Why Japanese households love foreign financial assets.

... instruments failed to take off because of their high commissions and fees. Foreign bond funds came next. These funds were attractive not only for their higher yields, but also for their unique monthly dividend-payment schedule. This ingenious payout structure is particularly attractive to retail inv ...

... instruments failed to take off because of their high commissions and fees. Foreign bond funds came next. These funds were attractive not only for their higher yields, but also for their unique monthly dividend-payment schedule. This ingenious payout structure is particularly attractive to retail inv ...

The Dividend Controversy

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

... who want higher dividends sell some shares to get cash. Those who want lower dividends use high dividends to buy more shares. ...

Why Risk Management

... Shocks to capital result in a reduction of bank loan supply (both in and outside crises and independent of structure) The effect of initial capital is stronger in crisis times Loan losses have the potential to exacerbate macroeconomic fluctuations, that is, financial instability may have real effect ...

... Shocks to capital result in a reduction of bank loan supply (both in and outside crises and independent of structure) The effect of initial capital is stronger in crisis times Loan losses have the potential to exacerbate macroeconomic fluctuations, that is, financial instability may have real effect ...

Financial Ratio Analysis

... spending, producer prices, consumer prices, and the competition. This is economic data that is readily available from government and private sources. Besides financial statement data, market data, and economic data, in financial analysis you also need to examine events that may help explain the com ...

... spending, producer prices, consumer prices, and the competition. This is economic data that is readily available from government and private sources. Besides financial statement data, market data, and economic data, in financial analysis you also need to examine events that may help explain the com ...

Efectos Fiscales sobre el Crecimiento Económico en la República

... rate and then levels off (at approximately 25 percent of national income). The Dominican Republic’s average domestic savings ratio over the period 1970-2000 was 15.3 percent with an average per capita income of $US 1385 (at 1995 prices). On the basis of the international cross-section evidence, this ...

... rate and then levels off (at approximately 25 percent of national income). The Dominican Republic’s average domestic savings ratio over the period 1970-2000 was 15.3 percent with an average per capita income of $US 1385 (at 1995 prices). On the basis of the international cross-section evidence, this ...

Download attachment

... The link between financial liberalization and financial development is not unambiguous, however. One common argument is that to benefit from more open cross-border financial transactions, financial systems need to be equipped with reasonable legal and institutional infrastructure.5 Specifically, in ...

... The link between financial liberalization and financial development is not unambiguous, however. One common argument is that to benefit from more open cross-border financial transactions, financial systems need to be equipped with reasonable legal and institutional infrastructure.5 Specifically, in ...

The transformation of the Spanish economy: a success story of

... • Lack of openness that limited growing possibilities, meaning that the difference between domestic savings and investment was financed through credit and public debt. The Openness degree of the Spanish economy ...

... • Lack of openness that limited growing possibilities, meaning that the difference between domestic savings and investment was financed through credit and public debt. The Openness degree of the Spanish economy ...

Kings County Board of Supervisors Chambers

... trained on how to use the raiting tool that will be put in place, they will submitt it individually to be analyzed before moving forward with a future development of a financial plan and strategy. Decisions will be made in the most responsible way. To summarize, Commissioner Stankovich stated he is ...

... trained on how to use the raiting tool that will be put in place, they will submitt it individually to be analyzed before moving forward with a future development of a financial plan and strategy. Decisions will be made in the most responsible way. To summarize, Commissioner Stankovich stated he is ...

21_EFM06-HoChienwei-Determinants of Direct Stock Holding

... liquidity constraints or may be a measure of financial astuteness (Bertaut, 1998). Rational investors are less likely to borrow money at higher interest rates from credit card companies to invest in stocks. Bertaut (1998) found convenience credit card users are more likely to participate in stock ma ...

... liquidity constraints or may be a measure of financial astuteness (Bertaut, 1998). Rational investors are less likely to borrow money at higher interest rates from credit card companies to invest in stocks. Bertaut (1998) found convenience credit card users are more likely to participate in stock ma ...

Capital Markets

... MOODY'S INVESTORS SERVICE Obligations rated Aaa are judged to be of the highest quality, subject to the lowest level of credit risk. Obligations rated Aa are judged to be of high quality and are subject to very low credit risk. ...

... MOODY'S INVESTORS SERVICE Obligations rated Aaa are judged to be of the highest quality, subject to the lowest level of credit risk. Obligations rated Aa are judged to be of high quality and are subject to very low credit risk. ...

IS-LM Tutorial

... Income and credit history– to get mortgages to buy home. One of these developments was securitization, the process by which one makes loans and then sells them to an investment bank which in turn bundles them together into a variety of “mortgage-backed securities” and then sells them to a third fina ...

... Income and credit history– to get mortgages to buy home. One of these developments was securitization, the process by which one makes loans and then sells them to an investment bank which in turn bundles them together into a variety of “mortgage-backed securities” and then sells them to a third fina ...

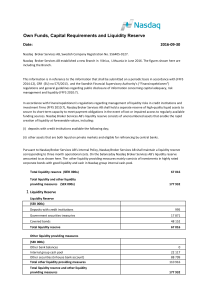

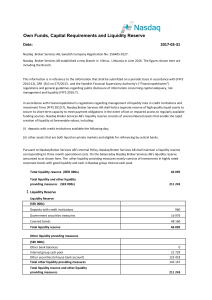

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

Real Estate Principles

... Landlords and tenants in space markets negotiate and determining rents, which produces cash flows that are of primary concern to participants in the real estate asset market. If the cash flows are attractive in the real estate asset market relative to other capital asset categories, the development ...

... Landlords and tenants in space markets negotiate and determining rents, which produces cash flows that are of primary concern to participants in the real estate asset market. If the cash flows are attractive in the real estate asset market relative to other capital asset categories, the development ...

Determinants of Private Credit in OECD Developed, BRIC´s and

... contributes to variance stabilization and linearization of possible exponential trends, common features in economic and financial series, besides converting differences into percentage rates, which are generally stationary (Hendry, 1997). ...

... contributes to variance stabilization and linearization of possible exponential trends, common features in economic and financial series, besides converting differences into percentage rates, which are generally stationary (Hendry, 1997). ...

“Azerbaijan Caspian Shipping” Closed Joint Stock Company

... Foreign exchange gains and losses resulting from the re-measurement into the functional currencies of respective Group’s entities are recognized in the consolidated statement of profit or loss or other comprehensive income. At 31 December 2016 the principal rate of exchange used for translating fore ...

... Foreign exchange gains and losses resulting from the re-measurement into the functional currencies of respective Group’s entities are recognized in the consolidated statement of profit or loss or other comprehensive income. At 31 December 2016 the principal rate of exchange used for translating fore ...

Ch 10 SG

... a. The government paid off loans for corporations. b. The government created the Federal Reserve. c. The government deregulated the banking industry. d. The government created the Federal Deposit Insurance Corporation. 37. What was one cause of the Savings and Loan crisis in the 1980s? a. not enough ...

... a. The government paid off loans for corporations. b. The government created the Federal Reserve. c. The government deregulated the banking industry. d. The government created the Federal Deposit Insurance Corporation. 37. What was one cause of the Savings and Loan crisis in the 1980s? a. not enough ...

Tough times continue for Singapore oil rig builders

... the provincial government to complete the implementation of the plans in October. In the previous month, the company resisted pressure from its bondholders to file for bankruptcy. (Caixin) UN warns next global recession may trigger sovereign debt default contagion (Sputnik News) Contagion risks rise ...

... the provincial government to complete the implementation of the plans in October. In the previous month, the company resisted pressure from its bondholders to file for bankruptcy. (Caixin) UN warns next global recession may trigger sovereign debt default contagion (Sputnik News) Contagion risks rise ...

IFM7 Chapter 17

... The advantages of private placements are lower flotation costs and greater speed, since the shares issued are not subject to SEC registration. d. A venture capitalist is the manager of a venture capital fund. The fund raises most of its capital from institutional investors and invests in start-up co ...

... The advantages of private placements are lower flotation costs and greater speed, since the shares issued are not subject to SEC registration. d. A venture capitalist is the manager of a venture capital fund. The fund raises most of its capital from institutional investors and invests in start-up co ...

Financialization

Financialization is a term sometimes used in discussions of the financial capitalism that has developed over the decades between 1980 and 2010, in which financial leverage tended to override capital (equity), and financial markets tended to dominate over the traditional industrial economy and agricultural economics.Financialization describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible or intangible, future or present promises, etc.) into a financial instrument. The intent of financialization is to be able to reduce any work product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.Workers, through a financial instrument such as a mortgage, may trade their promise of future work or wages for a home. The financialization of risk sharing is what makes possible all insurance. The financialization of a government's promises (e.g., US government bonds) is what makes possible all government deficit spending. Financialization also makes economic rents possible.