1 - CSUN.edu

... financial markets. Specifically, many countries have liberalized and deregulated their capital and foreign exchange markets in recent years. In addition, commercial and investment banks have facilitated international investments by introducing such products as American Depository Receipts (ADRs) and ...

... financial markets. Specifically, many countries have liberalized and deregulated their capital and foreign exchange markets in recent years. In addition, commercial and investment banks have facilitated international investments by introducing such products as American Depository Receipts (ADRs) and ...

Thank you for joining me. Over the next half hour

... Circled in the left display are projections of short-term rates—the Fed Funds rate—as implied by the Treasury bond market forward curves, which forecast where yields will be in the future. We use these projections in combination with a historical analysis of US yield curve to determine a possible p ...

... Circled in the left display are projections of short-term rates—the Fed Funds rate—as implied by the Treasury bond market forward curves, which forecast where yields will be in the future. We use these projections in combination with a historical analysis of US yield curve to determine a possible p ...

Short CV Form

... nor in the United States to launder the dirty money he received every month according to Montesinos, but then of course, he had the Asian financial circuit to trust upon. The existence of accounts related to Montesinos’ bribes and kickbacks in Switzerland is well known today, investigations progress ...

... nor in the United States to launder the dirty money he received every month according to Montesinos, but then of course, he had the Asian financial circuit to trust upon. The existence of accounts related to Montesinos’ bribes and kickbacks in Switzerland is well known today, investigations progress ...

Clinton Vs. Trump

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

... investments... at all. And two in five are without any long-term assets, such as property or a pension, to fall back on in the future. While alarming enough on their own, these figures become all the more concerning when considering ...

Capital Structure

... the optimal financial structure to be 100% debt. In the real world, most executives do not like a capital structure of 100% debt because that is a state known as “bankruptcy”. In the next chapter we will introduce the notion of a limit on the use of debt: financial distress. The important use of thi ...

... the optimal financial structure to be 100% debt. In the real world, most executives do not like a capital structure of 100% debt because that is a state known as “bankruptcy”. In the next chapter we will introduce the notion of a limit on the use of debt: financial distress. The important use of thi ...

WHAT IS CAPITALISM AND HOW IS IT CHANGING? An interview

... capitalism that seem to highlight the real historical evolution of capitalism: classical capitalism, market-oriented corporate capitalism, bank-oriented corporate capitalism, decentralized state capitalism, centralized state capitalism. The prevailing form in contemporary advanced countries is the ...

... capitalism that seem to highlight the real historical evolution of capitalism: classical capitalism, market-oriented corporate capitalism, bank-oriented corporate capitalism, decentralized state capitalism, centralized state capitalism. The prevailing form in contemporary advanced countries is the ...

Answers to Concepts Review and Critical Thinking Questions

... with their own management. The increase in institutional ownership of stock in the United States and the growing activism of these large shareholder groups may lead to a reduction in agency problems for U.S. corporations and a more efficient market for corporate control. 14. How much is too much? Wh ...

... with their own management. The increase in institutional ownership of stock in the United States and the growing activism of these large shareholder groups may lead to a reduction in agency problems for U.S. corporations and a more efficient market for corporate control. 14. How much is too much? Wh ...

European banks: Are we back to 2008?

... We do not advocate, however, indiscriminate buying of the sector. At BMO Global Asset Management, our investment process leads us to buy good quality businesses with durable competitive advantages, and we do believe that such businesses exist in the financial sector. The wholesale selling of the sec ...

... We do not advocate, however, indiscriminate buying of the sector. At BMO Global Asset Management, our investment process leads us to buy good quality businesses with durable competitive advantages, and we do believe that such businesses exist in the financial sector. The wholesale selling of the sec ...

Sherman SITREP for week ending January 28, 2011

... noted that the indexes employment-related indicators contributed just 0.02 to the index in March, falling 0.18 point from February. Confidence among American consumers dipped slightly earlier this month, but Americans are still more optimistic than they were before the election. The Conference Board ...

... noted that the indexes employment-related indicators contributed just 0.02 to the index in March, falling 0.18 point from February. Confidence among American consumers dipped slightly earlier this month, but Americans are still more optimistic than they were before the election. The Conference Board ...

The transmission mechanism and financial stability policy (pdf 572 kB)

... financial system are identified, including their effect on the real economy. Lastly, these two building blocks are used to define a target for financial stability policy and also to categorize the instruments for this new policy area. In Section III, the framework in the previous section is used to ...

... financial system are identified, including their effect on the real economy. Lastly, these two building blocks are used to define a target for financial stability policy and also to categorize the instruments for this new policy area. In Section III, the framework in the previous section is used to ...

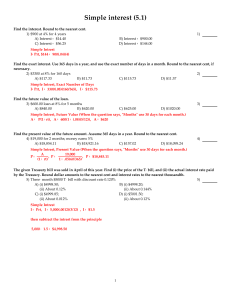

Simple interest (5.1)

... Present Value of Annuity (The ammount required to be deposited as a lump sum to equal what the future value of a simular annunity with said payments and intrest. The terms Payments and Present value let you know it is a Present value annunity question.) P=R ...

... Present Value of Annuity (The ammount required to be deposited as a lump sum to equal what the future value of a simular annunity with said payments and intrest. The terms Payments and Present value let you know it is a Present value annunity question.) P=R ...

H1 2007 - First Trust Bank

... accompanying slides will not be based on historical fact, but will be “forwardlooking” statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward looking statements. Factors that could ...

... accompanying slides will not be based on historical fact, but will be “forwardlooking” statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward looking statements. Factors that could ...

Glossary - State Bank of Pakistan

... Equities comprise common and preferred shares (stocks), which represent a share in the ownership of the company. In addition, the following are also considered as equities: depository receipts, most units of mutual funds, income trusts and warrants. Equities can be part of portfolio investment or di ...

... Equities comprise common and preferred shares (stocks), which represent a share in the ownership of the company. In addition, the following are also considered as equities: depository receipts, most units of mutual funds, income trusts and warrants. Equities can be part of portfolio investment or di ...

The Strategic Planning Approach

... 7. What are our principal outlets/distribution channels, present and future? 8. How is our business different than it was three and five years ago? 9. What is likely to be different about our business three and five years in the future? 10. What are our principal economic concerns? 11. What philosop ...

... 7. What are our principal outlets/distribution channels, present and future? 8. How is our business different than it was three and five years ago? 9. What is likely to be different about our business three and five years in the future? 10. What are our principal economic concerns? 11. What philosop ...

File - Global Business Research Journals

... borrows, it would have the pressure of creditors to make interest payments or it would risk bankruptcy. However, if the company issues stock to finance its project there is not that much pressure and management can pursue private benefits instead of seeking to maximize shareholder wealth. Demirgüç-K ...

... borrows, it would have the pressure of creditors to make interest payments or it would risk bankruptcy. However, if the company issues stock to finance its project there is not that much pressure and management can pursue private benefits instead of seeking to maximize shareholder wealth. Demirgüç-K ...

Microcredit: Conceptual Aspects Asymmetry of Information

... availability of information, demonstrate that small enterprises and those newlycreated, probably without collateral, are usually financed by family and friends. As the business grows, they gain access to credit via financial intermediation and bank credits. Consequently, if the individual does not o ...

... availability of information, demonstrate that small enterprises and those newlycreated, probably without collateral, are usually financed by family and friends. As the business grows, they gain access to credit via financial intermediation and bank credits. Consequently, if the individual does not o ...

MARKET AND ECONOMIC OUTLOOK 2016 Ends Mostly Strong

... Summer 2016 brought a significant political surprise emanating from the U.K. — Brexit. Britain’s vote to leave the European Union briefly sent shock waves through world markets before calm returned and markets recovered. The pollsters and so-called experts were dead wrong on the Brexit referendum. S ...

... Summer 2016 brought a significant political surprise emanating from the U.K. — Brexit. Britain’s vote to leave the European Union briefly sent shock waves through world markets before calm returned and markets recovered. The pollsters and so-called experts were dead wrong on the Brexit referendum. S ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.