A PROGRESSIVE PROGRAM FOR ECONOMIC RECOVERY & FINANCIAL RECONSTRUCTION

... Not since the Great Depression has the world faced an economic crisis as it does today, with enormous attendant loss in human progress and a serious threat of global instability. An interlocking set of downward pressures starting from the financial markets and extending into the real economy is unra ...

... Not since the Great Depression has the world faced an economic crisis as it does today, with enormous attendant loss in human progress and a serious threat of global instability. An interlocking set of downward pressures starting from the financial markets and extending into the real economy is unra ...

Systemic Risk and Regulation

... guarantees or IMF guarantees then banks or borrowers or somebody else who benefits from the guarantees will have an incentive to take risks – they obtain the upside if the risks pay off while the guarantor bears the downside ...

... guarantees or IMF guarantees then banks or borrowers or somebody else who benefits from the guarantees will have an incentive to take risks – they obtain the upside if the risks pay off while the guarantor bears the downside ...

Tunisia: Letter of Intent, Memorandum on Economic Financial

... The memorandum on economic and financial policies (MEFP), hereto annexed, sets out the principal elements of the program of reforms and policies that the government and the central bank intend to carry out during the period 2016 to 2019. It also describes macroeconomic objectives, structural reforms ...

... The memorandum on economic and financial policies (MEFP), hereto annexed, sets out the principal elements of the program of reforms and policies that the government and the central bank intend to carry out during the period 2016 to 2019. It also describes macroeconomic objectives, structural reforms ...

3.1 - United Nations Statistics Division

... Method for calculating financial intermediation services indirectly measured (FISIM) is refined (para 6.163-6.165) The 2008 SNA recommends that output of FISIM should be allocated between users (lenders and borrowers) treating the allocated amount either as intermediate consumption or final consum ...

... Method for calculating financial intermediation services indirectly measured (FISIM) is refined (para 6.163-6.165) The 2008 SNA recommends that output of FISIM should be allocated between users (lenders and borrowers) treating the allocated amount either as intermediate consumption or final consum ...

Chapter 3: Australia`s existing regulatory framework

... Ideally risk is accurately priced, adequately compensated by expected returns, and knowingly taken on by those with the best capacity to manage it. In practice, most countries erect some form of regulatory framework to ameliorate problems faced by (some) participants in identifying risk and to deal ...

... Ideally risk is accurately priced, adequately compensated by expected returns, and knowingly taken on by those with the best capacity to manage it. In practice, most countries erect some form of regulatory framework to ameliorate problems faced by (some) participants in identifying risk and to deal ...

Evolution by Region - Pennsylvania State University

... • Curious that H-S apply discount factor to net rather than gross income – Gross income in 2004 was $376 billion, so by their procedure, gross assets = $7.52 trillion, less than measured official gross assets of $10 trillion • Perhaps there is dark anti-matter! ...

... • Curious that H-S apply discount factor to net rather than gross income – Gross income in 2004 was $376 billion, so by their procedure, gross assets = $7.52 trillion, less than measured official gross assets of $10 trillion • Perhaps there is dark anti-matter! ...

Monetary Policy after the Crisis - Ten Lessons from a Fixed

... for Denmark in October 2008, and naturally it presented a challenge to communicate the need to raise interest rates in Denmark at a time when other central banks around the world were lowering theirs to support the financial sector in order to address the international financial crisis. Lesson 4: Th ...

... for Denmark in October 2008, and naturally it presented a challenge to communicate the need to raise interest rates in Denmark at a time when other central banks around the world were lowering theirs to support the financial sector in order to address the international financial crisis. Lesson 4: Th ...

A Preliminary Report on The Sources of Ireland’s Banking Crisis

... Ireland’s banking crisis bears the clear imprint of global influences, yet it was in crucial ways “home-made.” This report aims to clarify how different factors – external and domestic, macroeconomic and structural – interacted to cause the crisis. On this basis, it seeks to draw policy lessons, and ...

... Ireland’s banking crisis bears the clear imprint of global influences, yet it was in crucial ways “home-made.” This report aims to clarify how different factors – external and domestic, macroeconomic and structural – interacted to cause the crisis. On this basis, it seeks to draw policy lessons, and ...

Rethinking the Role of the Financial Sector in Economic Growth in

... The lack of competition in the sector was linked to the fragmentation in markets caused by national boundaries and a variety of formal and informal barriers to entry. This has given rise to the emergence of a sector that is dominated by a few large commercial banks in each country. This has led to ...

... The lack of competition in the sector was linked to the fragmentation in markets caused by national boundaries and a variety of formal and informal barriers to entry. This has given rise to the emergence of a sector that is dominated by a few large commercial banks in each country. This has led to ...

PDF Download

... Chapter 5 considers merger control and competition policy in Europe, where merger activity is gathering pace. Earlier, mergers were mainly an AngloSaxon phenomenon. Higher merger activity in Europe is driven by a combination of the long-term effects of market integration and globalisation, strong co ...

... Chapter 5 considers merger control and competition policy in Europe, where merger activity is gathering pace. Earlier, mergers were mainly an AngloSaxon phenomenon. Higher merger activity in Europe is driven by a combination of the long-term effects of market integration and globalisation, strong co ...

SMEs and poverty alleviation Thorsten Beck Executive Summary

... the introduction of credit registries or bureaus. By enhancing competition in the banking system, such institutions can help expand outreach, by either increasing competition among incumbent banks or easing the entry of new players. As is the case with policies that help push the financial system to ...

... the introduction of credit registries or bureaus. By enhancing competition in the banking system, such institutions can help expand outreach, by either increasing competition among incumbent banks or easing the entry of new players. As is the case with policies that help push the financial system to ...

Idea Sharing Session on Political Economy of Trade

... The government imposed high tariffs to obtain more revenue and protect domestic industries. Customs duties, together with sales taxes and development surcharges, constituted about 40% of government revenue. The maximum tariff rate was 400% and rates varied widely across products. Arbitrary price fix ...

... The government imposed high tariffs to obtain more revenue and protect domestic industries. Customs duties, together with sales taxes and development surcharges, constituted about 40% of government revenue. The maximum tariff rate was 400% and rates varied widely across products. Arbitrary price fix ...

Lessons for the euro from early American monetary and

... Lessons for the euro from early American monetary and financial history .....................................................................................................7 Analytical principles and distributional divisions ........................................8 Alexander Hamilton builds a more ...

... Lessons for the euro from early American monetary and financial history .....................................................................................................7 Analytical principles and distributional divisions ........................................8 Alexander Hamilton builds a more ...

Allocation of Financial Intermediation Services Indirectly

... accurate GDP levels could be obtained: GDP would include the entire value added generated by financial intermediaries, and not just the part corresponding to commissions and fees invoiced to ...

... accurate GDP levels could be obtained: GDP would include the entire value added generated by financial intermediaries, and not just the part corresponding to commissions and fees invoiced to ...

Summary of Opinions at the MPM in January

... would accommodate the upward pressure on long-term interest rates due to whatever reasons, by way of raising its 10Y JGB target yield. Second, many of the markets seem to suspect that the BOJ may have some policy intensions when they alter the specifications of any market operations. As discussed ab ...

... would accommodate the upward pressure on long-term interest rates due to whatever reasons, by way of raising its 10Y JGB target yield. Second, many of the markets seem to suspect that the BOJ may have some policy intensions when they alter the specifications of any market operations. As discussed ab ...

Accessing Capital

... businesses to obtain SBA loans outside of a real estate purchase. 4. Factoring and Alternative Lenders – Factors provide a loan against receivables or contracts that allow the business to gain immediate working capital to fulfill the order prior to client payment. While the cost of factoring is quit ...

... businesses to obtain SBA loans outside of a real estate purchase. 4. Factoring and Alternative Lenders – Factors provide a loan against receivables or contracts that allow the business to gain immediate working capital to fulfill the order prior to client payment. While the cost of factoring is quit ...

Financial crises, institutional change and small welfare states.

... In Denmark, direct intervention into the economy was less pronounced than in many other countries. The background can be found in the dominance of quite liberal way of thinking, in part due to the strong position of small enterprises both in agriculture and manufacturing. However, international capi ...

... In Denmark, direct intervention into the economy was less pronounced than in many other countries. The background can be found in the dominance of quite liberal way of thinking, in part due to the strong position of small enterprises both in agriculture and manufacturing. However, international capi ...

Baldwin & Wyplosz The Economics of Euroepan Integration

... • A menu hard to pick from: trade-offs are everywhere • All of this takes the view from a single country • Systems involve many countries and rest on agreed upon rules, including mutual support • Since the end of Bretton Woods, there is no world monetary system • This leaves room for regional moneta ...

... • A menu hard to pick from: trade-offs are everywhere • All of this takes the view from a single country • Systems involve many countries and rest on agreed upon rules, including mutual support • Since the end of Bretton Woods, there is no world monetary system • This leaves room for regional moneta ...

ECON 2301 Spring 2003

... The Federal Reserve System (cont'd) Functions of the Fed 1. Supplies the economy with fiduciary currency 2. Provides a payment-clearing system 3. Holds depository institutions’ reserves 4. Acts as the government’s fiscal agent 5. Supervises depository institutions 6. Acts as a “lender of last res ...

... The Federal Reserve System (cont'd) Functions of the Fed 1. Supplies the economy with fiduciary currency 2. Provides a payment-clearing system 3. Holds depository institutions’ reserves 4. Acts as the government’s fiscal agent 5. Supervises depository institutions 6. Acts as a “lender of last res ...

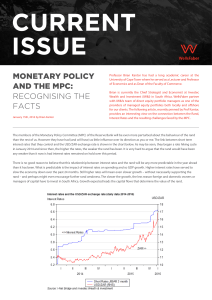

Monetary policy and the Mpc: Recognising the facts

... The members of the Monetary Policy Committee (MPC) of the Reserve Bank will be even more perturbed about the behaviour of the rand than the rest of us. However they have had (and will have) as little influence over its direction as you or me. The link between short term interest rates that they cont ...

... The members of the Monetary Policy Committee (MPC) of the Reserve Bank will be even more perturbed about the behaviour of the rand than the rest of us. However they have had (and will have) as little influence over its direction as you or me. The link between short term interest rates that they cont ...

Financial Innovations in EMC Capital Markets I. Preface

... by Lerner and Tufano1 to define Financial Innovation as “the act of creating and then popularizing new financial instruments, as well as new financial technologies, institutions and markets.” The Lerner and Tufano study also mentions in detail that “the innovations are sometimes divided into product ...

... by Lerner and Tufano1 to define Financial Innovation as “the act of creating and then popularizing new financial instruments, as well as new financial technologies, institutions and markets.” The Lerner and Tufano study also mentions in detail that “the innovations are sometimes divided into product ...

Global financial system

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic actors that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.A series of currency devaluations and oil crises in the 1970s led most countries to float their currencies. The world economy became increasingly financially integrated in the 1980s and 1990s due to capital account liberalization and financial deregulation. A series of financial crises in Europe, Asia, and Latin America followed with contagious effects due to greater exposure to volatile capital flows. The global financial crisis, which originated in the United States in 2007, quickly propagated among other nations and is recognized as the catalyst for the worldwide Great Recession. A market adjustment to Greece's noncompliance with its monetary union in 2009 ignited a sovereign debt crisis among European nations known as the Eurozone crisis.A country's decision to operate an open economy and globalize its financial capital carries monetary implications captured by the balance of payments. It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments. Both individuals and groups may participate in the global financial system. Consumers and international businesses undertake consumption, production, and investment. Governments and intergovernmental bodies act as purveyors of international trade, economic development, and crisis management. Regulatory bodies establish financial regulations and legal procedures, while independent bodies facilitate industry supervision. Research institutes and other associations analyze data, publish reports and policy briefs, and host public discourse on global financial affairs.While the global financial system is edging toward greater stability, governments must deal with differing regional or national needs. Some nations are trying to orderly discontinue unconventional monetary policies installed to cultivate recovery, while others are expanding their scope and scale. Emerging market policymakers face a challenge of precision as they must carefully institute sustainable macroeconomic policies during extraordinary market sensitivity without provoking investors to retreat their capital to stronger markets. Nations' inability to align interests and achieve international consensus on matters such as banking regulation has perpetuated the risk of future global financial catastrophes.