Argentina_en.pdf

... their effects on tax bases. Revenues from national taxes rose slightly as a percentage of GDP, largely on account of the higher contributions to social security resulting from the unification of the pension system under the State pay-as-you-go scheme. Conversely, the proceeds of taxes on foreign tra ...

... their effects on tax bases. Revenues from national taxes rose slightly as a percentage of GDP, largely on account of the higher contributions to social security resulting from the unification of the pension system under the State pay-as-you-go scheme. Conversely, the proceeds of taxes on foreign tra ...

The Evolution of the Finance

... This impressive paper would not have made it on to a Fed research seminar in those days. But, it would now in a world where fear of systemic risk is everywhere: ...

... This impressive paper would not have made it on to a Fed research seminar in those days. But, it would now in a world where fear of systemic risk is everywhere: ...

NUS Business School National University of Singapore BMA5011

... role of stabilization policy. The final segment of the course extends these analyses to the open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shoc ...

... role of stabilization policy. The final segment of the course extends these analyses to the open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shoc ...

International Trade - Madison County Schools

... • When economies are opened for international trade, differences between world and domestic prices encourage exports/imports ...

... • When economies are opened for international trade, differences between world and domestic prices encourage exports/imports ...

OVERVIEW

... Middle East and North African countries on the global economy through the channel of energy prices should be monitored carefully. Capital inflows to Turkey, which has relatively stronger economic fundamentals among emerging economies, continued; the economy continued to grow on the back of domestic ...

... Middle East and North African countries on the global economy through the channel of energy prices should be monitored carefully. Capital inflows to Turkey, which has relatively stronger economic fundamentals among emerging economies, continued; the economy continued to grow on the back of domestic ...

More Information

... According to the report, the same financial institutions that were deemed TBTF during the financial crisis not only remain TBTF, but are now even bigger. Federal Reserve data show that before the financial crisis, the top five U.S. banking institutions held $6.1 trillion in assets, equal to 43 perce ...

... According to the report, the same financial institutions that were deemed TBTF during the financial crisis not only remain TBTF, but are now even bigger. Federal Reserve data show that before the financial crisis, the top five U.S. banking institutions held $6.1 trillion in assets, equal to 43 perce ...

Financial system in B&H in combination with the financial crises and

... Basel II TCE counts as only loss absorbent part of equity shortened period to adapt until 01.jan.2013 in EU 9% tangible capital adequacy ratio introduced (until 30.06.2012) huge competition for capital – lack of capital Banks required to withhold 30 day system wide liquidity shock ...

... Basel II TCE counts as only loss absorbent part of equity shortened period to adapt until 01.jan.2013 in EU 9% tangible capital adequacy ratio introduced (until 30.06.2012) huge competition for capital – lack of capital Banks required to withhold 30 day system wide liquidity shock ...

Chapter 2

... Faster growth rates expected in developing countries such as Brazil, China, India, Indonesia, and Russia. More trade expected in emerging markets, regional trade areas, and the established markets in Europe, Japan, and U.S. Companies need to be more efficient, improve productivity, expand global rea ...

... Faster growth rates expected in developing countries such as Brazil, China, India, Indonesia, and Russia. More trade expected in emerging markets, regional trade areas, and the established markets in Europe, Japan, and U.S. Companies need to be more efficient, improve productivity, expand global rea ...

Chapter 1.

... uses interest rates and other instruments to control the money supply. The Purpose of Mon. Pol. Is to control inflation which is the rate of change of the price level. Conducted in Turkey by CBRT, In the U.S. by the Federal Reserve Bank (Fed) Why is it important to control the money ...

... uses interest rates and other instruments to control the money supply. The Purpose of Mon. Pol. Is to control inflation which is the rate of change of the price level. Conducted in Turkey by CBRT, In the U.S. by the Federal Reserve Bank (Fed) Why is it important to control the money ...

Macroeconomics - Econproph on Macro

... • Monetary policy to lower interest Problems: rates • Practicality: • Not effective in liquidity trap • Lag times on policy • Balanced budget over cycle • Size of response • Demand-side focus ...

... • Monetary policy to lower interest Problems: rates • Practicality: • Not effective in liquidity trap • Lag times on policy • Balanced budget over cycle • Size of response • Demand-side focus ...

HISTORY OF GLOBAL ECONOMY

... marked by a resurgence of economic prosperity, particularly in the United States. However, Germany saddled with reparations, payments to Allied powers (France in particular) for damages caused during the war faced devastating hardship. The Germany currency suffered a hyperinflation making it near wo ...

... marked by a resurgence of economic prosperity, particularly in the United States. However, Germany saddled with reparations, payments to Allied powers (France in particular) for damages caused during the war faced devastating hardship. The Germany currency suffered a hyperinflation making it near wo ...

The importance of well-developed - Bank for International Settlements

... supervision in order to try and avoid a repeat of the global financial crises, which led to an economic and sovereign debt crisis, which after 6 years the world economy is still struggling to recover from. However, it is also important that regulation is appropriately calibrated, and that a defensib ...

... supervision in order to try and avoid a repeat of the global financial crises, which led to an economic and sovereign debt crisis, which after 6 years the world economy is still struggling to recover from. However, it is also important that regulation is appropriately calibrated, and that a defensib ...

Accra conference presentation - Peter Chowla

... matching this to national needs and situations Capital account management tools Striking the right balance between stability and capital availability Environmental, social & governance risks ◦ Corruption may not be the biggest problem given global systemic risks ...

... matching this to national needs and situations Capital account management tools Striking the right balance between stability and capital availability Environmental, social & governance risks ◦ Corruption may not be the biggest problem given global systemic risks ...

Normal - Interest.co.nz

... borrowing costs could cause a sudden price correction, reducing consumer confidence, worsening banks’ balance sheets, and impacting overall economic activity. Tail risks and downside scenarios. Many of the above risks are closely linked, and the importance of agricultural sector exports to New Zeala ...

... borrowing costs could cause a sudden price correction, reducing consumer confidence, worsening banks’ balance sheets, and impacting overall economic activity. Tail risks and downside scenarios. Many of the above risks are closely linked, and the importance of agricultural sector exports to New Zeala ...

Introduction 1.1 Preamble The study of *Agricultural Finance* varies

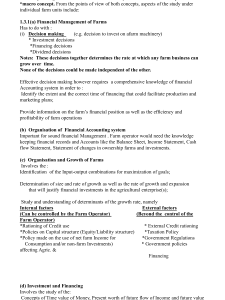

... “macro concept. From the points of view of both concepts, aspects of the study under individual farm units include: 1.3.1(a) Financial Management of Farms Has to do with : (i) Decision making (e.g. decision to invest on afarm machinery) * Investment decisions *Financing decisions *Dividend decisions ...

... “macro concept. From the points of view of both concepts, aspects of the study under individual farm units include: 1.3.1(a) Financial Management of Farms Has to do with : (i) Decision making (e.g. decision to invest on afarm machinery) * Investment decisions *Financing decisions *Dividend decisions ...

Bank of Israel

... system’s exposure to these risks. According to the Report, the domestic financial system maintained stability in recent months, against the background of the accommodative monetary policy in Israel and globally, and despite the gyrations in the financial markets. The banks and insurance companies re ...

... system’s exposure to these risks. According to the Report, the domestic financial system maintained stability in recent months, against the background of the accommodative monetary policy in Israel and globally, and despite the gyrations in the financial markets. The banks and insurance companies re ...

Suspected Illegal Money Deals Increase 2.5-Fold

... Local residents are required by the foreign exchange transaction law to fill out a bank form when sending money overseas and the banks are obliged to report all transactions amounting to $10,000 per year to the NTS. Some individuals try to bypass domestic banks and not report transactions to author ...

... Local residents are required by the foreign exchange transaction law to fill out a bank form when sending money overseas and the banks are obliged to report all transactions amounting to $10,000 per year to the NTS. Some individuals try to bypass domestic banks and not report transactions to author ...

Feb.12

... It confirms: US recession turned severe in September, when the worst of the financial crisis hit (Lehman bankruptcy…) ...

... It confirms: US recession turned severe in September, when the worst of the financial crisis hit (Lehman bankruptcy…) ...

Some Good Achievements

... – Strong profit, capital and liquidity position of the banking system (no bank failures): • Banks exceed not only the BIS regulatory minimum ratio, but also the NBS’s more conservative 12% floor, for regulatory capital as a share of risk-weighted assets • generally conservative and well-regulated • ...

... – Strong profit, capital and liquidity position of the banking system (no bank failures): • Banks exceed not only the BIS regulatory minimum ratio, but also the NBS’s more conservative 12% floor, for regulatory capital as a share of risk-weighted assets • generally conservative and well-regulated • ...

WEEK 9 Read the article on Financialization by Stockhammer for

... as shareholder value orientation, increasing household debt, changes in attitudes of individuals, increasing incomes from financial activities, increasing frequency of financial crises, and increasing ...

... as shareholder value orientation, increasing household debt, changes in attitudes of individuals, increasing incomes from financial activities, increasing frequency of financial crises, and increasing ...

WP24

... institutions at the world level, one (the IMF) to assist countries facing temporary balance of payments difficulties and pre-empt a protectionist response, the other (the World Bank) to redistribute resources to countries that were missing out in free market allocations and protect the legitimacy of ...

... institutions at the world level, one (the IMF) to assist countries facing temporary balance of payments difficulties and pre-empt a protectionist response, the other (the World Bank) to redistribute resources to countries that were missing out in free market allocations and protect the legitimacy of ...

Report overview [pdf]

... their impact is ephemeral. If bubbles are allowed to form, they will break and asset prices will continue to fall even if interest rates decline sharply. Central banks are then unable to stimulate demand. The severe recessions which result, require, as we have recently seen, large fiscal stimuli. Th ...

... their impact is ephemeral. If bubbles are allowed to form, they will break and asset prices will continue to fall even if interest rates decline sharply. Central banks are then unable to stimulate demand. The severe recessions which result, require, as we have recently seen, large fiscal stimuli. Th ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.

![Report overview [pdf]](http://s1.studyres.com/store/data/008781664_1-1830d3eb500407c73b24e758e32efc88-300x300.png)