizes we ...

Economics Working Paper Weathering the financial storm: The

... contraction in economic activity on top of a system-wide banking and currency collapse, others came off relatively lightly. This paper aims to explain this difference in cross-country experience by means of a non-structural econometric analysis using a variety of potential precrisis explanatory vari ...

... contraction in economic activity on top of a system-wide banking and currency collapse, others came off relatively lightly. This paper aims to explain this difference in cross-country experience by means of a non-structural econometric analysis using a variety of potential precrisis explanatory vari ...

Fintech and Disruptive Business Models in Financial Products

... development of highly leveraged products, such as synthetic exchangetraded funds serve primarily speculative purposes instead of genuinely beneficial economic purposes.25 Regulatory arbitrage is a major driver of financial innovation.26 For example, the development of processes to liquify long-term ...

... development of highly leveraged products, such as synthetic exchangetraded funds serve primarily speculative purposes instead of genuinely beneficial economic purposes.25 Regulatory arbitrage is a major driver of financial innovation.26 For example, the development of processes to liquify long-term ...

Capital Flight and the Hollowing Out of the Philippine Economy in

... neoliberal policies—indeed the Philippines is a good example of a country that closely followed neoliberal prescriptions (see Pritchett 2003; Bello et al. 2004)—we find that capital flight and external borrowing have increased with deregulation and financial liberalization. Such felicitous outcomes ...

... neoliberal policies—indeed the Philippines is a good example of a country that closely followed neoliberal prescriptions (see Pritchett 2003; Bello et al. 2004)—we find that capital flight and external borrowing have increased with deregulation and financial liberalization. Such felicitous outcomes ...

What is Financial Stability? Financial Stability

... Alawode and Al Sadek What is Financial Stability? ...

... Alawode and Al Sadek What is Financial Stability? ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.