The Global Financial Crisis: Governments, Banks and

... by which investments were made. Ever since the end of fixed exchange rates for most advanced nations in the 1970s, foreign exchange markets and especially futures markets have grown enormously. By mid-2007, daily turnover in these markets was over $3 trillion, more than three-fourths of which involv ...

... by which investments were made. Ever since the end of fixed exchange rates for most advanced nations in the 1970s, foreign exchange markets and especially futures markets have grown enormously. By mid-2007, daily turnover in these markets was over $3 trillion, more than three-fourths of which involv ...

Internal rate of return RAB – Regulated Asset Base

... The cost of debt was estimated by Ofwat based on the cost of companies’ existing debt and an assessment of likely future debt costs. Debt costs were derived from yields on debt markets. Small companies were allowed a slightly higher cost of debt since small companies have access to less competitive ...

... The cost of debt was estimated by Ofwat based on the cost of companies’ existing debt and an assessment of likely future debt costs. Debt costs were derived from yields on debt markets. Small companies were allowed a slightly higher cost of debt since small companies have access to less competitive ...

Securing a sustainable future for Higher Education

... But are HEIs in a position to meet these challenges? ...

... But are HEIs in a position to meet these challenges? ...

Financial instruments

... -- Belgian or foreign public body -- a Belgian or foreign private enterprise -- an international organisation -- a credit institution (in this case we refer to savings certificates rather than bonds). Their principle is straightforward: an interest rate which gives right to the payment of a periodic ...

... -- Belgian or foreign public body -- a Belgian or foreign private enterprise -- an international organisation -- a credit institution (in this case we refer to savings certificates rather than bonds). Their principle is straightforward: an interest rate which gives right to the payment of a periodic ...

bhsa- (aif) hecho relevante - finalizacion contrato con deutsche bank

... “Class D” shares, at the cutoff values prevailing at that moment, which right was exercised in February 2004. ...

... “Class D” shares, at the cutoff values prevailing at that moment, which right was exercised in February 2004. ...

Interest Rate Swaps

... provided the Government of Canada bond has the same principal amount and margin rate category as the swap. Similarly, a floating rate offset is available whereby the Member can offset the cash flows from a short (or long) position in a Government of Canada bond or bank paper with less than one year ...

... provided the Government of Canada bond has the same principal amount and margin rate category as the swap. Similarly, a floating rate offset is available whereby the Member can offset the cash flows from a short (or long) position in a Government of Canada bond or bank paper with less than one year ...

The Market of Financial Services: Segmentation and Targeting

... Corporate market segmentation (II) They often require custom-made financial services They often exert significant influence on the terms and conditions of financial services The demand for corporate financial services is influenced by the state of the economy, to a much greater extent than the ...

... Corporate market segmentation (II) They often require custom-made financial services They often exert significant influence on the terms and conditions of financial services The demand for corporate financial services is influenced by the state of the economy, to a much greater extent than the ...

The Loonie Set To Fly South

... As a consequence, the Canadian dollar is likely to head lower into the US$0.90-0.92 range later this year and into early 2014, before encountering some renewed stability in the second half of next year. Gradual interest rate hikes by the Bank of Canada beginning in the fourth quarter of next year ar ...

... As a consequence, the Canadian dollar is likely to head lower into the US$0.90-0.92 range later this year and into early 2014, before encountering some renewed stability in the second half of next year. Gradual interest rate hikes by the Bank of Canada beginning in the fourth quarter of next year ar ...

Downlaod File

... FINA 3311: Financial Management Principles Instructor: Rashida Sharmin Section (201) Project: Case Study By: Shouq Al-Hamoudi 200900213 Rasha Bubahait 200901816 Fadheelah Al-Soqair 200900765 ...

... FINA 3311: Financial Management Principles Instructor: Rashida Sharmin Section (201) Project: Case Study By: Shouq Al-Hamoudi 200900213 Rasha Bubahait 200901816 Fadheelah Al-Soqair 200900765 ...

"To improve the financing of our economy, we should further

... "To improve the financing of our economy, we should further develop and integrate capital markets. This would cut the cost of raising capital, notably for SMEs, and help reduce our very high dependence on bank funding. This would also increase the attractiveness of Europe as a place to invest." ...

... "To improve the financing of our economy, we should further develop and integrate capital markets. This would cut the cost of raising capital, notably for SMEs, and help reduce our very high dependence on bank funding. This would also increase the attractiveness of Europe as a place to invest." ...

characteristics and structural changes

... developed than is the case for the government sector. In spite of these advances, however, the overall scale of bond and equity financing remains relatively small and markets are illiquid when compared with those of large and advanced economies. The lack of comparable cross-country data on smaller s ...

... developed than is the case for the government sector. In spite of these advances, however, the overall scale of bond and equity financing remains relatively small and markets are illiquid when compared with those of large and advanced economies. The lack of comparable cross-country data on smaller s ...

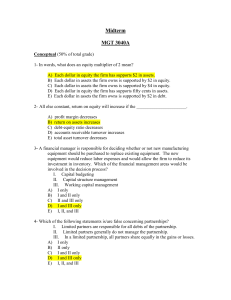

Answers to Midterm 3040A

... Each dollar in assets the firm owns is supported by $2 in equity. Each dollar in assets the firm owns is supported by $4 in equity. Each dollar in equity the firm has supports fifty cents in assets. Each dollar in assets the firm owns is supported by $2 in debt. ...

... Each dollar in assets the firm owns is supported by $2 in equity. Each dollar in assets the firm owns is supported by $4 in equity. Each dollar in equity the firm has supports fifty cents in assets. Each dollar in assets the firm owns is supported by $2 in debt. ...

I. INTRODUCTION TO SECURITIES TRADING AND MARKETS

... the largest investment banks in the U.S., collapsed, to be rescued by JP Morgan Chase with backing from the Federal Reserve. The special lending facilities of the Federal Reserve opened the discount window to investment banks to prevent an industry-wide collapse. IndyMac Bank F.S.B., another major d ...

... the largest investment banks in the U.S., collapsed, to be rescued by JP Morgan Chase with backing from the Federal Reserve. The special lending facilities of the Federal Reserve opened the discount window to investment banks to prevent an industry-wide collapse. IndyMac Bank F.S.B., another major d ...

Financial Development, Assets and International Trade

... technology determined parameter, and it is due to technological reasons that some industries rely more on tangible assets than other industries. The industry level data on tangibility that we employ here is taken from Braun (2003). He uses the information on assets of all active U.S.-based companies ...

... technology determined parameter, and it is due to technological reasons that some industries rely more on tangible assets than other industries. The industry level data on tangibility that we employ here is taken from Braun (2003). He uses the information on assets of all active U.S.-based companies ...

Submission 1 - Peter Mair - Alternative Default Fund Models

... – it was used widely in building super funds-management businesses, in operating discount broking facilities; in operating and acquiring insurance businesses – all as well as driving competitor banks to the wall. Regulatory incompetence on a grand scale delivered an ...

... – it was used widely in building super funds-management businesses, in operating discount broking facilities; in operating and acquiring insurance businesses – all as well as driving competitor banks to the wall. Regulatory incompetence on a grand scale delivered an ...

Shipping Rates

... advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital por ...

... advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital por ...

State of Competition Regime in Ghana Preliminary

... percent of the country’s population (Buchs & Mathisen, 2005). ...

... percent of the country’s population (Buchs & Mathisen, 2005). ...

June - sibstc

... exchange rates are highly inter-related. Reserve Bank changes the interest rates, may be too often, primarily to control the Inflation and the exchange rates. Take the example of stock market investment to understand the above principle. As we know our stock market is dominated by the overseas inves ...

... exchange rates are highly inter-related. Reserve Bank changes the interest rates, may be too often, primarily to control the Inflation and the exchange rates. Take the example of stock market investment to understand the above principle. As we know our stock market is dominated by the overseas inves ...

letter

... fair value accounting models and acting in an expeditious manner. We also applaud the FASB for the proposed OTTI FSP as we agree that it is a significant improvement from the current accounting model. We have focused our letter on a few aspects of the proposed FSPs that we believe the FASB should co ...

... fair value accounting models and acting in an expeditious manner. We also applaud the FASB for the proposed OTTI FSP as we agree that it is a significant improvement from the current accounting model. We have focused our letter on a few aspects of the proposed FSPs that we believe the FASB should co ...

ECONOMIC ANALYSIS OF PROJECTS

... Import component Domestic component Tax Net benefit of which: Enterprise Government Employment Domestic service ...

... Import component Domestic component Tax Net benefit of which: Enterprise Government Employment Domestic service ...

Dr William Muhairwe

... updated if older than 3 months after the accounting period. Need for comprehensive involvement of all stakeholders including Board, Ministry of Finance and Water. There is need to address internal structural deficiencies as one goes ahead with such financing mechanisms, i.e. . Debtors, water losses ...

... updated if older than 3 months after the accounting period. Need for comprehensive involvement of all stakeholders including Board, Ministry of Finance and Water. There is need to address internal structural deficiencies as one goes ahead with such financing mechanisms, i.e. . Debtors, water losses ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.