ECONOMICS IS NOT ALWAYS ECONOMICAL

... financial crisis. In addition, we determined that most emerging market economies were dependent on China for their growth. The indexes representing these countries began reflecting our thesis and the stock market performance of these countries have been awful. The FTSE Emerging Market Index is down ...

... financial crisis. In addition, we determined that most emerging market economies were dependent on China for their growth. The indexes representing these countries began reflecting our thesis and the stock market performance of these countries have been awful. The FTSE Emerging Market Index is down ...

Public Guarantees on Bank Bonds: Effectiveness and Costs

... A sudden worsening of the outlook for global growth since last summer has heightened fears for the soundness of heavily indebted borrowers, public and private alike Concerns are emerging that the phase of weakness will persist, in particular as a consequence of the deleveraging process of the pu ...

... A sudden worsening of the outlook for global growth since last summer has heightened fears for the soundness of heavily indebted borrowers, public and private alike Concerns are emerging that the phase of weakness will persist, in particular as a consequence of the deleveraging process of the pu ...

Banks lend more as economy grows

... increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low interest rates, also kept retiring their old bank debts and regularised their NPLs. “Thi ...

... increased, due to higher credit demand for larger working capital to finance growing outputs. A number of them went for fixed investment. Senior bankers say that private sector companies, taking advantage of low interest rates, also kept retiring their old bank debts and regularised their NPLs. “Thi ...

Morgan Stanley Dean Witter

... - Grew at 20% from 1999 Ranks among the top eight global active asset managers with over $500 billion of assets under management ...

... - Grew at 20% from 1999 Ranks among the top eight global active asset managers with over $500 billion of assets under management ...

Zeitgeist sitting on a powder keg

... The global economy is in turmoil. Countries whose per capita debt exceeds the available income of their citizens by 100% – such as Germany, for instance – are the rule and not the exception any longer. The increase in money supply through central banks, which consider themselves as public lenders ra ...

... The global economy is in turmoil. Countries whose per capita debt exceeds the available income of their citizens by 100% – such as Germany, for instance – are the rule and not the exception any longer. The increase in money supply through central banks, which consider themselves as public lenders ra ...

Chapter 9 - McGraw Hill Higher Education

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. 10. Pre ...

... 6. Show how a line of credit affects financial statements. 7. Explain how to account for bonds issued at face value and their related interest costs. 8. Use the straight-line method to amortize bond discounts and premiums. 9. Distinguish between current and noncurrent assets and liabilities. 10. Pre ...

Weekly Report 30th November 2014

... But why is everyone so eager to spend? A survey by Deloitte showed that almost half of the US shoppers had not made their holiday purchases yet and that the average shopper was expected to spend an average of $295 this weekend, a $9 increase since 2013. However, the shopping madness is not only on A ...

... But why is everyone so eager to spend? A survey by Deloitte showed that almost half of the US shoppers had not made their holiday purchases yet and that the average shopper was expected to spend an average of $295 this weekend, a $9 increase since 2013. However, the shopping madness is not only on A ...

303 13

... • It allowed AIG to issue what amounted to insurance without making sure that it had assets to cover its commitments. • Credit default swaps were over-the-counter two-party contracts, and so not subject to regulation. ...

... • It allowed AIG to issue what amounted to insurance without making sure that it had assets to cover its commitments. • Credit default swaps were over-the-counter two-party contracts, and so not subject to regulation. ...

Jerry L. Jordan RESTRUCTURING FINANCIAL INSTITUTIONS IN GLOBAL ECONOMY

... and services and to borrow and lend. Without them an economy would be confined to self-sufficiency or barter, which would inhibit the specialization in production upon which modern economies depend. Separating the time of consumption from production would be possible only by first storing goods. The ...

... and services and to borrow and lend. Without them an economy would be confined to self-sufficiency or barter, which would inhibit the specialization in production upon which modern economies depend. Separating the time of consumption from production would be possible only by first storing goods. The ...

New York Mercantile Exchange

... The basic principles of hedging can be used for many commodities for which no futures contract exists, because often they are similar to commodities that are traded. For example, diesel fuel and jet fuel are similar to heating oil, and the three are often priced within a few cents of each other. So, ...

... The basic principles of hedging can be used for many commodities for which no futures contract exists, because often they are similar to commodities that are traded. For example, diesel fuel and jet fuel are similar to heating oil, and the three are often priced within a few cents of each other. So, ...

A Macroprudential Perspective in the Conduct of Monetary Policy Ryuzo Miyao

... and evaluated from the viewpoint of the entire financial system, and institutional designs and policy responses are formed on these assessments. Such a macroprudential approach is also very useful in examining the risk of accumulation of financial imbalances when conducting monetary policy. In the p ...

... and evaluated from the viewpoint of the entire financial system, and institutional designs and policy responses are formed on these assessments. Such a macroprudential approach is also very useful in examining the risk of accumulation of financial imbalances when conducting monetary policy. In the p ...

Disclosure of G-SIB indicators

... (6) Offsetting short positions in relation to the specific equity securities included in item 3.c.(5) d. Net positive current exposure of securities financing transactions with other financial institutions (revised definition) e. Over-the-counter derivatives with other financial institutions that ha ...

... (6) Offsetting short positions in relation to the specific equity securities included in item 3.c.(5) d. Net positive current exposure of securities financing transactions with other financial institutions (revised definition) e. Over-the-counter derivatives with other financial institutions that ha ...

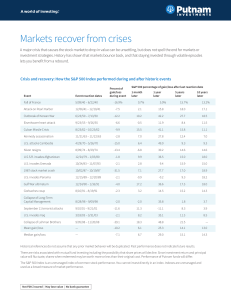

Markets recover from crises

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

... Historical references do not assume that any prior market behavior will be duplicated. Past performance does not indicate future results. There are risks associated with mutual fund investing including the possibility that share prices will decline. Since investment return and principal value will f ...

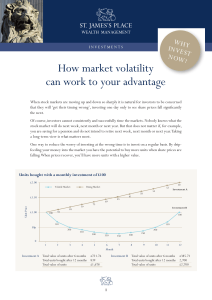

How market volatility can work to your advantage

... when stock markets are moving up and down so sharply it is natural for investors to be concerned that they will ‘get their timing wrong’, investing one day only to see share prices fall significantly the next. of course, investors cannot consistently and successfully time the markets. nobody knows w ...

... when stock markets are moving up and down so sharply it is natural for investors to be concerned that they will ‘get their timing wrong’, investing one day only to see share prices fall significantly the next. of course, investors cannot consistently and successfully time the markets. nobody knows w ...

Debt Market Monitor

... the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate increases will occur during the remainder of 2017. The consensus view, including that of the Fed, is that another two or three h ...

... the U.S. Federal Reserve surprised no one with its move to hike the fed funds rate by 0.25% at its March meeting. The focus of the markets is now on how many interest rate increases will occur during the remainder of 2017. The consensus view, including that of the Fed, is that another two or three h ...

as PDF

... (Wednesday), a slowing in July retail sales growth to just 0.2% month on month and another large trade deficit (all Thursday). Of these, the June quarter GDP growth figures will be of most interest with consumer spending holding up but investment and trade detracting from growth and some risk of a n ...

... (Wednesday), a slowing in July retail sales growth to just 0.2% month on month and another large trade deficit (all Thursday). Of these, the June quarter GDP growth figures will be of most interest with consumer spending holding up but investment and trade detracting from growth and some risk of a n ...

inflation, real interest rates and the shiller p/e

... Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shller P/E should be ...

... Investors often look at unconditional valuation metrics such as the Shiller P/E to infer if the stock market is cheap or expensive. Arnott argues that the fair value of the Shller P/E should be ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.